Inflation, Sub Zero Interest Rate …

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness”.

What was said in Charles Dickens’ ‘A Tale of Two Cities’ 150 years ago describes very well our current situation and dilemma: our economy is roaring back and there has been a recognition that government stimulus can work regardless of the debts incurred. On the other hand, inflation is coming, valuations of stocks and bonds and other financial assets are at some nose bleeding levels. Speculation abound in crypto, SPAC, …

Or just like what Warren Buffett said in this weekend’s Berkshire Hathaway’s annual meeting, ‘Charlie and I consider it the most interesting movie by far we’ve ever seen in terms of economics,’.

In this newsletter, we discuss several important topics in the context of the Buffett’s thinkings from the latest Berkshire’s meeting.

Economy recovery

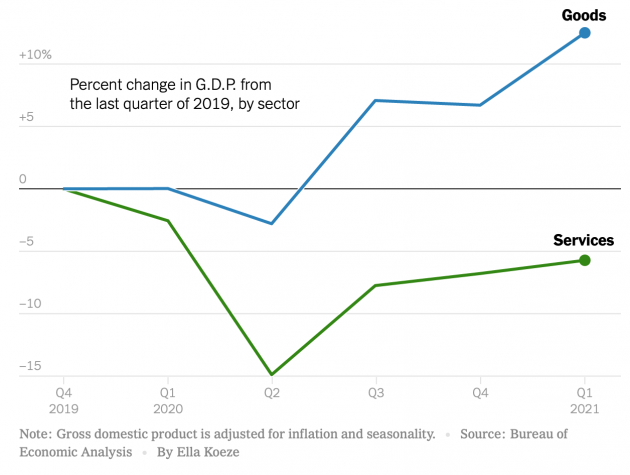

The US economy has experienced an extremely strong recovery. The US GDP growth in the first quarter of 2021 was 1.6 percent, or 6.4% on an annualized basis. Between goods and services, consumer spending on goods has shot up way above the last quarter of 2019, before the pandemic:

This is understandable as people are spending more on purchasing goods since they are confined to home or have limited mobility. On the other hand, it also tells us where most of government’s stimulus checks went.

The GDP is still yet back to the level prior to the pandemic but it’s very likely that we might be able to grow back at that level by the end of this quarter.

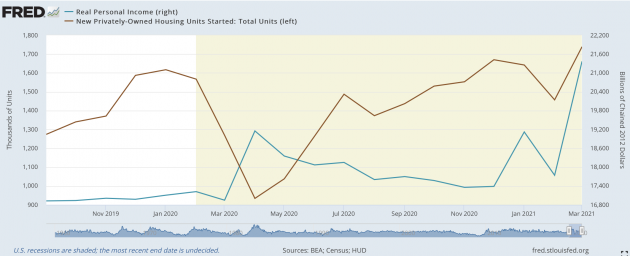

Many economic indicators are on fire. The following charts show that both the housing units started and real personal income have exceeded their levels a year ago:

Again, real personal income was way above prior levels before the pandemic mostly because of the government stimulus payments.

Nose bleeding valuation & sub zero interest rates

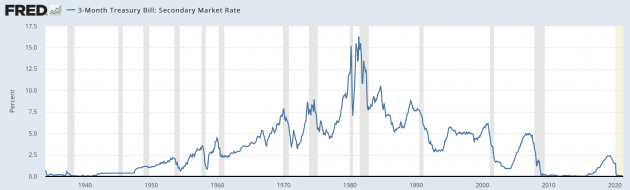

Meanwhile, interest rates are at historically low: the 3 month Treasury Bill rate is practically 0:

Furthermore, the long term interest rate (^TNX in the above chart represents 10 year Treasury note’s interest rate), often used as the discount rate to estimate the present value of a financial asset such as a stock, is also at a historically low.

The ultra low long term interest rate has an important implication as Buffett pointed out that “interest rates, basically, are to the value of assets, what gravity is to matter, essentially.”.

Intuitively, if you try to value a company’s stock, the simplest way is to compare its future value (say 10 years from now), discounted with the 10 year ultra safe interest rate. Basically, you just want to see how much the company earns in this 10-year period, compared with what you would get if you put the money to Treasury notes (10 year maturity).

