|

Vanguard ETF: |     |

7.4%* |

|

Diversified Core: |    |

8.1%* |

|

Six Core Asset ETFs: |    |

7.3%* |

Articles on IVW

- Improving on the No-Brainer Portfolio: Add More Asset Classes

04/24/2011

By Lowell Herr at ITA Wealth Management

Yesterday, I picked up this article on Seeking Alpha titled, "Lack of REITs & Commodities Now Shows in Bernstein's No-Brainer Portfolio's Performance." I first needed to look up the Bernstein No-Brainer Portfolio and found it included four ETFs. The asset allocation is quite simple.

IVW = 25%

VB = 25%

EFA or VFA = 25% I prefer to use VEU as my international investment.

BND = 25%

When I ran a Quantext Portfolio Planner analysis, I found the projected return to be 6.6%, projected uncertainty equals 13.8% for a ratio of 0.48. The Diversification Metric (DM) is a meager 16%. While this may be a No-Brainer Portfolio, it is projected to return less than the S&P 500 without much diversity.

When I substituted TLT for the BND bond fund, projections improved slightly. With only this change, projected return increased to 7.65% or better than expected from the S&P 500. Risk or projected uncertainty actually decreased slightly to 13.7%%. DM rose to 24%.

In the Seeking Alpha article, adding REITs and Commodities implied better results. While this was true in the past, is it likely to be true in the future? One would think so. However, when I ran the QPP analysis, including VWO, DBC, and VNQ lifted the return to 7.8% or only slightly better than the No-Brainer projections. Uncertainty jumped to 16.3% and DM actually fell to 23%. The Return/Uncertainty ratio was about the same at 0.54.

Given that QPP analysis is coming up with projections, and they are not significantly different from the No-Brainer Portfolio, I would go with the portfolio that adds more asset classes.

Exchange Tickers: (NYSE:BND), (NYSE:DBC), (NYSE:EFA), (NYSE:IVW), (NYSE:TLT), (NYSE:VB), (NYSE:VEU), (NYSE:VNQ), (NYSE:VWO)

Symbols: BND, DBC, EFA, IVW, TLT, VB, VEU, VNQ, VWO

- Armstrong's Informed Investor Lazy Portfolio Feels The Commodities Pain

04/18/2011

The incidents in Japan, the Middle East and even as far back as New Orleans teach us the danger of living on borrowed time, the reactors, the governments the levees keeping things going -- just one more year. The temptation to delay until next time is very seductive until disaster strikes and the cost to repair, dwarfs the cost to prevent. Many working people put off their retirement investing -- just one more year until it becomes a "hair on fire" problem -- which it now is for baby boomers for whom retirement is a near and present danger.

We continue to examine luminary portfolios to see what we can learn and use to further our investment portfolios.

Frank Armstrong, author of The Informed Investor, proposed this portfolio for an MSN Money article. The two key points of the portfolio are that it has four asset classes (US, International, REIT, Bonds) and relies on market indices rather than active management. The portfolio uses index funds because index funds eliminate manager risk. It overweights small-cap stocks as small-cap stocks have historically outperformed large caps stocks. The portfolio has a strong value tilt, based on the theory that, over the long haul, beaten-down stocks will perform better than high-flying growth stocks.

This should be a low cost, well performing portfolio.

The fund selection for testing the strategy is listed below with the ETF alternatives:

- 9.25% in Vanguard Small Cap Value VISVX (SCZ)

- 9.25% in Vanguard Value VIVAX (SPY, IYY)

- 6.25% in Vanguard Small-Cap Growth VISGX (VBK)

- 6.25% in Vanguard 500 Index VFINX (IVW)

- 31% in Vanguard Total International Stock VGTSX (EFA)

- 8% in Vanguard REIT VGSIX (IYR, VNQ, RWX)

- 30% in Vanguard Short-Term Bond VBISX (BND, AGG)

Things to note about the portfolio:

- This is designed as a lazy portfolio with limited rebalancing specified

- 31% in US equities is significant with a mix of large and small cap stocks

- With 70% in equities, this is a growth portfolio

- REIT is possibly underweighted

- There is no commodity asset class

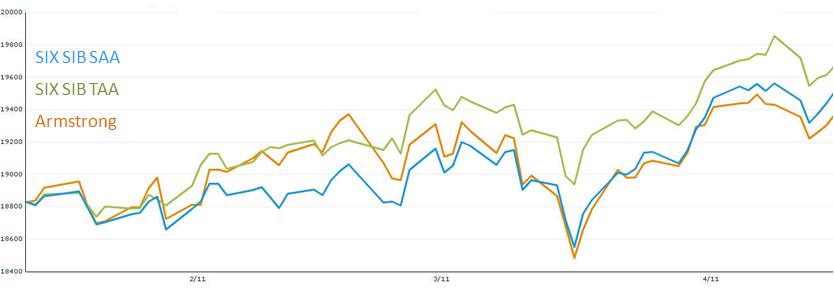

The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies. For comparison purpose, we also include the moderate model portfolios of a typical 6 asset SIB (Simpler Is Better) plan . This SIB plan has the following candidate index funds and their ETFs equivalent: US Equity: SPY or VTI

Commodity: DBC

Foreign Equity: EFA or VEU

REITs: IYR or VNQ or ICF

Emerging Market Equity: EEM or VWO

Fixed Income: AGG or BND

Portfolio Performance Comparison

Portfolio/Fund Name 1Yr AR 1Yr Sharpe 3Yr AR 3Yr Sharpe 5Yr AR 5Yr Sharpe Armstrong Original 10% 66% 4% 17% 5% 20% Six Core Asset ETF Benchmark Tactical Asset Allocation Moderate 10% 71% 9% 73% 13% 91% Six Core Asset ETF Benchmark Strategic Asset Allocation Moderate 13% 103% 3% 20% 7% 35% A detailed comparison can be found here

Takeaways

-

2010 was a good year for lazy portfolios and as we continue through 2011while equities are still performing well, not having a commodities option hurts returns

-

TAA has benefits in terms of being able to stay away from some area such as European equities

-

Index funds continue to show good results against managed funds

-

Larger asset class plans have the benefit of stability and good returns

Disclosure: MyPlanIQ does not have any business relationship with the company or companies mentioned in this article. It does not set up their retirement plans. The performance data of portfolios mentioned above are obtained through historical simulation and are hypothetical.

