Re-balance Cycle Reminder All MyPlanIQ’s newsletters are archived here.

For regular SAA and TAA portfolios, the next re-balance will be on Monday, April 17, 2017. You can also find the re-balance calendar for 2017 on ‘Dashboard‘ page once you log in.

As a reminder to expert users: advanced portfolios are still re-balanced based on their original re-balance schedules and they are not the same as those used in Strategic and Tactical Asset Allocation (SAA and TAA) portfolios of a plan.

Please note that we now list the next re-balance date on every portfolio page.

Practical Consideration For IRAs And 401k Accounts

It’s very common for many users to have several accounts – some of them are 401k or employer sponsored retirement accounts, some of them are IRAs and some of them are taxable accounts. In this newsletter, we look at IRAs and 401k type accounts in more details and offer some observations. For a related topic on how to allocate overall capital across multiple accounts, please refer to December 16, 2013: Tax Efficient Portfolio Planning.

Brokerages for IRAs

Many major brokerages still target active traders instead of portfolio builders. To the extent we have investigated, we are really not satisfied with what’s provided for retail investors who just want to construct a balanced asset allocation portfolio instead of trading ETFs and stocks. For example, so far, no brokerages other than FolioInvesting provide a basket portfolio rebalance feature that allow investors to rebalance a portfolio at once, not being forced to issue many sell and buy orders. The good news is that such a feature exists in many 401k accounts. However, if you limit yourself to only finding a brokerage that’s good for portfolio construction, here are some of our observations:

ETFs

You want to find a brokerage that provides ETFs commission free or low commission. If you consider Vanguard’s ETFs are good enough for your portfolio construction, you might as well open an account in Vanguard brokerage. The other choice is TDAmetrade, that provides most of Vanguard ETFs commission free. If you still want to get some exposure to other ETFs, the other choice is Merrill Edge, which allows you to have 30 commission free trades in each month if you have over $50,000 in your combined Bank of America bank accounts and brokerage accounts. Other firms provides commission free ETFs that are either very illiquid (such as Schwab’s many commission free ETFs) or incomplete. Fidelity offers half baked commission free ETF trades that are only buy commission free, but not sell. We think you can be better off in other brokerages that offer real commission free trades.

Here is the summary:

- Vanguard brokerage: commission free Vanguard ETFs which are relatively complete and extremely low cost.

- TD Ameritrade: provides most Vanguard ETFs commission free.

- Merrill Edge: if you have over $50,000 in combined accounts, you are entitled to 30 commission free ETF trades.

Index funds

For this purpose, we found that Vanguard brokerage is probably the best that provides all Vanguard funds without transaction fees. Fidelity and Schwab also provide some good low cost index funds (though they are not as complete as Vanguard’s). Other than these, many firms have limited low cost index funds and thus making it very hard to construct a low cost portfolio. Furthermore, many brokerages put a minimum 3 month holding period for a mutual fund, otherwise, they will charge transaction fee. In TD Ameritrade case, it has an unusual 6 month requirement, rendering itself almost not useful.

IRA or 401k accounts

If you have a 401k plan from your current employer, you don’t have much choice as you can’t abandon your 401k and establish a new IRA or add to an existing IRA. However, if you have a 401lk/403B or other retirement accounts, you do have a choice whether you should retain your old 401k account or just roll over to an IRA or to your current 401k account. Things to consider:

- 401k might have some ultra low cost funds, especially index funds. Sometimes, for a large plan, your administrator can manage to negotiate extremely low fees for some funds (mainly for Collective Investment Trust funds or CITs). However, considering today’s rock bottom expenses of index ETF or index mutual funds, this has become less attractive.

- 401k might allow you to access to some good funds that are not available to retail investors in a discount brokerage (in which your IRA is most likely to reside). Examples include DFA (Dimensional Fund Advisors) funds that can be only purchased through financial advisors in a retail brokerage account or some load waived share classes (such as institutional or class A) of funds.

- As stated above, 401k has a one click feature to allow you to rebalance your account based on the percentage allocation. That makes your rebalance trades much easier.

In general, even if the above does exist, to simplify your life and consolidate your financial accounts (lots of people are really bogged down by too many accounts), it’s still a good practice to just pick a good low cost brokerage for your IRA and move your old 401ks there.

