Re-balance Cycle Reminder All MyPlanIQ’s newsletters are archived here.

For regular SAA and TAA portfolios, the next re-balance will be on Next Monday, December 9, 2013. You can also find the re-balance calendar for 2013 on ‘Dashboard‘ page once you log in.

As a reminder to expert users: advanced portfolios are still re-balanced based on their original re-balance schedules and they are not the same as those used in Strategic and Tactical Asset Allocation (SAA and TAA) portfolios of a plan.

Please note that we now list the next re-balance date on every portfolio page.

Versatile Multiple Portfolio Construction

We introduced the concept of portfolios of portfolios before:

We described several ways to utilize our ‘static portfolio’ concept to construct a versatile portfolio.

We believe that our ‘Static Portfolio‘ feature has been underutilized or might be simply buried among many features we offer. Let’s first review this concept:

- After logging on to your account, you can access that by going to Dashboard and then click on Static Portfolio on the left panel.

- Static Portfolio is Free for a registered user. Static portfolios accept not only ETFs, but mutual funds and MyPlanIQ portfolios as inputs!

- Advanced Static Portfolio is available to an expert subscriber. It allows you to create a portfolio with custom allocation percentages over asset classes in a list of funds given by you. Doing so, you can construct a Strategic Allocation portfolio using a set of funds you identify.

We encourage everyone to try out this feature. Remember, some ETF portfolio providers charge over $150 to let you create your own ETF portfolios with weights specified by you!

100% stock and 100% bond portfolios

Many users might mistaken that we only provide moderate portfolios. In fact, you can mix several portfolios with various risk profile together. For example, here are the 3 100% stock (or risk profile 0) portfolios:

Portfolio Performance Comparison (as of 12/2/2013)

| Ticker/Portfolio Name | YTD Return** |

1Yr AR | 3Yr AR | 5Yr AR | 5Yr Sharpe | 10Yr AR | 10Yr Sharpe |

|---|---|---|---|---|---|---|---|

| Six Core Asset ETFs Tactical Asset Allocation Most Aggressive | 20.0% | 23.5% | 9.5% | 13.6% | 0.81 | 14.5% | 0.78 |

| MyPlanIQ Diversified Core Allocation ETF Plan Tactical Asset Allocation Most Aggressive | 18.1% | 23.4% | 10.6% | 14.4% | 0.89 | 15.3% | 0.88 |

| Retirement Income ETFs Tactical Asset Allocation Most Aggressive | 13.8% | 18.3% | 7.6% | 13.0% | 0.78 | 14.0% | 0.76 |

| SPY (SPDR S&P 500) | 29.0% | 30.2% | 17.4% | 17.5% | 0.86 | 7.6% | 0.32 |

| EFA (iShares MSCI EAFE Index) | 18.0% | 23.1% | 10.0% | 13.0% | 0.52 | 6.9% | 0.24 |

| EEM (iShares MSCI Emerging Markets Index) | -3.3% | 3.2% | -0.2% | 15.2% | 0.51 | 10.9% | 0.29 |

**YTD: Year to Date

See detailed year by year comparison >>

In fact, all of these portfolios can be found in their individual plans (in the ‘Other Related Portfolios’ section).

All of these portfolios have risk profile 0, meaning when times are ‘good’ (such as right now), they can invest 100% in stock funds or REITs. However since all of these are tactical portfolios, they can also invest 100% in bonds or cash (such as in 2008 to early 2009). These portfolios are also ‘global’ in the sense that all of the 3 portfolios above rotate among ETFs in US stocks, international stocks, emerging market stocks and REITs.

Again, we remind readers that you should pay more attention to their risk factors such as drawdown and Sharpe ratios before judging a portfolio or a fund.

Similarly, one can construct a 100% bond portfolio or just use those listed on Fixed Income Bond Fund Portfolios.

Using stock portfolios and bond portfolios to construct a balanced portfolio

Supposed that you have 60% of your money in TDAmeritrade and 40% in Fidelity, you can mirror your TDAmeritrade account with MyPlanIQ Diversified Core Allocation ETF Plan Tactical Asset Allocation Most Aggressive: that means you are buying and selling ETFs in your TDAmeritrade account.

In the meantime, you follow Fidelity Total Return Bond in your Fidelity account. That means you are buying and selling no load no transaction fee total return bond mutual funds in your Fidelity account.

Now effectively, you have a moderate (risk profile 40 or 60% stocks/40% bonds) overall composite portfolio.

How well has this portfolio done? Compared with the moderate portfolio from MyPlanIQ Diversified Core Allocation ETF Plan?

