Re-balance Cycle Reminder All MyPlanIQ’s newsletters are archived here.

Regular AAC (Asset Allocation Composite), SAA and TAA portfolios are always rebalanced on the first trading day of a month. the next re-balance will be on Monday June 1, 2020.

Please note: As of March 1, 2020, we officially phased out our old rebalance calendar for both SAA and TAA. They are now always rebalanced on the first trading day of a month.

As a reminder to expert users: advanced portfolios are still re-balanced based on their original re-balance schedules and they are not the same as those used in Strategic and Tactical Asset Allocation (SAA and TAA) portfolios of a plan.

The Real, Sensible And Wise Warren Buffett

Last weekend, Warren Buffett, one of the most famous and highly revered investors in the world, held a live online virtual annual shareholder meeting for his company, Berkshire Hathaway. Buffett, a man of almost 90 years old, ran the meeting non-stop for almost 5 hours and again delivered valuable and memorable business, finance and life lessons.

Though many in the internet were quick to point out that this might be the first time Buffett was pessimistic, uncertain and sometimes contradicting, we think this offers a good opportunity for us to see a real and sensible Buffett from whom average investors can learn a great deal.

Buy and hold?

Buffett has been widely quoted to be a buy and hold stock investor: financial advisors, service firms and media often use his name to persuade people to stay the course in stock investing: perpetually buying and holding stocks forever. He himself did have quotes like “Our favorite holding period is forever.” So it was shocking for many to hear that Berkshire Hathaway liquidated all of its four major airline stock holdings in this crisis, most likely during the market bottom in March. So what happened?

The short answer is: it makes sense. Nothing inconsistent here.

The long answer is as follows:

Regardless of what have been said and quoted about Buffett, he is in essence a business man. Ultimately, he invests/purchases businesses based on their intrinsic earnings or profit potential, not based on any public stock price quotes for these companies. Amid the Covid-19 crisis, he found that the airline business has some fundamental long term issues such as “We like those airlines but the world has changed…and I don’t know how it’s changed,” Because of the recent Covid-19 crisis, those airlines are now planning to borrow $10 billion to $12 billion each. “That takes away from the upside,” he said, “and I don’t know whether two or three years from now, that as many people will fly as many passenger miles as they did last year …The future is much less clear to me about how the business will turn out through absolutely no fault of the airlines themselves.”

Imagine you are a business person who owns an airline business and let that sink in for a moment, and then ask yourself what to do?

Well, if the underlying condition of your business becomes so much uncertain going forward (not uncertain on how much you’ll be able to make, but not even sure whether you’ll be able to survive in the future), what would you do? Maybe you’ll need to cut the loss and move on.

And that’s exactly what Buffett did.

But how about his ‘buy and hold forever’ mantra? Well, what Buffett really meant here is that: daily pricing of a business in a public exchange (called ‘stock exchange’) is totally unreliable and most times is absurd. If you think about the stock exchange as a person, let’s call it Mr. Market, you’ll find Mr. Market is extremely volatile, sometimes, it quotes you an outrageously expensive price and sometimes, it offers you a fire sale. Furthermore, Mr. Market’s mood is quick to change: as short as seconds.

This of course was partially caused by the short term uncertainty of a business: no body, even the CEO or the owner of a company, can precisely know how the business will do in the coming month, coming quarter and years.

But one thing is certain, on aggregate, high quality businesses will earn inflation beating profits in a long term in a fair capital market (see, for example, March 18, 2019: The Risk Of Stock Investing). So to realize this, one has to buy and hold stocks for a long time, in general 20 years or longer. This is more out of necessity than for the sake of owning a stock for a long time, income tax issue notwithstanding.

So as shocking as it might seem, Buffett’s sales of the airline stocks with a large loss is totally consistent with his past teaching.

Individual stocks or S&P 500 index?

It’s actually very challenging for many average investors (in fact, for most professional investors too) to study, evaluate and monitor individual businesses. That’s why Buffett actually suggested individual investors to buy S&P 500 index: “In my view, for most people, the best thing to do is owning the S&P 500 index fund.”. This time, he emphasized the low cost: “There are huge amounts of money people pay for advice they really don’t need” .