How to allocate among IRAs and 401k accounts

If you have both IRA and 401k accounts, you need to decide what asset classes or styles of portfolios to be held in what accounts. For general allocation between taxable and tax deferred accounts, we outlined some suggestions in December 16, 2013: Tax Efficient Portfolio Planning. But among tax deferred IRA and 401k accounts, there are more to consider:

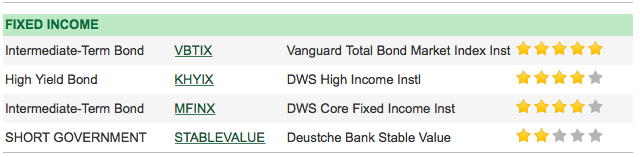

- IRAs can allow access to a relatively complete list of total return bond funds (see June 3, 2013: Total Return Bond Fund Portfolios For Major Brokerages on using these funds to construct a fixed income portfolio) that are generally not available in a 401k plan. In fact, we have observed that many plans actually ignore or overlook the importance of having good choices of fixed income funds. Most plans only feature a few fixed income funds and leave investors not many choices to enhance the fixed income side returns. For example, here are the fixed income funds in DEUTSCHE BANK MATCHED SAVINGS PLAN. In this case, a major investment bank has decided to only offer a bond market index fund, an active intermediate bond fund and a high yield bond fund for all of its fixed income lineup.

- IRAs in general have more asset class choices. If you choose a brokerage right, you can also choose funds with low expense.

In general, we would suggest that first allocate your fixed income portion as much as possible in an IRA if your 401k plan lacks of good fixed income funds (which is usually the case). You then try to leave the active or tactical portion as much as possible in IRAs if you can do this part in index mutual funds or commission free ETFs. That would also mean if you have a strategic portion, try to do that in the 401k account in this situation.

Unfortunately, the above suggestion seems to under utilize the good portfolio level basket rebalance feature available in 401k plans as the more active (tactical) portfolios would need this feature most. But investors just have to make some tradeoff in this situation.

To summarize, even among retirement accounts, investors should make an effort to consider how to allocate funds and assets by looking at the pros and cons in these types of accounts. From the above discussion, one can see both discount brokerage based IRAs and employer sponsored (401k) accounts have weakness to avoid.

Market Overview

The politics induced volatility was in full display last week. US stocks and high yield bonds fell. The failed health care law repeal effort reminds investors of a harsher reality that the new administration’s promised reform is not a smooth sailing. The highly overvalued markets can only make things more susceptible to downside. We remain cautious. Investors should stay the course.

For more detailed asset trend scores, please refer to 360° Market Overview.

Now that the Trump administration is officially sworn in, the new president is facing the reality to deliver his many promises to make substantial changes. As the nation is posed to invest, the most important factor to watch is how productive the investments will be. Simply put, productive investments will result in better return on investment (ROI), tangibly or intangibly. They should also increase productivity that in turns will improve our standard of living. Capital misallocation can result in a higher growth but might not improve the real standard of living, which is the ultimate goal of economic activities. Whether the new president can truly achieve this goal is still yet to be seen. One thing is certain: we will see more market volatilities.

In terms of investments, U.S. stock valuation is at a historically high level. It is thus not a good time to take excessive risk. However, we remain optimistic on U.S. economy in the long term and believe much better investment opportunities will arise in the future.

We again would like to stress for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Latest Articles

- March 13, 2017: Long Term Stock Valuation Review

- March 6, 2017: Asset Classes for Retirement Investments

- February 27, 2017: Fidelity Total Bond Fund Review

- February 20, 2017: Long Term Stock Timing Based Portfolios And Their Roles

- February 13, 2017: Alternative Investment Portfolios Review

- February 6, 2017: Tax Free Municipal Bond Investments Review

- January 30, 2017: Brokerage Specific Conservative Portfolios

- January 23, 2017: Fixed Income Portfolio Review

- January 16, 2017: Long Term Trend Following Portfolio Review

- January 9, 2017: Tactical Asset Allocation Review

- January 3, 2017: Strategic Asset Allocation Review

- December 12, 2016: Enhanced Index Funds

- December 5, 2016: Review Of Broad Base Core Mutual Funds For Brokerages

- November 28, 2016: Core Index ETFs Review

- November 21, 2016: International Exposure Of U.S. Large Companies

- November 14, 2016: Asset Trends After The Election

- November 7, 2016: Rising Rate And Current Bond Trend

- October 31, 2016: Economy Power And Long Term Stock Returns

- October 24, 2016: Current Commodity Trend And Managed Futures

- October 17, 2016: Investment Mistakes And Good Or Bad Investment Strategies

- October 10, 2016: Momentum Investing Review

- October 3, 2016: Survey & Feedback

- September 26, 2016: Fixed Income Investing: Actively Managed Funds vs. Index Funds

