|

Vanguard ETF: |     |

7.4%* |

|

Diversified Core: |    |

8.1%* |

|

Six Core Asset ETFs: |    |

7.3%* |

Articles on GSG

- Strategic and Tactical Allocation for Retirement Investments

10/17/2011

Strategic Asset Allocation(SAA) and Tactical Asset Allocation(TAA) can complement to each other. The following is a recent article Core Satellite Portfolios For Long-Term Investments published on SeekingAlpha.com that discussed this issue:

"Recent market swings and weakness have proven to be difficult for both strategic and tactical asset allocation strategies. For a long-term investor who is concerned about his/her retirement investments, such as 401(k)s, IRAs, 403(b)s and variable annuity accounts, it is thus important to understand the strength and weaknes of the two common strategies.

The concept of core satellite portfolio construction has been adopted for several years by many investment advisers, wealth managers and financial planners. The EDHEC has collected several papers detailing this concept."

......

Read more on Core Satellite Portfolios For Long-Term Investments.

See the Core Satellite Six Core Asset ETFs 25 Core 75 Satellite portfolio and the comparison with strategic asset allocation and tactical asset allocation.

Symbols: SPX, COMP, AGG, BND, DBC, EEM, EFA, GSG, IYR, SPY, VEU, VNQ, VTI, VWO, Retirement Investments, Portfolio Management, Asset Allocation

- Advisors Turning to Alternative Investments: What ETFs Can You Use?

08/30/2011

Indexuniverse.com reports the following:

"Alternative investments, including hedge fund strategies, are becoming more popular, as many advisors turn to off-the-beaten-path vehicles for everything from portfolio diversification to risk management to generate returns, a study from Cambridge, Mass.-based Cogent Research showed.

To date, nearly 80 percent of all retail advisors interviewed in the survey rely on alternative strategies within client portfolios, allocating on average 11 percent of their book to such strategies. Apart from hedge funds, alternative investment strategies include venture capital, private equity, limited partnerships and structured products and notes.

Of all those making use of alternative investment strategies, more than 40 percent of them will increase their use of ETFs in the next 12 months. Comparative data weren’t available, as this is the first time Cogent addressed the use of alternatives."

Read more on

Advisors Turning To Alternative Investments

For investors who have IRAs and taxable accounts, they can access to ETFs easily these days. While we certainly do not suggest average investors to venture into venture capital, private equity and other illiquid asset classes, some of hedge fund style ETFs can be useful for asset allocation purpose. Furthermore, our Tactical Asset Allocation(TAA) strategy can be classified as an alternative investment strategy (it depends on whether one would throw anything non-conventional Tactical Asset Allocation(TAA) into the 'alternative' bucket).

We should also point out that many people consider Real Estate Investment Trusts (REITs such as IYR, VNQ), Gold (GLD, IAU), Silver (SLV) or commodities (DBC, GSG) as alternative investments.

Considering recent market and economic environments, these ETFs or strategies are playing an important roles in retirement investing for diversification and risk management purposes. In fact, many of these strategies or portfolios have done a good job to hedge against general stock market (S&P 500 SPX, Nasdaq COMP) downturns.

We have published several research articles on alternative ETFs:

Managed Futures ETFs Are Useful Portfolio Diversifiers

6 Hedge Fund ETFs for Average Investors

Commodity Investing: Long/Short (S&P Commodity Trend Indicators) vs. Long-Only

Or these portfolios:

Permanent Global Portfolio ETF Plan

MyPlanIQ Diversified Core Allocation ETF Plan

Symbols: SPX, COMP, IYR, VNQ, GLD, IAU, SLV, DBC, GSG, Portfolio Strategy & Asset Allocation

- GCC Leads Broad Based Commodity ETFs

05/10/2011

Investing is a major concern especially for those for whom retirement is the next step in their lives. Every investor has their own concept of investing; some are investing for long term and some are investing for a shorter term. We review ETF’s in a number of major asset classes to provide insight into building a long term investment portfolio that can bring the best risk adjusted returns even in the light of uncertain circumstances.

Despite the recent selloff, 2011 be an important year for commodities. Due to the Fed’s approach, the dollar will continue to drop which, in turn, makes owning a commodity an attractive investment. The commodities markets are classified into three major categories i.e.

· Food items

· Base metal and precious metal.

· Energy related commodities

The combination of slower growth in U.S. service industries and fewer German manufacturing orders helped drive the Standard & Poor’s GSCI Index of 24 commodities down 11 percent last week, the most since December 2008, and erased all the gains since mid-March.