Symbols: VISVX, SCZ, VIVAX, SPY, IYY, VISGX, VBK, VFINX, IVW, VGTSX, EFA, VGSIX, IYR, VNQ, RWX, BND, AGG, DBC, VEU, ICF, EEM, VWO - Bernstein No Brainer and Smart Money Lazy Portfolios Under The Microscope

04/15/2011

Retirement investing is now a "hair on fire" problem for Boomers who have no time to waste in getting their portfolios in order. The challenge is how to avoid being overwhelmed with conflicting data and shutting down.

We present simple approaches to understand the path to higher returns with lower risk.

Dr. William Bernstein is the author of the "Intelligent Asset Allocator" and "The Four Pillars of Investing." He's also a physician, neurologist and financial adviser to high-net-worth individuals. He has proposed a number of lazy portfolios. There are two that we now examine in the light of a more active benchmark which has monthly instead of annual rebalancing.

The no-brainer portfolio comprises the following fund allocation:

-

25% in Vanguard 500 Index VFINX (IVW)

-

25% in Vanguard Small Cap NAESX or VTMSX (VB)

-

25% in Vanguard Total International VGTSX or VTMGX (EFA, VEA)

-

25% in Vanguard Total Bond VBMFX or VBISX (BND)

Things to note about the portfolio:

-

Heavily weighted towards domestic equities

-

Similar to a three asset SIB [simpler-is-better] with domestic, international and fixed income

-

It would be better to have some REIT or emerging markets exposure

The smart money portfolio comprises the following fund allocation:-

40% Vanguard Short Term Investment Grade VFSTX (SCJ, SHY)

-

15% Vanguard Total Stock Market VTSMX (VTI)

-

10% Vanguard Small Cap Value VISVX (VBR)

-

10% Vanguard Value Index VIVAX (VTV)

-

5% Vanguard Emerging Markets Stock VEIEX (VWO)

-

5% Vanguard European Stock VEURX (VEU)

-

5% Vanguard Pacific Stock VPACX (VPL)

-

5% Vanguard Small Cap Value NAESX or VTMSX (VB)

To summarize:

-

40% in U.S. equities

-

10% in international equities

-

5% in emerging market equities

-

5% in REITs

-

40% in fixed income

The smart money portfolio is more conservative and has two more asset classes but they only represent five percent of the portfolio each. With 80% of the portfolio in US and fixed income, it isn't very different from the no brainer portfolio.

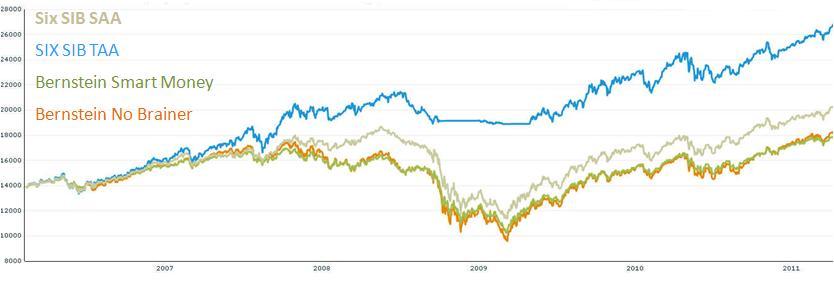

We are going to use the SIB (Simpler Is Better) Portfolio as a benchmark. The SIB comprise – market index funds (ETFs or Mutual Funds) from key asset classes that can be used to measure historical returns to show the impact of asset class selection rather than fund or stock selection. We are going to use a six asset ETF SIBs. This will enable us to see the type of returns we can expect and contrast Mutual Funds and ETFsThe following funds are used:

Asset Class Ticker Name LARGE BLEND VTI Vanguard Total Stock Market ETF Foreign Large Blend VEU Vanguard FTSE All-World ex-US ETF DIVERSIFIED EMERGING MKTS VWO Vanguard Emerging Markets Stock ETF REAL ESTATE VNQ Vanguard REIT Index ETF COMMODITIES BROAD BASKET DBC PowerShares DB Commodity Idx Trking Fund Intermediate-Term Bond BND Vanguard Total Bond Market ETF The strategic asset allocation strategy has 40% in fixed income and 12% in the other five funds.

The tactical asset allocation strategy has 40% in fixed income and 30% in the top two asset class funds determined by the price momentum -- unless that performance is below fixed income when the money will be diverted to fixed income. If fixed income is performing below cash, the fixed income portion will be cash.Portfolio Analysis

Portfolio Performance Comparison

Portfolio/Fund Name 1Yr AR 1Yr Sharpe 3Yr AR 3Yr Sharpe 5Yr AR 5Yr Sharpe P William Bernstein No Brainer Nine Fund Portfolio Annual Rebalance 8% 79% 4% 20% 4% 21% P William Bernstein No Brainer Four Fund Portfolio 11% 87% 4% 18% 5% 19% Six Core Asset ETF Benchmark Tactical Asset Allocation Moderate 10% 71% 9% 73% 13% 91% Six Core Asset ETF Benchmark Strategic Asset Allocation Moderate 13% 103% 4% 20% 7% 35% Takeaways

- Both Bernstein portfolios perform satisfactorily for a lazy portfolio – it is surprising that the no-brainer performs so well against its more diversified smart-money cousin

- The Six Asset SIB buy and hold outperforms both Bernstein portfolios based on broader diversification.

