Re-balance Cycle Reminder All MyPlanIQ’s newsletters are archived here.

For regular SAA and TAA portfolios, the next re-balance will be on Monday, November 13, 2017. You can also find the re-balance calendar for 2017 on ‘Dashboard‘ page once you log in.

As a reminder to expert users: advanced portfolios are still re-balanced based on their original re-balance schedules and they are not the same as those used in Strategic and Tactical Asset Allocation (SAA and TAA) portfolios of a plan.

Please note that we now list the next re-balance date on every portfolio page.

REITs As An Asset Class

REITs (Real Estate Investment Trusts) are companies that own or finance real estate. These companies, by law, have to pay out at least 90% of their income (mostly rental income) as dividends to their shareholders. Since these companies’ main business is in real estate that produces regular rental income ( (75% of their total asset should be in real estate), they are distinctly different from other companies like technology, industrial or health care that relies on selling products and services for profits.

Traditionally, REITs are classified as a sector in financial industry. In fact, even today, in stock screening tools provided by many brokerages, they are treated as an special sector. However, MyPlanIQ believes they deserve to be a distinct asset class and have treated them as such.

In the following, we look at the two most important factors that determine an asset class.

Stocks like long term returns

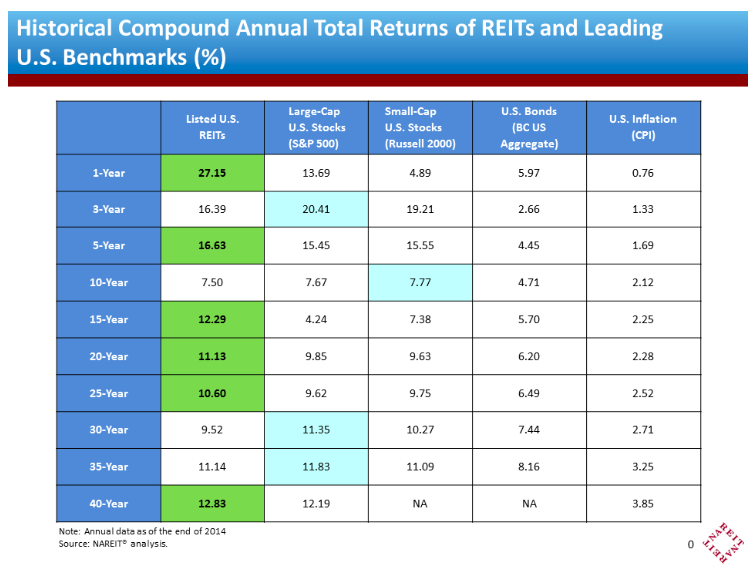

To qualify as a major asset class, it has to produce a reasonable long term return. Investors derive returns from REITs through their dividends and capital price appreciation. The following return chart is courtesy from NAREIT (National Association of REITs):

The data are up to end of 2014. One can see that REITs have slightly outperformed S&P 500 for various periods up to 40 years. This is significant as we now have a comparable asset class that delivers stock like long term returns.

However, REIT index funds like VGSIX (Vanguard REIT Index Inv) or IYR (iShares US Real Estate) do exhibit higher volatility. For example, VGSIX lost -63.7% alone in 2008, compared with -47.7% loss of S&P 500. It has maximum drawdown 73.1% that occurred from 2007 to 2009, compared with S&P 500’s 55.3%. Its standard deviation, a measure of daily volatility, is also higher than S&P 500: 26.8 vs. 17.8.

This implies that this asset has lower risk adjusted return, or Sharpe ratio. So it leads to the next question, does it add additional value to a portfolio?

Diversification and correlation with stocks

Fortunately, even though more often than not, REITs behave closely as general equity/stock market index, they do exhibit weak correlation at times, sometimes when general stock markets were in a dump.

For example, the following table shows how they fared compared with S&P 500 (VFINX) during the technology induced bear market from 2000 to 2003.

| Fund Name | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|

| VGSIX (Vanguard REIT Index Inv) | 3.7% | 12.3% | 26.3% | -3.9% | -16.3% |

| VFINX (Vanguard 500 Index Investor) | -22.2% | -12% | -9.1% | 21.1% | 28.6% |

During that bear market, REITs became an excellent diversifier: producing double digit annual return while stocks lost over 40%. On the other hand, we also showed the returns of two additional years (1998 and 1999) that preceded 2000. In those two years, compared with S&P 500’s double digit returns, it had very meaningful loss.

REITs had a negative correlation with stocks in those years. However, during the 2008-2009 financial crisis, REITs lost big. This is understandable: that bear market was caused by real estate debacle.