Despite this, the recent growth in commodity markets is due to the following factors:

· More demand: The world population grew from 2.5 billion in 1950 to 6.7 billion by the end of 2010. The phenomenal growth in the population cause the agriculture related product demand to increase and this is not going to change

· Dollar lower: There has been a systematic devaluation of dollar by the FED over the last 2 years

Commodities of the asset class table with excellent return of 39.21% in the last one year. The second position goes to US small cap growth with a return of 31.51%. Although the one year returns are good, the five year returns are not good.

The broad-based commodities table are as follows:

Description

Symbol

1 Yr

3 Yr

5 Yr

Avg. Volume(K)

1 Yr Sharpe

GreenHaven Continuous Commodity

35.08%

-0.26%

NA

252

213.18%

iPath DJ-UBS Commodity Index Tracker

25.12%

-9.47%

NA

449

138.13%

iShares S&P GSCI Commodity-Index

18.14%

-19.3%

NA

671

91.86%

ELEMENTS Rogers Intl Commodity

28.59%

-9.45%

NA

706

150.16%

PowerShares DB Commodity Index

24.89%

-9.57%

3.48%

2,363

128.67%

GCC clearly turned out to the winner with the annual return of 35.08% RJI take the second position followed by DJP from a volume perspective (high liquidity and low trading friction) DBC shows the best consistent performance over the year showing fair returns in terms in term of five year of around 6.47%.

The GCC portfolio has wide sector wise division such as Agriculture, Agriculture life stocks, Agriculture Grains, energy and metals. The sector division of investment provides an excellent hedge against various market outcomes. All the metals have rallied in the last 2 years and the energy price is also high giving the fund value an additional boost. GCC has an average annual return of 25.19%, the average volumes are low in relation to the other ETF’s but the reason is that the fund is newly established and it will likely grow. The expense to ratio is 0.85%.

The broad based commodities fund provides an effective hedge in periods of recession and rising inflation. World growth is expected to double by the end of the 2030 and we need an increasing food supply and energy to accommodate this. In the light of this, the prospects of the broad based commodity are very bright.

Exchange Tickers: (NYSE: GCC), (NYSE: DJP), (NYSE: GSG), (NYSE: RJI), (NYSE: DBC)

Symbols: GCC, DJP, GSG, RJI, DBC

Disclaimer:

MyPlanIQ does not have any business relationship with the company or companies mentioned in this article. It does not set up their retirement plans. The performance data of portfolios mentioned above are obtained through historical simulation and are hypothetical.

- Keep It Simple Stupid -- A Simple Benchmark to Measure Your Investment Returns

04/19/2011

Living on borrowed time: nuclear reactors, oppressive governments, levees that keep out flood waters -- keeping things going -- just one more year. The temptation to delay until next time is very seductive until disaster strikes and the cost to repair, dwarfs the cost to prevent. Many working people put off their retirement investing -- just one more year until it becomes a "hair on fire" problem -- which it now is for baby boomers for whom retirement is a near and present danger.There is an easy to understand strategy that can improve returns with low risk. If you have a portfolio with the correct asset classes represented, over the long term, you will get better results at a lower risk than picking the latest and greatest fund or stock. This is not the bleeding edge of new ideas. This is proven and widely used – being the basis of most money manager’s strategies.

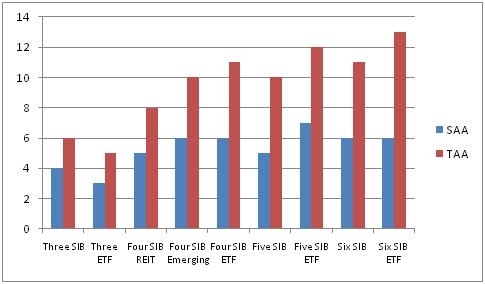

MyPlanIQ created SIB portfolios (Simpler Is Better) – market index funds from key asset classes that can be used to measure historical returns to show the impact of asset class selection rather than fund or stock selection. SIB portfolios for different numbers of asset classes are built and used to benchmark returns. From this, conclusions can be drawn as to what is an effective investment strategy for today.

The following funds were used:

Index Funds Asset Class

Ticker

Name

Large Blend

Vanguard Total Stock Mkt Idx

Foreign Large Blend

VGTSX

Vanguard Total Intl Stock Index

Diversified Emerging Markets

VEIEX

Vanguard Emerging Mkts Stock Idx

Real Estate

VGSIX

Vanguard REIT Index

Commodities Broad Basket

PowerShares DB Commodity Idx Trking Fund

Intermediate-Term Bond

Vanguard Total Bond Market Index

ETF Asset Classes

Ticker

Description

LARGE BLEND

Vanguard Total Stock Market ETF

Foreign Large Blend

Vanguard FTSE All-World ex-US ETF

Diversified Emerging Markets

Vanguard Emerging Markets Stock ETF

Real Estate

Vanguard REIT Index ETF

Commodities Broad Basket

DBC

PowerShares DB Commodity Idx Trking Fund

Intermediate-Term Bond

Vanguard Total Bond Market ETF

Three Asset Class SIB: The three core assets are U.S. and international equities and fixed income. This represents what used to be conventional wisdom: Heavy dependence on the U.S. and the rest of the developed world. With a conservative strategic asset allocation strategy, the portfolio would consist of 60% fixed income and 20% each for U.S. and international equities. With a tactical asset allocation strategy, the fixed income would never be less than 60% but the split of the three asset classes would move based on asset price movement.

