Inflation protected securities (TIPS) for current overvalued markets

Amid a buoyant financial market that sees everything is rising, prudent investors are actually facing an increasingly tougher market condition: on the fixed income/bond side, zero or even negative interest rate is unprecedented. Eventually, one way or the other, interest rate will rise and as a result, bond prices will decline. It’s a matter of when, not if. It’s also a matter of how much decline. On the risk asset side, stocks and REITs have risen to a level where their valuation is also historically high. For these risk assets, investors are more familiar with their behavior: they will eventually suffer from a violent correction, as much as a 30%-50% loss. Again, this is just a matter of when and how much decline, not if.

One of the most important goals in investing is to preserve your purchasing power, before even considering a real wealth increase. Inflation is a real threat even for the most conservative investors: those who keep cash under mattress. Unless they are willing to suffer from the loss of purchasing power, they are forced to participate (or invest) in other assets. The much harder question is what to invest. In old times, these most conservative investor can earn reasonable interests from their bank accounts or from bonds purchased. Even when bad inflation indeed happens, the interests earned along the way can still make up some of the loss. However, with rates being so low at the moment, these investors are forced to venture into other areas, both for the purpose of preserving purchasing power and earning a little along the way.

One way to combat such a potential loss is to subscribe to a tactical or dynamic investing strategy, such as MyPlanIQ’s Tactical Asset Allocation(TAA). Such a strategy is often coined as a timing strategy that has been usually labeled as ‘bad’ by status quo financial professionals. However, numerous articles we have published on this subject and our 6 year and on going live record have illustrated its effectiveness. Admittedly, there are issues in such a strategy (see, for example, July 22, 2013: Tactical Asset Allocation: The Good, The Bad And The Ugly). However, with enough patience and disciplined implementation, this can work.

The other way is to find some safer investments that might help to combat inflation. Gold has had an on and off favor. The problem with gold is that it is extremely volatile and can be very hard to comprehend its real value. It could have a place in an overall asset allocation portfolio such as the famous Harry Browne Permanent Portfolio. But having a sizable exposure to it can make your portfolio/investments way too much volatile for most investors.

Enter inflation protected securities (TIPS). TIPS were first introduced in 1997 as a way for government (and later on, some corporations) to help investors such as insurance companies and retirees to preserve their purchasing power. Here is what’s stated on Treasury Direct website (a place you can purchase TIPS directly):

Treasury Inflation-Protected Securities, or TIPS, provide protection against inflation. The principal of a TIPS increases with inflation and decreases with deflation, as measured by the Consumer Price Index. When a TIPS matures, you are paid the adjusted principal or original principal, whichever is greater.

TIPS pay interest twice a year, at a fixed rate. The rate is applied to the adjusted principal; so, like the principal, interest payments rise with inflation and fall with deflation.

In essence, TIPS will deliver, through both interests and principal appreciation (depreciation in the case of deflation), inflation adjusted constant monetary value.

TIPS have been touted as ‘worry-free investments’ by Zvi Bodie in his popular book Risk Less and Prosper. He suggests ultra conservative investors to purchase maturity matched individual I-bonds (Series I savings bonds). Such an approach at least can guarantee you not to lose your purchasing power.

However, for most investors, putting the entire savings to TIPS is too conservative. Some investors might expect to have higher spending that can not be exactly matched by individual TIPS bonds. Furthermore, many would like to grow their assets in order to make them last for a longer retirement period. Finally, some might even want to leave some of their wealth to their heirs or charitable organizations.

Aside from buying individual TIPS to match your short term needs, we prefer constructing a diversified portfolio that can employ various assets, including TIPS. A good example is David Swensen’s lazy portfolio that was discussed in a recent newsletter May 30, 2016: Swensen Portfolio And Permanent Portfolios. In the following, we will discuss in some details TIPS in a portfolio.

PIMCO’s recent studies on long duration TIPS

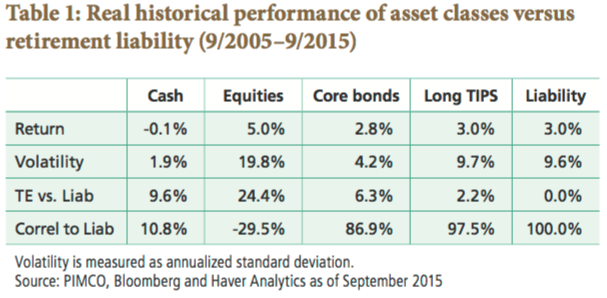

PIMCO recently published a study The Role of Long-Maturity TIPS in Retirement Portfolios. We find its studies interesting as we are a fan of using both intermediate term TIPS and long term TIPS (more later on this) in a portfolio. The paper shows the following table:

This table illustrates a hypothetical scenario for a worker who was 55 in 2005 and expected to retire in 10 years. As it turns out, investing in equities in that 10 year period yields the best return. However, in the TE vs. Liab (Tracking Error vs. Liability) row, it shows that stocks can have 24.4% variations. What this means is that in this 10 year period, there are many times (24.4%) when the worker would have faced a short fall (liability not matched, using PIMCO’s jargon) in his retirement income if he would retire at that point of time. Times like beginning of 2009 till 2013 are the examples. In fact, if he would retire in 2011, he would have faced 60% short fall in his retirement income.