Recently, REITs again have shown some divergence from stocks. For example, based on our Asset Trends and Correlation page, at this moment, it has the lowest correlation (0.38) with US stocks in the decade:

In a word, REITs can be a reasonable portfolio diversifier. It can have weak or negative correlation at times that can help to make a portfolio more stable.

Recent weakness

REITs usually show weakness at the start of an interest rate hike cycle. This is because investors become more concerned about their income when interest rates are high — in such a period, REITs will have tighter financing condition and cost that in turns can hurt their income. However, once the rate hike cycle is near its end, REITs usually show strength as they have done their inflation/interest rate hike adjustment in terms of their rental income (by raising rental prices, for example) to fully compensate for the higher rates. So in a longer term, REITs can deliver above inflation excessive returns similar to stocks.

The following table shows the recent weakness in REITs:

| Fund | YTD Return** |

1Yr AR | 3Yr AR | 5Yr AR | 10Yr AR |

|---|---|---|---|---|---|

| VGSIX (Vanguard REIT Index Inv) | 5.5% | 6.4% | 9.8% | 10.1% | 5.8% |

| VFINX (Vanguard 500 Index Investor) | 15.7% | 22.0% | 13.1% | 14.5% | 7.2% |

It has had a noticeable weak return in the past one year. This reflects investors’ concern in the current rate hike period.

REITs in asset allocation

Based on the above data, we make several observations:

- REITs can be a good portfolio diversifier as it delivers stock like long term return while having weak correlation with stocks.

- For Strategic Asset Allocation (SAA), investors can allocate some capital to REITs. A good reference allocation is P David Swensen Yale Individual Investor Portfolio Annual Rebalancing that has a sizable allocation (20%) in REITs. Based on its volatility, on the other hand, we believe its allocation should be lower than that for US stocks.

- For Tactical Asset Allocation(TAA), REITs should be a candidate asset such that it can be used at times when it shows strength.

Market Overview

US stocks continued to break their record territory. Interest rate sensitive sectors like REITs, bonds and commodities did pretty well last week, probably reflecting investors’ lessening concern on rate hike effect. As summer is ending, stocks and other risk assets haven’t shown much weakness and continued to rise. Again, considering the very high stock valuation and low interest rates (that are rising), we are cautiously optimistic. Stay the course but manage risk within an acceptable range.

For more detailed asset trend scores, please refer to 360° Market Overview.

Now that the Trump administration has been in the office for more than half a year, it has stumbled and encountered many difficulties to implement its promised changes in terms of tax cuts, job stimulation and infrastructure spending. On the other hand, stocks continued to ascend, regardless of the progress. Looking ahead, however, we remain convinced that markets will experience more volatilities at some point when reality finally sets in.

In terms of investments, U.S. stock valuation is at a historically high level. It is thus not a good time to take excessive risk. However, we remain optimistic on U.S. economy in the long term and believe much better investment opportunities will arise in the future.

We again would like to stress for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Latest Articles

- October 9, 2017: Conservative Portfolios Revisited

- October 2, 2017: The Role of Short Term Bond Funds

- September 25, 2017: Fees In Cash Investments

- September 18, 2017: Conservative Portfolios Review

- September 11, 2017: International Diversification Effect

- September 4, 2017: Invest And Speculate Revisited

- August 28, 2017: Total Return Bond Fund Portfolios: Where Do They Fit?

- August 21, 2017: Portfolio Performance: A Walk In The Past

- August 14, 2017: Fidelity Commission Free ETFs Update

- August 7, 2017: I Didn’t Learn Anything — Mistake vs. Temporary Underperformance

- July 31, 2017: Asset Classes And Fund Choices: A Primer

- July 24, 2017: Total Return Bond Fund Portfolios And Cash

- July 17, 2017: Long Term Stock Holding Periods For Retirement

- July 10, 2017: Half Year Asset Trend Review

- June 26, 2017: How To Beat The Best Balanced Allocation Fund

- June 19, 2017: Newsletter Collection Update

- June 12, 2017: A Mixed Bag Performance of Momentum Investing

- June 5, 2017: How To Start A New Portfolio

- May 29, 2017: Alternative Assets And Their Role In Portfolios

- May 22, 2017: Summer Seasonality And Portfolio Management

- May 15, 2017: Cash: Banking Or Investing?