- Tactical Asset Allocation reduces downside risk and that wins in the current uncertain environment

Symbols: BND, DBC, EFA, IVW, NAESX, RWX, SCJ, SHY, VB, VBR, VEA, VEIEX, VEU, VEURX, VFINX, VFSTX, VGSIX, VISVX, VIVAX, VNQ, VPACX, VPL, VTI, VTMGX, VTMSX, VTSMX, VTV, VWO

Disclosure:

MyPlanIQ does not have any business relationship with the company or companies mentioned in this article. It does not set up their retirement plans. The performance data of portfolios mentioned

-

- Schwab Mutual Funds Beat out ETFs

04/06/2011

l

Retirement investing is a "hair on fire" problem -- especially for baby boomers for whom retirement is a near and present danger. There is a real lack of consistent, unbiased information that a retiree can use to help improve risk adjusted returns. Blogger Jenny Hollingworth has been teaching herself about investing and has come to the point where she is going to choose a plan and make her first investments.

In her recent post New Steps she sorted through a list of alternatives and chose the Schwab OneSource Select List Funds.

The reason for her choice was:

- The highest possible rating for each plan is 5 stars. So I bypassed anything that didn’t have 5 (because really, why go for less?)

- Picked out a name I knew: Schwab. Specifically: Schwab OneSource Select List Funds. I selected it.

- This is an application to Charles Schwab's OneSource Select List mutual funds. These funds are No Load and No Transaction Fee (NTF) mutual funds. Based on Schwab's policy, the no load NTF funds have 90 days redemption fee period. As of 1/1/2010, there are total 140 OneSource Select List funds available from Schwab.

We are going to review the Schwab OneSource Select List Funds to see whether she chose a good plan. The plan consists of 137 funds. These funds enable participants to gain exposure to 6 major assets: US Equity, Commodity, Foreign Equity, REITs, Emerging Market Equity, Fixed Income.

