Is This The Peak Or Correction?

Stock markets just went through a mini downturn or correction or whatever it is called. Here is the latest trend table:

Major Asset Classes Trend

08/04/2014

| Description | Symbol | 1 Week | 4 Weeks | 13 Weeks | 26 Weeks | 52 Weeks | Trend Score |

|---|---|---|---|---|---|---|---|

| Emerging Market Stks | VWO | -1.47% | 0.85% | 9.37% | 22.69% | 15.56% | 9.4% |

| Frontier Market Stks | FRN | -0.75% | -0.4% | 4.22% | 20.18% | 12.17% | 7.08% |

| US Equity REITs | VNQ | -1.72% | 0.52% | 3.49% | 15.37% | 14.06% | 6.34% |

| International REITs | RWX | -1.32% | -0.43% | 4.5% | 15.56% | 12.31% | 6.12% |

| US Stocks | VTI | -1.9% | -2.22% | 3.02% | 11.38% | 15.2% | 5.1% |

| Emerging Mkt Bonds | PCY | -1.26% | -0.25% | 3.17% | 10.59% | 10.46% | 4.54% |

| International Developed Stks | VEA | -2.12% | -2.97% | 0.1% | 9.51% | 12.05% | 3.31% |

| Municipal Bonds | MUB | -0.17% | 0.99% | 1.32% | 3.75% | 8.33% | 2.84% |

| International Treasury Bonds | BWX | -0.4% | -0.45% | 0.36% | 4.43% | 6.43% | 2.07% |

| Intermediate Treasuries | IEF | 0.04% | 1.13% | 1.65% | 2.04% | 4.2% | 1.81% |

| US Credit Bonds | CIU | 0.15% | 0.55% | 0.98% | 2.09% | 4.53% | 1.66% |

| Total US Bonds | BND | 0.06% | 0.65% | 1.08% | 2.12% | 4.34% | 1.65% |

| US High Yield Bonds | JNK | -0.96% | -1.94% | -0.11% | 3.2% | 7.93% | 1.62% |

| Mortgage Back Bonds | MBB | 0.01% | 0.26% | 1.0% | 1.75% | 4.43% | 1.49% |

| Treasury Bills | SHV | 0.01% | 0.0% | 0.0% | 0.0% | 0.02% | 0.01% |

| Gold | GLD | -1.27% | -2.39% | -1.77% | 2.2% | -1.36% | -0.92% |

| Commodities | DBC | -1.29% | -3.36% | -3.47% | 1.73% | -1.75% | -1.63% |

All risk assets have undergone some correction since last week. As we stated in the previous week’s newsletter:

However, we are concerned about the recent weakness (or divergence) of high yield (or junk) bonds. Such a divergence can not go on for a long time and will be resolved one way or the other.

we are still seeing that high yield bonds (represented by JNK) is still ranked below the ‘safe’ total bond index BND even after the recovery today (8/4/2014).

What is more revealing is that small cap stocks are on the verge of making a trend change: they briefly touched negative trend scores during this weekend:

US Equity Style Trend

08/04/2014

| Description | Symbol | 1 Week | 4 Weeks | 13 Weeks | 26 Weeks | 52 Weeks | Trend Score |

|---|---|---|---|---|---|---|---|

| Russell Largecap Growth | IWF | -1.73% | -1.99% | 3.49% | 10.83% | 17.06% | 5.53% |

| Russell Largecap Index | IWB | -1.88% | -1.93% | 3.23% | 12.06% | 15.86% | 5.47% |

| Russell Midcap Value | IWS | -2.27% | -2.52% | 2.23% | 12.86% | 16.34% | 5.33% |

| Russell Largecap Value | IWD | -2.23% | -1.94% | 2.84% | 13.06% | 14.36% | 5.22% |

| Russell Midcap Indedx | IWR | -1.86% | -2.74% | 2.35% | 10.86% | 14.58% | 4.64% |

| Russell Midcap Growth | IWP | -1.41% | -2.71% | 2.67% | 9.18% | 13.18% | 4.18% |

| Russell Smallcap Index | IWM | -1.21% | -5.19% | 0.18% | 3.43% | 7.19% | 0.88% |

| Russell Smallcap Value | IWN | -1.61% | -5.47% | -0.8% | 5.08% | 7.09% | 0.86% |

| Russell Smallcap Growth | IWO | -0.9% | -5.02% | 1.05% | 1.75% | 7.19% | 0.82% |

So it feels like the long overdue correction is likely on its way.