Three Core Asset Portfolios

1 year AR

3 year AR

5 year AR

SAA Index

11%

1%

4%

SAA ETF Index

15%

1%

3%

TAA Index

7%

4%

6%

TAA ETF Index

9%

4%

5%

The SAA (buy and hold) strategy represents what many people may end up with. There is little thought put into which asset classes are represented but these are the most likely ones to be covered.

The TAA strategy gives a little higher long term performance because of the ability to move to other asset classes when one aspect of the economy is slowing.It’s clear that world economics has changed; becoming smaller, more interlinked and complex. It’s no longer possible to ignore the impact of emerging markets and we are very aware that real estate has an impact on the economy.

If you are just using three asset classes, you should look to upgrade your portfolio immediately.

Four Asset Class SIB: There are two variants for the four asset class SIB. Either add emerging markets or real estate trusts to the three asset class SIB. Note that the international asset class means established nations such as those in Europe and emerging asset classes are represented by developing nations. With a conservative strategic asset allocation strategy, the portfolio would consist of 60% fixed income and 13.33% each for U.S., international and REIT or emerging market equities. With a tactical asset allocation strategy, the fixed income would never be less than 60% but the split of the three asset classes would move based on asset price movement.

Four Core Asset Portfolios

1 year AR

3 year AR

5 year AR

SAA Em Index

12%

2%

6%

SAA REIT Index

17%

2%

5%

SAA ETF Em

16%

2%

6%

TAA Emerging

11%

7%

10%

TAA REIT

15%

6%

8%

TAA ETF Em

15%

7%

11%

Adding another asset class improves the performance as it balances risk. TAA is also able to increase its long term benefit over SAA as there are more asset classes to move into when one of the asset classes is not performing properly. Choosing between REIT and emerging markets is hard and further diversification is of long term value.

If you are using a four asset class portfolio, you could be doing better. Making the choice between emerging markets and real estate is a tough one.

Five Asset Class SIB: Has been covered in a previous article and the results are included for completeness. The five class SIB takes both REIT and Emerging markets so is a fusion of the two four asset class SIBs.

Five Core Asset Portfolios

1 year AR

3 year AR

5 year AR

SAA Index

15%

3%

5%

SAA ETF

20%

3%

7%

TAA Index

15%

8%

10%

TAA ETF

19%

8%

12%

The five asset class SIB is a strong platform for portfolio creation. It has broad diversification and, with tactical asset allocation, good returns.

If you are using a five asset class portfolio, you are in good shape – but take a look at the six asset class portfolio because it will be increasingly important in the current macro economic climate.

Six Asset Class SIB: The last asset class adds commodities to the portfolio. This gives another type of asset class and will further help diversification

Adding another asset class does not significantly improve the result within the 5 year time frame. It may be asked whether the extra effort of building and managing a six asset class portfolio is worth it. Broader diversification is good, but is it really necessary? In our view, the addition of commodities will be increasingly important as commodities will protect against inflation as the recovery slowly continues and there is increasing inflationary pressure.

Figure 1 5 Year Annualized Returns for the different SIBs with SAA and TAA strategies

What conclusions can be drawn from this?

-

It’s time to leave a three asset class portfolio in the past. The world is more connected and complex and higher returns require more sophistication

-

Four and five asset class portfolios have fared well and show solid returns but everybody should consider adding commodities in the light of the current economic realities

-

This is not rocket science and you should be able to increase your returns and be in control of improving your returns

-

ETF’s are a very effective vehicle for implementing a SIB strategy and deliver excellent returns compared to the other funds selected

Symbols: AGG, BND, DBC, EEM, EFA, GSG, ICF, IYR, LQD, SPY, TLT, VEU, VNQ, VTI, VWO, VTSMX, VGTSX, VEIEX, VGSIX, VBMFX

Exchange Tickers: (NYSE: AGG), (NYSE: BND), (NYSE: DBC), (NYSE: EEM), (NYSE: EFA), (NYSE: GSG), (NYSE: ICF), (NYSE: IYR), (NYSE: LQD), (NYSE: SPY), (NYSE: TLT), (NYSE: VEU), (NYSE: VNQ), (NYSE: VTI), (NYSE: VWO), (NYSE: VTSMX), (NYSE:VGTSX), (NYSE:VEIEX), (NYSE:VGSIX), (NYSE:VBMFX)