- May 8, 2017: Holding Period of Long Term Timing Portfolios

- May 1, 2017: Debate on Risk vs. Volatility

- April 24, 2017: The Long Term Stock Market Timing Return Since 1871

- April 17, 2017: Risk vs. Volatility: Long Term Stock Market Returns

- April 10, 2017: Total Return Bond ETFs And Portfolios

- April 3, 2017: Quarter End Asset Trend Review

- March 27, 2017: Practical Consideration For IRAs And 401k Accounts

- March 20, 2017: Fund Fees: That’s (Still) Outrageous

- March 13, 2017: Long Term Stock Valuation Review

- March 6, 2017: Asset Classes for Retirement Investments

- February 27, 2017: Fidelity Total Bond Fund Review

- February 20, 2017: Long Term Stock Timing Based Portfolios And Their Roles

- February 13, 2017: Alternative Investment Portfolios Review

- February 6, 2017: Tax Free Municipal Bond Investments Review

- January 30, 2017: Brokerage Specific Conservative Portfolios

- January 23, 2017: Fixed Income Portfolio Review

- January 16, 2017: Long Term Trend Following Portfolio Review

- January 9, 2017: Tactical Asset Allocation Review

- January 3, 2017: Strategic Asset Allocation Review

- December 12, 2016: Enhanced Index Funds

- December 5, 2016: Review Of Broad Base Core Mutual Funds For Brokerages

- November 28, 2016: Core Index ETFs Review

- November 21, 2016: International Exposure Of U.S. Large Companies

- November 14, 2016: Asset Trends After The Election

- November 7, 2016: Rising Rate And Current Bond Trend

- October 31, 2016: Economy Power And Long Term Stock Returns

- October 24, 2016: Current Commodity Trend And Managed Futures

- October 17, 2016: Investment Mistakes And Good Or Bad Investment Strategies

- October 10, 2016: Momentum Investing Review

- October 3, 2016: Survey & Feedback

- September 26, 2016: Fixed Income Investing: Actively Managed Funds vs. Index Funds

- September 19, 2016: Stock Investing: Actively Managed Funds vs. Index Funds

- September 12, 2016: Newsletter Update

- September 5, 2016: Overvalued Markets And Long Term Timing Strategies

- August 29, 2016: Your 401K Finally Draws Attention

- August 22, 2016: Inflation Protected Securities TIPS For Current Overvalued Markets

- August 15, 2016: Risk On: Emerging Market Stocks And Small Cap Stocks

- August 8, 2016: Portfolio Construction Using Stock ETFs And Bond Mutual Funds

- August 1, 2016: Adding Value To Your Own Investments

- July 25, 2016: Tactical Asset Allocation Funds Review

- July 18, 2016: Strategic Asset Allocation & Lazy Portfolio Review

- July 11, 2016: Asset Trend Review

- June 27, 2016: Secular Cycles For Tactical And Strategic Investment Strategies

- June 20, 2016: A World of Debt

- June 13, 2016: Managed Futures For Portfolio Building

- June 6, 2016: Newsletter Summary

- May 30, 2016: Swensen Portfolio And Permanent Portfolios

- May 23, 2016: AAII Article And Some Web Changes

- May 16, 2016: The PIMCO (Dis)Advantages

- May 9, 2016: Boost Your Dull Summer Investments

- May 2, 2016: Low Cost Index Fund Investing

- April 25, 2016: Tax Free Municipal Bond Funds & Portfolios

- April 18, 2016: Asset Class Trend Review

- April 11, 2016: Construction of Sound And Conservative Portfolios

- March 28, 2016: Total Return Bond ETFs Review

- March 21, 2016: Small And Large Company Stock Performance In Different Economic Expansion Cycles

- March 14, 2016: Are Tactical And Timing Strategies Losing Steam?

- March 7, 2016: Defined Maturity Bond Fund Analysis

- February 29, 2016: Smart Strategic Asset Allocation Rebalance When Market Trend Changes

- February 22, 2016: Be Cash Smart

- February 15, 2016: Bond ETF Portfolios

- February 8, 2016: Newsletter Collection Update

- February 1, 2016: Total Return Bond Fund Portfolios In A Volatile Period

- January 25, 2016: Alternative Portfolios Review

- January 18, 2016: Strategic Asset Allocation: A Cautious Outlook

- January 11, 2016: Review Of Trend Following Tactical Asset Allocation

- January 4, 2016: What Worked And Didn’t In 2015

- December 21, 2015: Distressed Assets

- December 14, 2015: High Yield Bonds And Their Correlation With Stocks

- December 7, 2015: Diversification And Global Allocation

- November 30, 2015: Investors and Speculators Combined

- November 23, 2015: Active Stock Fund Performance Consistency

- November 16, 2015: Permanent, Risk Parity And Alternative Portfolios Review

- November 9, 2015: Broad Base Core Mutual Fund Review

- November 2, 2015: Broad Base Index Core ETFs Review

- October 26, 2015: Total Return Bond Fund Review

- October 19, 2015: Advanced Portfolio Review

- October 12, 2015: What About Commodities?

