Tips For 401k Open Enrollment

It is this time again: October and early November are usually the open enrollment period when employees can make once a year change for their medical health insurance, retirement 401k plan investments and other benefits. Even though we focus on retirement investing, every now and then, we receive users’ questions on 401k, IRAs and in general, investing for retirement. We will use this newsletter to address some of these issues.

First, some basic information.

Contribution and company match

When one makes a contribution to a retirement plan, there is usually an annual limit. For a normal 401k, the annual contribution limit is $18,000. Remember, if you are 50 years or older, you can contribute extra (so called catch-up contribution). Its limit for 2015 is $6,000. You can find more info on this page.

Many companies or employers offer 401k match. This match is usually limited, varies from company to company. For example, a company can offer a match up to 5% of an employee’s annual salary or total compensation (i.e. including bonus). Another company might simply have an absolute dollar amount such as up to $4,000. Please note company match does not count against an individual contribution limit. This is an often asked question.

Company match is like a free salary raise, it is highly recommended to take advantage of this as much as possible.

How much do you need to save for retirement?

There are many online retirement calculators one can use to figure out how much you should save to achieve your retirement goal. MyPlanIQ’s retirement calculator is a simple one that can help you to get a ball park number in 5 minutes. Some of calculators can be very sophisticated. They can take many parameters that include contribution limits, family situation (married, kids etc.), tax rate etc.

Retirement calculators are meant to help you get a sense on how much you need to save. They are really just rule of thumb. One shouldn’t go overboard on this. Since your personal situation changes every year, the best is to check this often.

The following are some of retirement calculators that we find useful:

Vanguard retirement calculator

MarketWatch or SmartMoney Retirement Planner

Blackrock’s new CoRI index based calculator is also interesting to play with, especially if you are between 55 to 64.

401k, IRA Or Taxable?

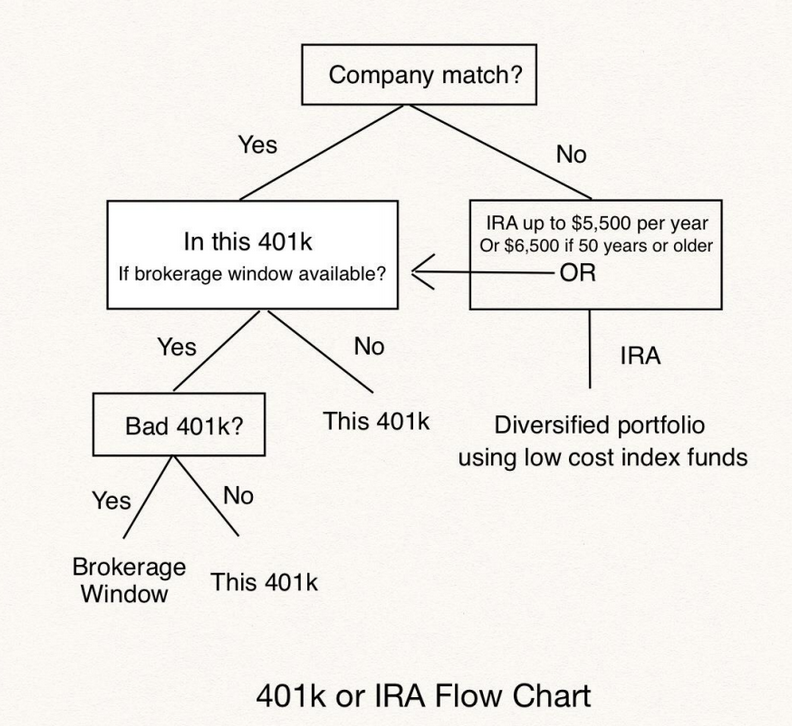

Since there are various issues regarding 401k plans such as high fees and limited investment options (a ‘bad’ or ‘good’ 401k plan, which we will address shortly), we are often asked whether one should choose 401k or IRAs or even just go to taxable accounts. This is a question that has many answers, depending on various situations. We show the following flow chart without much explanation. Wealthfront’s Andy Rachleff wrote an interesting article to discuss this in more details.

Note in the above chart, we also include brokerage window option that exists in many large 401k plans. For these plans, they allow their participants to invest in a brokerage link account instead of that inside the 401k plan. This allows much wider selections in terms of no load mutual funds. However, for most participants, we will only suggest going to the brokerage window route only if their 401k plans are ‘bad’.

Good or bad 401 plans

This leads to our discussion on what means a ‘good’ or ‘bad’ 401k plan. A quick and dirty way to do that is to evaluate a plan using the two criteria:

- Plan and fund expenses: For an individual fund, a ‘good’ expense ratio should be less than 0.6%. You should definitely not pay something higher than 1.5%, even for funds considered as ‘good’. Further more, plan wide expense should be controlled around 0.63%, the average plan expense number in 20012. As the Department of Labor has pushed more disclosure on fees charged or hidden in a plan, many plan sponsors and advisors are more aware and more transparent on this issue. If you are unclear on your plan, demand them to give a detailed breakdown. Better yet, such information should be made public to all of participants.