Asset Class Ticker Name LARGE VALUE AAGPX American Beacon Lg Cap Value Inv Foreign Large Value AAIPX American Beacon Intl Equity Inv Retirement Income AANPX American Beacon Retire Inc & Apprec Inv High Yield Muni ABHYX American Century High-Yield Muni Inv Inflation-Protected Bond ACITX American Century Infl-Adj Bond Inv Muni National Long ACLVX American Century Long-Term Tax-Free Inv MID-CAP VALUE ACMVX American Century Mid Cap Value Inv Conservative Allocation AONIX American Century One Choice: Vry Cnsrv I MID-CAP VALUE ARDEX Aston/River Road Dividend All Cap Val N Target Date 2011-2015 ARFIX American Century LIVESTRONG 2015 Inv Retirement Income ARTOX American Century LIVESTRONG Inc Inv Target Date 2021-2025 ARWIX American Century LIVESTRONG 2025 Inv Target Date 2031-2035 ARYIX American Century LIVESTRONG 2035 Inv SMALL VALUE AVPAX American Beacon Small Cp Val Inv EUROPE STOCK AXEAX Threadneedle European Equity A Muni National Interm BMBSX Baird Intermediate Muni Bd Inv Technology BOGSX Black Oak Emerging Technology Small Growth BSCFX Baron Small Cap Moderate Allocation BUFBX Buffalo Balanced Technology BUFTX Buffalo Science & Technology DIVERSIFIED EMERGING MKTS CEMVX Causeway Emerging Markets Investor MID-CAP BLEND CHTTX Aston/Optimum Mid Cap N Intermediate Government CPTNX American Century Government Bond Inv Small Growth CSMVX Century Small Cap Select Inv REAL ESTATE CSRSX Cohen & Steers Realty Shares Long-Short CVSIX Calamos Market Neutral Income A SMALL BLEND DISSX Dreyfus Small Cap Stock Index Bank Loan EABLX Eaton Vance Floating Rate Adv Conservative Allocation EXDAX Manning & Napier Pro-Blend Cnsrv Term S Foreign Large Blend EXWAX Manning & Napier World Opportunities A Moderate Allocation FAGSX First American Strat Growth Allc A Financial FBRSX FBR Small Cap Financial ULTRASHORT BOND FEUGX Federated Adjustable Rate Secs Instl Intermediate Government FICMX Federated Income Instl Muni National Interm FIMTX Federated Intermediate Municipal Instl LARGE BLEND FMIHX FMI Large Cap Long-Short FMLSX Wasatch-1st Source Long/Short SHORT GOVERNMENT FSGVX Federated US Govt 1-3 Yr Instl Muni Short FSHIX Federated Shrt-Interm Dur Muni Instl Short-Term Bond FSTIX Federated Short-Term Income Instl Intermediate-Term Bond FTRFX Federated Total Return Bond Instl Svc SMALL BLEND GABSX Gabelli Small Cap Growth AAA Communications GABTX GAMCO Global Telecommunications AAA LARGE GROWTH HCAIX Harbor Capital Appreciation Inv Foreign Large Blend HIINX Harbor International Inv WORLD STOCK HLMGX Harding Loevner Global Equity Advisor Foreign Large Growth HLMNX Harding Loevner International Equity Inv Equity Energy ICENX ICON Energy S China Region ICHKX Guinness Atkinson China & Hong Kong LARGE VALUE INDZX RiverSource Diversified Equity Inc A Moderate Allocation JABAX Janus Balanced T Health JAGLX Janus Global Life Sciences T LARGE GROWTH JAMRX Janus Research T Small Growth JATTX Janus Triton T Foreign Large Blend JETAX Artio International Equity II A Target Date 2021-2025 JNSAX JPMorgan SmartRetirement 2025 A LARGE BLEND JRMSX INTECH Risk-Managed Core T Target Date 2011-2015 JSFAX JPMorgan SmartRetirement 2015 A Target Date 2026-2030 JSMAX JPMorgan SmartRetirement 2030 A Target Date 2016-2020 JTTAX JPMorgan SmartRetirement 2020 A LARGE BLEND JUEAX JPMorgan US Equity A LARGE VALUE JVLAX JHancock3 Disciplined Value A Small Growth KGSCX Kalmar Growth-with-Value Small Cap LARGE GROWTH LGILX Laudus Growth Investors US Large Cap Gr WORLD BOND LIFNX Laudus Mondrian Intl Fixed Income Foreign Large Blend LISOX Lazard Intl Strategic Equity Open Multisector Bond LSBRX Loomis Sayles Bond Retail DIVERSIFIED PACIFIC/ASIA MAPIX Matthews Asia Pacific Equity Income PACIFIC/ASIA EX-JAPAN STK MAPTX Matthews Pacific Tiger Investor China Region MCHFX Matthews China Investor Muni National Interm MITFX Marshall Intermediate Tax-Free Inv JAPAN STOCK MJFOX Matthews Japan Investor Foreign Large Blend MKIEX McKee International Equity Instl DIVERSIFIED PACIFIC/ASIA MPACX Matthews Asia Pacific Investor High Yield Bond MWHYX Metropolitan West High Yield Bond M Short-Term Bond MWLDX Metropolitan West Low Duration Bond M Intermediate-Term Bond MWTRX Metropolitan West Total Return Bond M MID-CAP BLEND NMMCX Northern Multi-Manager Mid Cap SMALL VALUE NOSGX Northern Small Cap Value Muni National Long NOTEX Northern Tax-Exempt Small Growth NSPAX ING Small Cap Opportunities A Foreign Small/Mid Value OAKEX Oakmark International Small Cap I WORLD STOCK OAKGX Oakmark Global I COMMODITIES BROAD BASKET PCRDX PIMCO Commodity Real Ret Strat D Emerging Markets Bond PEMDX PIMCO Emerging Markets Bond D LARGE BLEND PEOPX Dreyfus S&P 500 Index WORLD BOND PFODX PIMCO Foreign Bond (USD-Hedged) D Intermediate-Term Bond PGBOX JPMorgan Core Bond A Multisector Bond PONDX PIMCO Income D LARGE BLEND PRBLX Parnassus Equity Income - Inv Inflation-Protected Bond PRRDX PIMCO Real Return D SMALL VALUE PSOAX JPMorgan Small Cap Value A Intermediate-Term Bond PTTDX PIMCO Total Return D SMALL BLEND RYTFX Royce Total Return Svc Intermediate-Term Bond SAMIX RidgeWorth Intermediate Bond I Foreign Large Blend SICNX Schwab International Core Equity Inst Foreign Large Blend SIEIX RidgeWorth Intl Equity Index I ULTRASHORT BOND SIGVX RidgeWorth US Gov Sec Ultra-Short Bd I Target Date 2031-2035 SRJAX JPMorgan SmartRetirement 2035 A DIVERSIFIED EMERGING MKTS SSEMX SSgA Emerging Markets Instl High Yield Bond STHTX RidgeWorth High Income I Muni National Interm STTBX RidgeWorth Investment Grade T/E Bond I LARGE BLEND SWANX Schwab Core Equity Inv Global Real Estate SWASX Schwab Global Real Estate Select Target Date 2026-2030 SWDRX Schwab Target 2030 LARGE VALUE SWDSX Schwab Dividend Equity Financial SWFFX Schwab Financial Services Target Date 2011-2015 SWGRX Schwab Target 2015 Intermediate Government SWGSX Schwab GNMA Long-Short SWHEX Schwab Hedged Equity Health SWHFX Schwab Health Care Target Date 2021-2025 SWHRX Schwab Target 2025 Intermediate-Term Bond SWIIX Schwab Premier Income Instl Foreign Large Blend SWISX Schwab International Index Retirement Income SWKRX Schwab Monthly Income Enh Payout Retirement Income SWLRX Schwab Monthly Income Max Payout LARGE GROWTH SWLSX Schwab Large-Cap Growth Foreign Large Growth SWMIX Laudus International MarketMasters Sel Small Growth SWMSX Laudus Small-Cap MarketMasters Select Muni National Interm SWNTX Schwab Tax-Free Bond Moderate Allocation SWOBX Schwab Balanced Inv LARGE BLEND SWPPX Schwab S&P 500 Index SMALL BLEND SWSSX Schwab Small Cap Index LARGE GROWTH TGCNX TCW Select Equities N Mid-Cap Growth TGDNX TCW Growth Equities N EQUITY PRECIOUS METALS TGLDX Tocqueville Gold LARGE BLEND TICRX TIAA-CREF Social Choice Eq Retail LARGE GROWTH TIRTX TIAA-CREF Large-Cap Growth Retail LARGE GROWTH TWCGX American Century Growth Inv Muni National Interm TWTIX American Century Interm-T Tx-Fr Bd Inv SHORT GOVERNMENT TWUSX American Century Short-Term Govt Inv LARGE VALUE TWVLX American Century Value Inv Foreign Large Value TWWDX Thomas White International Foreign Large Growth UMBWX Scout International SMALL VALUE VSFAX Federated Clover Small Value A Mid-Cap Growth WTMGX Westcore MIDCO Growth LARGE VALUE YAFFX Yacktman Focused Asset Class Number of funds Balanced Fund 21 REITs 2 Fixed Income 34 Commodity 1 Sector Fund 9 Foreign Equity 18 Emerging Market Equity 7 US Equity 41 Other 4 Total 137