- October 5, 2015: Core Satellite Portfolios In A 401k Account

- September 28, 2015: Risk Managed Strategic Asset Allocation Portfolios Revisited

- September 21, 2015: Quest For The Best Investment Strategy

- September 14, 2015: Core Satellite Portfolios In Market Turmoil

- September 7, 2015: Market Rout Creates An Opportunity to Reposition Your Portfolios

- August 31, 2015: Review of Asset Allocation Funds and Portfolios

- August 24, 2015: Market Rout And Your Portfolios

- August 17, 2015: ETF or Mutual Fund Based Portfolios

- August 10, 2015: Updated Newsletter Collection

- August 3, 2015: Slippery Asset Trends

- July 27, 2015: Performance Dispersion Among Momentum Based Portfolios

- July 20, 2015: Global Balanced Portfolio Benchmarks

- July 13, 2015: Pain in Tactical Portfolios

- July 6, 2015: Fixed Income Total Return Bond Funds In Strategic Asset Allocation Portfolios

- June 29, 2015: Core ETF Commission Free Portfolios

- June 22, 2015: Secular Asset Trends

- June 15, 2015: Giving Up Bonds?

- June 1, 2015: Summer Blues?

- May 26, 2015: Cash, Bonds and Stocks In A Rising Rate Environment

- May 18, 2015: Portfolio Update

- May 11, 2015: Pain in Fixed Income?

- May 4, 2015: The Balanced Stock and Long Term Treasury Bond Portfolios

- April 27, 2015: Long Term Treasury Bond Behavior

- April 20, 2015: 529 College Savings Plan Rebalance Policy Change

- April 13, 2015: Total Return Bond Funds As Smart Cash

- April 6, 2015: The Low Return Environment

- March 30, 2015: Brokerage Specific Core Mutual Fund Portfolios 2

- March 23, 2015: Investment Arithmetic for Long Term Investments

- March 16, 2015: Brokerage Specific Core Mutual Fund Portfolios

- March 9, 2015: Newsletter Collection Update

- March 2, 2015: Total Return Bond ETFs

- February 23, 2015: Why Is Global Tactical Asset Allocation Not Popular?

- February 16, 2015: Where Are Permanent Portfolios Going?

- February 9, 2015: How Have Asset Allocation Funds Done?

- February 2, 2015: Risk Management Everywhere

- January 26, 2015: Composite Portfolios Review

- January 19, 2015: Fixed Income Investing Review

- January 12, 2015: How Does Trend Following Tactical Asset Allocation Strategy Deliver Returns

- January 5, 2015: When Forecast Fails

- December 22, 2014: Long Term Asset Returns: How Long Is Long?

- December 15, 2014: Beaten Down Assets

- December 8, 2014: Implementing Core Asset Portfolios In a Brokerage

- December 1, 2014: Two Key Issues of Investment Strategies

- November 24, 2014: Holiday Readings

- November 17, 2014: Retirement Spending Portfolios Update

- November 10, 2014: Fixed Income Or Cash

- November 3, 2014: Asset Trend Review

- October 27, 2014: Investment Loss, Mistakes And Market Cycles

- October 20, 2014: Strategic Portfolios With Managed Volatility

- October 13, 2014: Embrace Volatility

- October 6, 2014: Tips For 401k Open Enrollment

- September 29, 2014: What Can We Learn From Bill Gross’ Departure From PIMCO?

- September 22, 2014: Why Total Return Bond Funds?

- September 15, 2014: Equity And Total Return Bond Fund Composite Portfolios

- September 8, 2014: Momentum Based Portfolios Review

- September 1, 2014: Risk & Diversification: Mint.com Interview

- August 25, 2014: Remember Risk

- August 18, 2014: Consistency, The Most Important Edge In Investing: Tactical Case

- August 11, 2014: What To Do In Overvalued Stock Markets

- August 4, 2014: Is This The Peak Or Correction?

- July 28, 2014: Stock Musings

- July 21, 2014: Permanent Portfolios & Four Pillar Foundation Based Framework

- July 14, 2014: Composite Portfolios Review

- July 7, 2014: Portfolio Behavior During Market Corrections

- June 30, 2014: Half Year Brokerage ETF and Mutual Fund Portfolios Review

- June 23, 2014: Newsletter Collection Update

- June 16, 2014: There Are Always Lottery Winners

- June 9, 2014: The Arithmetic of Investment Mistakes

- June 2, 2014: Tips On Portfolio Rebalance

- May 26, 2014: In Praise Of Low Cost Core Asset Class Based Portfolios

- May 19, 2014: Consistency, The Most Important Edge In Investing: Strategic Case

- May 12, 2014: How To Handle An Elevated Overvalued Market

- May 5, 2014: Asset Allocation Funds Review

- April 28, 2014: Now The Economy Backs To The ‘Old Normal’, Should Our Investments Too?

- April 21, 2014: Total Return Bond Investing In The Current Market Environment

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.