Disclosure:MyPlanIQ does not have any business relationship with the company or companies mentioned in this article. It does not set up their retirement plans. The performance data of portfolios mentioned above are obtained through historical simulation and are hypothetical. -

- Schwab Mutual Funds Beat out ETFs

04/06/2011

l

Retirement investing is a "hair on fire" problem -- especially for baby boomers for whom retirement is a near and present danger. There is a real lack of consistent, unbiased information that a retiree can use to help improve risk adjusted returns. Blogger Jenny Hollingworth has been teaching herself about investing and has come to the point where she is going to choose a plan and make her first investments.

In her recent post New Steps she sorted through a list of alternatives and chose the Schwab OneSource Select List Funds.

The reason for her choice was:

- The highest possible rating for each plan is 5 stars. So I bypassed anything that didn’t have 5 (because really, why go for less?)

- Picked out a name I knew: Schwab. Specifically: Schwab OneSource Select List Funds. I selected it.

- This is an application to Charles Schwab's OneSource Select List mutual funds. These funds are No Load and No Transaction Fee (NTF) mutual funds. Based on Schwab's policy, the no load NTF funds have 90 days redemption fee period. As of 1/1/2010, there are total 140 OneSource Select List funds available from Schwab.

We are going to review the Schwab OneSource Select List Funds to see whether she chose a good plan. The plan consists of 137 funds. These funds enable participants to gain exposure to 6 major assets: US Equity, Commodity, Foreign Equity, REITs, Emerging Market Equity, Fixed Income.