So if the discount rate is ultra low, you don’t need a company to make much to justify to hold its stock. For example, currently, the forward 12-month P/E ratio for the S&P 500 is 22 (see the latest Factset report), that would mean the S&P 500 ‘conglomerate’ earns 1/22 or 4.5% per year (so called earnings yield). Compared this with the current 1.6% 10-year Treasury note’s interest rate, it doesn’t seem that the S&P 500 is expensive.

The above is a very simple quick back-of-the-envelope calculation. It’s based on the assumption that the long term interest rate will stay at this level for the coming years. Buffett used the above argument to indicate that stocks are very, very cheap. But he quickly followed up with ‘Now, the question is what interest rates do over time.’ This ‘stocks are very very cheap if the interest rates stay this low for a long time’ argument is based on the big if — if interest rates stay low indefinitely. Buffett further said, ‘there are consequences to everything’. They just don’t know what they are and when that will occur. Of course, we have no clue either.

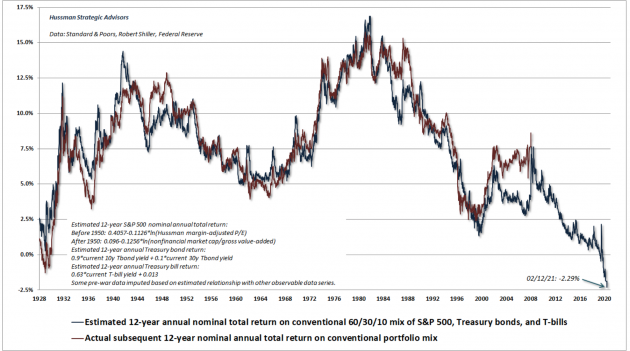

When you use other famous long term stock metrics, the current valuation is indeed nose bleeding. For example, the following shows Dr. Hussman’s estimated 12-year annual nominal return will be -2.29% for a 60/30/10 mix of S&P 500, Treasury bonds and T-bills:

Notice that his chart even shows the valuations in 1920s and 1930s, the great depression period. In fact, however many people claimed that the current interest rate is at a historically low in an uncharted territory, the 3 month Treasury bill was indeed at the zero levels in 1930s:

To be fair, the sub zero interest rate part happened before. History does not repeat itself, but it rhymes.

That’s why this is a fascinating time. On the other hand, it’s also probably the most dangerous time as we are in an uncharted territory with many strong and bold fiscal and monetary policies.

Inflation is coming

Unfortunately, the inflation has begun to rise rapidly. Buffett stated:

We’re seeing very substantial inflation. It’s very interesting. We’re raising prices. People are raising prices to us, and it’s being accepted. Take home building. We’ve got nine home builders in addition to our manufactured housing operation, which is the largest in the country. So we really do a lot of housing. The costs are just up, up, up. Steel costs, just every day they’re they’re going up. And there hasn’t yet been because the wage stuff follows. The UAW writes a three-year contract, we got a three-year contract, but if you’re buying steel at General motors or someplace, you’re paying more every day. So it’s an economy really, it’s red hot. And we weren’t expecting it.

Bear in mind that Berkshire Hathaway is the largest diverse conglomerate in the US. Their operations span over consumers, utilities, energies and infrastructure. So Buffett’s observation is extremely insightful. For sure, inflation is coming.

The danger of rapidly rising inflation, of course, is that it will eventually reach a saturated point where consumer buying power is eroded and companies suddenly face slow or declined earnings. Again, no one knows when this turning point will be. It could be a year or two or it could be many many years from now.

What to do

As always, Buffett and Munger were very frank and honest with what they can do and what they can’t do. They readily admitted that they have no idea on the near term future of economy and markets. On the other hand, they just stick to their old way of doing business: just focus on running a solid business (or businesses in their case), invest based on their long adhered principles and let the nature take care of the rest.

This is exactly one should do, regardless whether they are quants, traders or long term stock investors: you stick to a sound plan through thick and thin.