Calling a peak or correction

Many in the financial media are calling this is the peak or the correction. Among them are John Hussman (who’s been very consistent in pointing out the overvalued market conditions), Goldman Sachs and Mark Hulbert (see 3 market warning signs predict 20% stock tumble).

Since we have been a worrywart on current economies and markets for some time, it does seem that we tend to make such a call.

Many average investors are influenced by market actions and financial reports and make their investment decisions accordingly. Right now, it is a perfect example time for many to make this type of calls and then their investment decisions.

For those who believe this is the peak or the beginning of the long waited deep correction, they will sell equities (stocks) if they have already held them. For those who have new money to invest, they will say, let me wait.

For those who believe this is a temporary shallow correction, they will start to invest more money into stocks or even increase their risk exposure by selling bonds to buy more stocks.

However, many forget to ask themselves the more important follow up question: what happens if my call turns out to be ‘incorrect’:

For people who decide to sell their stocks or wait for a better entry point, what happens if markets recover from here? Shall you wait for another one? What happens if the ‘other’ correction will not come in a year or two? Do you have the patience and the guts to see markets are soaring high? What will happen if you finally capitulate at a later stage when markets are even higher? Don’t answer this right away. Imagine the situation a bit before giving your answers. Can you withstand that? It has happened before: we have users who have been waiting to get a better entry point since 2009!

For people who decide to increase their exposure in stocks or step into the stocks right now, they should ask themselves: what happens if after my purchases, stocks start to tank? Do I sell or wait it out? Do I have patience and risk tolerance to see markets losing 20%, 30% or even 40%? Again, imagine you are going through these situations before answering to yourself. It has happened before, needless to say (remember 2001-2002, 2008-2009).

The key to do the above exercise is to realize that, as what we have pointed out numerous times, making a call is one thing, how to handle various possible consequences of such calls is another.

The process or a well designed plan is the key, not a particular call. In fact, we know financial markets are pretty random and no one can predict markets 100%. That implies there will be plenty of wrong calls. It is like in playing a chess game, you have to imagine and look several steps ahead. Just acting on the current situation and making a move without looking ahead and foreseeing the possible difficulties usually call for troubles later on in the game.

It is the probability to make a correct calls and the process or response in the case of a wrong call that matter. Most of the time the lack of corresponding or well planed actions when a prediction goes wrong is the major culprit to damage one’s investments.

That brings us to the most important part in investing: a sound and systematic strategy. Without a strategy, we will act in a random or pseudo random fashion. It does seem to be very convincing or rational to call a peak right now and act on it. But if you don’t have a plan to handle the follow up situation: if this is not a peak in some near term, what do you do? chances are that your portfolios can suffer.

For us, we believe that asset allocation is the most important factor in portfolio management. Strategic Asset Allocation and Tactical Asset Allocation are two strategies we advocate. Each one might act differently in the same situation (such as in the current situations) but both of them have their merits and weakness. Staying on course in a predefined strategy is the key, as what we have alluded in articles:

- May 19, 2014: Consistency, The Most Important Edge In Investing: Strategic Case

- July 29, 2013: Strategic Asset Allocation: The Good, The Bad And The Ugly

- July 22, 2013: Tactical Asset Allocation: The Good, The Bad And The Ugly

So our simple answer to the peak question is: we don’t know whether this is the peak or not (even though subjectively we tend to call this is the peak). What we will do is to follow the strategy that will respond in a consistent and systematic way instead.

A user’s question

This brings us to a recent question that is posted on support/help forum:

In light of the May 12 newsletter describing the difficult conditions of the current market and how to invest new dollars, what would be your recommendation to a person that has changed jobs and is starting a new 401K? Should he just start applying his monthly contributions allocated via TAA or SAA? Or should he hold cash until “the correction”? This money will not be utilized for 30 year or so. This person plans to use a risk profile of 10-15 at his current age of 35. I lean towards just starting DCA via TAA the monthly contributions now as no one can predict when a correction may occur. Would appreciate your thoughts.

You can find this question through this link New employer, new 401K.

