Aggregated Holdings in a Portfolio of Portfolios

We would like to announce that a new feature has been released: a user can now view the aggregated holdings and transactions of a portfolio of portfolios and receive rebalance emails when the portfolio or one of its sub portfolios has a rebalance transaction.

The above requires that you are following (if a portfolio is customized by you, you are automatically following this portfolio) all of the portfolios involved.

Let’s walk through the concept of portfolio of portfolios below:

Supposed that you are interested in a portfolio that uses Tactical Asset Allocation for your risk assets (i.e. stocks and/or REITs or commodities) and uses a Fixed Income Bond Fund Portfolios for your fixed income portion in a 60% stocks and 40% bonds allocation (a ‘moderate’ portfolio or risk profile 40). You further select

- MyPlanIQ Diversified Core Allocation ETF TAA Stocks: this is a customized portfolio that has risk profile 0

- Fidelity Total Return Bond: a followed portfolio

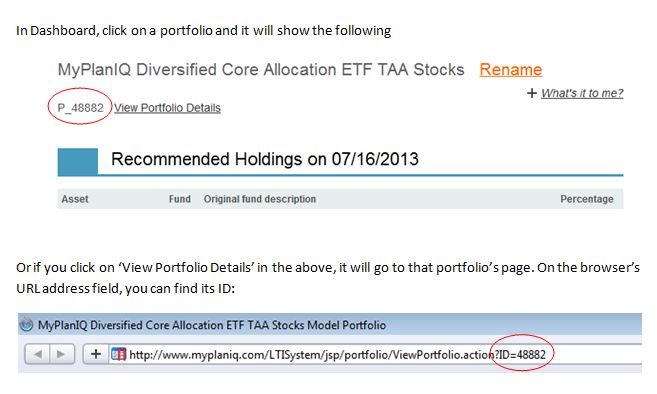

To use the feature of portfolio of portfolios, you’ll need to find out a portfolio’s symbol. In MyPlanIQ, a portfolio is treated as a fund that has a ticker symbol. In the portfolio case, its symbol is P_ID where ID is a series of digits that represent this portfolio. The following shows how to find a portfolio’s ID:

Using the above method, you can find the two portfolios’ symbols (from the circles):

- MyPlanIQ Diversified Core Allocation ETF TAA Stocks: symbol is P_48882

- Fidelity Total Return Bond: symbol is P_48596

So now we are able to build a 60% TAA stocks P_48882 and 40% fixed income bond P_48596 portfolio. To do so, you can simply use ‘Static Portfolios’ feature you can find on Dashboard to do so.

We call the new portfolio My 60 TAA Stocks 40 Total Return Bond Portfolio.

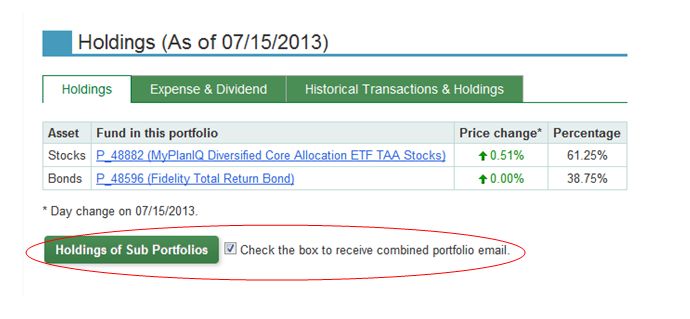

Now to enable the aggregated viewing for the above portfolio, you can click on the portfolio on your Dashboard->Static Portfolios table and do the following

- Check the box to receive combined portfolio email

- Click on ‘Holdings of Sub Portfolios‘ to reveal the aggregated holdings.

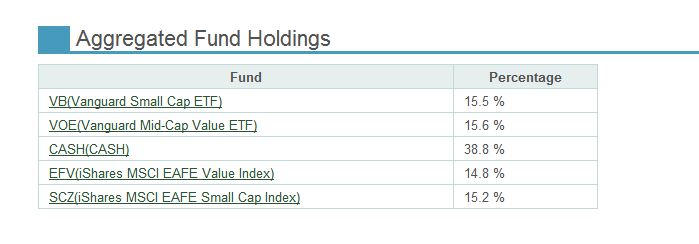

That will popup a window to show the aggregated holdings for this composite portfolio (or portfolio of portfolios).:

Notice in the aggregated holdings (as well as in aggregated rebalance emails), holdings for a same fund will be combined together.

How To Use Composite Portfolios

Now that we have a complete tool set to deal with portfolios of portfolios or composite portfolios, let’s take a look at the ways to utilize it to construct a good portfolio:

- Use different strategies or portfolios for your equity (stocks or risk assets) portion while using other strategies for the fixed income portion. The above example is a good example that uses TAA for all equity while using total return bond fund upgrade for fixed income. This is a portfolio that has downside protection for both equity and fixed income by using Tactical while in the meantime, it uses good total return bond mutual funds for its fixed income portion instead of bond ETFs, which are still not as compelling as their mutual fund counter parts. The following shows that this portfolio out performs the TAA moderate portfolio MyPlanIQ Diversified Core Allocation ETF Plan Tactical Asset Allocation Moderate by some meaningful margins:

Portfolio Performance Comparison

| Ticker/Portfolio Name | YTD Return** |

1Yr AR | 3Yr AR | 5Yr AR | 5Yr Sharpe | 10Yr AR | 10Yr Sharpe |

|---|---|---|---|---|---|---|---|

| VFINX | 18.5% | 27.9% | 18.1% | 8.5% | 0.32 | 7.4% | 0.3 |

| VBINX | 9.7% | 15.6% | 12.3% | 7.7% | 0.51 | 6.9% | 0.48 |

| My 60 TAA Stocks 40 Total Return Bond Portfolio | 4.7% | 11.5% | 9.5% | 9.3% | 0.94 | 12.2% | 1.11 |

| MyPlanIQ Diversified Core Allocation ETF Plan Tactical Asset Allocation Moderate | 3.6% | 10.5% | 8.1% | 6.5% | 0.6 | 10.5% | 0.91 |

*: NOT annualized

**YTD: Year to Date

- Core Satellite concept: use Strategic Asset Allocation as your core portfolio while use Tactical Asset Allocation as your satellite portion. Such a combination uses both Strategic and Tactical strengths to complement with each. There are numerous ways to form a core portfolio. For example, you can use permanent portfolios or risk parity all weather portfolios mentioned in

February 25, 2013: Risk Parity All Weather & Permanent Portfolio Review. Even though these portfolios have taken a beating recently, they are still solid for long term purposes.