For us at MyPlanIQ, we believe it’s a fool’s game to predict. Instead, one should adopt a sound strategy that reacts to market actions and avoid big loss when markets eventually go on a big correction. What we advocate:

- Invest in low cost stock index funds and some excellent fixed income funds if desired. Even Buffett instructed the trustees of his estates to invest substantial assets (90%) to S&P 500 index fund. Stocks or equities can deliver inflation beating returns in the long term.

- Have a proper asset allocation. Though bonds are yielding little, no one knows whether their prices will continue to go up (thus yields will go to zero or even further negative). Furthermore, allocating to relatively safe assets gives you peace of mind and a good capital to deploy when markets experience a huge sudden loss (remember Black Monday in 1987).

- Avoid large loss by tactically reducing risk assets such as stocks and risky bonds when markets are in a downtrend. Strategies like our Asset Allocation Composite (AAC) or Tactical Asset Allocation(TAA) avoid large loss and capture returns in up trends. These strategies can achieve a reasonable (comparable or better than buy and hold) return in the long term with much lower interim loss.

Market Overview

These days, it just feels that investors don’t talk about the valuation and market risk anymore (or much). The Q1 earnings reports continue to be stellar in aggregate. Here is the latest on April 30, 2021, last Friday:

- 60%% of the companies reported by last Friday, the blended earnings growth was 45.8%, compared with 33.8% the week before, 30.2% two weeks before and, 23.8% on March 31, 2021.

So indeed companies continued to surprise positively, the blended earnings growth rate just kept going up as more companies reported earnings.

Though stocks have risen so much, there is no sign for investors to abandon them. This is of course understandable as we can see that even Buffett and Munger are feeling TINA (There Is No Alternative) to stocks.

Of course, good things will not continue indefinitely. We are again cautiously optimistic and reiterate the following practice:

- For strategic allocation (buy and hold) investors, ignore the current market behavior. Remember, as what we have emphasized numerous times, when you choose and commit to a strategic portfolio, you essentially know and commit that your investment horizon (or the time you need to utilize this capital) is 20 years or longer. As we pointed out, if your investments are those diversified (index) funds such as an S&P 500 index fund (VFINX, for example), you know your money is in some solid ‘business’ that eventually (20 years later) will deliver some reasonable returns. As long as you are comfortable with this thesis, you should sit tight and forget about the current gyration.

- For tactical investors, again, you have to ignore the current market noise. Furthermore, you should follow your strategy rigorously, especially in a time like this. Human emotion, both optimistic and pessimistic, and human desire, both greedy and fearful, are your worst enemies. This has been shown to be true time and time again.

Stock valuation now reached another high. For the moment, we believe it’s prudent to be cautious while riding on market uptrend. However how serious a correction might be, we have confidence in the US economy in the long term and thus in the stocks in aggregate. We just need to manage through interim losses carefully.

We again would like to emphasize that for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.

Latest Articles

- April 26, 2021: The Best Active Fixed Income Funds Are Still Hard To Beat

- April 19, 2021: New And Old Useful Features

- April 12, 2021: Risk Parity Funds In Current Environment

- April 5, 2021: DoubleLine Shiller CAPE 10 Based Funds Update

- March 29, 2021: International Stocks vs. US Stocks

- March 22, 2021: Ultra Short Term Bond ETF Portfolio As A Money Market Fund

- March 15, 2021: Make Your Own Private Bank

- March 8, 2021: The Not So Orderly Market Rotation Amid Rising Bond Yields

- March 1, 2021: Average 20% Annual Returns: The Upper Bound Of Stock Investments?!

- February 22, 2021: Rising Bond Yields And Current Stock Trends

- February 8, 2021: Total Return Bond ETFs Review

- February 1, 2021: REITs And Major Asset Trends

- January 25, 2021: Industry ETFs And ARK ETFs Portfolios

- January 11, 2021: Smart Cash Management: Can I Just Withdraw From My Bond Portfolio?

- January 4, 2021: Our Investment Philosophy For 2021 And Beyond

- December 14, 2020: Style and Factor ETFs Portfolio Reviews

- December 7, 2020: A Really Long Term (30 Years) Stock Returns

- November 30, 2020: Higher Return Portfolios: Part 2

- November 16, 2020: Higher Return Portfolios

- November 9, 2020: Fixed Income Funds Update

- November 2, 2020: Polls Are Useless vs. This Investment Strategy Doesn’t Work!

