Re-balance Cycle Reminder All MyPlanIQ’s newsletters are archived here.

For regular SAA and TAA portfolios, the next re-balance will be on Monday, December 3, 2018. You can also find the re-balance calendar for 2017 on ‘Dashboard‘ page once you log in.

As a reminder to expert users: advanced portfolios are still re-balanced based on their original re-balance schedules and they are not the same as those used in Strategic and Tactical Asset Allocation (SAA and TAA) portfolios of a plan.

Please note that we now list the next re-balance date on every portfolio page.

Allocation Mutual Fund Review

It’s been a while since last time we looked at some of representative asset allocation funds. MyPlanIQ has been tracking some of best allocation funds on SmartMoneyIQ Managers. In this newsletter, we want to look at their recent performance.

US allocation funds

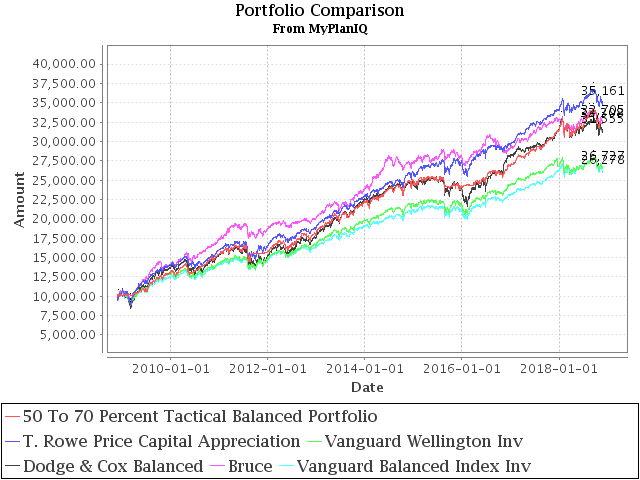

These funds are moderate allocation (Morningstar defines this category as 50% to 70% equity) funds that mainly invest in US stocks and bonds.

| Ticker/Portfolio Name | YTD Return** |

1Yr AR | 3Yr AR | 5Yr AR | 10Yr AR | 15 Yr AR | MaxDD |

|---|---|---|---|---|---|---|---|

| 50 To 70 Percent Tactical Balanced Portfolio | 3.0% | 5.5% | 9.7% | 8.2% | 12.4% | 10.6% | 12.9% |

| PRWCX (T. Rowe Price Capital Appreciation) | 2.5% | 3.9% | 8.1% | 9.0% | 14.3% | 9.3% | 41.8% |

| VWELX (Vanguard Wellington Inv) | -0.9% | -2.1% | 6.1% | 6.2% | 11.0% | 7.8% | 36.1% |

| DODBX (Dodge & Cox Balanced) | -0.5% | 2.7% | 8.5% | 7.1% | 13.0% | 7.4% | 50.2% |

| BRUFX (Bruce) | -0.7% | 0.0% | 4.5% | 6.7% | 13.0% | 9.6% | 42.2% |

| VBINX (Vanguard Balanced Index Inv) | -0.3% | 1.5% | 6.7% | 6.6% | 10.8% | 7% | 36% |

MaxDD: Maximum Drawdown (a peak to a following trough)

10 year chart

As 2008, the previous bear market is fading away from the last 10 year period, we include 15 year period that covers from 11/26/2003 to today. This period excludes the 2000-2002 bear market.

Unfortunately, as US bonds (VBMFX, for example) have been losing money this year, funds except for PRWCX have slightly lost money this year.

All of these funds have outperformed the benchmark index fund VBINX (Vanguard standard 60% stocks and 40% bonds allocation fund) for the past 10 and 15 years. Among them, the small (only $500 million asset under management) Bruce fund (BRUFX) has done a very respectable job: it actually outperformed PRWCX (9.6% vs. 9.3%) in the last 15 years. Dodge & Cox balanced fund (DODBX), a traditional power house in value stocks and fixed income, was hurt by its big loss in 2008. However, it has since recovered nicely.

The best allocation fund

T.Rowe Price Capital Appreciation (PRWCX), one of the best allocation funds that we have reviewed several times, again stands out: compared with all of funds in the table, it still delivered a positive year to date (YTD) 2.5% return. Furthermore, it’s the top performer in the last 5, 10 and 15 years.