The reason, certainly is that one can do as well as or even better than many active managers/advisors with much lower risk: a broad base index like S&P 500 is a very consistent, no surprise index that’s very diversified. It will be much less seriously impacted when something goes wrong. For example, Buffett’s mistake in airline stocks affected Berkshire’s investment returns in some meaningful way as the airline stocks took up about 10% or so of the overall investment portfolio. So a half or 50% loss of these stock values will probably shave 4-5% off the overall portfolio’s return.

Another interesting question came up in the meeting was that when Buffett was asked to address Berkshire’s underperformance against S&P 500 for the past 10 and even 15 years, he only assured that he and others in Berkshire are fully vested in Berkshire and will do their best for the company. He can’t guarantee Berkshire’s stock will beat S&P 500 even in the long term. Again, as we have discussed in the past (see, April 1, 2019: S&P 500 As A Business), when you invest in S&P 500 index, you are effectively investing in a business that has had an outstanding long term track record for more than 100 years: 4-6% extra annual returns over inflation and never lost any money (i.e. negative profit) in any single year since 1871. Warren Buffett, as great as or better than any great investor in the world, was just simply very honest here to advocate S&P 500 index investment!

Stocks are of good long term values vs. Buffett isn’t buying anything at the moment

Some people find it confusing that while Buffett advocated buying and holding stocks is much better than holding Treasury bills, Buffett himself didn’t buy anything in the last several months, even when stock markets were in a dump.

Again, Buffett as a businessman is just simply trying to find good businesses with a good price (preferably dirt cheap prices). If he can’t find anything undervalued, he would rather wait.

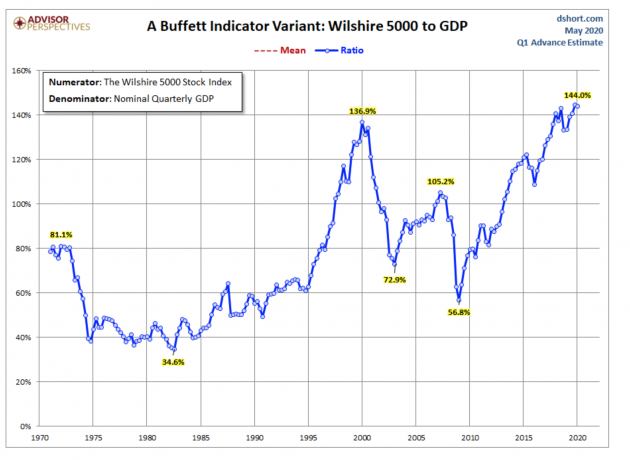

Who said you need to always plunge your money to stocks in any moment? Granted, for most of average investors, it’s hard for them to value individual stocks. But Buffett did offer a very good and simple valuation method for general stock market: the ratio of total stock market capitalization to Gross National Product (GNP) as a yard stick to measure the stock market valuation. In his 2001 Fortune magazine article, he stated that

“The ratio has certain limitations in telling you what you need to know. Still, it is probably the best single measure of where valuations stand at any given moment”.

At the moment, the indicator stood at:

Source: Advisor Perspective

So with the ratio being at historical high, higher than those in 2000 and 2007 peaks, no wonder why Buffett couldn’t find bargains fast enough (the Federal Reserve acted super fast this time to rescue the market and that gave Buffett a very little window to find bargains) and he’s still holding lot of cash right now.

