Core Satellite Portfolios In A 401k Account

One of the most frequently asked questions on how to use MyPlanIQ asset allocation portfolios is that it is often hard to just implement a Tactical Asset Allocation(TAA) in such an account. The main reason is that for many active 401k accounts, investors are still contributing (adding) new salary deduction money per pay check to the account. The inflow of the new money makes it hard to keep track of the holding periods of funds invested, thus making the rebalance of the more active TAA much harder not to violate minimum holding periods imposed by funds or the plan.

Fortunately, there is an easy and good solution to this if you decide to implement a core satellite portfolio instead of a pure TAA portfolio in a 401k account. We regularly discussed a core satellite portfolio methodology, as most often in the recent newsletter September 14, 2015: Core Satellite Portfolios In Market Turmoil. Interested readers can refer to our core satellite section in Newsletter Collection for more background readings.

Implementation details of a core satellite portfolio in a 401k account

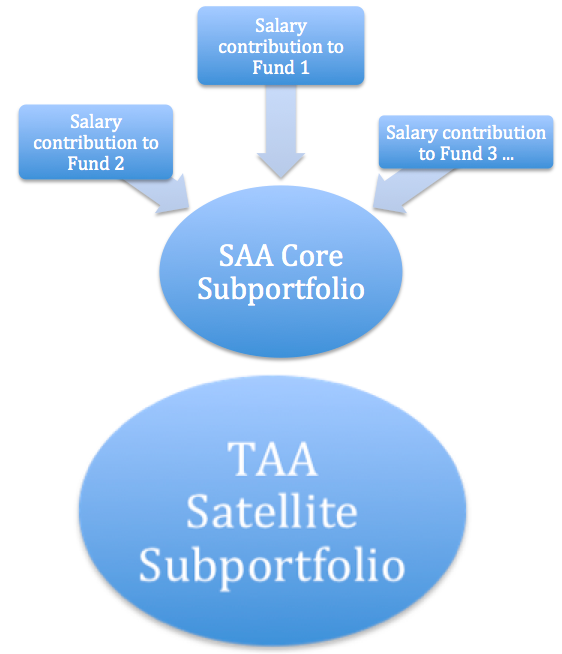

The best way to implement a core satellite portfolio in a 401k account is to construct an SAA (core) subportfolio that invests the newly added (salary deduction per pay check, for example) and a TAA (satellite) subportfolio that invests old money. A normal process would look like the following:

- In a newly established 401k account (i.e. for people who just start a job in a new firm and the 401k account starts from 0 money), you would designate all of the new money in an SAA portfolio for a couple of years. Month in and month out, you just keep adding the new money to the funds you select. In general, you change your fund (and asset allocation) selection infrequently, such as once a year.

- Depending on your design (based on your risk profile and own personal taste), when the account grows to a certain level that you deem to need to have capital protection (it can be after 1 year or as long as after 5 years), you now start to allocate some of this old money to a satellite TAA subportfolio. But you always keep the core SAA to invest the new money.

- Once a year, you would move some money in the SAA subportfolio to the TAA subportfolio. However, you will always keep the SAA at a level such that it holds money added in the more recent year (at least one year, for example).

The following picture illustrates the concept:

Note: if you move a 401k account to a new 401k account due to job change, you should consider that portion of money as old and allocate it in both SAA and TAA subportfolios, again depending on the allocation breakdown between the SAA and TAA.

Basically, the above process would result in designating new contribution to the SAA holdings while you manually allocate and rebalance the existing account based on the SAA and TAA breakdown.

Assuming you maintain at least one year or so new money in buy and hold SAA holdings, the process eliminates messy holding period concern and guarantees that no minimum holding period restriction is violated for the newly contributed money. Of course, for the TAA part, you would still need to obey the minimum holding period restriction. By default, MyPlanIQ assumes 3 month minimum holding period for each fund and that is usually more than enough to satisfy the requirement.