Though traditionally, PRWCX has been adept to using convertible bonds in its fixed income portion, recently, this fund has gradually shifted to more traditional bonds. In fact, as of September 2018, the fund held 6% government bonds and 8% cash. Based on Morningstar, the fund manager is also very flexible to overweight/underweight stocks and bonds in its stated range (stocks can range from 50% to as much as 80% at some time).

The allocation on 9/30/2018 is as follows:

| Asset | % Allocation |

|---|---|

| Cash | 7.93 |

| US Stock | 60.56 |

| Non US Stock | 2.58 |

| Bond | 24.64 |

| Other | 4.30 |

Courtesy of Morningstar Inc.

It’s remarkable that this fund’s equity portion has outperformed S&P 500 by some big margin for the past 10 and 15 years. Furthermore, its fixed income also outperformed Barclay total bond index (VBMFX).

Unfortunately, this fund has been closed to new investors since 2014. Some investors might still be able to access to this fund through their 401k and other retirement plans.

For the sake of comparing with PRWCX, we again include our ‘best balanced portfolio’ in the table. The recent review of this portfolio (50 To 70 Percent Tactical Balanced Portfolio) is in the newsletter June 18, 2018: The ‘Best’ Balanced Portfolio Continues To Excel.

We are happy to report that this portfolio is delivering better YTD return. Though it lost to PRWCX in the last 5 and 10 years, when 2008 bear market is included in the 15 year period, it has done much better, both in terms of annualized return (10.6% vs. 9.3%) and maximum drawdown (12.9% vs. 40.8%). As the stocks are in their late bull market stage of a full market cycle, we are again confident that this portfolio will continue to outperform even the best best allocation funds.

Market overview

Investors have largely ignored the high earnings in last quarter (Q3): based on Factset, S&P 500 companies’ earnings growth rate is 25.9%, much higher than the expected 19.3% on September 30, 2018. Investors are now more focused on futures earnings: the average analyst expectation for 2019 earnings growth is only 9%. This slowdown, if materialized, will definitely affect stock prices.

Unfortunately, as pointed out before, the three major factors, rising interest rate, higher labor cost and higher production cost (additionally caused by the trade war/friction), are all new to this extended market cycle since 2009. In addition, now that stocks are already (and still are even after the recent market drop) extended and expensive (in terms of valuation), we are seeing a difficult market condition ahead.

As always, we believe in risk managing and staying the course in a sound plan.

In terms of investments, U.S. stock valuation is still at a historically high level and it might still have a bigger correction. It is thus not a good time to take excessive risk. However, we remain optimistic about U.S. economy in the long term and believe much better investment opportunities will arise in the future.

We again would like to stress for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.

Latest Articles

- November 19, 2018: Is The Recent Downtrend Sustainable?

- November 12, 2018: The Staggering Low Interest Rates From Big Banks

- November 5, 2018: The ‘Right’ Or ‘Wrong’ Decision

- October 29, 2018: Taxable Total Return Bond Plus Muni Bond Fund Based Portfolios

- October 22, 2018: DoubleLine Shiller CAPE 10 Based Fund Review

- October 15, 2018: Newsletter Collection Update

- October 8, 2018: Asset Trend Review

- October 1, 2018: Taxable vs. Tax Exempt High Yield Bonds

- September 24, 2018: High Yield Bonds In A Rising Rate Environment

- September 10, 2018: Value, Growth And Blend Stock Style Investing

- August 27, 2018: Money Market ETFs?

- August 20, 2018: How Momentum Investing Stacks Up?

- August 13, 2018: Total Return Bond ETF

- August 6, 2018: Fidelity Zero-Fee Index Funds

- July 30, 2018: Tax Efficient Portfolios

- July 23, 2018: Municipal Bond Funds And Portfolios

- July 16, 2018: A Guide To Conservative Portfolios

- July 9, 2018: Conservative Allocation Mutual Funds Based Portfolios

- July 2, 2018: Small Cap Stocks For The Long Term

- June 25, 2018: What Can We Learn From GE’s Removal From Dow Jones Index?

- June 18, 2018: The ‘Best’ Balanced Portfolio Continues To Excel

- June 11, 2018: Is 10 Year Long Enough For Portfolio Comparison?