As of Apr 5, 2011, this plan investment choice is rated as above average based on MyPlanIQ Plan Rating methodology that was designed to measure how effective a plan's available investment funds are . It has the following detailed ratings:Diversification -- Rated as great (98%)

Fund Quality -- Rated as average (54%)

Portfolio Building -- Rated as great (86%)

Overall Rating: above average (80%)Portfolio Discussions

The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies. For comparison purpose, we also include the moderate model portfolios of a typical 6 asset SIB (Simpler Is Better) plan . This SIB plan has the following candidate index funds and their ETFs equivalent:

US Equity: SPY or VTI

Commodity: DBC

Foreign Equity: EFA or VEU

REITs: IYR or VNQ or ICF

Emerging Market Equity: EEM or VWO

Fixed Income: AGG or BND

Performance chart (as of Apr 5, 2011)Performance table (as of Apr 5, 2011)

Portfolio Name 1Yr AR 1Yr Sharpe 3Yr AR 3Yr Sharpe 5Yr AR 5Yr Sharpe Schwab OneSource Select List Funds Tactical Asset Allocation Moderate 13% 106% 10% 91% 13% 110% Schwab OneSource Select List Funds Strategic Asset Allocation Moderate 12% 152% 4% 32% 7% 52% Six Core Asset ETF Benchmark Tactical Asset Allocation Moderate 10% 81% 9% 82% 13% 89% Six Core Asset ETF Benchmark Strategic Asset Allocation Moderate 14% 121% 4% 20% 7% 34% With six asset classes and a wide number of funds, the returns beat the six asset class benchmark. With high scores in all categories, this plan delivers portfolios that have produced strong historical returns.

Symbols: SPY, VTI, EFA, VEU, EEM, VWO, IYR, VNQ, ICF, AGG, BND, DBC, HYG, JNK, PHB, AOM, AOK, CIU, BIV, ITM, MUB, TFI, PZA, MLN, IYH, IXJ, VHT, XBI, PBE, DBR, RYH, EFG, IXP, PTE, DGG, LTL, MTK, PTF, DBT, RYT, ROM, GWL, PFA, IVE, IWW, JKF, VTV, ELV, PWV, RPV, SCHV, SCZ, EFV, PID, DWM, IYF, VFH, IPF, PFI, DRF, RYF, IFGL, RWX, TZE, TZG, TZI, TZO, TZL, IGOV, BWX, WIP, IVV, IYY, IWV, VV, DLN, RSP, SCHX, IOO, VT, SHY, SHV, VGSH, PLK, USY, IEV, VGK, PEF, DEB, IVW, IWZ, JKE, VUG, ELG, QQQQ, RPG, SCHG, IJJ, IWS, JKI, VOE, EMV, PWP, RFV, UVU, IJH, IWR, JKG, VO, MDY, EMM, PJG, DON, EZM, MVV, IJS, IWN, JKL, VBR, DSV, PWY, RZV, UVT, IJR, IWM, JKJ, VB, DSC, PJM, DES, SAA, UWM, SCHA, GMM, PXH, DEM, SCHE, GBF, LAG, PCY, CSJ, BSV, VCSH, ITE, IXC, IPW, DBE, RYE, DKA, IEI, VGIT, IJK, IWP, VOT, EMG, PWJ, RFG, UKW, IJT, IWO, JKK, VBK, DSG, PWT, RZG, UKK, TIP, DBP, EPP, VPL, GMF, PAF, AAXJ, DND, EWJ, JPP, PJO, DXJ, GSG, BIL

Disclosure:

MyPlanIQ does not have any business relationship with the company or companies mentioned in this article. It does not set up their retirement plans. The performance data of portfolios mentioned above are obtained through historical simulation and are hypothetical.

Originally from the UK, Jenny Hollingworth lives with her husband and two sons in Northern California. She is a wife, mother, writer, theatre director, coffee drinker, avid reader, keen walker, movie watcher, Jane Austen lover and observer of life, in no particular order. MyPlanIQ has no formal relationship with Jenny Hollingworth.

- Schwab Select ETF Plan Has Bright Prospects

04/06/2011

Schwab ETF Plan Has Good Pedigree and Bright Prospects Retirement is now a "hair on fire" problem. There is much talk of working longer, downsizing, living on less. However, there is something you can do to help improve your risk adjusted returns. Look at your portfolios and plans to build a diversified portfolio with a systematic investment strategy.

This is not as hard as you might think -- to highlight this point, we feature a plan created by a non professional that matches up well with any of the other plans. Kevin Carr. is an individual investor who employs a long term strategy. He manages an individual common stock portfolio as well as many plans on MyPlan IQ. If you have any questions regarding this plan please contact him.

This plan provides you with Schwab's experts’ top picks of low-cost ETFs representing approximately 50 ETFs, based on rigorous criteria including expenses, tracking error, trading volume, and more. Schwab ETFs trade commission free. There are no redemption periods so you can start today and not worry about holding periods.We report on this Schwab ETF Select List which consists of 49 funds. These funds give exposure to 6 major assets: US Equity, Commodity, Foreign Equity, REITs, Emerging Market Equity, Fixed Income.