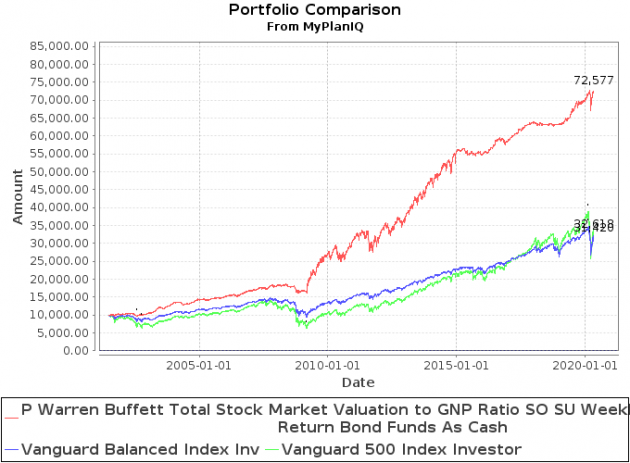

For an average investor, acting like Buffett based on his indicator to buy and sell S&P 500 index fund has actually done a far better job than just simply buying and holding S&P 500 all the time. MyPlanIQ has tracked the following portfolio for more than 10 years now:

| Ticker/Portfolio Name | YTD Return |

1Yr AR | 3Yr AR | 5Yr AR | 10Yr AR | 15Yr AR | Since 7/1/2001 |

|---|---|---|---|---|---|---|---|

| P Warren Buffett Total Stock Market Valuation to GNP Ratio SO SU Weekly Strategy Total Return Bond Funds As Cash | 4.1% | 11.8% | 6.0% | 5.3% | 9.7% | 11.5% | 11.1% |

| SPY (SPDR S&P 500 ETF) | -11.6% | -1.1% | 8.0% | 8.3% | 11.3% | 8.2% | 6.6% |

AR: Annualized Return

Our take away from the meeting is that we are seeing a real, sensible, honest and extremely wise person who has been very consistent, disciplined and smart in his business and investment decisions. Regarding Berkshire’s recent underperformance, we encourage readers to read the famous contract bridge story: ‘If you had played it right you would have lost it.’“ In fact, long term Berkshire’s shareholders should find it more assuring that Buffett is still sticking to his investment approach. Regardless of whether Berkshire’s stock will outperform S&P 500 in the long term (subjectively, we believe it will as it’s cheaper than S&P 500 right now), the business is in a good hand.

Though financial media tend to simplify his teachings in some bite size messages, one can benefit greatly if paying enough attention and digging through a bit to understand Warren Buffett’s overall approach. As a bonus, this learning extends beyond investing to our daily life.

Market overview

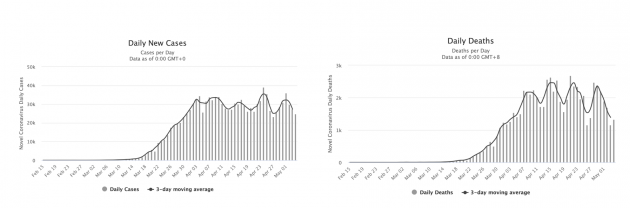

As the Covid-19 crisis drags on, it seems that people are getting restless and even numb to the ongoing infections and deaths. The following two charts show the latest (as of 5/4/2020) daily trends in the U.S.:

Even though it declines a bit, the curves are not flattened as much as one would wish. As more states are reopening up economy, this is still very concerning. IHME is now projecting a total of 134k deaths by August this year, a whopping increase from 60k two weeks ago.

Earnings wise, investors seem to be determined to shrug off the bad earnings in 2020 all together: based on Factset, Q1 earnings decline is now -13.7% and analysts further expect the full year earnings decline to be -17.8%. S&P 500 index stood at 2800 level, not far from its all time high.

Again we emphasize that stocks are still highly overvalued. Given the plenty of uncertainties associated with Covid-19 crisis, one shouldn’t be complacent. In fact, as stocks are still highly priced, it’s a good time to review your portfolio allocation and make adjustments based on your risk tolerance. Our boilerplate suggestions below still apply:

- For strategic allocation (buy and hold) investors, ignore the current market behavior. Remember, as what we have emphasized numerous times, when you choose and commit to a strategic portfolio, you essentially know and commit that your investment horizon (or the time you need to utilize this capital) is 20 years or longer. As we pointed out, if your investments are those diversified (index) funds such as an S&P 500 index fund (VFINX, for example), you know your money is in some solid ‘business’ that eventually (20 years later) will deliver some reasonable returns. As long as you are comfortable with this thesis, you should sit tight and forget about the current gyration.