- October 26, 2020: Recent Improvements

- October 19, 2020: REIT Indexes As Businesses

- October 12, 2020: Stock Indexes As Businesses

- October 5, 2020: Asset Trend Review

- September 28, 2020: Retirement Spending: Your Portfolio’s Volatility Matters

- September 21, 2020: Boring Utility Stocks Are Excellent Long Term Winners

- September 14, 2020: Surprised, Active Fixed Income Investors Have Done Better Than Stock Investors For The Last 20 Years!

- August 31, 2020: Investing In An Ultra-Low Return Environment

- August 24, 2020: Target Maturity Bond ETFs For Short Term Cash

- August 17, 2020: Newsletter Collection Update

- August 10, 2020: Fixed Income In A Speculative Era

- August 3, 2020: Sound Investment Strategies

- July 27, 2020: Total Return Bond Funds Update

- July 20, 2020: Divergence Between Value And Growth Stocks Everywhere

- July 13, 2020: Short Term Cash, Treasury Bills, CDs And Future Fixed Income

- July 6, 2020: Bond ETFs vs. Bond Mutual Funds

- June 29, 2020: Industry Sector ETF Rotation With Composite Momentum

- June 22, 2020: Industry Sector Rotation With Composite Momentum

- June 15, 2020: Advanced Minimum Equity Portfolios

- June 8, 2020: Recent Positive Developments

- June 1, 2020: Minimum Equity Portfolios

- May 18, 2020: Core Satellite Portfolios In The Current Pandemic

- May 11, 2020: Asset Trends Review

- May 4, 2020: The Real, Sensible And Wise Warren Buffett

- April 27, 2020: Total Return Bond Funds & Portfolios

- April 20, 2020: Multi-Factor ETFs and Rotation

- April 13, 2020: A Closer Look At 401(k) Investment Portfolios

- April 6, 2020: Long Term Stock Market Timing Since 1871 Revisited

- March 30, 2020: How Did Bond ETFs And Mutual Funds Fare In The Current Crisis?

- March 23, 2020: Chaos And Hope

- March 16, 2020: A Live Lesson

- March 9, 2020: Risk And Reward

- March 2, 2020: The Risk Of Coronavirus Outbreak

- February 24, 2020: Long Term Stock Valuation Based Investment Strategies

- February 10, 2020: Update On Short Term Cash, Treasury Bills and Brokered CDs

- February 3, 2020: Investment Landscape For Retirees And Would-be Retirees: Stocks

- January 27, 2020: Investment Landscape For Retirees And Would-be Retirees: Fixed Income

- January 13, 2020: Portfolio Performance: A Walk In The Past II

- January 6, 2020: Asset Outlook and Portfolio Strategies

- December 16, 2019: Q&As On Our Services

- December 9, 2019: Portfolio Constructions For Advanced Users

- December 2, 2019: Newsletter Collection Update

- November 25, 2019: Core ETFs or Core Mutual Funds Portfolios

- November 18, 2019: Introducing MyPlanIQ Asset Allocation Composite Strategy

- November 11, 2019: Market Indicator And Momentum

- November 4, 2019: Factor ETF Rotation

- October 28, 2019: Multi-factor ETFs vs. Equal Weight Multi-Factor Portfolios

- October 21, 2019: Multi-factor ETFs: Value And Momentum

- October 14, 2019: Low Volatility Factor ETFs

- October 7, 2019: Zero Commission Era Has Arrived, Is It Really That Good?

- September 30, 2019: Boosting Bond ETF Portfolio’s Return With Muni Bond ETFs

- September 23, 2019: Value ETFs

- September 16, 2019: Factor ETFs

- September 9, 2019: Momentum Factor Stock ETFs

- August 26, 2019: Employer 401k Match: Yet Another Free Lunch Not To Be Missed

- August 19, 2019: PIMCO Income Fund and Other Total Return Bond Funds Update

- August 12, 2019: Aggressive Fixed Income Portfolios?