- September 19, 2016: Stock Investing: Actively Managed Funds vs. Index Funds

- September 12, 2016: Newsletter Update

- September 5, 2016: Overvalued Markets And Long Term Timing Strategies

- August 29, 2016: Your 401K Finally Draws Attention

- August 22, 2016: Inflation Protected Securities TIPS For Current Overvalued Markets

- August 15, 2016: Risk On: Emerging Market Stocks And Small Cap Stocks

- August 8, 2016: Portfolio Construction Using Stock ETFs And Bond Mutual Funds

- August 1, 2016: Adding Value To Your Own Investments

- July 25, 2016: Tactical Asset Allocation Funds Review

- July 18, 2016: Strategic Asset Allocation & Lazy Portfolio Review

- July 11, 2016: Asset Trend Review

- June 27, 2016: Secular Cycles For Tactical And Strategic Investment Strategies

- June 20, 2016: A World of Debt

- June 13, 2016: Managed Futures For Portfolio Building

- June 6, 2016: Newsletter Summary

- May 30, 2016: Swensen Portfolio And Permanent Portfolios

- May 23, 2016: AAII Article And Some Web Changes

- May 16, 2016: The PIMCO (Dis)Advantages

- May 9, 2016: Boost Your Dull Summer Investments

- May 2, 2016: Low Cost Index Fund Investing

- April 25, 2016: Tax Free Municipal Bond Funds & Portfolios

- April 18, 2016: Asset Class Trend Review

- April 11, 2016: Construction of Sound And Conservative Portfolios

- March 28, 2016: Total Return Bond ETFs Review

- March 21, 2016: Small And Large Company Stock Performance In Different Economic Expansion Cycles

- March 14, 2016: Are Tactical And Timing Strategies Losing Steam?

- March 7, 2016: Defined Maturity Bond Fund Analysis

- February 29, 2016: Smart Strategic Asset Allocation Rebalance When Market Trend Changes

- February 22, 2016: Be Cash Smart

- February 15, 2016: Bond ETF Portfolios

- February 8, 2016: Newsletter Collection Update

- February 1, 2016: Total Return Bond Fund Portfolios In A Volatile Period

- January 25, 2016: Alternative Portfolios Review

- January 18, 2016: Strategic Asset Allocation: A Cautious Outlook

- January 11, 2016: Review Of Trend Following Tactical Asset Allocation

- January 4, 2016: What Worked And Didn’t In 2015

- December 21, 2015: Distressed Assets

- December 14, 2015: High Yield Bonds And Their Correlation With Stocks

- December 7, 2015: Diversification And Global Allocation

- November 30, 2015: Investors and Speculators Combined

- November 23, 2015: Active Stock Fund Performance Consistency

- November 16, 2015: Permanent, Risk Parity And Alternative Portfolios Review

- November 9, 2015: Broad Base Core Mutual Fund Review

- November 2, 2015: Broad Base Index Core ETFs Review

- October 26, 2015: Total Return Bond Fund Review

- October 19, 2015: Advanced Portfolio Review

- October 12, 2015: What About Commodities?

- October 5, 2015: Core Satellite Portfolios In A 401k Account

- September 28, 2015: Risk Managed Strategic Asset Allocation Portfolios Revisited

- September 21, 2015: Quest For The Best Investment Strategy

- September 14, 2015: Core Satellite Portfolios In Market Turmoil

- September 7, 2015: Market Rout Creates An Opportunity to Reposition Your Portfolios

- August 31, 2015: Review of Asset Allocation Funds and Portfolios

- August 24, 2015: Market Rout And Your Portfolios

- August 17, 2015: ETF or Mutual Fund Based Portfolios

- August 10, 2015: Updated Newsletter Collection

- August 3, 2015: Slippery Asset Trends

- July 27, 2015: Performance Dispersion Among Momentum Based Portfolios

- July 20, 2015: Global Balanced Portfolio Benchmarks

- July 13, 2015: Pain in Tactical Portfolios

- July 6, 2015: Fixed Income Total Return Bond Funds In Strategic Asset Allocation Portfolios

- June 29, 2015: Core ETF Commission Free Portfolios

- June 22, 2015: Secular Asset Trends

- June 15, 2015: Giving Up Bonds?