We encourage our users to exercise the look ahead or what-if scenario analysis technique to chip in here. The process of formulating a good answer to help others will help yourself.

Please participate!

Portfolio Review

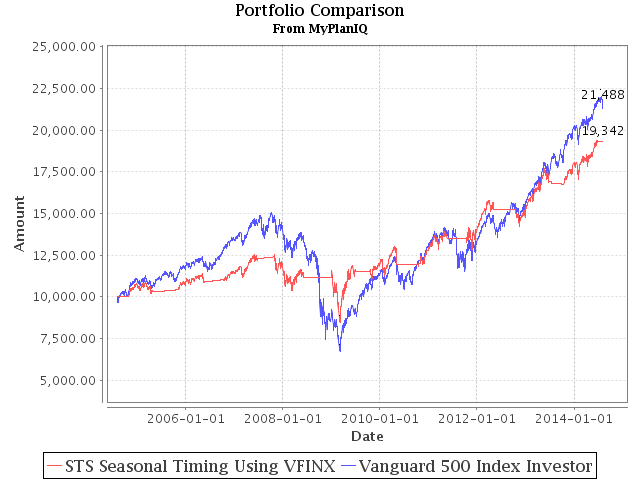

The Sell in May and Go Away Seasonal Timing strategy didn’t seem to work well this summer until recently! With the stock market being strong all through May and June. The portfolio finally exited stocks at the end of June.

Portfolio Performance Comparison (as of 8/4/2014):

| Ticker/Portfolio Name | YTD Return** |

1Yr AR | 3Yr AR | 5Yr AR | 10Yr AR | 10Yr Sharpe | Since 7/1/1987 |

|---|---|---|---|---|---|---|---|

| STS Seasonal Timing Using VFINX | 7.0% | 15.0% | 12.7% | 10.9% | 6.8% | 0.45 | 8.4% |

| VFINX (Vanguard 500 Index Investor) | 6.0% | 15.6% | 17.0% | 16.7% | 7.9% | 0.33 | 9.3% |

Even though this portfolio under performed VFINX (S&P 500) by about 1% in the last 10 years or since its inception (1987), its maximum drawdown is 33% vs. VFINX’s 55%! Its Sharpe ratio is higher. Furthermore, there are several ways to enhance this portfolio returns (such as investing in a bond portfolio instead of going to cash).

Market Overview

In addition to the over valuation, US stocks also exhibit two major divergence: small cap stock weakness and high yield bond weakness. However, emerging market stocks are still showing relatively strong upward trend. They also corrected less compared with US and developed markets (Europe and Japan) stocks. At the moment, it is unclear whether the trends have turned and we will wait for more confirmation.

For more detailed asset trend scores, please refer to 360° Market Overview.

We would like to remind our readers that markets are more precarious now than other times in the last 5 years. It is a good time and imperative to adjust to a risk level you are comfortable with right now. However, recognizing our deficiency to predict the markets, we will stay on course.

We again copy our position statements (from previous newsletters):

Our position has not changed: We still maintain our cautious attitude to the recent stock market strength. Again, we have not seen any meaningful or substantial structural change in the U.S., European and emerging market economies. However, we will let markets sort this out and will try to take advantage over its irrational behavior if it is possible.

We again would like to stress for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Latest Articles

- July 28, 2014: Stock Musings

- July 21, 2014: Permanent Portfolios & Four Pillar Foundation Based Framework

- July 14, 2014: Composite Portfolios Review

- July 7, 2014: Portfolio Behavior During Market Corrections

- June 30, 2014: Half Year Brokerage ETF and Mutual Fund Portfolios Review

- June 23, 2014: Newsletter Collection Update

- June 16, 2014: There Are Always Lottery Winners

- June 9, 2014: The Arithmetic of Investment Mistakes

- June 2, 2014: Tips On Portfolio Rebalance

- May 26, 2014: In Praise Of Low Cost Core Asset Class Based Portfolios

- May 19, 2014: Consistency, The Most Important Edge In Investing: Strategic Case

- May 12, 2014: How To Handle An Elevated Overvalued Market

- May 5, 2014: Asset Allocation Funds Review

- April 28, 2014: Now The Economy Backs To The ‘Old Normal’, Should Our Investments Too?

- April 21, 2014: Total Return Bond Investing In The Current Market Environment

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.