- August 5, 2019: Long Term Investment Strategies And Short Term Market Noises

- July 29, 2019: Fixed Income Portfolios In A Lower Yield Environment

- July 22, 2019: Core Satellite Portfolios Balance Fluctuation

- July 15, 2019: Quality Stock Factor ETFs

- July 8, 2019: Surprise! Brokerages Make Most From Your Cash, Not Commissions

- July 1, 2019: Utilities Sector Review

- June 24, 2019: Asset Allocation Funds Review

- June 17, 2019: Latest Performance Comparison Among Several Advanced Strategies

- June 10, 2019: Money Market And Ultra Short Term Bond Funds

- June 3, 2019: What We Can Learn From The Seasonality Strategy

- May 20, 2019: Morningstar Portfolio Manager Awards

- May 13, 2019: Total Return Bond ETFs Review

- May 6, 2019: Global Allocation Revisited

- April 29, 2019: Asset Trend Review

- April 22, 2019: The Current State Of Fixed Income

- April 15, 2019: The Importance Of Fixed Income Returns For Retirement Spending

- April 8, 2019: Newsletter Collection Update

- April 1, 2019: S&P 500 As A Business

- March 25, 2019: Health Care Sector Review

- March 18, 2019: The Risk Of Stock Investing

- March 11, 2019: Consumer Staples Sector Review

- March 4, 2019: Global Stock Valuation Update

- February 25, 2019: ‘Bad’ Tactical Strategy

- February 11, 2019: “Best” Balanced Fund And Portfolios Revisited

- February 4, 2019: Cash And Money Market Funds: Interests And Safety

- January 28, 2019: Fixed Income Review

- January 14, 2019: Tactical Asset Allocation Portfolio Review

- January 7, 2019: Global Strategic Asset Allocation Portfolio Review

- December 17, 2018: Robinhood’s ‘Revolution’ Or Gimmick

- December 10, 2018: How Defensive Are REITs?

- December 3, 2018: Conservative Core Satellite Portfolio

- November 26, 2018: Allocation Mutual Fund Review

- November 19, 2018: Is The Recent Downtrend Sustainable?

- November 12, 2018: The Staggering Low Interest Rates From Big Banks

- November 5, 2018: The ‘Right’ Or ‘Wrong’ Decision

- October 29, 2018: Taxable Total Return Bond Plus Muni Bond Fund Based Portfolios

- October 22, 2018: DoubleLine Shiller CAPE 10 Based Fund Review

- October 15, 2018: Newsletter Collection Update

- October 8, 2018: Asset Trend Review

- October 1, 2018: Taxable vs. Tax Exempt High Yield Bonds

- September 24, 2018: High Yield Bonds In A Rising Rate Environment

- September 10, 2018: Value, Growth And Blend Stock Style Investing

- August 27, 2018: Money Market ETFs?

- August 20, 2018: How Momentum Investing Stacks Up?

- August 13, 2018: Total Return Bond ETF

- August 6, 2018: Fidelity Zero-Fee Index Funds

- July 30, 2018: Tax Efficient Portfolios

- July 23, 2018: Municipal Bond Funds And Portfolios

- July 16, 2018: A Guide To Conservative Portfolios

- July 9, 2018: Conservative Allocation Mutual Funds Based Portfolios

- July 2, 2018: Small Cap Stocks For The Long Term

- June 25, 2018: What Can We Learn From GE’s Removal From Dow Jones Index?

- June 18, 2018: The ‘Best’ Balanced Portfolio Continues To Excel

- June 11, 2018: Is 10 Year Long Enough For Portfolio Comparison?

- June 4, 2018: Action Plan: Risk Review For Investments

- May 21, 2018: Rising Rates, Consumer Staples And Stock Index

- May 14, 2018: Newsletter Collection Update

- May 7, 2018: Money Market Fund Taxonomy

- April 30, 2018: Momentum Investing Review

- April 23, 2018: Commodities In Current Environment

- April 16, 2018: Municipal Bonds As A Fixed Income Asset Class

- April 9, 2018: Exponential Or Compounding Nature In Investing

- April 2, 2018: Inside Of The Stock Chaos

- March 26, 2018: Total Return Bond Update

- March 19, 2018: Treasury Bills vs. Brokered CDs

- March 12, 2018: Defensive Conservative Portfolio Review

- March 5, 2018: Warren Buffett’s Advices

- February 26, 2018: Pros And Cons of Strategic And Tactical Portfolios In 2018

- February 12, 2018: Trend Review

- February 5, 2018: Market Selloff And Long Term Investing

- January 29, 2018: The New Addition To Our Total Return Bond Fund Candidates

- January 22, 2018: Where Are Bonds Heading?

