|

Vanguard ETF: |     |

7.4%* |

|

Diversified Core: |    |

8.1%* |

|

Six Core Asset ETFs: |    |

7.3%* |

Articles on PFA

- TD Ameritrade Commission Free ETF’s Empowers Both Strategic and Tactical Asset Allocation

10/19/2010

The recent news that TD Ameritrade are providing over 100 ETF’s commission free is a perfect fit for a retirement portfolio. Investors are able to trade once a month and pick from a wide range of ETF’s without incurring any trading fees. Combine this with an IRA where the tax consequences of trading are removed and you have an almost ideal scenario and back tested returns demonstrate the point.

There is a continuing dilemma between wanting to increase returns while mitigating downside risk against the perceived risk of adopting a tactical asset allocation strategy. It is clear that tactical asset allocation consistently delivers higher returns at a lower risk. At the same time many are uncomfortable moving away from buy and hold which has been the mantra over the past twenty years.

In a previous article we introduced the notion of a core-satellite portfolio where the assets are split between tactical and strategic asset allocation strategies as a way of introducing tactical asset allocation in a step-by-step fashion.

TD Ameritrade making so many ETF’s available commission free allows another alternative to be considered and that is maintaining classic strategic asset allocation – i.e. all asset classes are fully represented at all times but with so many funds in each class, use fund momentum to rotate styles such that the funds in each asset class are regularly optimized.

CategoryJan-08Jan-09Jan-10Apr-10Jul-10Oct-10US EquitiesIWNVUG, MGKIWNVIGIWSVOInternational EquitiesEWJEWGEWJEWAAAXJAAXJEmerging MarketsEWZEWZEWZILFVWOVWOReal EstateVNQVNQVNQVNQVNQVNQCommoditiesDBCDBCDBCDBCDBCDBCBalanced FundAOKAOKAOKAOKAOKFixed IncomeSHY, WIP, JNKSHM, BWXSHY, WIP, JNKVCSH, BWX, JNKCASH, AGG, JNKCASH, AGG, JNKWe used the MyPlanIQ system to build and monitor a moderate risk (40% fixed income) strategic asset allocation portfolio. With five risk based asset classes, each of those classes would have 12% of the assets dedicated to them but the funds would be evaluated every month and the optimal fund selected based on the momentum within the class.

This can be compared with a Six asset SIB for which there is just one fund in each asset class.

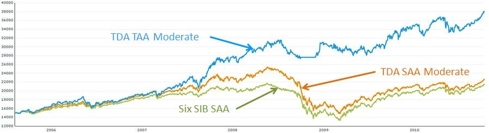

From the performance chart, it is clear that there is increased upside potential from being able to switch funds within an asset class. Unfortunately, there is less ability to minimize downside risk when an asset class is under downward pressure.Despite this, for those who want to stay with a buy and hold in terms of asset classes, using this approach can squeeze some extra returns from the strategy.

With the large number of funds in six asset classes, momentum based asset allocation can be seen in its best light.

Portfolio Performance ComparisonPortfolio Name1Yr AR1Yr Sharpe3Yr AR3Yr Sharpe5Yr AR5Yr Sharpe13%87%13%86%20%128%10%83%-1%-6%9%46%11%93%1%5%8%40%Takeaways- ETF’s provide the basis for an outstanding portfolio with either strategic or tactical asset allocation. This is clearly demonstrated with TD’s wide range of commission free funds

- Using a web based application takes a lot of the effort from finding the best funds for either strategy

- Strategic asset allocation with styles rotation can deliver solid results using a well trusted strategy

- Tactical asset allocation greatly benefits from the large number of funds

labels:investment,

Symbols:GSG,DBC,AOK,EEM,GMM,PXH,DEM,SCHE,PCY,VTI,VT,IEV,VGK,PEF,DEB,EFA,VEU,GWL,PFA,EFG,EFV,PID,DWM,IFSM,VSS,SCHC,SCZ,IFGL,RWX,HYG,JNK,PHB,TIP,IEI,VGIT,ITE,AGG,CIU,BIV,BND,EWJ,JPP,PJO,DXJ,IVV,IYY,IWV,VV,SPY,DLN,RSP,SCHX,IVW,IWZ,JKE,VUG,ELG,QQQQ,RPG,SCHG,IVE,IWW,Commission,Free,ETFs,Strategic,Asset,Allocation,Tactical,Asset,Allocation,Asset,Allocation,styles,rotation,

- Apple 401K: A Great Company with an Average Retirement Plan

10/19/2010

As one of the gee-whiz high tech companies, Apple Inc. (AAPL) is well known for its innovative consumer products such as Macs, iPods, iPhones and iPads. It is also a known fact for many high tech workers in San Francisco Bay Area that Apple provides wonderful employee benefits. In this article, we take a closer look at Apple's 401K plan'sfund lineups and its rating. We then discuss how participants in Apple 401K can achieve reasonable investment results using asset allocation strategies. We will also discuss how those portfolios are positioned in today’s market environment.