- Similar to the portfolio in the previous section, you can construct other risk managed portfolios such as the one mentioned in our June 10, 2013: Risk Managed Strategic Asset Allocation Portfolios. In fact, taking the above two ideas together, one can construct a powerful composite portfolio that has sub portfolios for each major asset class such as a dedicated (sub)portfolio for US equity, another dedicated (sub)portfolio for international stocks and/or a dedicated portfolio for commodities (such as using a long short portfolios like P S and P Diversified Trend Indicators on Advanced Strategies page.

- Use various strategies or mixed with allocation mutual funds/ETFs: for example, if you are fond of T. Rowe Price Capital Appreciation (PRWCX) and you would like to use this in combination with other MyPlanIQ TAA or SAA portfolios, you can create a static portfolio that allocates some portion to PRWCX and others to other portfolios.

Portfolio Performance Review

We reviewed a core satellite portfolio Harry Browne Permanent Portfolio Core Satellite in newsletter February 27th 2012: Core Satellite Portfolios And Static Portfolios. At that time, the performance was as follows:

Portfolio Performance Comparison (as of 2/27/2012)

| Portfolio/Fund Name | YTD Return |

1Yr AR | 1Yr Sharpe | 3Yr AR | 3Yr Sharpe | 5Yr AR | 5Yr Sharpe |

|---|---|---|---|---|---|---|---|

| Vanguard ETFs Tactical Asset Allocation Moderate | 3% | 1% | 21% | 10% | 70% | 9% | 55% |

| Harry Browne Permanent Portfolio Core Satellite | 4% | 7% | 91% | 12% | 121% | 9% | 80% |

| VBINX | 6% | 7% | 39% | 19% | 130% | 4% | 19% |

| Harry Browne Permanent Portfolio | 5% | 13% | 147% | 13% | 135% | 9% | 90% |

Now:

Portfolio Performance Comparison

| Ticker/Portfolio Name | YTD Return** |

1Yr AR | 1Yr Sharpe | 3Yr AR | 3Yr Sharpe | 5Yr AR | 5Yr Sharpe | 10Yr AR | 10Yr Sharpe |

|---|---|---|---|---|---|---|---|---|---|

| Vanguard ETFs Tactical Asset Allocation Moderate | 3.4% | 8.3% | 1.09 | 10.1% | 1.09 | 9.1% | 0.76 | 10.1% | 0.77 |

| Harry Browne Permanent Portfolio Core Satellite | -0.5% | 2.5% | 0.42 | 8.4% | 1.23 | 7.6% | 0.9 | 8.8% | 0.94 |

| VBINX | 9.7% | 15.6% | 2.18 | 12.3% | 1.21 | 7.7% | 0.51 | 6.9% | 0.48 |

| Harry Browne Permanent Portfolio | -4.1% | -2.6% | -0.44 | 6.5% | 0.99 | 6.1% | 0.74 | 7.5% | 0.9 |

*: NOT annualized

**YTD: Year to Date

Click here for more detailed performance data>>

So a year earlier, Harry Browne Permanent Portfolio was very much in comparable with the Harry Browne Permanent Portfolio Core Satellite but now, it seems the Core Satellite has outperformed the original by a bigger margin. What we can draw from this is that using multiple portfolios correctly, one can improve both returns and reduce risks without being forced to take extra risk. Such a ‘free’ lunch is worth pursuing.

Market Overview

Markets continue to stabilize and now they are back to the up trends in a more explicit way. In fact, REITs, along with US stocks and international stocks are now sitting at the top spots in the trend ranking tables shown on 360° Market Overview or Asset Trends & Correlations. However, there have been more and more fundamental erosion such as today’s retail sales miss report.

On fixed income side, both high yield and short term credit bonds are positive while other segments are recovering. Again, subjectively, we are in the ‘bonds are not doomed, at least not right now camp’. Nevertheless, even though we are not optimistic at all in current situation, we will stay on the course to let markets work through these uncertainties.

Please refer to 360° Market Overview or Asset Trends & Correlations for various asset class trend rankings. At current level, Treasury bonds are in a better valuation.

We again copy our position statements (from previous newsletters):

Our position has not changed: We still maintain our cautious attitude to the recent stock market strength. Again, we have not seen any meaningful or substantial structural change in the U.S., European and emerging market economies. However, we will let markets sort this out and will try to take advantage over its irrational behavior if it is possible.

We again would like to stress for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Latest Articles

- The Optimist’s Antidote

- Ritholtz on Gold and on Making Predictions; How Secular Bull Markets End; Winning vs. Investing

- Early Take on How Boomers Are Faring

- Diversification: Why Not Put Everything in Whatever Will Go Up the Most?

- European stocks beckon as EU turns around

- The Rise of Smart Beta

- Stock Market Sentiment Surveys: AAII Edition

- Budget? What Budget?

- July 8, 2013: When To Retire And Bear Market Impact On Retirement Income And Spending

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.