- For tactical investors, again, you have to ignore the current market noise. Furthermore, you should follow your strategy rigorously, especially in a time like this. Human emotion, both optimistic and pessimistic, and human desire, both greedy and fearful, are your worst enemies. This has been shown to be true time and time again.

For more detailed current market trends, please refer to 360° Market Overview.

In terms of investments, stocks are somewhat cheaper. Investors should not be swayed by the current market volatility and economic distress, instead, they should stand ready to take advantage of the opportunities. For most Americans, we offer the following Winston Churchill’s remark made in the darkest days of World War II: “The Americans will always do the right thing, but only after they have tried everything else.” As a country, the US (and the rest of the world) will get over this, as always, even after stumbles. The past development has been very supportive to our optimistic long term view so far.

We again would like to stress for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.

Latest Articles

- April 27, 2020: Total Return Bond Funds & Portfolios

- April 20, 2020: Multi-Factor ETFs and Rotation

- April 13, 2020: A Closer Look At 401(k) Investment Portfolios

- April 6, 2020: Long Term Stock Market Timing Since 1871 Revisited

- March 30, 2020: How Did Bond ETFs And Mutual Funds Fare In The Current Crisis?

- March 23, 2020: Chaos And Hope

- March 16, 2020: A Live Lesson

- March 9, 2020: Risk And Reward

- March 2, 2020: The Risk Of Coronavirus Outbreak

- February 24, 2020: Long Term Stock Valuation Based Investment Strategies

- February 10, 2020: Update On Short Term Cash, Treasury Bills and Brokered CDs

- February 3, 2020: Investment Landscape For Retirees And Would-be Retirees: Stocks

- January 27, 2020: Investment Landscape For Retirees And Would-be Retirees: Fixed Income

- January 13, 2020: Portfolio Performance: A Walk In The Past II

- January 6, 2020: Asset Outlook and Portfolio Strategies

- December 16, 2019: Q&As On Our Services

- December 9, 2019: Portfolio Constructions For Advanced Users

- December 2, 2019: Newsletter Collection Update

- November 25, 2019: Core ETFs or Core Mutual Funds Portfolios

- November 18, 2019: Introducing MyPlanIQ Asset Allocation Composite Strategy

- November 11, 2019: Market Indicator And Momentum

- November 4, 2019: Factor ETF Rotation

- October 28, 2019: Multi-factor ETFs vs. Equal Weight Multi-Factor Portfolios

- October 21, 2019: Multi-factor ETFs: Value And Momentum

- October 14, 2019: Low Volatility Factor ETFs

- October 7, 2019: Zero Commission Era Has Arrived, Is It Really That Good?

- September 30, 2019: Boosting Bond ETF Portfolio’s Return With Muni Bond ETFs

- September 23, 2019: Value ETFs

- September 16, 2019: Factor ETFs

- September 9, 2019: Momentum Factor Stock ETFs

- August 26, 2019: Employer 401k Match: Yet Another Free Lunch Not To Be Missed

- August 19, 2019: PIMCO Income Fund and Other Total Return Bond Funds Update

- August 12, 2019: Aggressive Fixed Income Portfolios?