Asset Class Ticker Name LARGE VALUE AAGPX American Beacon Lg Cap Value Inv Foreign Large Value AAIPX American Beacon Intl Equity Inv Retirement Income AANPX American Beacon Retire Inc & Apprec Inv High Yield Muni ABHYX American Century High-Yield Muni Inv Inflation-Protected Bond ACITX American Century Infl-Adj Bond Inv Muni National Long ACLVX American Century Long-Term Tax-Free Inv MID-CAP VALUE ACMVX American Century Mid Cap Value Inv Conservative Allocation AONIX American Century One Choice: Vry Cnsrv I MID-CAP VALUE ARDEX Aston/River Road Dividend All Cap Val N Target Date 2011-2015 ARFIX American Century LIVESTRONG 2015 Inv Retirement Income ARTOX American Century LIVESTRONG Inc Inv Target Date 2021-2025 ARWIX American Century LIVESTRONG 2025 Inv Target Date 2031-2035 ARYIX American Century LIVESTRONG 2035 Inv SMALL VALUE AVPAX American Beacon Small Cp Val Inv EUROPE STOCK AXEAX Threadneedle European Equity A Muni National Interm BMBSX Baird Intermediate Muni Bd Inv Technology BOGSX Black Oak Emerging Technology Small Growth BSCFX Baron Small Cap Moderate Allocation BUFBX Buffalo Balanced Technology BUFTX Buffalo Science & Technology DIVERSIFIED EMERGING MKTS CEMVX Causeway Emerging Markets Investor MID-CAP BLEND CHTTX Aston/Optimum Mid Cap N Intermediate Government CPTNX American Century Government Bond Inv Small Growth CSMVX Century Small Cap Select Inv REAL ESTATE CSRSX Cohen & Steers Realty Shares Long-Short CVSIX Calamos Market Neutral Income A SMALL BLEND DISSX Dreyfus Small Cap Stock Index Bank Loan EABLX Eaton Vance Floating Rate Adv Conservative Allocation EXDAX Manning & Napier Pro-Blend Cnsrv Term S Foreign Large Blend EXWAX Manning & Napier World Opportunities A Moderate Allocation FAGSX First American Strat Growth Allc A Financial FBRSX FBR Small Cap Financial ULTRASHORT BOND FEUGX Federated Adjustable Rate Secs Instl Intermediate Government FICMX Federated Income Instl Muni National Interm FIMTX Federated Intermediate Municipal Instl LARGE BLEND FMIHX FMI Large Cap Long-Short FMLSX Wasatch-1st Source Long/Short SHORT GOVERNMENT FSGVX Federated US Govt 1-3 Yr Instl Muni Short FSHIX Federated Shrt-Interm Dur Muni Instl Short-Term Bond FSTIX Federated Short-Term Income Instl Intermediate-Term Bond FTRFX Federated Total Return Bond Instl Svc SMALL BLEND GABSX Gabelli Small Cap Growth AAA Communications GABTX GAMCO Global Telecommunications AAA LARGE GROWTH HCAIX Harbor Capital Appreciation Inv Foreign Large Blend HIINX Harbor International Inv WORLD STOCK HLMGX Harding Loevner Global Equity Advisor Foreign Large Growth HLMNX Harding Loevner International Equity Inv Equity Energy ICENX ICON Energy S China Region ICHKX Guinness Atkinson China & Hong Kong LARGE VALUE INDZX RiverSource Diversified Equity Inc A Moderate Allocation JABAX Janus Balanced T Health JAGLX Janus Global Life Sciences T LARGE GROWTH JAMRX Janus Research T Small Growth JATTX Janus Triton T Foreign Large Blend JETAX Artio International Equity II A Target Date 2021-2025 JNSAX JPMorgan SmartRetirement 2025 A LARGE BLEND JRMSX INTECH Risk-Managed Core T Target Date 2011-2015 JSFAX JPMorgan SmartRetirement 2015 A Target Date 2026-2030 JSMAX JPMorgan SmartRetirement 2030 A Target Date 2016-2020 JTTAX JPMorgan SmartRetirement 2020 A LARGE BLEND JUEAX JPMorgan US Equity A LARGE VALUE JVLAX JHancock3 Disciplined Value A Small Growth KGSCX Kalmar Growth-with-Value Small Cap LARGE GROWTH LGILX Laudus Growth Investors US Large Cap Gr WORLD BOND LIFNX Laudus Mondrian Intl Fixed Income Foreign Large Blend LISOX Lazard Intl Strategic Equity Open Multisector Bond LSBRX Loomis Sayles Bond Retail DIVERSIFIED PACIFIC/ASIA MAPIX Matthews Asia Pacific Equity Income PACIFIC/ASIA EX-JAPAN STK MAPTX Matthews Pacific Tiger Investor China Region MCHFX Matthews China Investor Muni National Interm MITFX Marshall Intermediate Tax-Free Inv JAPAN STOCK MJFOX Matthews Japan Investor Foreign Large Blend MKIEX McKee International Equity Instl DIVERSIFIED PACIFIC/ASIA MPACX Matthews Asia Pacific Investor High Yield Bond MWHYX Metropolitan West High Yield Bond M Short-Term Bond MWLDX Metropolitan West Low Duration Bond M Intermediate-Term Bond MWTRX Metropolitan West Total Return Bond M MID-CAP BLEND NMMCX Northern Multi-Manager Mid Cap SMALL VALUE NOSGX Northern Small Cap Value Muni National Long NOTEX Northern Tax-Exempt Small Growth NSPAX ING Small Cap Opportunities A Foreign Small/Mid Value OAKEX Oakmark International Small Cap I WORLD STOCK OAKGX Oakmark Global I COMMODITIES BROAD BASKET PCRDX PIMCO Commodity Real Ret Strat D Emerging Markets Bond PEMDX PIMCO Emerging Markets Bond D LARGE BLEND PEOPX Dreyfus S&P 500 Index WORLD BOND PFODX PIMCO Foreign Bond (USD-Hedged) D Intermediate-Term Bond PGBOX JPMorgan Core Bond A Multisector Bond PONDX PIMCO Income D LARGE BLEND PRBLX Parnassus Equity Income - Inv Inflation-Protected Bond PRRDX PIMCO Real Return D SMALL VALUE PSOAX JPMorgan Small Cap Value A Intermediate-Term Bond PTTDX PIMCO Total Return D SMALL BLEND RYTFX Royce Total Return Svc Intermediate-Term Bond SAMIX RidgeWorth Intermediate Bond I Foreign Large Blend SICNX Schwab International Core Equity Inst Foreign Large Blend SIEIX RidgeWorth Intl Equity Index I ULTRASHORT BOND SIGVX RidgeWorth US Gov Sec Ultra-Short Bd I Target Date 2031-2035 SRJAX JPMorgan SmartRetirement 2035 A DIVERSIFIED EMERGING MKTS SSEMX SSgA Emerging Markets Instl High Yield Bond STHTX RidgeWorth High Income I Muni National Interm STTBX RidgeWorth Investment Grade T/E Bond I LARGE BLEND SWANX Schwab Core Equity Inv Global Real Estate SWASX Schwab Global Real Estate Select Target Date 2026-2030 SWDRX Schwab Target 2030 LARGE VALUE SWDSX Schwab Dividend Equity Financial SWFFX Schwab Financial Services Target Date 2011-2015 SWGRX Schwab Target 2015 Intermediate Government SWGSX Schwab GNMA Long-Short SWHEX Schwab Hedged Equity Health SWHFX Schwab Health Care Target Date 2021-2025 SWHRX Schwab Target 2025 Intermediate-Term Bond SWIIX Schwab Premier Income Instl Foreign Large Blend SWISX Schwab International Index Retirement Income SWKRX Schwab Monthly Income Enh Payout Retirement Income SWLRX Schwab Monthly Income Max Payout LARGE GROWTH SWLSX Schwab Large-Cap Growth Foreign Large Growth SWMIX Laudus International MarketMasters Sel Small Growth SWMSX Laudus Small-Cap MarketMasters Select Muni National Interm SWNTX Schwab Tax-Free Bond Moderate Allocation SWOBX Schwab Balanced Inv LARGE BLEND SWPPX Schwab S&P 500 Index SMALL BLEND SWSSX Schwab Small Cap Index LARGE GROWTH TGCNX TCW Select Equities N Mid-Cap Growth TGDNX TCW Growth Equities N EQUITY PRECIOUS METALS TGLDX Tocqueville Gold LARGE BLEND TICRX TIAA-CREF Social Choice Eq Retail LARGE GROWTH TIRTX TIAA-CREF Large-Cap Growth Retail LARGE GROWTH TWCGX American Century Growth Inv Muni National Interm TWTIX American Century Interm-T Tx-Fr Bd Inv SHORT GOVERNMENT TWUSX American Century Short-Term Govt Inv LARGE VALUE TWVLX American Century Value Inv Foreign Large Value TWWDX Thomas White International Foreign Large Growth UMBWX Scout International SMALL VALUE VSFAX Federated Clover Small Value A Mid-Cap Growth WTMGX Westcore MIDCO Growth LARGE VALUE YAFFX Yacktman Focused Asset Class Number of funds Balanced Fund 21 REITs 2 Fixed Income 34 Commodity 1 Sector Fund 9 Foreign Equity 18 Emerging Market Equity 7 US Equity 41 Other 4 Total 137