Apple 401K's 401K plan consists of 14 funds. These funds enable participants to gain exposure to 4 major assets: Fixed Income , US Equity , Foreign Equity , REITs . The list of minor asset classes covered:

Foreign Large Blend: EFA , VEU , GWL , PFAGlobal Real Estate: IFGL , RWXHigh Yield Bond: HYG , JNK , PHBIntermediate-Term Bond: AGG,CIU , BIV,BNDLARGE BLEND: IVV,IYY,IWV , VTI,VV , SPY , DLN , RSP , SCHXLARGE GROWTH: IVW,IWZ,JKE , VUG , ELG , QQQQ , RPG , SCHGModerate Allocation: AOMSMALL BLEND: IJR,IWM,JKJ , VB , DSC , PJM , DES , SAA,UWM , SCHAAs of 10/12/2010, this plan investment choice is rated as Averagebased on MyPlanIQ Plan Rating methodology that was designed to measure how effective a plan's available investment funds are . It has the following detailed ratings:Diversification -- Rated as above average (80%)Fund Quality -- Rated as poor (9%)Portfolio Building -- Rated as above average (75%)Overall Rating: average (57%)The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies ( SAA and TAA , both provided by MyPlanIQ). For comparison purpose, we also include the moderate model portfolios of a typical four asset SIB (Simpler Is Better) plan . This SIB plan has the following candidate index funds and their ETFs equivalent:

REITs:( IYR or VNQ or ICF )Fixed Income:( AGG or BND )Foreign Equity:( EFA or VEU )US Equity:( SPY or VTI )

Performance Chart (As of 10/12/2010)

Performance table

Portfolio Name

1Yr AR

1Yr Sharpe

3Yr AR

3Yr Sharpe

5Yr AR

5Yr Sharpe

9%

88%

7%

82%

10%

104%

9%

119%

1%

2%

5%

30%

Four Core Asset Index Funds REITs Tactical Asset Allocation Moderate

11%

78%

5%

48%

10%

91%

Four Core Asset Index Funds REITs Strategic Asset Allocation Moderate

13%

98%

0%

-0%

6%

24%

Currently, asset classes in REITs, Fixed Income and High Yield Bonds are doing relatively well. These asset classes are available to Apple 401K participants.

To summarize, Apple 401K plan participants can achieve reasonable investment returns by adopting asset allocation strategies that are tailored to their risk profiles. Currently, funds the tactical asset allocation strategy over weighs include REITs and High Yield Bonds. However, Apple can do better to her employees by improving its fund selection such as making better funds available.labels:investment,

Symbols:SPY,IVV,IWV,VTI,VV,DLN,IVW,IWZ,JKE,VUG,ELG,QQQQ,RPG,SCHG,AOM,IWM,IJR,VB,DSC,JKJ,SCHA,AGG,BND,CIU,BIV,HYG,JNK,PHB,EFA,VEU,GWL,PFA,ETFs,Portfolio,Building,401K,

labels: investment

Symbols: SPY, IVV, IWV, VTI, VV, DLN, IVW, IWZ, JKE, VUG, ELG, QQQQ, RPG, SCHG, AOM, IWM, IJR, VB, DSC, JKJ, SCHA, AGG, BND, CIU, BIV, HYG, JNK, PHB, EFA, VEU, GWL, PFA, ETFs, Portfolio Building, 401K

- Aflac Incorporated 401(k) Savings and Profit Sharing Plan Report On 12/03/2010

12/03/2010

This report reviews Aflac Incorporated 401(k) Savings and Profit Sharing Plan plan. We will discuss the investment choices and present the plan rating by MyPlanIQ. Current economic and market conditions are discussed in the context of the investment portfolios in the plan. We will then show how participants in Aflac Incorporated 401(k) Savings and Profit Sharing Plan can achieve reasonable investment results using asset allocation strategies.

Plan Review and Rating

AFLAC Inc (Ticker:AFL) has the "Aflac Incorporated 401(k) Savings and Profit Sharing Plan".

Aflac Incorporated 401(k) Savings and Profit Sharing Plan's 401K plan consists of 11 funds. These funds enable participants to gain exposure to 3 major assets: US Equity, Foreign Equity, Fixed Income. The list of minor asset classes covered:

Foreign Large Blend: EFA, VEU, GWL, PFA

Intermediate-term Bond: AGG, CIU, BIV, BND

Large Blend: IVV, IYY, IWV, VTI, VV, SPY, DLN, RSP, SCHX

Large Growth: IVW, IWZ, JKE, VUG, ELG, QQQQ, RPG, SCHG

Large Value: IVE, IWW, JKF, VTV, ELV, PWV, RPV, SCHV

Mid-cap Growth: IJK, IWP, VOT, EMG, PWJ, RFG, UKW

Moderate Allocation: AOM

Small Growth: IJT, IWO, JKK, VBK, DSG, PWT, RZG, UKK

As of Dec 2, 2010, this plan investment choice is rated as based on MyPlanIQ Plan Rating methodology that measures the effectiveness of a plan's available investment funds. It has the following detailed ratings:

Diversification -- Rated as (35%)

Fund Quality -- Rated as (33%)

Portfolio Building -- Rated as (36%)

Overall Rating: (35%)Current Economic and Market Conditions

We have experienced an uncertain 2010: plenty of worries on whether the US economy will climb out of the great recession and recover.

