|

Vanguard ETF: |     |

7.4%* |

|

Diversified Core: |    |

8.1%* |

|

Six Core Asset ETFs: |    |

7.3%* |

Articles on Asset

- TD Ameritrade Commission Free ETFs: Comprehensive Portfolio Building Blocks

10/19/2010

TD Ameritrade (Ticker: AMTD) just announced that it offers 100+ commission free ETFs for its clients.The 100+ (a precise number is 101) ETFs were selected by Morningstar that include ETFs from iShares, Vanguard, State Street, PowerShares, and others. In comparison, Schwab's free ETFs include only 11 of its own funds. Similarly, Vanguard offers 47 Vanguard ETFs for free. Fidelity was the first one that offers 25 iShares ETFs for free. See the official TD Ameritrade offering for more details.

MyPlanIQ views this is a very significant step for small investors (well we are not sure whether TD Ameritrade would still offer such a deal to very large accounts). We have constructed an investment plan TD Ameritrade Commission Free ETFs to take advantage of these ETFs. Though for the trades of these ETFs to be eligible for commission free, TD Ameritrade's customers have to hold these ETFs for more than 30 days, such a restriction is not significant for our plan since the plan only rebalances at most once per month. In this plan, the minimum holding period for each fund is set to be 1 month, which is equivalent to 30 days.TD Ameritrade Commission Free ETFs's 401K plan consists of 101 funds. These funds enable participants to gain exposure to 6 major assets: Emerging Market Equity , Foreign Equity , Fixed Income , US Equity , Commodity , REITs . We view this is the most comprehensive coverage of major asset classes.

The list of minor asset classes covered are:COMMODITIES BROAD BASKET: GSG , DBC

Conservative Allocation: AOK

DIVERSIFIED EMERGING MKTS: EEM , GMM , PXH , DEM , SCHE

Emerging Markets Bond: PCY

EQUITY: VTI,VT

EUROPE STOCK: IEV , VGK , PEF , DEB

Foreign Large Blend: EFA , VEU , GWL , PFA

Foreign Large Growth: EFG

Foreign Large Value: EFV , PID , DWM

FOREIGN SMALL/MID GROWTH: IFSM , VSS , SCHC

Foreign Small/Mid Value: SCZ

Global Real Estate: IFGL , RWX

High Yield Bond: HYG , JNK , PHB

Inflation-Protected Bond: TIP

Intermediate Government: IEI , VGIT , ITE

Intermediate-Term Bond: AGG,CIU , BIV,BND

JAPAN STOCK: EWJ , JPP , PJO , DXJ

LARGE BLEND: IVV,IYY,IWV , VTI,VV , SPY , DLN , RSP , SCHX

LARGE GROWTH: IVW,IWZ,JKE , VUG , ELG , QQQQ , RPG , SCHG

LARGE VALUE: IVE,IWW,JKF , VTV , ELV , PWV , RPV , SCHV

Latin America Stock: ILF , GML

LONG GOVERNMENT: TLT,TLH,IEF , EDV,VGLT , TLO , PLW

Long-Term Bond: CLY,LQD , BLV,VCLT

MID-CAP BLEND: IJH,IWR,JKG , VO , MDY,EMM , PJG , DON,EZM , MVV

Mid-Cap Growth: IJK,IWP , VOT , EMG , PWJ , RFG , UKW

MID-CAP VALUE: IJJ,IWS,JKI , VOE , EMV , PWP , RFV , UVU

Moderate Allocation: AOM

Multisector Bond: AGG,GBF , BND , LAG

Muni National Interm: ITM

Muni National Long: MUB , TFI , PZA , MLN

Muni National Short: SUB , SHM , PVI , SMB

PACIFIC/ASIA EX-JAPAN STK: EPP,AAXJ , GMF , PAF , DND

REAL ESTATE: IYR,ICF , VNQ

SHORT GOVERNMENT: SHY,SHV , VGSH , PLK , USY

Short-Term Bond: CSJ , BSV,VCSH

SMALL BLEND: IJR,IWM,JKJ , VB , DSC , PJM , DES , SAA,UWM , SCHA

Small Growth: IJT,IWO,JKK , VBK , DSG , PWT , RZG , UKK

SMALL VALUE: IJS,IWN,JKL , VBR , DSV , PWY , RZV , UVT

SPECIALTY-REAL ESTATE: RWR , PSR , URE

World Allocation: AOR , AOA

WORLD BOND: IGOV , BWX,WIP

WORLD STOCK: IOO , VTAs of Oct 15, 2010, this plan investment choice is rated as above average based on MyPlanIQ Plan Rating methodology that was designed to measure how effective a plan's available investment funds are . It has the following detailed ratings:

Diversification -- Rated as great (97%)

Fund Quality -- Rated as below average (29%)

Portfolio Building -- Rated as great (90%)

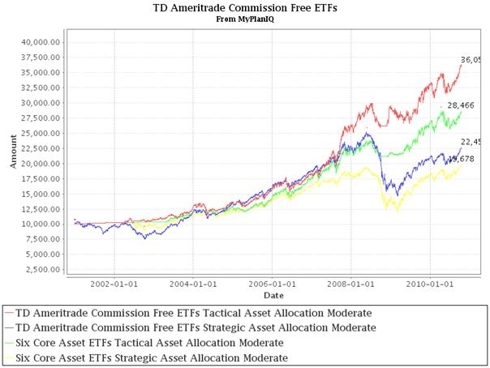

Overall Rating: above average (74%)The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies ( SAA and TAA , both provided by MyPlanIQ). For comparison purpose, we also include the moderate model portfolios of a typical five asset SIB (Simpler Is Better) plan . This SIB plan has the following candidate index funds and their ETFs equivalent:

REITs:( IYR or VNQ or ICF )

Fixed Income:( AGG or BND )

Commodity:(DBC)

Foreign Equity:( EFA or VEU )

Emerging Market Equity:( EEM or VWO )

US Equity:( SPY or VTI )

Performance chart (as of Oct 15, 2010)Performance table (as of Oct 15, 2010)

Portfolio Name 1Yr AR 1Yr Sharpe 3Yr AR 3Yr Sharpe 5Yr AR 5Yr Sharpe TD Ameritrade Commission Free ETFs Tactical Asset Allocation Moderate 13% 87% 13% 86% 20% 128% TD Ameritrade Commission Free ETFs Strategic Asset Allocation Moderate 10% 85% -1% -6% 9% 47% Six Core Asset ETFs Tactical Asset Allocation Moderate 10% 65% 9% 66% 17% 114% Six Core Asset ETFs Strategic Asset Allocation Moderate 11% 84% 2% 9% 9% 42% To summarize, TD Ameritrade Commission Free ETFs plan is very comprehensive and allows investors to achieve significant performance with reasonable risk. With now all of the top discount brokers (Fidelity, Schwab and TD Ameritrade) offering such commission free ETFs, investors are now free from trading cost and focus on portfolio building in terms of better asset allocation strategies.

labels:investment,

Symbols:SUB,SHM,PVI,SMB,EPP,AAXJ,GMF,PAF,DND,SHY,SHV,VGSH,PLK,USY,CSJ,BSV,VCSH,AOR,AOA,IGOV,BWX,WIP,IOO,VT,RWR,PSR,URE,IJS,IWN,JKL,VBR,DSV,PWY,RZV,UVT,IJT,IWO,JKK,VBK,DSG,PWT,RZG,UKK,IJR,IWM,JKJ,VB,DSC,PJM,DES,SAA,UWM,SCHA,ITM,MUB,TFI,PZA,MLN,AGG,GBF,BND,LAG,IJJ,ETFs,Portfolio,Building,Asset,Allocation,Commission,Free,

- Top Tier ETF Providers Playoffs II

10/19/2010

Based on an article published by Bank Investment Consultant by Matt Ackermann, Vanguard, one of the largest index fund and ETF providers, will offer commission-free trading to its brokerage clients that use its lineups of 46 proprietary ETFs. This represents a comparable move as Fidelity and Schwab.

In addition to Fidelity and Schwab plans, MyPlanIQ now has a Vanguard major ETF plan. Notice since most Vanguard ETFs have short history, the performance data of the model portfolios are meaningful since 2003 (before that, most ETFs did not exist).

The following is the list of the ETFs supported in this plan (for up to date info, please see the Vanguard ETF page.