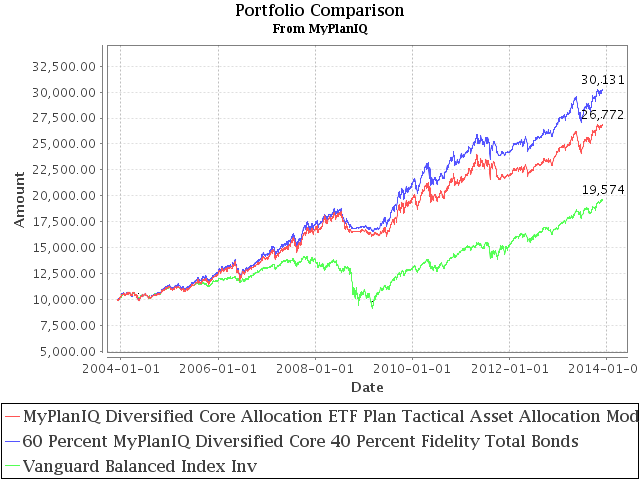

We use Static Portfolio to construct 60 Percent MyPlanIQ Diversified Core 40 Percent Fidelity Total Bonds. The following is the performance:

Portfolio Performance Comparison (as of 12/2/2013)

| Ticker/Portfolio Name | YTD Return** |

1Yr AR | 3Yr AR | 5Yr AR | 5Yr Sharpe | 10Yr AR | 10Yr Sharpe |

|---|---|---|---|---|---|---|---|

| 60 Percent MyPlanIQ Diversified Core 40 Percent Fidelity Total Bonds | 11.0% | 14.2% | 8.7% | 12.2% | 1.23 | 11.7% | 1.06 |

| MyPlanIQ Diversified Core Allocation ETF Plan Tactical Asset Allocation Moderate | 9.8% | 13.3% | 7.6% | 10.1% | 0.97 | 10.3% | 0.91 |

| VBINX (Vanguard Balanced Index Inv) | 16.1% | 16.8% | 11.5% | 13.3% | 1.09 | 7.0% | 0.49 |

**YTD: Year to Date

See year by year detailed comparison >>

Apparently, this ‘new’ composite portfolio does better than the Diversified Core Moderate portfolio. This is also consistent with what we have stated before: in bond investing, it is easier to find a consistent active bond mutual fund manager who can out perform bond markets than in stock investing. We believe that current bond ETF offerings are still not good enough to out perform active bond mutual funds.

There are many ways to construct a balanced portfolio. For example, you can use the same risk profile in two portfolios and that will result in an overall portfolio with the same risk profile. Or you can use various risk profiles in different accounts, so long as they result in an overall portfolio with risk profile you can take. For example, let’s say you have $1 million investable assets broken down as $100K in Company A 401K, $100K in Schwab IRA, $100K in Fidelity Personal Annuity, $700K in TD Ameritrade taxable account. If you want to construct a risk profile 40 portfolio, you can consider the following:

- $100K in Fidelity Personal Annuity: risk profile 40 (i.e. target portfolio) since this money can not be moved around.

- $100K Company A 401K: risk profile 0 — it is better to have actively traded stocks in tax deferred accounts

- $100K Schwab IRA: risk profile 0

- $700K Schwab taxable: risk profile 80 — that means 20%x700 = $140K in stocks

In fact, you can further divide the Schwab $700K into 2 parts: $140 in Schwab Commission Free ETFs (using risk profile 0) and $560 in Schwab Total Return Bond portfolio.

You can then construct a static portfolio to monitor your overall situation. All can be found in that static portfolio’s holdings such as the current holding of 60 Percent MyPlanIQ Diversified Core 40 Percent Fidelity Total Bonds:

| Asset | Fund in this portfolio | Price change* | Percentage |

|---|---|---|---|

| stocks | P_51098 (MyPlanIQ Diversified Core Allocation ETF Plan Tactical Asset Allocation Most Aggressive) | 0.62% | 63.46% |

| bonds | P_46880 (Schwab Total Return Bond) | 0.00% | 36.54% |

* Day change on 12/02/2013.