- June 4, 2018: Action Plan: Risk Review For Investments

- May 21, 2018: Rising Rates, Consumer Staples And Stock Index

- May 14, 2018: Newsletter Collection Update

- May 7, 2018: Money Market Fund Taxonomy

- April 30, 2018: Momentum Investing Review

- April 23, 2018: Commodities In Current Environment

- April 16, 2018: Municipal Bonds As A Fixed Income Asset Class

- April 9, 2018: Exponential Or Compounding Nature In Investing

- April 2, 2018: Inside Of The Stock Chaos

- March 26, 2018: Total Return Bond Update

- March 19, 2018: Treasury Bills vs. Brokered CDs

- March 12, 2018: Defensive Conservative Portfolio Review

- March 5, 2018: Warren Buffett’s Advices

- February 26, 2018: Pros And Cons of Strategic And Tactical Portfolios In 2018

- February 12, 2018: Trend Review

- February 5, 2018: Market Selloff And Long Term Investing

- January 29, 2018: The New Addition To Our Total Return Bond Fund Candidates

- January 22, 2018: Where Are Bonds Heading?

- January 15, 2018: Tactical Portfolios Review

- January 8, 2018: Strategic Portfolios Review

- December 18, 2017: Record Highs And Risk

- December 11, 2017: Cash Return And Interest Rate Update

- December 4, 2017: Mutual Fund Star Ratings: Are They Useful?

- November 20, 2017: Thankful And Mindful

- November 13, 2017: Is This A Good Time For Retirees Or Would Be Retirees?

- November 6, 2017: Newsletter Collection Update

- October 30, 2017: Rising Interest Rates

- October 23, 2017: A Primer For Portfolios

- October 16, 2017: REITs As An Asset Class

- October 9, 2017: Conservative Portfolios Revisited

- October 2, 2017: The Role of Short Term Bond Funds

- September 25, 2017: Fees In Cash Investments

- September 18, 2017: Conservative Portfolios Review

- September 11, 2017: International Diversification Effect

- September 4, 2017: Invest And Speculate Revisited

- August 28, 2017: Total Return Bond Fund Portfolios: Where Do They Fit?

- August 21, 2017: Portfolio Performance: A Walk In The Past

- August 14, 2017: Fidelity Commission Free ETFs Update

- August 7, 2017: I Didn’t Learn Anything — Mistake vs. Temporary Underperformance

- July 31, 2017: Asset Classes And Fund Choices: A Primer

- July 24, 2017: Total Return Bond Fund Portfolios And Cash

- July 17, 2017: Long Term Stock Holding Periods For Retirement

- July 10, 2017: Half Year Asset Trend Review

- June 26, 2017: How To Beat The Best Balanced Allocation Fund

- June 19, 2017: Newsletter Collection Update

- June 12, 2017: A Mixed Bag Performance of Momentum Investing

- June 5, 2017: How To Start A New Portfolio

- May 29, 2017: Alternative Assets And Their Role In Portfolios

- May 22, 2017: Summer Seasonality And Portfolio Management

- May 15, 2017: Cash: Banking Or Investing?