- January 15, 2018: Tactical Portfolios Review

- January 8, 2018: Strategic Portfolios Review

- December 18, 2017: Record Highs And Risk

- December 11, 2017: Cash Return And Interest Rate Update

- December 4, 2017: Mutual Fund Star Ratings: Are They Useful?

- November 20, 2017: Thankful And Mindful

- November 13, 2017: Is This A Good Time For Retirees Or Would Be Retirees?

- November 6, 2017: Newsletter Collection Update

- October 30, 2017: Rising Interest Rates

- October 23, 2017: A Primer For Portfolios

- October 16, 2017: REITs As An Asset Class

- October 9, 2017: Conservative Portfolios Revisited

- October 2, 2017: The Role of Short Term Bond Funds

- September 25, 2017: Fees In Cash Investments

- September 18, 2017: Conservative Portfolios Review

- September 11, 2017: International Diversification Effect

- September 4, 2017: Invest And Speculate Revisited

- August 28, 2017: Total Return Bond Fund Portfolios: Where Do They Fit?

- August 21, 2017: Portfolio Performance: A Walk In The Past

- August 14, 2017: Fidelity Commission Free ETFs Update

- August 7, 2017: I Didn’t Learn Anything — Mistake vs. Temporary Underperformance

- July 31, 2017: Asset Classes And Fund Choices: A Primer

- July 24, 2017: Total Return Bond Fund Portfolios And Cash

- July 17, 2017: Long Term Stock Holding Periods For Retirement

- July 10, 2017: Half Year Asset Trend Review

- June 26, 2017: How To Beat The Best Balanced Allocation Fund

- June 19, 2017: Newsletter Collection Update

- June 12, 2017: A Mixed Bag Performance of Momentum Investing

- June 5, 2017: How To Start A New Portfolio

- May 29, 2017: Alternative Assets And Their Role In Portfolios

- May 22, 2017: Summer Seasonality And Portfolio Management

- May 15, 2017: Cash: Banking Or Investing?

- May 8, 2017: Holding Period of Long Term Timing Portfolios

- May 1, 2017: Debate on Risk vs. Volatility

- April 24, 2017: The Long Term Stock Market Timing Return Since 1871

- April 17, 2017: Risk vs. Volatility: Long Term Stock Market Returns

- April 10, 2017: Total Return Bond ETFs And Portfolios

- April 3, 2017: Quarter End Asset Trend Review

- March 27, 2017: Practical Consideration For IRAs And 401k Accounts

- March 20, 2017: Fund Fees: That’s (Still) Outrageous

- March 13, 2017: Long Term Stock Valuation Review

- March 6, 2017: Asset Classes for Retirement Investments

- February 27, 2017: Fidelity Total Bond Fund Review

- February 20, 2017: Long Term Stock Timing Based Portfolios And Their Roles

- February 13, 2017: Alternative Investment Portfolios Review

- February 6, 2017: Tax Free Municipal Bond Investments Review

- January 30, 2017: Brokerage Specific Conservative Portfolios

- January 23, 2017: Fixed Income Portfolio Review

- January 16, 2017: Long Term Trend Following Portfolio Review

- January 9, 2017: Tactical Asset Allocation Review

- January 3, 2017: Strategic Asset Allocation Review

- December 12, 2016: Enhanced Index Funds

- December 5, 2016: Review Of Broad Base Core Mutual Funds For Brokerages

- November 28, 2016: Core Index ETFs Review

- November 21, 2016: International Exposure Of U.S. Large Companies

- November 14, 2016: Asset Trends After The Election

- November 7, 2016: Rising Rate And Current Bond Trend

- October 31, 2016: Economy Power And Long Term Stock Returns

- October 24, 2016: Current Commodity Trend And Managed Futures

- October 17, 2016: Investment Mistakes And Good Or Bad Investment Strategies

- October 10, 2016: Momentum Investing Review

- October 3, 2016: Survey & Feedback

- September 26, 2016: Fixed Income Investing: Actively Managed Funds vs. Index Funds