On the other hand, long TIPS not only delivered a satisfactory return that matches the expectation (liability), it did it with very low TE vs. Liab, just 2.2%. That means in this period, there are only 2% of times when this worker would lose sleep and worry about his retirement income.

The paper further points out that long term TIPS are the least sensitive to current valuation level, compared with equities and core (traditional) bonds. This is a very important property to understand, especially in the current overvalued situation for both bonds and stocks!

Long term TIPS in Permanent Income Portfolio

In May 30, 2016: Swensen Portfolio And Permanent Portfolio, we brought up Permanent Income Portfolio with Long TIPS that replaces intermediate term TIPS with long term TIPS. Let’s look at its performance again:

| Ticker/Portfolio Name | YTD Return** |

1Yr AR | 3Yr AR | 5Yr AR | 5Yr Sharpe | From 9/9/2009 |

|---|---|---|---|---|---|---|

| Permanent Income Portfolio with Long TIPS | 12.2% | 11.6% | 9.4% | 7.4% | 1.19 | 8.8% |

| Permanent Income Portfolio | 9.5% | 9.7% | 8.0% | 6.8% | 1.45 | 8% |

| Harry Browne Permanent Portfolio | 12.7% | 10.6% | 6.5% | 4.4% | 0.72 | 7.3% |

| VWINX (Vanguard Wellesley Income Inv) | 9.3% | 11.5% | 8.2% | 8.8% | 1.92 | 8.9% |

Market Overview

Markets are showing some fatigue after the flurry of earnings reports was finally over. REITs have shown some sign of weakness: several mall operators and retailers are closing their physical stores because online retailers have been making inroads in the retail market. Emerging market economies are stable but are not showing strong momentum. The overhang of low interest rates has strained global economy. At the moment, markets are in a breathing wait and see mode. As stated before, investors are pinning their hope on an earning recovery, after five consecutive quarters’ decline.

For more detailed asset trend scores, please refer to 360° Market Overview.

We would like to remind our readers that since the financial crisis in 2008-2009, we have not seen substantial structural change in the U.S., European and emerging market economies. Economies have heavily relied on low interest debts. Capital might be misallocated to unproductive investments and consumption. U.S. stock valuation is at a historically high level. It is thus not a good time to take excessive risk. However, we remain optimistic on U.S. economy in the long term and believe much better investment opportunities will arise in the future.

We again would like to stress for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Latest Articles

- August 8, 2016: Portfolio Construction Using Stock ETFs And Bond Mutual Funds

- August 1, 2016: Adding Value To Your Own Investments

- July 25, 2016: Tactical Asset Allocation Funds Review

- July 18, 2016: Strategic Asset Allocation & Lazy Portfolio Review

- July 11, 2016: Asset Trend Review

- June 27, 2016: Secular Cycles For Tactical And Strategic Investment Strategies

- June 20, 2016: A World of Debt

- June 13, 2016: Managed Futures For Portfolio Building

- June 6, 2016: Newsletter Summary

- May 30, 2016: Swensen Portfolio And Permanent Portfolios

- May 23, 2016: AAII Article And Some Web Changes

- May 16, 2016: The PIMCO (Dis)Advantages

- May 9, 2016: Boost Your Dull Summer Investments

- May 2, 2016: Low Cost Index Fund Investing

- April 25, 2016: Tax Free Municipal Bond Funds & Portfolios

- April 18, 2016: Asset Class Trend Review

- April 11, 2016: Construction of Sound And Conservative Portfolios

- March 28, 2016: Total Return Bond ETFs Review

- March 21, 2016: Small And Large Company Stock Performance In Different Economic Expansion Cycles

- March 14, 2016: Are Tactical And Timing Strategies Losing Steam?

- March 7, 2016: Defined Maturity Bond Fund Analysis

- February 29, 2016: Smart Strategic Asset Allocation Rebalance When Market Trend Changes

- February 22, 2016: Be Cash Smart

- February 15, 2016: Bond ETF Portfolios

- February 8, 2016: Newsletter Collection Update

- February 1, 2016: Total Return Bond Fund Portfolios In A Volatile Period

- January 25, 2016: Alternative Portfolios Review

- January 18, 2016: Strategic Asset Allocation: A Cautious Outlook

- January 11, 2016: Review Of Trend Following Tactical Asset Allocation

- January 4, 2016: What Worked And Didn’t In 2015

- December 21, 2015: Distressed Assets

- December 14, 2015: High Yield Bonds And Their Correlation With Stocks

- December 7, 2015: Diversification And Global Allocation

- November 30, 2015: Investors and Speculators Combined

- November 23, 2015: Active Stock Fund Performance Consistency

- November 16, 2015: Permanent, Risk Parity And Alternative Portfolios Review

- November 9, 2015: Broad Base Core Mutual Fund Review

- November 2, 2015: Broad Base Index Core ETFs Review

- October 26, 2015: Total Return Bond Fund Review

- October 19, 2015: Advanced Portfolio Review

- October 12, 2015: What About Commodities?