Asset Class Ticker Name LARGE BLEND SCHX Schwab U.S. Large-Cap ETF LARGE GROWTH SCHG Schwab U.S. Large-Cap Growth ETF LARGE VALUE SCHV Schwab U.S. Large-Cap Value ETF MID-CAP BLEND VO Vanguard Mid-Cap ETF Mid-Cap Growth VOT Vanguard Mid-Cap Growth ETF MID-CAP VALUE VOE Vanguard Mid-Cap Value ETF SMALL BLEND SCHA Schwab U.S. Small-Cap ETF Small Growth VBK Vanguard Small Cap Growth ETF SMALL VALUE VBR Vanguard Small Cap Value ETF LARGE BLEND SCHB Schwab U.S. Broad Market ETF LARGE VALUE VYM Vanguard High Dividend Yield Indx ETF Foreign Large Blend SCHF Schwab International Equity ETF Foreign Large Growth EFG iShares MSCI EAFE Growth Index Foreign Large Value EFV iShares MSCI EAFE Value Index FOREIGN SMALL/MID GROWTH SCHC Schwab International Small-Cap Eq ETF DIVERSIFIED EMERGING MKTS SCHE Schwab Emerging Markets Equity ETF Foreign Large Blend VEU Vanguard FTSE All-World ex-US ETF WORLD STOCK VT Vanguard Total World Stock Index ETF EUROPE STOCK VGK Vanguard European ETF DIVERSIFIED PACIFIC/ASIA VPL Vanguard Pacific Stock ETF JAPAN STOCK EWJ iShares MSCI Japan Index China Region GXC SPDR S&P China Intermediate-Term Bond BND Vanguard Total Bond Market ETF SHORT GOVERNMENT SCHO Schwab Short-Term U.S. Treasury ETF Intermediate Government SCHR Schwab Intermediate-Term U.S. Trsy ETF LONG GOVERNMENT TLH iShares Barclays 10-20 Year Treasury Bd Inflation-Protected Bond SCHP Schwab U.S. TIPS ETF Intermediate-Term Bond CIU iShares Barclays Intermediate Credit Bd High Yield Bond JNK SPDR Barclays Capital High Yield Bond WORLD BOND BWX SPDR Barclays Capital Intl Treasury Bond Muni National Long MUB iShares S&P National AMT-Free Muni Bd Consumer Discretionary XLY Consumer Discret Select Sector SPDR Consumer Staples XLP Consumer Staples Select Sector SPDR Equity Energy XLE Energy Select Sector SPDR Financial XLF Financial Select Sector SPDR Health XLV Health Care Select Sector SPDR Industrials XLI Industrial Select Sector SPDR Natural Resources XLB Materials Select Sector SPDR Technology XLK Technology Select Sector SPDR Communications IYZ iShares Dow Jones US Telecom Utilities XLU Utilities Select Sector SPDR COMMODITIES BROAD BASKET DBC PowerShares DB Commodity Index Tracking Commodities Agriculture DBA PowerShares DB Agriculture Commodities Precious Metals IAU iShares Gold Trust Commodities Industrial Metals DBB PowerShares DB Base Metals Commodities Energy USL United States 12 Month Oil MISCELLANEOUS SECTOR PFF iShares S&P U.S. Preferred Stock Index REAL ESTATE VNQ Vanguard REIT Index ETF Asset Class Number of funds Balanced Fund 0 REITs 1 Fixed Income 9 Commodity 5 Sector Fund 11 Foreign Equity 8 Emerging Market Equity 3 US Equity 11 Other 1 Total 49 Many are looking for access to a well rounded ETF plan through Schwab. This fills this hole and as Schwab makes more of their own funds available, it will be possible to move them into the plan. On this review, the only comment would be to add another REIT choice. The other asset classes have a good number of selections without being overwhelming.

As of Apr 4, 2011, this plan investment choice is rated as above average based on MyPlanIQ Plan Rating methodology that was designed to measure how effective a plan's available investment funds are . It has the following detailed ratings:

Diversification -- Rated as great (99%)

Fund Quality -- Rated as average (47%)

Portfolio Building -- Rated as average (56%)

Overall Rating: above average (66%)

Thehigh diversification score means that all the major and minor asset classes have been ticked. Fund quality is lower because some of the ETF's don't have a long history but that shouldn't impede the ability for the future.

Portfolio Discussions

The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies. For comparison purpose, we also include the moderate model portfolios of a typical 6 asset SIB (Simpler Is Better) plan . This SIB plan has the following candidate index funds and their ETFs equivalent:

US Equity: SPY or VTI

Commodity: DBC

Foreign Equity: EFA or VEU

REITs: IYR or VNQ or ICF

Emerging Market Equity: EEM or VWO

Fixed Income: AGG or BND

Performance chart (as of Apr 4, 2011)Performance table (as of Apr 4, 2011)

Portfolio Name 1Yr AR 1Yr Sharpe 3Yr AR 3Yr Sharpe 5Yr AR 5Yr Sharpe Schwab ETF Select List Tactical Asset Allocation Moderate 9% 82% 8% 72% 12% 89% Schwab ETF Select List Strategic Asset Allocation Moderate 14% 118% 3% 15% 4% 20% Six Core Asset ETF Benchmark Tactical Asset Allocation Moderate 9% 81% 10% 82% 13% 89% Six Core Asset ETF Benchmark Strategic Asset Allocation Moderate 14% 121% 4% 20% 7% 34%

This portfolio performs well against the six asset ETF benchmark- SAA provides lower volatility while albeit delivering lower historical returns but as more of the newer funds are applied to the portfolio, there will be more opportunity for closing the gap

- The TAA portfolios run neck and neck over the five year period

In a future article, we will review performance over the last three months to see how the plan has performed in the light of recent events.