- June 1, 2015: Summer Blues?

- May 26, 2015: Cash, Bonds and Stocks In A Rising Rate Environment

- May 18, 2015: Portfolio Update

- May 11, 2015: Pain in Fixed Income?

- May 4, 2015: The Balanced Stock and Long Term Treasury Bond Portfolios

- April 27, 2015: Long Term Treasury Bond Behavior

- April 20, 2015: 529 College Savings Plan Rebalance Policy Change

- April 13, 2015: Total Return Bond Funds As Smart Cash

- April 6, 2015: The Low Return Environment

- March 30, 2015: Brokerage Specific Core Mutual Fund Portfolios 2

- March 23, 2015: Investment Arithmetic for Long Term Investments

- March 16, 2015: Brokerage Specific Core Mutual Fund Portfolios

- March 9, 2015: Newsletter Collection Update

- March 2, 2015: Total Return Bond ETFs

- February 23, 2015: Why Is Global Tactical Asset Allocation Not Popular?

- February 16, 2015: Where Are Permanent Portfolios Going?

- February 9, 2015: How Have Asset Allocation Funds Done?

- February 2, 2015: Risk Management Everywhere

- January 26, 2015: Composite Portfolios Review

- January 19, 2015: Fixed Income Investing Review

- January 12, 2015: How Does Trend Following Tactical Asset Allocation Strategy Deliver Returns

- January 5, 2015: When Forecast Fails

- December 22, 2014: Long Term Asset Returns: How Long Is Long?

- December 15, 2014: Beaten Down Assets

- December 8, 2014: Implementing Core Asset Portfolios In a Brokerage

- December 1, 2014: Two Key Issues of Investment Strategies

- November 24, 2014: Holiday Readings

- November 17, 2014: Retirement Spending Portfolios Update

- November 10, 2014: Fixed Income Or Cash

- November 3, 2014: Asset Trend Review

- October 27, 2014: Investment Loss, Mistakes And Market Cycles

- October 20, 2014: Strategic Portfolios With Managed Volatility

- October 13, 2014: Embrace Volatility

- October 6, 2014: Tips For 401k Open Enrollment

- September 29, 2014: What Can We Learn From Bill Gross’ Departure From PIMCO?

- September 22, 2014: Why Total Return Bond Funds?

- September 15, 2014: Equity And Total Return Bond Fund Composite Portfolios

- September 8, 2014: Momentum Based Portfolios Review

- September 1, 2014: Risk & Diversification: Mint.com Interview

- August 25, 2014: Remember Risk

- August 18, 2014: Consistency, The Most Important Edge In Investing: Tactical Case

- August 11, 2014: What To Do In Overvalued Stock Markets

- August 4, 2014: Is This The Peak Or Correction?

- July 28, 2014: Stock Musings

- July 21, 2014: Permanent Portfolios & Four Pillar Foundation Based Framework

- July 14, 2014: Composite Portfolios Review

- July 7, 2014: Portfolio Behavior During Market Corrections

- June 30, 2014: Half Year Brokerage ETF and Mutual Fund Portfolios Review

- June 23, 2014: Newsletter Collection Update

- June 16, 2014: There Are Always Lottery Winners

- June 9, 2014: The Arithmetic of Investment Mistakes

- June 2, 2014: Tips On Portfolio Rebalance

- May 26, 2014: In Praise Of Low Cost Core Asset Class Based Portfolios

- May 19, 2014: Consistency, The Most Important Edge In Investing: Strategic Case

- May 12, 2014: How To Handle An Elevated Overvalued Market

- May 5, 2014: Asset Allocation Funds Review

- April 28, 2014: Now The Economy Backs To The ‘Old Normal’, Should Our Investments Too?

- April 21, 2014: Total Return Bond Investing In The Current Market Environment

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.

Diversified Asset Allocation Portfolios For Your Plans

Diversified Asset Allocation Portfolios For Your Plans