- August 5, 2019: Long Term Investment Strategies And Short Term Market Noises

- July 29, 2019: Fixed Income Portfolios In A Lower Yield Environment

- July 22, 2019: Core Satellite Portfolios Balance Fluctuation

- July 15, 2019: Quality Stock Factor ETFs

- July 8, 2019: Surprise! Brokerages Make Most From Your Cash, Not Commissions

- July 1, 2019: Utilities Sector Review

- June 24, 2019: Asset Allocation Funds Review

- June 17, 2019: Latest Performance Comparison Among Several Advanced Strategies

- June 10, 2019: Money Market And Ultra Short Term Bond Funds

- June 3, 2019: What We Can Learn From The Seasonality Strategy

- May 20, 2019: Morningstar Portfolio Manager Awards

- May 13, 2019: Total Return Bond ETFs Review

- May 6, 2019: Global Allocation Revisited

- April 29, 2019: Asset Trend Review

- April 22, 2019: The Current State Of Fixed Income

- April 15, 2019: The Importance Of Fixed Income Returns For Retirement Spending

- April 8, 2019: Newsletter Collection Update

- April 1, 2019: S&P 500 As A Business

- March 25, 2019: Health Care Sector Review

- March 18, 2019: The Risk Of Stock Investing

- March 11, 2019: Consumer Staples Sector Review

- March 4, 2019: Global Stock Valuation Update

- February 25, 2019: ‘Bad’ Tactical Strategy

- February 11, 2019: “Best” Balanced Fund And Portfolios Revisited

- February 4, 2019: Cash And Money Market Funds: Interests And Safety

- January 28, 2019: Fixed Income Review

- January 14, 2019: Tactical Asset Allocation Portfolio Review

- January 7, 2019: Global Strategic Asset Allocation Portfolio Review

- December 17, 2018: Robinhood’s ‘Revolution’ Or Gimmick

- December 10, 2018: How Defensive Are REITs?

- December 3, 2018: Conservative Core Satellite Portfolio

- November 26, 2018: Allocation Mutual Fund Review

- November 19, 2018: Is The Recent Downtrend Sustainable?

- November 12, 2018: The Staggering Low Interest Rates From Big Banks

- November 5, 2018: The ‘Right’ Or ‘Wrong’ Decision

- October 29, 2018: Taxable Total Return Bond Plus Muni Bond Fund Based Portfolios

- October 22, 2018: DoubleLine Shiller CAPE 10 Based Fund Review

- October 15, 2018: Newsletter Collection Update

- October 8, 2018: Asset Trend Review

- October 1, 2018: Taxable vs. Tax Exempt High Yield Bonds

- September 24, 2018: High Yield Bonds In A Rising Rate Environment

- September 10, 2018: Value, Growth And Blend Stock Style Investing

- August 27, 2018: Money Market ETFs?

- August 20, 2018: How Momentum Investing Stacks Up?

- August 13, 2018: Total Return Bond ETF

- August 6, 2018: Fidelity Zero-Fee Index Funds

- July 30, 2018: Tax Efficient Portfolios

- July 23, 2018: Municipal Bond Funds And Portfolios

- July 16, 2018: A Guide To Conservative Portfolios

- July 9, 2018: Conservative Allocation Mutual Funds Based Portfolios

- July 2, 2018: Small Cap Stocks For The Long Term

- June 25, 2018: What Can We Learn From GE’s Removal From Dow Jones Index?

- June 18, 2018: The ‘Best’ Balanced Portfolio Continues To Excel

- June 11, 2018: Is 10 Year Long Enough For Portfolio Comparison?

- June 4, 2018: Action Plan: Risk Review For Investments

- May 21, 2018: Rising Rates, Consumer Staples And Stock Index

- May 14, 2018: Newsletter Collection Update

- May 7, 2018: Money Market Fund Taxonomy

- April 30, 2018: Momentum Investing Review

- April 23, 2018: Commodities In Current Environment

- April 16, 2018: Municipal Bonds As A Fixed Income Asset Class

- April 9, 2018: Exponential Or Compounding Nature In Investing

- April 2, 2018: Inside Of The Stock Chaos

- March 26, 2018: Total Return Bond Update

- March 19, 2018: Treasury Bills vs. Brokered CDs

- March 12, 2018: Defensive Conservative Portfolio Review

- March 5, 2018: Warren Buffett’s Advices

- February 26, 2018: Pros And Cons of Strategic And Tactical Portfolios In 2018

- February 12, 2018: Trend Review

- February 5, 2018: Market Selloff And Long Term Investing

- January 29, 2018: The New Addition To Our Total Return Bond Fund Candidates

- January 22, 2018: Where Are Bonds Heading?