Kay Takeaways- Building a plan of funds is not the preserve of the few -- anybody who has the interest and application to research can provide well constructed plans

- It is possible to benefit from those individuals while still having transparency and not being captive to any particular broker

Symbols: SPY, VTI, EFA, VEU, EEM, VWO, IYR, VNQ, ICF, AGG, BND, DBC, HYG, JNK, PHB, CIU, BIV, MUB, TFI, PZA, MLN, GII, PUI, DBU, RYU, UPW, IYH, IXJ, VHT, XBI, PBE, DBR, RYH, EFG, IXP, PTE, DGG, LTL, IYM, IGE, VAW, XLB, XME, PYZ, DBN, RTM, UYM, MTK, PTF, DBT, RYT, ROM, GWL, PFA, IVE, IWW, JKF, VTV, ELV, PWV, RPV, SCHV, EFV, PID, DWM, IYF, VFH, IPF, PFI, DRF, RYF, KXI, VDC, PSL, DPN, RHS, RXI, VCR, IYJ, EXI, VIS, IGOV, BWX, WIP, IVV, IYY, IWV, VV, DLN, RSP, SCHX, IOO, VT, SHY, SHV, VGSH, PLK, USY, TLT, TLH, IEF, EDV, VGLT, TLO, PLW, IEV, VGK, PEF, DEB, IVW, IWZ, JKE, VUG, ELG, QQQQ, RPG, SCHG, IJJ, IWS, JKI, VOE, EMV, PWP, RFV, UVU, IJH, IWR, JKG, VO, MDY, EMM, PJG, DON, EZM, MVV, IFSM, VSS, SCHC, IJS, IWN, JKL, VBR, DSV, PWY, RZV, UVT, IJR, IWM, JKJ, VB, DSC, PJM, DES, SAA, UWM, SCHA, GMM, PXH, DEM, SCHE, ITE, IXC, IPW, DBE, RYE, DKA, IEI, VGIT, IJK, IWP, VOT, EMG, PWJ, RFG, UKW, IJT, IWO, JKK, VBK, DSG, PWT, RZG, UKK, TIP, EPP, VPL, GMF, PAF, EWJ, JPP, PJO, DXJ, GSG

Disclosure:

MyPlanIQ does not have any business relationship with the company or companies mentioned in this article. It does not set up their retirement plans. The performance data of portfolios mentioned above are obtained through historical simulation and are hypothetical.

- National Semiconductor Provides Good Funds in Their Retirement Plan

04/04/2011

- MidAmerican Energy Company's 401K Plan: More Diversification Needed

03/31/2011

- Caterpillar's 401K Retirement Plan: Reasonable Investment Choices But Could Be More Systematic

03/28/2011

- Accenture 401K Retirement Plan: High Quality and Low Cost Funds with Proper Diversification

03/25/2011

- Online Pioneer Amazon.com Can Expand Its 401K Plan for More Diversification

03/22/2011

- Employees in Sprint Nextel Dial up An Average 401K Retirement Plan

03/22/2011

- Starbucks Should Expand Its 401K Retirement Plan, Just As What It Did in Their Business

03/11/2011

- NetApp's 401K: More Diversification and Better Quality Can Help

03/10/2011

- Shell Versus Morningstar -- More is Better

02/27/2011

- Initiating Tracking of US Subclasses

02/22/2011

- E-Trade ETF Plan Hits Most of the High Notes

02/16/2011

- RSP Leads US Large Cap Blend Equities

02/14/2011

- JPMorgan Chase -- Top Tier Company -- Second Tier Retirement Plan

01/15/2011

- FEDEX Doesn't Deliver on It's Retirement Plan

01/07/2011

- American Flies Above United in Plan Structure, Below United in Returns

01/06/2011

- Aflac Incorporated 401(k) Savings and Profit Sharing Plan Report On 12/03/2010

12/03/2010

This report reviews Aflac Incorporated 401(k) Savings and Profit Sharing Plan plan. We will discuss the investment choices and present the plan rating by MyPlanIQ. Current economic and market conditions are discussed in the context of the investment portfolios in the plan. We will then show how participants in Aflac Incorporated 401(k) Savings and Profit Sharing Plan can achieve reasonable investment results using asset allocation strategies.

Plan Review and Rating

AFLAC Inc (Ticker:AFL) has the "Aflac Incorporated 401(k) Savings and Profit Sharing Plan".

Aflac Incorporated 401(k) Savings and Profit Sharing Plan's 401K plan consists of 11 funds. These funds enable participants to gain exposure to 3 major assets: US Equity, Foreign Equity, Fixed Income. The list of minor asset classes covered:

Foreign Large Blend: EFA, VEU, GWL, PFA

Intermediate-term Bond: AGG, CIU, BIV, BND

Large Blend: IVV, IYY, IWV, VTI, VV, SPY, DLN, RSP, SCHX

Large Growth: IVW, IWZ, JKE, VUG, ELG, QQQQ, RPG, SCHG

Large Value: IVE, IWW, JKF, VTV, ELV, PWV, RPV, SCHV

Mid-cap Growth: IJK, IWP, VOT, EMG, PWJ, RFG, UKW

Moderate Allocation: AOM

Small Growth: IJT, IWO, JKK, VBK, DSG, PWT, RZG, UKK

As of Dec 2, 2010, this plan investment choice is rated as based on MyPlanIQ Plan Rating methodology that measures the effectiveness of a plan's available investment funds. It has the following detailed ratings:

Diversification -- Rated as (35%)

Fund Quality -- Rated as (33%)

Portfolio Building -- Rated as (36%)

Overall Rating: (35%)Current Economic and Market Conditions

We have experienced an uncertain 2010: plenty of worries on whether the US economy will climb out of the great recession and recover.