- May 8, 2017: Holding Period of Long Term Timing Portfolios

- May 1, 2017: Debate on Risk vs. Volatility

- April 24, 2017: The Long Term Stock Market Timing Return Since 1871

- April 17, 2017: Risk vs. Volatility: Long Term Stock Market Returns

- April 10, 2017: Total Return Bond ETFs And Portfolios

- April 3, 2017: Quarter End Asset Trend Review

- March 27, 2017: Practical Consideration For IRAs And 401k Accounts

- March 20, 2017: Fund Fees: That’s (Still) Outrageous

- March 13, 2017: Long Term Stock Valuation Review

- March 6, 2017: Asset Classes for Retirement Investments

- February 27, 2017: Fidelity Total Bond Fund Review

- February 20, 2017: Long Term Stock Timing Based Portfolios And Their Roles

- February 13, 2017: Alternative Investment Portfolios Review

- February 6, 2017: Tax Free Municipal Bond Investments Review

- January 30, 2017: Brokerage Specific Conservative Portfolios

- January 23, 2017: Fixed Income Portfolio Review

- January 16, 2017: Long Term Trend Following Portfolio Review

- January 9, 2017: Tactical Asset Allocation Review

- January 3, 2017: Strategic Asset Allocation Review

- December 12, 2016: Enhanced Index Funds

- December 5, 2016: Review Of Broad Base Core Mutual Funds For Brokerages

- November 28, 2016: Core Index ETFs Review

- November 21, 2016: International Exposure Of U.S. Large Companies

- November 14, 2016: Asset Trends After The Election

- November 7, 2016: Rising Rate And Current Bond Trend

- October 31, 2016: Economy Power And Long Term Stock Returns

- October 24, 2016: Current Commodity Trend And Managed Futures

- October 17, 2016: Investment Mistakes And Good Or Bad Investment Strategies

- October 10, 2016: Momentum Investing Review

- October 3, 2016: Survey & Feedback

- September 26, 2016: Fixed Income Investing: Actively Managed Funds vs. Index Funds

- September 19, 2016: Stock Investing: Actively Managed Funds vs. Index Funds

- September 12, 2016: Newsletter Update

- September 5, 2016: Overvalued Markets And Long Term Timing Strategies

- August 29, 2016: Your 401K Finally Draws Attention

- August 22, 2016: Inflation Protected Securities TIPS For Current Overvalued Markets

- August 15, 2016: Risk On: Emerging Market Stocks And Small Cap Stocks

- August 8, 2016: Portfolio Construction Using Stock ETFs And Bond Mutual Funds

- August 1, 2016: Adding Value To Your Own Investments

- July 25, 2016: Tactical Asset Allocation Funds Review

- July 18, 2016: Strategic Asset Allocation & Lazy Portfolio Review

- July 11, 2016: Asset Trend Review

- June 27, 2016: Secular Cycles For Tactical And Strategic Investment Strategies

- June 20, 2016: A World of Debt

- June 13, 2016: Managed Futures For Portfolio Building

- June 6, 2016: Newsletter Summary

- May 30, 2016: Swensen Portfolio And Permanent Portfolios

- May 23, 2016: AAII Article And Some Web Changes

- May 16, 2016: The PIMCO (Dis)Advantages

- May 9, 2016: Boost Your Dull Summer Investments

- May 2, 2016: Low Cost Index Fund Investing

- April 25, 2016: Tax Free Municipal Bond Funds & Portfolios

- April 18, 2016: Asset Class Trend Review

- April 11, 2016: Construction of Sound And Conservative Portfolios

- March 28, 2016: Total Return Bond ETFs Review

- March 21, 2016: Small And Large Company Stock Performance In Different Economic Expansion Cycles

- March 14, 2016: Are Tactical And Timing Strategies Losing Steam?

- March 7, 2016: Defined Maturity Bond Fund Analysis

- February 29, 2016: Smart Strategic Asset Allocation Rebalance When Market Trend Changes

- February 22, 2016: Be Cash Smart

- February 15, 2016: Bond ETF Portfolios

- February 8, 2016: Newsletter Collection Update

- February 1, 2016: Total Return Bond Fund Portfolios In A Volatile Period

- January 25, 2016: Alternative Portfolios Review

- January 18, 2016: Strategic Asset Allocation: A Cautious Outlook

- January 11, 2016: Review Of Trend Following Tactical Asset Allocation

- January 4, 2016: What Worked And Didn’t In 2015

- December 21, 2015: Distressed Assets

- December 14, 2015: High Yield Bonds And Their Correlation With Stocks

- December 7, 2015: Diversification And Global Allocation

- November 30, 2015: Investors and Speculators Combined

- November 23, 2015: Active Stock Fund Performance Consistency

- November 16, 2015: Permanent, Risk Parity And Alternative Portfolios Review

- November 9, 2015: Broad Base Core Mutual Fund Review

- November 2, 2015: Broad Base Index Core ETFs Review

- October 26, 2015: Total Return Bond Fund Review

- October 19, 2015: Advanced Portfolio Review

- October 12, 2015: What About Commodities?

- October 5, 2015: Core Satellite Portfolios In A 401k Account

- September 28, 2015: Risk Managed Strategic Asset Allocation Portfolios Revisited

- September 21, 2015: Quest For The Best Investment Strategy

- September 14, 2015: Core Satellite Portfolios In Market Turmoil

- September 7, 2015: Market Rout Creates An Opportunity to Reposition Your Portfolios

- August 31, 2015: Review of Asset Allocation Funds and Portfolios

- August 24, 2015: Market Rout And Your Portfolios

- August 17, 2015: ETF or Mutual Fund Based Portfolios

- August 10, 2015: Updated Newsletter Collection

- August 3, 2015: Slippery Asset Trends

- July 27, 2015: Performance Dispersion Among Momentum Based Portfolios

- July 20, 2015: Global Balanced Portfolio Benchmarks

- July 13, 2015: Pain in Tactical Portfolios

- July 6, 2015: Fixed Income Total Return Bond Funds In Strategic Asset Allocation Portfolios

- June 29, 2015: Core ETF Commission Free Portfolios

- June 22, 2015: Secular Asset Trends

- June 15, 2015: Giving Up Bonds?