As of Apr 5, 2011, this plan investment choice is rated as above average based on MyPlanIQ Plan Rating methodology that was designed to measure how effective a plan's available investment funds are . It has the following detailed ratings:Diversification -- Rated as great (98%)

Fund Quality -- Rated as average (54%)

Portfolio Building -- Rated as great (86%)

Overall Rating: above average (80%)Portfolio Discussions

The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies. For comparison purpose, we also include the moderate model portfolios of a typical 6 asset SIB (Simpler Is Better) plan . This SIB plan has the following candidate index funds and their ETFs equivalent:

US Equity: SPY or VTI

Commodity: DBC

Foreign Equity: EFA or VEU

REITs: IYR or VNQ or ICF

Emerging Market Equity: EEM or VWO

Fixed Income: AGG or BND

Performance chart (as of Apr 5, 2011)Performance table (as of Apr 5, 2011)

Portfolio Name 1Yr AR 1Yr Sharpe 3Yr AR 3Yr Sharpe 5Yr AR 5Yr Sharpe Schwab OneSource Select List Funds Tactical Asset Allocation Moderate 13% 106% 10% 91% 13% 110% Schwab OneSource Select List Funds Strategic Asset Allocation Moderate 12% 152% 4% 32% 7% 52% Six Core Asset ETF Benchmark Tactical Asset Allocation Moderate 10% 81% 9% 82% 13% 89% Six Core Asset ETF Benchmark Strategic Asset Allocation Moderate 14% 121% 4% 20% 7% 34% With six asset classes and a wide number of funds, the returns beat the six asset class benchmark. With high scores in all categories, this plan delivers portfolios that have produced strong historical returns.

Symbols: SPY, VTI, EFA, VEU, EEM, VWO, IYR, VNQ, ICF, AGG, BND, DBC, HYG, JNK, PHB, AOM, AOK, CIU, BIV, ITM, MUB, TFI, PZA, MLN, IYH, IXJ, VHT, XBI, PBE, DBR, RYH, EFG, IXP, PTE, DGG, LTL, MTK, PTF, DBT, RYT, ROM, GWL, PFA, IVE, IWW, JKF, VTV, ELV, PWV, RPV, SCHV, SCZ, EFV, PID, DWM, IYF, VFH, IPF, PFI, DRF, RYF, IFGL, RWX, TZE, TZG, TZI, TZO, TZL, IGOV, BWX, WIP, IVV, IYY, IWV, VV, DLN, RSP, SCHX, IOO, VT, SHY, SHV, VGSH, PLK, USY, IEV, VGK, PEF, DEB, IVW, IWZ, JKE, VUG, ELG, QQQQ, RPG, SCHG, IJJ, IWS, JKI, VOE, EMV, PWP, RFV, UVU, IJH, IWR, JKG, VO, MDY, EMM, PJG, DON, EZM, MVV, IJS, IWN, JKL, VBR, DSV, PWY, RZV, UVT, IJR, IWM, JKJ, VB, DSC, PJM, DES, SAA, UWM, SCHA, GMM, PXH, DEM, SCHE, GBF, LAG, PCY, CSJ, BSV, VCSH, ITE, IXC, IPW, DBE, RYE, DKA, IEI, VGIT, IJK, IWP, VOT, EMG, PWJ, RFG, UKW, IJT, IWO, JKK, VBK, DSG, PWT, RZG, UKK, TIP, DBP, EPP, VPL, GMF, PAF, AAXJ, DND, EWJ, JPP, PJO, DXJ, GSG, BIL

Disclosure:

MyPlanIQ does not have any business relationship with the company or companies mentioned in this article. It does not set up their retirement plans. The performance data of portfolios mentioned above are obtained through historical simulation and are hypothetical.