- Investment fund choices: Our rule of thumb here is that a ‘good’ plan should at least offer three core asset class funds and one additional asset class fund. The three core assets are

- US stocks — preferably include index funds and some core style index or good low cost active managed funds in small cap stocks or mid cap stocks.

- International stocks — preferably include index funds

- Bonds — preferably include Inflation-Protected bonds (TIPS)

- and an additional asset class such as Real Estate Investment Trusts (REITs) or Emerging market stocks.

For investment fund options, low cost index funds for each major asset class or at least diversified active fund for each major asset class are the essential elements to build a good diversified portfolio. If your plan does not meet this requirement, you should consider to use brokerage window or other options if they are available.

Portfolio Review

Lazy portfolios‘ performance has been nothing but stellar for the past 5 years. The follow table shows their performance:

Portfolio Performance Comparison (as of 10/6/2014):

| Ticker/Portfolio Name | YTD Return** |

1Yr AR | 3Yr AR | 5Yr AR | 10Yr AR | 10Yr Sharpe |

|---|---|---|---|---|---|---|

| P David Swensen Yale Individual Investor Portfolio Annual Rebalancing | 7.8% | 11.0% | 12.2% | 11.1% | 8.3% | 0.49 |

| Fund Advice Ultimate Buy and Hold Lazy Portfolio | 2.3% | 4.3% | 8.6% | 7.1% | 6.5% | 0.44 |

| The Coffee House Lazy Portfolio ETFs | 4.6% | 8.3% | 11.8% | 10.2% | ||

| Harry Browne Permanent Portfolio | 5.5% | 5.6% | 2.7% | 6.4% | 7.1% | 0.85 |

| Wasik Nano | 5.5% | 8.0% | 10.4% | 9.2% | ||

| 7Twelve Original Portfolio | 3.4% | 5.9% | 10.0% | 8.4% | ||

| VBINX (Vanguard Balanced Index Inv) | 5.2% | 10.9% | 14.8% | 11.4% | 7.1% | 0.51 |

See detailed year by year performance >>

David Swensen’s portfolio is again a standout as it benefits from the strength of long term Treasury bonds. Notice also this portfolio’s decent performance in 2013, even after the dismal performance of the long term bonds in that year. This again illustrates the concept of ‘insurance’ by using long term bonds.

Market Overview

Markets are still at a major trend turning point. It is encouraging though to see the recent high yield bond strength (albeit it might be a short lived one). As always, we want to be vigilant while still maintaining the course.

For more detailed asset trend scores, please refer to 360° Market Overview.

We would like to remind our readers that markets are more precarious now than other times in the last 5 years. It is a good time and imperative to adjust to a risk level you are comfortable with right now. However, recognizing our deficiency to predict the markets, we will stay on course.

We again copy our position statements (from previous newsletters):

Our position has not changed: We still maintain our cautious attitude to the recent stock market strength. Again, we have not seen any meaningful or substantial structural change in the U.S., European and emerging market economies. However, we will let markets sort this out and will try to take advantage over its irrational behavior if it is possible.

We again would like to stress for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Latest Articles

- September 29, 2014: What Can We Learn From Bill Gross’ Departure From PIMCO?

- September 22, 2014: Why Total Return Bond Funds?

- September 15, 2014: Equity And Total Return Bond Fund Composite Portfolios

- September 8, 2014: Momentum Based Portfolios Review

- September 1, 2014: Risk & Diversification: Mint.com Interview

- August 25, 2014: Remember Risk

- August 18, 2014: Consistency, The Most Important Edge In Investing: Tactical Case

- August 11, 2014: What To Do In Overvalued Stock Markets

- August 4, 2014: Is This The Peak Or Correction?

- July 28, 2014: Stock Musings

- July 21, 2014: Permanent Portfolios & Four Pillar Foundation Based Framework

- July 14, 2014: Composite Portfolios Review

- July 7, 2014: Portfolio Behavior During Market Corrections

- June 30, 2014: Half Year Brokerage ETF and Mutual Fund Portfolios Review

- June 23, 2014: Newsletter Collection Update

- June 16, 2014: There Are Always Lottery Winners

- June 9, 2014: The Arithmetic of Investment Mistakes

- June 2, 2014: Tips On Portfolio Rebalance

- May 26, 2014: In Praise Of Low Cost Core Asset Class Based Portfolios

- May 19, 2014: Consistency, The Most Important Edge In Investing: Strategic Case

- May 12, 2014: How To Handle An Elevated Overvalued Market

- May 5, 2014: Asset Allocation Funds Review

- April 28, 2014: Now The Economy Backs To The ‘Old Normal’, Should Our Investments Too?

- April 21, 2014: Total Return Bond Investing In The Current Market Environment

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.