- October 5, 2015: Core Satellite Portfolios In A 401k Account

- September 28, 2015: Risk Managed Strategic Asset Allocation Portfolios Revisited

- September 21, 2015: Quest For The Best Investment Strategy

- September 14, 2015: Core Satellite Portfolios In Market Turmoil

- September 7, 2015: Market Rout Creates An Opportunity to Reposition Your Portfolios

- August 31, 2015: Review of Asset Allocation Funds and Portfolios

- August 24, 2015: Market Rout And Your Portfolios

- August 17, 2015: ETF or Mutual Fund Based Portfolios

- August 10, 2015: Updated Newsletter Collection

- August 3, 2015: Slippery Asset Trends

- July 27, 2015: Performance Dispersion Among Momentum Based Portfolios

- July 20, 2015: Global Balanced Portfolio Benchmarks

- July 13, 2015: Pain in Tactical Portfolios

- July 6, 2015: Fixed Income Total Return Bond Funds In Strategic Asset Allocation Portfolios

- June 29, 2015: Core ETF Commission Free Portfolios

- June 22, 2015: Secular Asset Trends

- June 15, 2015: Giving Up Bonds?

- June 1, 2015: Summer Blues?

- May 26, 2015: Cash, Bonds and Stocks In A Rising Rate Environment

- May 18, 2015: Portfolio Update

- May 11, 2015: Pain in Fixed Income?

- May 4, 2015: The Balanced Stock and Long Term Treasury Bond Portfolios

- April 27, 2015: Long Term Treasury Bond Behavior

- April 20, 2015: 529 College Savings Plan Rebalance Policy Change

- April 13, 2015: Total Return Bond Funds As Smart Cash

- April 6, 2015: The Low Return Environment

- March 30, 2015: Brokerage Specific Core Mutual Fund Portfolios 2

- March 23, 2015: Investment Arithmetic for Long Term Investments

- March 16, 2015: Brokerage Specific Core Mutual Fund Portfolios

- March 9, 2015: Newsletter Collection Update

- March 2, 2015: Total Return Bond ETFs

- February 23, 2015: Why Is Global Tactical Asset Allocation Not Popular?

- February 16, 2015: Where Are Permanent Portfolios Going?

- February 9, 2015: How Have Asset Allocation Funds Done?

- February 2, 2015: Risk Management Everywhere

- January 26, 2015: Composite Portfolios Review

- January 19, 2015: Fixed Income Investing Review

- January 12, 2015: How Does Trend Following Tactical Asset Allocation Strategy Deliver Returns

- January 5, 2015: When Forecast Fails

- December 22, 2014: Long Term Asset Returns: How Long Is Long?

- December 15, 2014: Beaten Down Assets

- December 8, 2014: Implementing Core Asset Portfolios In a Brokerage

- December 1, 2014: Two Key Issues of Investment Strategies

- November 24, 2014: Holiday Readings

- November 17, 2014: Retirement Spending Portfolios Update

- November 10, 2014: Fixed Income Or Cash

- November 3, 2014: Asset Trend Review

- October 27, 2014: Investment Loss, Mistakes And Market Cycles

- October 20, 2014: Strategic Portfolios With Managed Volatility

- October 13, 2014: Embrace Volatility

- October 6, 2014: Tips For 401k Open Enrollment

- September 29, 2014: What Can We Learn From Bill Gross’ Departure From PIMCO?

- September 22, 2014: Why Total Return Bond Funds?

- September 15, 2014: Equity And Total Return Bond Fund Composite Portfolios

- September 8, 2014: Momentum Based Portfolios Review

- September 1, 2014: Risk & Diversification: Mint.com Interview

- August 25, 2014: Remember Risk

- August 18, 2014: Consistency, The Most Important Edge In Investing: Tactical Case

- August 11, 2014: What To Do In Overvalued Stock Markets

- August 4, 2014: Is This The Peak Or Correction?

- July 28, 2014: Stock Musings

- July 21, 2014: Permanent Portfolios & Four Pillar Foundation Based Framework

- July 14, 2014: Composite Portfolios Review

- July 7, 2014: Portfolio Behavior During Market Corrections

- June 30, 2014: Half Year Brokerage ETF and Mutual Fund Portfolios Review

- June 23, 2014: Newsletter Collection Update

- June 16, 2014: There Are Always Lottery Winners

- June 9, 2014: The Arithmetic of Investment Mistakes

- June 2, 2014: Tips On Portfolio Rebalance

- May 26, 2014: In Praise Of Low Cost Core Asset Class Based Portfolios

- May 19, 2014: Consistency, The Most Important Edge In Investing: Strategic Case

- May 12, 2014: How To Handle An Elevated Overvalued Market

- May 5, 2014: Asset Allocation Funds Review

- April 28, 2014: Now The Economy Backs To The ‘Old Normal’, Should Our Investments Too?

- April 21, 2014: Total Return Bond Investing In The Current Market Environment

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.