- January 15, 2018: Tactical Portfolios Review

- January 8, 2018: Strategic Portfolios Review

- December 18, 2017: Record Highs And Risk

- December 11, 2017: Cash Return And Interest Rate Update

- December 4, 2017: Mutual Fund Star Ratings: Are They Useful?

- November 20, 2017: Thankful And Mindful

- November 13, 2017: Is This A Good Time For Retirees Or Would Be Retirees?

- November 6, 2017: Newsletter Collection Update

- October 30, 2017: Rising Interest Rates

- October 23, 2017: A Primer For Portfolios

- October 16, 2017: REITs As An Asset Class

- October 9, 2017: Conservative Portfolios Revisited

- October 2, 2017: The Role of Short Term Bond Funds

- September 25, 2017: Fees In Cash Investments

- September 18, 2017: Conservative Portfolios Review

- September 11, 2017: International Diversification Effect

- September 4, 2017: Invest And Speculate Revisited

- August 28, 2017: Total Return Bond Fund Portfolios: Where Do They Fit?

- August 21, 2017: Portfolio Performance: A Walk In The Past

- August 14, 2017: Fidelity Commission Free ETFs Update

- August 7, 2017: I Didn’t Learn Anything — Mistake vs. Temporary Underperformance

- July 31, 2017: Asset Classes And Fund Choices: A Primer

- July 24, 2017: Total Return Bond Fund Portfolios And Cash

- July 17, 2017: Long Term Stock Holding Periods For Retirement

- July 10, 2017: Half Year Asset Trend Review

- June 26, 2017: How To Beat The Best Balanced Allocation Fund

- June 19, 2017: Newsletter Collection Update

- June 12, 2017: A Mixed Bag Performance of Momentum Investing

- June 5, 2017: How To Start A New Portfolio

- May 29, 2017: Alternative Assets And Their Role In Portfolios

- May 22, 2017: Summer Seasonality And Portfolio Management

- May 15, 2017: Cash: Banking Or Investing?

- May 8, 2017: Holding Period of Long Term Timing Portfolios

- May 1, 2017: Debate on Risk vs. Volatility

- April 24, 2017: The Long Term Stock Market Timing Return Since 1871

- April 17, 2017: Risk vs. Volatility: Long Term Stock Market Returns

- April 10, 2017: Total Return Bond ETFs And Portfolios

- April 3, 2017: Quarter End Asset Trend Review

- March 27, 2017: Practical Consideration For IRAs And 401k Accounts

- March 20, 2017: Fund Fees: That’s (Still) Outrageous

- March 13, 2017: Long Term Stock Valuation Review

- March 6, 2017: Asset Classes for Retirement Investments

- February 27, 2017: Fidelity Total Bond Fund Review

- February 20, 2017: Long Term Stock Timing Based Portfolios And Their Roles

- February 13, 2017: Alternative Investment Portfolios Review

- February 6, 2017: Tax Free Municipal Bond Investments Review

- January 30, 2017: Brokerage Specific Conservative Portfolios

- January 23, 2017: Fixed Income Portfolio Review

- January 16, 2017: Long Term Trend Following Portfolio Review

- January 9, 2017: Tactical Asset Allocation Review

- January 3, 2017: Strategic Asset Allocation Review

- December 12, 2016: Enhanced Index Funds

- December 5, 2016: Review Of Broad Base Core Mutual Funds For Brokerages

- November 28, 2016: Core Index ETFs Review

- November 21, 2016: International Exposure Of U.S. Large Companies

- November 14, 2016: Asset Trends After The Election

- November 7, 2016: Rising Rate And Current Bond Trend

- October 31, 2016: Economy Power And Long Term Stock Returns

- October 24, 2016: Current Commodity Trend And Managed Futures

- October 17, 2016: Investment Mistakes And Good Or Bad Investment Strategies

- October 10, 2016: Momentum Investing Review

- October 3, 2016: Survey & Feedback

- September 26, 2016: Fixed Income Investing: Actively Managed Funds vs. Index Funds