- September 19, 2016: Stock Investing: Actively Managed Funds vs. Index Funds

- September 12, 2016: Newsletter Update

- September 5, 2016: Overvalued Markets And Long Term Timing Strategies

- August 29, 2016: Your 401K Finally Draws Attention

- August 22, 2016: Inflation Protected Securities TIPS For Current Overvalued Markets

- August 15, 2016: Risk On: Emerging Market Stocks And Small Cap Stocks

- August 8, 2016: Portfolio Construction Using Stock ETFs And Bond Mutual Funds

- August 1, 2016: Adding Value To Your Own Investments

- July 25, 2016: Tactical Asset Allocation Funds Review

- July 18, 2016: Strategic Asset Allocation & Lazy Portfolio Review

- July 11, 2016: Asset Trend Review

- June 27, 2016: Secular Cycles For Tactical And Strategic Investment Strategies

- June 20, 2016: A World of Debt

- June 13, 2016: Managed Futures For Portfolio Building

- June 6, 2016: Newsletter Summary

- May 30, 2016: Swensen Portfolio And Permanent Portfolios

- May 23, 2016: AAII Article And Some Web Changes

- May 16, 2016: The PIMCO (Dis)Advantages

- May 9, 2016: Boost Your Dull Summer Investments

- May 2, 2016: Low Cost Index Fund Investing

- April 25, 2016: Tax Free Municipal Bond Funds & Portfolios

- April 18, 2016: Asset Class Trend Review

- April 11, 2016: Construction of Sound And Conservative Portfolios

- March 28, 2016: Total Return Bond ETFs Review

- March 21, 2016: Small And Large Company Stock Performance In Different Economic Expansion Cycles

- March 14, 2016: Are Tactical And Timing Strategies Losing Steam?

- March 7, 2016: Defined Maturity Bond Fund Analysis

- February 29, 2016: Smart Strategic Asset Allocation Rebalance When Market Trend Changes

- February 22, 2016: Be Cash Smart

- February 15, 2016: Bond ETF Portfolios

- February 8, 2016: Newsletter Collection Update

- February 1, 2016: Total Return Bond Fund Portfolios In A Volatile Period

- January 25, 2016: Alternative Portfolios Review

- January 18, 2016: Strategic Asset Allocation: A Cautious Outlook

- January 11, 2016: Review Of Trend Following Tactical Asset Allocation

- January 4, 2016: What Worked And Didn’t In 2015

- December 21, 2015: Distressed Assets

- December 14, 2015: High Yield Bonds And Their Correlation With Stocks

- December 7, 2015: Diversification And Global Allocation

- November 30, 2015: Investors and Speculators Combined

- November 23, 2015: Active Stock Fund Performance Consistency

- November 16, 2015: Permanent, Risk Parity And Alternative Portfolios Review

- November 9, 2015: Broad Base Core Mutual Fund Review

- November 2, 2015: Broad Base Index Core ETFs Review

- October 26, 2015: Total Return Bond Fund Review

- October 19, 2015: Advanced Portfolio Review

- October 12, 2015: What About Commodities?

- October 5, 2015: Core Satellite Portfolios In A 401k Account

- September 28, 2015: Risk Managed Strategic Asset Allocation Portfolios Revisited

- September 21, 2015: Quest For The Best Investment Strategy

- September 14, 2015: Core Satellite Portfolios In Market Turmoil

- September 7, 2015: Market Rout Creates An Opportunity to Reposition Your Portfolios

- August 31, 2015: Review of Asset Allocation Funds and Portfolios

- August 24, 2015: Market Rout And Your Portfolios

- August 17, 2015: ETF or Mutual Fund Based Portfolios

- August 10, 2015: Updated Newsletter Collection

- August 3, 2015: Slippery Asset Trends

- July 27, 2015: Performance Dispersion Among Momentum Based Portfolios

- July 20, 2015: Global Balanced Portfolio Benchmarks

- July 13, 2015: Pain in Tactical Portfolios

- July 6, 2015: Fixed Income Total Return Bond Funds In Strategic Asset Allocation Portfolios

- June 29, 2015: Core ETF Commission Free Portfolios

- June 22, 2015: Secular Asset Trends

- June 15, 2015: Giving Up Bonds?