- The Federal Reserve embarked on Quantitative Easing II (QE2) to stimulate the economy.

- The housing market is still at its low but largely stabilized.

- The unemployment rate is stuck at 9%.

Americans continue to face an uncertain future, given (among others) the high unemployment rate, large federal and local government debts and global trade imbalance. With such an economic backdrop, the stock and debt markets are going to be volatile. Despite this, markets have been resilient and appear positioned to rebound.

In this market it is even more critical to properly diversify and respond market changes. MyPlanIQ offers two asset allocation strategies: strategic and tactical asset allocation strategies ( SAA and TAA for participants in Aflac Incorporated 401(k) Savings and Profit Sharing Plan).

Strategic Asset Allocation is based on well known modern portfolio theory and its key features include: diversification, proper fund selection and periodically re-balancing.

Tactical Asset Allocation works on a diversified array of assets provided by funds in a plan and adjusts asset mixes based on market conditions such as asset price momentum utilized by TAA.

Portfolio Discussions

The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies. For comparison purpose, we also include the moderate model portfolios of a typical 3 asset SIB (Simpler Is Better) plan . This SIB plan has the following candidate index funds and their ETFs equivalent:

US Equity: (SPY or VTI)

Foreign Equity: (EFA or VEU)

Fixed Income: (AGG or BND)

Performance chart (as of Dec 2, 2010)Performance table (as of Dec 2, 2010)

Portfolio Name 1Yr AR 1Yr Sharpe 3Yr AR 3Yr Sharpe 5Yr AR 5Yr Sharpe Aflac Incorporated 401(k) Savings and Profit Sharing Plan Tactical Asset Allocation Moderate 4% 34% 5% 64% 8% 81% Aflac Incorporated 401(k) Savings and Profit Sharing Plan Strategic Asset Allocation Moderate 10% 100% 2% 8% 6% 31% Three Core Asset ETF Index Funds Tactical Asset Allocation Moderate -4% -35% 1% 9% 4% 27% Three Core Asset ETF Index Funds Strategic Asset Allocation Moderate 9% 60% -0% -3% 4% 13% Currently, asset classes in US Equity (SPY,VTI), Foreign Equity (EFA,VEU) and Fixed Income (AGG,BND) are doing relatively well. These asset classes are available to Aflac Incorporated 401(k) Savings and Profit Sharing Plan participants.

To summarize, Aflac Incorporated 401(k) Savings and Profit Sharing Plan plan participants can achieve reasonable investment returns by adopting asset allocation strategies that are tailored to their risk profiles.

Symbols: AFL , SPY , VTI , EFA , VEU , AGG , BND , AOM , CIU , BIV , GWL , PFA , IVE , IWW , JKF , VTV , ELV , PWV , RPV , SCHV , IVV , IYY , IWV , VV , DLN , RSP , SCHX , IVW , IWZ , JKE , VUG , ELG , QQQQ , RPG , SCHG , IJK , IWP , VOT , EMG , PWJ , RFG , UKW , IJT , IWO , JKK , VBK , DSG , PWT , RZG , UKK

- ALLERGAN, INC. SAVINGS AND INVESTMENT PLAN Report On 12/03/2010

12/03/2010

- Apartment Investment and Management Company 401(k) Retirement Plan Report On 12/03/2010

12/03/2010

- ASSURANT 401(k) PLAN A&PLAN B Report On 12/03/2010

12/03/2010

- Abercrombie Fitch Co. Savings and Retirement Plan Report On 12/03/2010

12/03/2010

- Apache Design Solutions 401K Report On 12/03/2010

12/03/2010

- Allegheny Ludlum Corporation Personal Retirement and 401(k) Savings Account Plan Report On 12/03/2010

12/03/2010

- ALLEGHENY ENERGY EMPLOYEE STOCK OWNERSHIP AND SAVINGS PLAN Report On 12/03/2010

12/03/2010

- BAKER 401(k) PLAN Report On 12/03/2010

12/03/2010

- BRISTOL-MYERS SQUIBB COMPANY SAVINGS AND INVESTMENT PROGRAM Report On 12/03/2010

12/03/2010

- PEABODY WESTERN-UMWA 401(K) PLAN Report On 12/03/2010

12/03/2010

- Peabody Investments Corp.Employee Retirement Account Report On 12/03/2010

12/03/2010

- Capital Accumulation Plan of The Chubb Corporation Report On 12/03/2010

12/03/2010

- CEPHALON, INC. 401(k) PROFIT SHARING PLAN Report On 12/03/2010

12/03/2010

- CABOT OIL & GAS CORPORATION SAVINGS INVESTMENT PLAN Report On 12/03/2010

12/03/2010

- Danaher Corporation Subsidiaries Retirement and Savings Plan Report On 12/03/2010

12/03/2010

- Danaher Corporation Subsidiaries Savings Plan Report On 12/03/2010

12/03/2010

- EQT CORPORATION SAVINGS AND PROTECTION PLAN Report On 12/03/2010

12/03/2010

- Vanguard Variable Annuity Report On 12/06/2010

12/06/2010

- The Franklin Templeton NJBEST New Jersey 529 College Savings Plan Report On 12/07/2010

12/07/2010

- TD Ameritrade Commission Free ETFs Report On 12/07/2010

12/07/2010

- Qualcomm 401(k) Plan Report On 12/07/2010

12/07/2010

- Vanguard-VA-Clone Report On 12/07/2010

12/07/2010

- Tiffany Co. Employee Profit Sharing and Retirement Savings Plan Report On 03/21/2011

03/21/2011

- Sprint Nextel 401K Plan Report On 03/21/2011

03/21/2011