- June 1, 2015: Summer Blues?

- May 26, 2015: Cash, Bonds and Stocks In A Rising Rate Environment

- May 18, 2015: Portfolio Update

- May 11, 2015: Pain in Fixed Income?

- May 4, 2015: The Balanced Stock and Long Term Treasury Bond Portfolios

- April 27, 2015: Long Term Treasury Bond Behavior

- April 20, 2015: 529 College Savings Plan Rebalance Policy Change

- April 13, 2015: Total Return Bond Funds As Smart Cash

- April 6, 2015: The Low Return Environment

- March 30, 2015: Brokerage Specific Core Mutual Fund Portfolios 2

- March 23, 2015: Investment Arithmetic for Long Term Investments

- March 16, 2015: Brokerage Specific Core Mutual Fund Portfolios

- March 9, 2015: Newsletter Collection Update

- March 2, 2015: Total Return Bond ETFs

- February 23, 2015: Why Is Global Tactical Asset Allocation Not Popular?

- February 16, 2015: Where Are Permanent Portfolios Going?

- February 9, 2015: How Have Asset Allocation Funds Done?

- February 2, 2015: Risk Management Everywhere

- January 26, 2015: Composite Portfolios Review

- January 19, 2015: Fixed Income Investing Review

- January 12, 2015: How Does Trend Following Tactical Asset Allocation Strategy Deliver Returns

- January 5, 2015: When Forecast Fails

- December 22, 2014: Long Term Asset Returns: How Long Is Long?

- December 15, 2014: Beaten Down Assets

- December 8, 2014: Implementing Core Asset Portfolios In a Brokerage

- December 1, 2014: Two Key Issues of Investment Strategies

- November 24, 2014: Holiday Readings

- November 17, 2014: Retirement Spending Portfolios Update

- November 10, 2014: Fixed Income Or Cash

- November 3, 2014: Asset Trend Review

- October 27, 2014: Investment Loss, Mistakes And Market Cycles

- October 20, 2014: Strategic Portfolios With Managed Volatility

- October 13, 2014: Embrace Volatility

- October 6, 2014: Tips For 401k Open Enrollment

- September 29, 2014: What Can We Learn From Bill Gross’ Departure From PIMCO?

- September 22, 2014: Why Total Return Bond Funds?

- September 15, 2014: Equity And Total Return Bond Fund Composite Portfolios

- September 8, 2014: Momentum Based Portfolios Review

- September 1, 2014: Risk & Diversification: Mint.com Interview

- August 25, 2014: Remember Risk

- August 18, 2014: Consistency, The Most Important Edge In Investing: Tactical Case

- August 11, 2014: What To Do In Overvalued Stock Markets

- August 4, 2014: Is This The Peak Or Correction?

- July 28, 2014: Stock Musings

- July 21, 2014: Permanent Portfolios & Four Pillar Foundation Based Framework

- July 14, 2014: Composite Portfolios Review

- July 7, 2014: Portfolio Behavior During Market Corrections

- June 30, 2014: Half Year Brokerage ETF and Mutual Fund Portfolios Review

- June 23, 2014: Newsletter Collection Update

- June 16, 2014: There Are Always Lottery Winners

- June 9, 2014: The Arithmetic of Investment Mistakes

- June 2, 2014: Tips On Portfolio Rebalance

- May 26, 2014: In Praise Of Low Cost Core Asset Class Based Portfolios

- May 19, 2014: Consistency, The Most Important Edge In Investing: Strategic Case

- May 12, 2014: How To Handle An Elevated Overvalued Market

- May 5, 2014: Asset Allocation Funds Review

- April 28, 2014: Now The Economy Backs To The ‘Old Normal’, Should Our Investments Too?

- April 21, 2014: Total Return Bond Investing In The Current Market Environment