Using funds and MyPlanIQ portfolios to construct a versatile portfolio

You can further extend your static portfolio by including other (mutual) funds in the portfolio. For example, you can add the following mutual funds to the above static portfolio to augment diversification:

| Asset | Fund in this portfolio | Percentage |

|---|---|---|

| stocks | P_51098 (MyPlanIQ Diversified Core Allocation ETF Plan Tactical Asset Allocation Most Aggressive) | 42% |

| bonds | P_46880 (Schwab Total Return Bond) | 28% |

| balanced | PRWCX (T. Rowe Price Capital Appreciation) | 10% |

| permanent | PRPFX (Permanent Portfolio) | 10% |

| risk_parity | ABRRX (Invesco Balanced-Risk Allc R) | 5% |

| conservative | BERIX (Berwyn Income) | 5% |

Let’s call this portfolio My Alternative Hedge Fund. Here is its performance:

| Name | 1Wk Return |

YTD* Return |

1Yr AR** |

3Yr AR** |

5Yr AR** |

10Yr AR** |

|---|---|---|---|---|---|---|

| My Alternative Hedge Fund | -0.2% | 10.1% | 12.6% | 8.7% | N/A | N/A |

| VFINX (Vanguard (S&P 500) Index) | -0.2% | 28.6% | 29.7% | 17.4% | 17.4% | 7.5% |

| VBINX (Vanguard Balance (60% stocks/40% bonds) | -0.1% | 16.1% | 16.8% | 11.5% | 13.3% | 7.0% |

To summarize, we encourage our users to fully utilize our system. You can use static portfolio feature to construct many versatile and diversified portfolios. Whether you are a mutual fund investor or an ETF investor, you can use the feature to construct a portfolio and let our system monitor and inform you when it is up to rebalancing time.

Portfolio Performance Review

Let’s review several tactical and conventional allocation mutual funds:

Portfolio Performance Comparison (as of 12/02/2013)

| Ticker/Portfolio Name | YTD Return** |

1Yr AR | 3Yr AR | 5Yr AR | 5Yr Sharpe | 10Yr AR | 10Yr Sharpe |

|---|---|---|---|---|---|---|---|

| PRWCX (T. Rowe Price Capital Appreciation) | 20.0% | 21.2% | 14.5% | 17.4% | 1.25 | 9.3% | 0.58 |

| MALOX (BlackRock Global Allocation Instl) | 13.1% | 14.9% | 7.9% | 11.3% | 0.95 | 9.2% | 0.72 |

| GTAA (Cambria Global Tactical ETF) | 1.6% | 3.9% | 1.2% | ||||

| GDAFX (Goldman Sachs Dynamic Allocation A) | 3.9% | 3.6% | 3.9% | ||||

| PASDX (PIMCO All Asset D) | 0.3% | 2.1% | 5.8% | 12.1% | 1.3 | 6.5% | 0.65 |

| PGMAX (PIMCO Global Multi-Asset A) | -8.4% | -6.5% | -0.2% | 6.5% | 0.62 |

**YTD: Year to Date

The conventional allocation portfolios such as PRWCX and MALOX have outdone the more unconventional tactical funds such as PASDX and GDAFX (though GDAFX is a conservative allocation fund, compared with PRWCX that can have up to 70% invested in stocks). A real disappointment is PIMCO Global Multi-Asset A (PGMAX): the fund was introduced right after the 2009’s financial crisis and it was designed for PIMCO’s New Normal environment.

However, both PRWCX and MALOX have much bigger volatility or drawdown than PASDX, for example. With all of the conventional ones doing well, maybe it is time to be more worried and beware of the reverse to mean phenomenon.

Market Overview

The Black Friday, Cyber Monday or whatever retailers try to entice more consumption from consumers aside, markets so far have taken a breath. We are still worried on the weakness in bonds, the weakness in emerging market stocks and REITs. We are seeing a very uneven development. Maybe eventually US QEs and global QE-equivalent might manage to pull us out of the slump and give us another year or two good time. Even assuming that turns out to be true, we dislike such financial engineering driven economic ‘miracle’ and believe that in such a situation, it will be only more dangerous and hostile for investors in the coming years.

For more detailed asset trend scores, please refer to 360° Market Overview.

We would like to remind our readers that markets are more precarious now than other times in the last 5 years. It is a good time and imperative to adjust to a risk level you are comfortable with right now. However, recognizing our deficiency to predict the markets, we will stay on course.

We again copy our position statements (from previous newsletters):

Our position has not changed: We still maintain our cautious attitude to the recent stock market strength. Again, we have not seen any meaningful or substantial structural change in the U.S., European and emerging market economies. However, we will let markets sort this out and will try to take advantage over its irrational behavior if it is possible.

We again would like to stress for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Latest Articles

- How to catch the market’s upside with a downside cushion

- Is It The End Of The Line For Stock Investments?

- Warren Buffett and Charlie Munger’s Best Advice

- 6 Reasons For Index Fund Investors To Give Thanks

- November 25, 2013: Downtrend of Bond Market in Place, Will It Continue?

- 5 bad ways to pick a mutual fund

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.