In general, many 401k plans (such as those on Fidelity or Schwab 401k platforms) allow you to instruct the system what funds to invest for the contributions and what funds to invest for the existing money (rebalances). To some extent, many 401k plans are better designed to implement an asset allocation portfolio compared with brokerage accounts that usually don’t have a basket rebalance mechanism available to clients.

Core satellite portfolio advantage in 401k

The main advantage of core satellite portfolios is their use of two often complemented strategies (strategic and tactical) that can smooth out portfolio’s returns in various of market conditions. However, adding constant new contributions to a core SAA while investing a more substantial part of ‘old’ money in a satellite TAA has several advantages:

- The regular added contributions will be able to capture market downturns and get a better investment price when markets are low. This has a distinct advantage over just putting money to ‘safe’ money market or bond funds when markets have a down trend (and because TAA dictates moving to cash). The core SAA will serve as a buy low mechanism in this case.

- You regularly rebalance the overall account (once per year, for example, as suggested in the above) between the SAA and TAA, thus you can take profits from the SAA portion when markets are high, thus sell high in this case.

- A more advanced version would be you only move part of the excessive SAA portion to TAA when TAA calls for a risk reduction. What that does is that it is possible to let your profit run until markets hit a soft patch instead of taking profits too early. You can also decide to skip such SAA to TAA moves if you find that you are comfortable with the risk.

Finally, perhaps the most important advantage of this approach is that it is easier to implement and it does not make your account completely subject to either one’s weakness, thus reducing emotional anxiety that usually tests many investors’ patience.

For working year employees who contribute to a 401k account, core satellite portfolio approach, implemented as above, can be an effective and practical solution.

Market Overview

Stocks underwent a surge after Friday’s payroll report which missed the expectation by a big margin. It is hard to pinpoint the cause of the rally. As stated before, markets go through a couple of decline and rally phases, even in a downtrend. At the moment, it looks like markets are increasingly hinging on the third quarter earnings and some other fundamental data. Based on Thomson Reuters, earnings of S&P 500 companies are expected to decline by over 4.2% in the third quarter. This is the headwind to the current markets. In the interest rate side, it does look like it is less likely the Fed will be able to raise the rate in the near months. Regardless, market valuation is still high and we are still in a downturn trend at the moment. Investors should exercise caution.

For more detailed asset trend scores, please refer to 360° Market Overview.

We would like to remind our readers that markets are more precarious now than other times in the last 5 years. It is a good time and imperative to adjust to a risk level you are comfortable with right now. However, recognizing our deficiency to predict the markets, we will stay on course.

We again copy our position statements (from previous newsletters):

Our position has not changed: We still maintain our cautious attitude to the recent stock market strength. Again, we have not seen any meaningful or substantial structural change in the U.S., European and emerging market economies. However, we will let markets sort this out and will try to take advantage over its irrational behavior if it is possible.

We again would like to stress for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Latest Articles

- September 28, 2015: Risk Managed Strategic Asset Allocation Portfolios Revisited

- September 21, 2015: Quest For The Best Investment Strategy

- September 14, 2015: Core Satellite Portfolios In Market Turmoil

- September 7, 2015: Market Rout Creates An Opportunity to Reposition Your Portfolios

- August 31, 2015: Review of Asset Allocation Funds and Portfolios

- August 24, 2015: Market Rout And Your Portfolios

- August 17, 2015: ETF or Mutual Fund Based Portfolios

- August 10, 2015: Updated Newsletter Collection

- August 3, 2015: Slippery Asset Trends

- July 27, 2015: Performance Dispersion Among Momentum Based Portfolios

- July 20, 2015: Global Balanced Portfolio Benchmarks

- July 13, 2015: Pain in Tactical Portfolios

- July 6, 2015: Fixed Income Total Return Bond Funds In Strategic Asset Allocation Portfolios

- June 29, 2015: Core ETF Commission Free Portfolios

- June 22, 2015: Secular Asset Trends

- June 15, 2015: Giving Up Bonds?