- September 19, 2016: Stock Investing: Actively Managed Funds vs. Index Funds

- September 12, 2016: Newsletter Update

- September 5, 2016: Overvalued Markets And Long Term Timing Strategies

- August 29, 2016: Your 401K Finally Draws Attention

- August 22, 2016: Inflation Protected Securities TIPS For Current Overvalued Markets

- August 15, 2016: Risk On: Emerging Market Stocks And Small Cap Stocks

- August 8, 2016: Portfolio Construction Using Stock ETFs And Bond Mutual Funds

- August 1, 2016: Adding Value To Your Own Investments

- July 25, 2016: Tactical Asset Allocation Funds Review

- July 18, 2016: Strategic Asset Allocation & Lazy Portfolio Review

- July 11, 2016: Asset Trend Review

- June 27, 2016: Secular Cycles For Tactical And Strategic Investment Strategies

- June 20, 2016: A World of Debt

- June 13, 2016: Managed Futures For Portfolio Building

- June 6, 2016: Newsletter Summary

- May 30, 2016: Swensen Portfolio And Permanent Portfolios

- May 23, 2016: AAII Article And Some Web Changes

- May 16, 2016: The PIMCO (Dis)Advantages

- May 9, 2016: Boost Your Dull Summer Investments

- May 2, 2016: Low Cost Index Fund Investing

- April 25, 2016: Tax Free Municipal Bond Funds & Portfolios

- April 18, 2016: Asset Class Trend Review

- April 11, 2016: Construction of Sound And Conservative Portfolios

- March 28, 2016: Total Return Bond ETFs Review

- March 21, 2016: Small And Large Company Stock Performance In Different Economic Expansion Cycles

- March 14, 2016: Are Tactical And Timing Strategies Losing Steam?

- March 7, 2016: Defined Maturity Bond Fund Analysis

- February 29, 2016: Smart Strategic Asset Allocation Rebalance When Market Trend Changes

- February 22, 2016: Be Cash Smart

- February 15, 2016: Bond ETF Portfolios

- February 8, 2016: Newsletter Collection Update

- February 1, 2016: Total Return Bond Fund Portfolios In A Volatile Period

- January 25, 2016: Alternative Portfolios Review

- January 18, 2016: Strategic Asset Allocation: A Cautious Outlook

- January 11, 2016: Review Of Trend Following Tactical Asset Allocation

- January 4, 2016: What Worked And Didn’t In 2015

- December 21, 2015: Distressed Assets

- December 14, 2015: High Yield Bonds And Their Correlation With Stocks

- December 7, 2015: Diversification And Global Allocation

- November 30, 2015: Investors and Speculators Combined

- November 23, 2015: Active Stock Fund Performance Consistency

- November 16, 2015: Permanent, Risk Parity And Alternative Portfolios Review

- November 9, 2015: Broad Base Core Mutual Fund Review

- November 2, 2015: Broad Base Index Core ETFs Review

- October 26, 2015: Total Return Bond Fund Review

- October 19, 2015: Advanced Portfolio Review

- October 12, 2015: What About Commodities?

- October 5, 2015: Core Satellite Portfolios In A 401k Account

- September 28, 2015: Risk Managed Strategic Asset Allocation Portfolios Revisited

- September 21, 2015: Quest For The Best Investment Strategy

- September 14, 2015: Core Satellite Portfolios In Market Turmoil

- September 7, 2015: Market Rout Creates An Opportunity to Reposition Your Portfolios

- August 31, 2015: Review of Asset Allocation Funds and Portfolios

- August 24, 2015: Market Rout And Your Portfolios

- August 17, 2015: ETF or Mutual Fund Based Portfolios

- August 10, 2015: Updated Newsletter Collection

- August 3, 2015: Slippery Asset Trends

- July 27, 2015: Performance Dispersion Among Momentum Based Portfolios

- July 20, 2015: Global Balanced Portfolio Benchmarks

- July 13, 2015: Pain in Tactical Portfolios

- July 6, 2015: Fixed Income Total Return Bond Funds In Strategic Asset Allocation Portfolios

- June 29, 2015: Core ETF Commission Free Portfolios

- June 22, 2015: Secular Asset Trends

- June 15, 2015: Giving Up Bonds?