Originally from the UK, Jenny Hollingworth lives with her husband and two sons in Northern California. She is a wife, mother, writer, theatre director, coffee drinker, avid reader, keen walker, movie watcher, Jane Austen lover and observer of life, in no particular order. MyPlanIQ has no formal relationship with Jenny Hollingworth.

- Schwab Select ETF Plan Has Bright Prospects

04/06/2011

- Tactically Manage An Income Producing Portfolio With Commodity Exposure

03/25/2011

- Commodities Withstood the Recent Market Selloff

03/21/2011

- Earthquakes and Wars Call for Diversification and Tactical Asset Allocation in Investing

03/20/2011

- 'Safe' Assets' Trends Back to Positive: Risk Aversion Began?

03/14/2011

- Major Assets: Risk Assets Strong While Safe Assets Have Negative Trends

03/07/2011

- Commodities Showed Their Hedge Amid Equity Weakness

02/28/2011

- Shell Versus Morningstar -- More is Better

02/27/2011

- Energy Commodities and Gold Strong: Gold's Role in Asset Allocation

02/26/2011

- Major Asset Trends: U.S. Stocks and REITs Strong, International Bonds Worth Considering

02/22/2011

- Commodity ETF Trends: Silver Breaks Out, Gold Steady Amid Commodity Strength

02/20/2011

- Major Asset Trends: Divergence of U.S. Stocks and Emerging Market Stocks Continues

02/14/2011

- Beware of Divergence Among Energy Commodity ETFs

02/14/2011

- Rising Energy Costs: Casting a Cloud over Energy-Dependent Sector ETFs

01/15/2011

- Asset Allocation: Focus Risk on Long Duration Bonds

01/14/2011

- Allegheny Ludlum Corporation Personal Retirement and 401(k) Savings Account Plan Report On 12/03/2010

12/03/2010

This report reviews Allegheny Ludlum Corporation Personal Retirement and 401(k) Savings Account Plan plan. We will discuss the investment choices and present the plan rating by MyPlanIQ. Current economic and market conditions are discussed in the context of the investment portfolios in the plan. We will then show how participants in Allegheny Ludlum Corporation Personal Retirement and 401(k) Savings Account Plan can achieve reasonable investment results using asset allocation strategies.

Plan Review and Rating

--

Allegheny Ludlum Corporation Personal Retirement and 401(k) Savings Account Plan's 401K plan consists of 55 funds. These funds enable participants to gain exposure to 5 major assets: US Equity, Foreign Equity, Commodity, Emerging Market Equity, Fixed Income. The list of minor asset classes covered:

Commodities Broad Basket: GSG, DBC

Conservative Allocation: AOK

Diversified Emerging Mkts: EEM, GMM, PXH, DEM, SCHE

Diversified Pacific/asia: EPP, VPL, GMF, PAF

Equity Energy: ITE, IXC, IPW, DBE, RYE, DKA

Europe Stock: IEV, VGK, PEF, DEB

Foreign Large Blend: EFA, VEU, GWL, PFA

Foreign Small/mid Growth: IFSM, VSS, SCHC

Health: IYH, IXJ, VHT, XBI, PBE, DBR, RYH

Inflation-protected Bond: TIP

Intermediate-term Bond: AGG, CIU, BIV, BND

Large Blend: IVV, IYY, IWV, VTI, VV, SPY, DLN, RSP, SCHX

Large Growth: IVW, IWZ, JKE, VUG, ELG, QQQQ, RPG, SCHG

Large Value: IVE, IWW, JKF, VTV, ELV, PWV, RPV, SCHV

Latin America Stock: ILF, GML

Long Government: TLT, TLH, IEF, EDV, VGLT, TLO, PLW

Mid-cap Value: IJJ, IWS, JKI, VOE, EMV, PWP, RFV, UVU

Multisector Bond: AGG, GBF, BND, LAG

Natural Resources: IYM, IGE, VAW, XLB, XME, PYZ, DBN, RTM, UYM

Pacific/asia Ex-japan Stk: EPP, AAXJ, GMF, PAF, DND

Short Government: SHY, SHV, VGSH, PLK, USY

Short-term Bond: CSJ, BSV, VCSH

Small Growth: IJT, IWO, JKK, VBK, DSG, PWT, RZG, UKK

Technology: MTK, PTF, DBT, RYT, ROM

As of Dec 2, 2010, this plan investment choice is rated as based on MyPlanIQ Plan Rating methodology that measures the effectiveness of a plan's available investment funds. It has the following detailed ratings:

Diversification -- Rated as (91%)

Fund Quality -- Rated as (48%)

Portfolio Building -- Rated as (84%)

Overall Rating: (75%)Current Economic and Market Conditions

We have experienced an uncertain 2010: plenty of worries on whether the US economy will climb out of the great recession and recover.