- June 1, 2015: Summer Blues?

- May 26, 2015: Cash, Bonds and Stocks In A Rising Rate Environment

- May 18, 2015: Portfolio Update

- May 11, 2015: Pain in Fixed Income?

- May 4, 2015: The Balanced Stock and Long Term Treasury Bond Portfolios

- April 27, 2015: Long Term Treasury Bond Behavior

- April 20, 2015: 529 College Savings Plan Rebalance Policy Change

- April 13, 2015: Total Return Bond Funds As Smart Cash

- April 6, 2015: The Low Return Environment

- March 30, 2015: Brokerage Specific Core Mutual Fund Portfolios 2

- March 23, 2015: Investment Arithmetic for Long Term Investments

- March 16, 2015: Brokerage Specific Core Mutual Fund Portfolios

- March 9, 2015: Newsletter Collection Update

- March 2, 2015: Total Return Bond ETFs

- February 23, 2015: Why Is Global Tactical Asset Allocation Not Popular?

- February 16, 2015: Where Are Permanent Portfolios Going?

- February 9, 2015: How Have Asset Allocation Funds Done?

- February 2, 2015: Risk Management Everywhere

- January 26, 2015: Composite Portfolios Review

- January 19, 2015: Fixed Income Investing Review

- January 12, 2015: How Does Trend Following Tactical Asset Allocation Strategy Deliver Returns

- January 5, 2015: When Forecast Fails

- December 22, 2014: Long Term Asset Returns: How Long Is Long?

- December 15, 2014: Beaten Down Assets

- December 8, 2014: Implementing Core Asset Portfolios In a Brokerage

- December 1, 2014: Two Key Issues of Investment Strategies

- November 24, 2014: Holiday Readings

- November 17, 2014: Retirement Spending Portfolios Update

- November 10, 2014: Fixed Income Or Cash

- November 3, 2014: Asset Trend Review

- October 27, 2014: Investment Loss, Mistakes And Market Cycles

- October 20, 2014: Strategic Portfolios With Managed Volatility

- October 13, 2014: Embrace Volatility

- October 6, 2014: Tips For 401k Open Enrollment

- September 29, 2014: What Can We Learn From Bill Gross’ Departure From PIMCO?

- September 22, 2014: Why Total Return Bond Funds?

- September 15, 2014: Equity And Total Return Bond Fund Composite Portfolios

- September 8, 2014: Momentum Based Portfolios Review

- September 1, 2014: Risk & Diversification: Mint.com Interview

- August 25, 2014: Remember Risk

- August 18, 2014: Consistency, The Most Important Edge In Investing: Tactical Case

- August 11, 2014: What To Do In Overvalued Stock Markets

- August 4, 2014: Is This The Peak Or Correction?

- July 28, 2014: Stock Musings

- July 21, 2014: Permanent Portfolios & Four Pillar Foundation Based Framework

- July 14, 2014: Composite Portfolios Review

- July 7, 2014: Portfolio Behavior During Market Corrections

- June 30, 2014: Half Year Brokerage ETF and Mutual Fund Portfolios Review

- June 23, 2014: Newsletter Collection Update

- June 16, 2014: There Are Always Lottery Winners

- June 9, 2014: The Arithmetic of Investment Mistakes

- June 2, 2014: Tips On Portfolio Rebalance

- May 26, 2014: In Praise Of Low Cost Core Asset Class Based Portfolios

- May 19, 2014: Consistency, The Most Important Edge In Investing: Strategic Case

- May 12, 2014: How To Handle An Elevated Overvalued Market

- May 5, 2014: Asset Allocation Funds Review

- April 28, 2014: Now The Economy Backs To The ‘Old Normal’, Should Our Investments Too?

- April 21, 2014: Total Return Bond Investing In The Current Market Environment

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.