- June 1, 2015: Summer Blues?

- May 26, 2015: Cash, Bonds and Stocks In A Rising Rate Environment

- May 18, 2015: Portfolio Update

- May 11, 2015: Pain in Fixed Income?

- May 4, 2015: The Balanced Stock and Long Term Treasury Bond Portfolios

- April 27, 2015: Long Term Treasury Bond Behavior

- April 20, 2015: 529 College Savings Plan Rebalance Policy Change

- April 13, 2015: Total Return Bond Funds As Smart Cash

- April 6, 2015: The Low Return Environment

- March 30, 2015: Brokerage Specific Core Mutual Fund Portfolios 2

- March 23, 2015: Investment Arithmetic for Long Term Investments

- March 16, 2015: Brokerage Specific Core Mutual Fund Portfolios

- March 9, 2015: Newsletter Collection Update

- March 2, 2015: Total Return Bond ETFs

- February 23, 2015: Why Is Global Tactical Asset Allocation Not Popular?

- February 16, 2015: Where Are Permanent Portfolios Going?

- February 9, 2015: How Have Asset Allocation Funds Done?

- February 2, 2015: Risk Management Everywhere

- January 26, 2015: Composite Portfolios Review

- January 19, 2015: Fixed Income Investing Review

- January 12, 2015: How Does Trend Following Tactical Asset Allocation Strategy Deliver Returns

- January 5, 2015: When Forecast Fails

- December 22, 2014: Long Term Asset Returns: How Long Is Long?

- December 15, 2014: Beaten Down Assets

- December 8, 2014: Implementing Core Asset Portfolios In a Brokerage

- December 1, 2014: Two Key Issues of Investment Strategies

- November 24, 2014: Holiday Readings

- November 17, 2014: Retirement Spending Portfolios Update

- November 10, 2014: Fixed Income Or Cash

- November 3, 2014: Asset Trend Review

- October 27, 2014: Investment Loss, Mistakes And Market Cycles

- October 20, 2014: Strategic Portfolios With Managed Volatility

- October 13, 2014: Embrace Volatility

- October 6, 2014: Tips For 401k Open Enrollment

- September 29, 2014: What Can We Learn From Bill Gross’ Departure From PIMCO?

- September 22, 2014: Why Total Return Bond Funds?

- September 15, 2014: Equity And Total Return Bond Fund Composite Portfolios

- September 8, 2014: Momentum Based Portfolios Review

- September 1, 2014: Risk & Diversification: Mint.com Interview

- August 25, 2014: Remember Risk

- August 18, 2014: Consistency, The Most Important Edge In Investing: Tactical Case

- August 11, 2014: What To Do In Overvalued Stock Markets

- August 4, 2014: Is This The Peak Or Correction?

- July 28, 2014: Stock Musings

- July 21, 2014: Permanent Portfolios & Four Pillar Foundation Based Framework

- July 14, 2014: Composite Portfolios Review

- July 7, 2014: Portfolio Behavior During Market Corrections

- June 30, 2014: Half Year Brokerage ETF and Mutual Fund Portfolios Review

- June 23, 2014: Newsletter Collection Update

- June 16, 2014: There Are Always Lottery Winners

- June 9, 2014: The Arithmetic of Investment Mistakes

- June 2, 2014: Tips On Portfolio Rebalance

- May 26, 2014: In Praise Of Low Cost Core Asset Class Based Portfolios

- May 19, 2014: Consistency, The Most Important Edge In Investing: Strategic Case

- May 12, 2014: How To Handle An Elevated Overvalued Market

- May 5, 2014: Asset Allocation Funds Review

- April 28, 2014: Now The Economy Backs To The ‘Old Normal’, Should Our Investments Too?

- April 21, 2014: Total Return Bond Investing In The Current Market Environment