- The Federal Reserve embarked on Quantitative Easing II (QE2) to stimulate the economy.

- The housing market is still at its low but largely stabilized.

- The unemployment rate is stuck at 9%.

Americans continue to face an uncertain future, given (among others) the high unemployment rate, large federal and local government debts and global trade imbalance. With such an economic backdrop, the stock and debt markets are going to be volatile. Despite this, markets have been resilient and appear positioned to rebound.

In this market it is even more critical to properly diversify and respond market changes. MyPlanIQ offers two asset allocation strategies: strategic and tactical asset allocation strategies ( SAA and TAA for participants in Aflac Incorporated 401(k) Savings and Profit Sharing Plan).

Strategic Asset Allocation is based on well known modern portfolio theory and its key features include: diversification, proper fund selection and periodically re-balancing.

Tactical Asset Allocation works on a diversified array of assets provided by funds in a plan and adjusts asset mixes based on market conditions such as asset price momentum utilized by TAA.

Portfolio Discussions

The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies. For comparison purpose, we also include the moderate model portfolios of a typical 3 asset SIB (Simpler Is Better) plan . This SIB plan has the following candidate index funds and their ETFs equivalent:

US Equity: (SPY or VTI)

Foreign Equity: (EFA or VEU)

Fixed Income: (AGG or BND)

Performance chart (as of Dec 2, 2010)Performance table (as of Dec 2, 2010)

Portfolio Name 1Yr AR 1Yr Sharpe 3Yr AR 3Yr Sharpe 5Yr AR 5Yr Sharpe Aflac Incorporated 401(k) Savings and Profit Sharing Plan Tactical Asset Allocation Moderate 4% 34% 5% 64% 8% 81% Aflac Incorporated 401(k) Savings and Profit Sharing Plan Strategic Asset Allocation Moderate 10% 100% 2% 8% 6% 31% Three Core Asset ETF Index Funds Tactical Asset Allocation Moderate -4% -35% 1% 9% 4% 27% Three Core Asset ETF Index Funds Strategic Asset Allocation Moderate 9% 60% -0% -3% 4% 13% Currently, asset classes in US Equity (SPY,VTI), Foreign Equity (EFA,VEU) and Fixed Income (AGG,BND) are doing relatively well. These asset classes are available to Aflac Incorporated 401(k) Savings and Profit Sharing Plan participants.

To summarize, Aflac Incorporated 401(k) Savings and Profit Sharing Plan plan participants can achieve reasonable investment returns by adopting asset allocation strategies that are tailored to their risk profiles.

Symbols: AFL , SPY , VTI , EFA , VEU , AGG , BND , AOM , CIU , BIV , GWL , PFA , IVE , IWW , JKF , VTV , ELV , PWV , RPV , SCHV , IVV , IYY , IWV , VV , DLN , RSP , SCHX , IVW , IWZ , JKE , VUG , ELG , QQQQ , RPG , SCHG , IJK , IWP , VOT , EMG , PWJ , RFG , UKW , IJT , IWO , JKK , VBK , DSG , PWT , RZG , UKK

- ALLERGAN, INC. SAVINGS AND INVESTMENT PLAN Report On 12/03/2010

12/03/2010

- ASSURANT 401(k) PLAN A&PLAN B Report On 12/03/2010

12/03/2010

- Apache Design Solutions 401K Report On 12/03/2010

12/03/2010

- Allegheny Ludlum Corporation Personal Retirement and 401(k) Savings Account Plan Report On 12/03/2010

12/03/2010

- AMERICAN EXPRESS RETIREMENT SAVINGS PLAN Report On 12/03/2010

12/03/2010

- ALLEGHENY ENERGY EMPLOYEE STOCK OWNERSHIP AND SAVINGS PLAN Report On 12/03/2010

12/03/2010

- BAKER 401(k) PLAN Report On 12/03/2010

12/03/2010

- BRISTOL-MYERS SQUIBB COMPANY SAVINGS AND INVESTMENT PROGRAM Report On 12/03/2010

12/03/2010

- PEABODY WESTERN-UMWA 401(K) PLAN Report On 12/03/2010

12/03/2010

- Peabody Investments Corp.Employee Retirement Account Report On 12/03/2010

12/03/2010

- CEPHALON, INC. 401(k) PROFIT SHARING PLAN Report On 12/03/2010

12/03/2010

- CVS CAREMARK CORPORATION AND AFFILIATED COMPANIES Report On 12/03/2010

12/03/2010

- Vanguard Variable Annuity Report On 12/06/2010

12/06/2010

- TD Ameritrade Commission Free ETFs Report On 12/07/2010

12/07/2010

- Qualcomm 401(k) Plan Report On 12/07/2010

12/07/2010

- Vanguard-VA-Clone Report On 12/07/2010

12/07/2010

- Tiffany Co. Employee Profit Sharing and Retirement Savings Plan Report On 03/21/2011

03/21/2011

- Sprint Nextel 401K Plan Report On 03/21/2011

03/21/2011