- June 1, 2015: Summer Blues?

- May 26, 2015: Cash, Bonds and Stocks In A Rising Rate Environment

- May 18, 2015: Portfolio Update

- May 11, 2015: Pain in Fixed Income?

- May 4, 2015: The Balanced Stock and Long Term Treasury Bond Portfolios

- April 27, 2015: Long Term Treasury Bond Behavior

- April 20, 2015: 529 College Savings Plan Rebalance Policy Change

- April 13, 2015: Total Return Bond Funds As Smart Cash

- April 6, 2015: The Low Return Environment

- March 30, 2015: Brokerage Specific Core Mutual Fund Portfolios 2

- March 23, 2015: Investment Arithmetic for Long Term Investments

- March 16, 2015: Brokerage Specific Core Mutual Fund Portfolios

- March 9, 2015: Newsletter Collection Update

- March 2, 2015: Total Return Bond ETFs

- February 23, 2015: Why Is Global Tactical Asset Allocation Not Popular?

- February 16, 2015: Where Are Permanent Portfolios Going?

- February 9, 2015: How Have Asset Allocation Funds Done?

- February 2, 2015: Risk Management Everywhere

- January 26, 2015: Composite Portfolios Review

- January 19, 2015: Fixed Income Investing Review

- January 12, 2015: How Does Trend Following Tactical Asset Allocation Strategy Deliver Returns

- January 5, 2015: When Forecast Fails

- December 22, 2014: Long Term Asset Returns: How Long Is Long?

- December 15, 2014: Beaten Down Assets

- December 8, 2014: Implementing Core Asset Portfolios In a Brokerage

- December 1, 2014: Two Key Issues of Investment Strategies

- November 24, 2014: Holiday Readings

- November 17, 2014: Retirement Spending Portfolios Update

- November 10, 2014: Fixed Income Or Cash

- November 3, 2014: Asset Trend Review

- October 27, 2014: Investment Loss, Mistakes And Market Cycles

- October 20, 2014: Strategic Portfolios With Managed Volatility

- October 13, 2014: Embrace Volatility

- October 6, 2014: Tips For 401k Open Enrollment

- September 29, 2014: What Can We Learn From Bill Gross’ Departure From PIMCO?

- September 22, 2014: Why Total Return Bond Funds?

- September 15, 2014: Equity And Total Return Bond Fund Composite Portfolios

- September 8, 2014: Momentum Based Portfolios Review

- September 1, 2014: Risk & Diversification: Mint.com Interview

- August 25, 2014: Remember Risk

- August 18, 2014: Consistency, The Most Important Edge In Investing: Tactical Case

- August 11, 2014: What To Do In Overvalued Stock Markets

- August 4, 2014: Is This The Peak Or Correction?

- July 28, 2014: Stock Musings

- July 21, 2014: Permanent Portfolios & Four Pillar Foundation Based Framework

- July 14, 2014: Composite Portfolios Review

- July 7, 2014: Portfolio Behavior During Market Corrections

- June 30, 2014: Half Year Brokerage ETF and Mutual Fund Portfolios Review

- June 23, 2014: Newsletter Collection Update

- June 16, 2014: There Are Always Lottery Winners

- June 9, 2014: The Arithmetic of Investment Mistakes

- June 2, 2014: Tips On Portfolio Rebalance

- May 26, 2014: In Praise Of Low Cost Core Asset Class Based Portfolios

- May 19, 2014: Consistency, The Most Important Edge In Investing: Strategic Case

- May 12, 2014: How To Handle An Elevated Overvalued Market

- May 5, 2014: Asset Allocation Funds Review

- April 28, 2014: Now The Economy Backs To The ‘Old Normal’, Should Our Investments Too?

- April 21, 2014: Total Return Bond Investing In The Current Market Environment