- The Federal Reserve embarked on Quantitative Easing II (QE2) to stimulate the economy.

- The housing market is still at its low but largely stabilized.

- The unemployment rate is stuck at 9%.

Americans continue to face an uncertain future, given (among others) the high unemployment rate, large federal and local government debts and global trade imbalance. With such an economic backdrop, the stock and debt markets are going to be volatile. Despite this, markets have been resilient and appear positioned to rebound.

In this market it is even more critical to properly diversify and respond market changes. MyPlanIQ offers two asset allocation strategies: strategic and tactical asset allocation strategies ( SAA and TAA for participants in Allegheny Ludlum Corporation Personal Retirement and 401(k) Savings Account Plan).

Strategic Asset Allocation is based on well known modern portfolio theory and its key features include: diversification, proper fund selection and periodically re-balancing.

Tactical Asset Allocation works on a diversified array of assets provided by funds in a plan and adjusts asset mixes based on market conditions such as asset price momentum utilized by TAA.

Portfolio Discussions

The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies. For comparison purpose, we also include the moderate model portfolios of a typical 4 asset SIB (Simpler Is Better) plan . This SIB plan has the following candidate index funds and their ETFs equivalent:

US Equity: (SPY or VTI)

Foreign Equity: (EFA or VEU)

Emerging Market Equity: (EEM or VWO)

Fixed Income: (AGG or BND)

Performance chart (as of Dec 2, 2010)Performance table (as of Dec 2, 2010)

Portfolio Name 1Yr AR 1Yr Sharpe 3Yr AR 3Yr Sharpe 5Yr AR 5Yr Sharpe Allegheny Ludlum Corporation Personal Retirement and 401(k) Savings Account Plan Tactical Asset Allocation Moderate 6% 44% 7% 51% 16% 109% Allegheny Ludlum Corporation Personal Retirement and 401(k) Savings Account Plan Strategic Asset Allocation Moderate 12% 119% 3% 21% 9% 61% Four Core Asset ETF Index Funds Emerging Markets Tactical Asset Allocation Moderate 1% 6% 6% 49% 12% 78% Four Core Asset ETF Index Funds Emerging Markets Strategic Asset Allocation Moderate 10% 75% 2% 6% 7% 31% Currently, asset classes in Foreign Equity (EFA,VEU), Emerging Market Equity (EEM,VWO) and Fixed Income (AGG,BND) are doing relatively well. These asset classes are available to Allegheny Ludlum Corporation Personal Retirement and 401(k) Savings Account Plan participants.

To summarize, Allegheny Ludlum Corporation Personal Retirement and 401(k) Savings Account Plan plan participants can achieve reasonable investment returns by adopting asset allocation strategies that are tailored to their risk profiles.

Symbols: ATI , SPY , VTI , EFA , VEU , EEM , VWO , AGG , BND , DBC , AOK , CIU , BIV , IYH , IXJ , VHT , XBI , PBE , DBR , RYH , IYM , IGE , VAW , XLB , XME , PYZ , DBN , RTM , UYM , MTK , PTF , DBT , RYT , ROM , GWL , PFA , IVE , IWW , JKF , VTV , ELV , PWV , RPV , SCHV , IVV , IYY , IWV , VV , DLN , RSP , SCHX , SHY , SHV , VGSH , PLK , USY , TLT , TLH , IEF , EDV , VGLT , TLO , PLW , IEV , VGK , PEF , DEB , IVW , IWZ , JKE , VUG , ELG , QQQQ , RPG , SCHG , IJJ , IWS , JKI , VOE , EMV , PWP , RFV , UVU , IFSM , VSS , SCHC , GMM , PXH , DEM , SCHE , GBF , LAG , CSJ , BSV , VCSH , ITE , IXC , IPW , DBE , RYE , DKA , ILF , GML , IJT , IWO , JKK , VBK , DSG , PWT , RZG , UKK , TIP , EPP , VPL , GMF , PAF , AAXJ , DND , GSG

- TD Ameritrade Commission Free ETFs Report On 12/07/2010

12/07/2010