Consumer Discretionary VCR Consumer Staples VDC Dividend Appreciation VIG Emerging Markets VWO Energy VDE Europe Pacific VEA European VGK Extended Duration Treasury EDV Extended Market VXF Financials VFH FTSE All-World ex-US VEU FTSE All-World ex-US Small-Cap VSS Growth VUG Health Care VHT High Dividend Yield VYM Industrials VIS Information Technology VGT Intermediate-Term Bond BIV Intermediate-Term Corporate Bond VCIT Intermediate-Term Government Bond VGIT Large-Cap VV Long-Term Bond BLV Long-Term Corporate Bond VCLT Long-Term Government Bond VGLT Materials VAW Mega Cap 300 MGC Mega Cap 300 Growth MGK Mega Cap 300 Value MGV Mid-Cap VO Mid-Cap Growth VOT Mid-Cap Value VOE Mortgage-Backed Securities VMBS Pacific VPL REIT VNQ Short-Term Bond BSV Short-Term Corporate Bond VCSH Short-Term Government Bond VGSH Small-Cap VB Small-Cap Growth VBK Small-Cap Value VBR Telecommunication Services VOX Total Bond Market BND Total Stock Market VTI Total World Stock VT Utilities VPU Value VTV Vanguard ETFs's 401K plan consists of 43 funds. These funds enable participants to gain exposure to 5 major assets: Emerging Market Equity , Foreign Equity , Fixed Income , US Equity , REITs . The list of minor asset classes covered:

Communications: IXP , PTE , DGG , LTL

Consumer Discretionary: RXI , VCR

Consumer Staples: KXI , VDC , PSL , DPN , RHS

DIVERSIFIED EMERGING MKTS: EEM , GMM , PXH , DEM , SCHE

DIVERSIFIED PACIFIC/ASIA: EPP , VPL , GMF , PAF

Equity Energy: ITE,IXC , IPW , DBE , RYE , DKA

EUROPE STOCK: IEV , VGK , PEF , DEB

Financial: IYF , VFH , IPF , PFI , DRF , RYF

Foreign Large Blend: EFA , VEU , GWL , PFA

FOREIGN SMALL/MID GROWTH: IFSM , VSS , SCHC

Health: IYH,IXJ , VHT , XBI , PBE , DBR , RYH

Industrials: IYJ,EXI , VIS

Intermediate-Term Bond: AGG,CIU , BIV,BND

LARGE BLEND: IVV,IYY,IWV , VTI,VV , SPY , DLN , RSP , SCHX

LARGE GROWTH: IVW,IWZ,JKE , VUG , ELG , QQQQ , RPG , SCHG

LARGE VALUE: IVE,IWW,JKF , VTV , ELV , PWV , RPV , SCHV

LONG GOVERNMENT: TLT,TLH,IEF , EDV,VGLT , TLO , PLW

Long-Term Bond: CLY,LQD , BLV,VCLT

MID-CAP BLEND: IJH,IWR,JKG , VO , MDY,EMM , PJG , DON,EZM , MVV

Mid-Cap Growth: IJK,IWP , VOT , EMG , PWJ , RFG , UKW

MID-CAP VALUE: IJJ,IWS,JKI , VOE , EMV , PWP , RFV , UVU

Natural Resources: IYM,IGE , VAW , XLB,XME , PYZ , DBN , RTM , UYM

REAL ESTATE: IYR,ICF , VNQ

SHORT GOVERNMENT: SHY,SHV , VGSH , PLK , USY

Short-Term Bond: CSJ , BSV,VCSH

SMALL BLEND: IJR,IWM,JKJ , VB , DSC , PJM , DES , SAA,UWM , SCHA

Small Growth: IJT,IWO,JKK , VBK , DSG , PWT , RZG , UKK

SMALL VALUE: IJS,IWN,JKL , VBR , DSV , PWY , RZV , UVT

Technology: MTK , PTF , DBT , RYT , ROM

Utilities: GII , PUI , DBU , RYU , UPW

WORLD STOCK: IOO , VTAs of Oct 15, 2010, this plan investment choice is rated as averagebased on MyPlanIQ Plan Rating methodology that was designed to measure how effective a plan's available investment funds are . It has the following detailed ratings:

Diversification -- Rated as above average (74%)

Fund Quality -- Rated as below average (33%)

Portfolio Building -- Rated as average (37%)

Overall Rating: average (47%)The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies ( SAA and TAA , both provided by MyPlanIQ). For comparison purpose, we also include the moderate model portfolios of a typical five asset SIB (Simpler Is Better) plan . This SIB plan has the following candidate index funds and their ETFs equivalent:

REITs:( IYR or VNQ or ICF )

Fixed Income:( AGG or BND )

Foreign Equity:( EFA or VEU )

Emerging Market Equity:( EEM or VWO )

US Equity:( SPY or VTI )

Performance chart (as of Oct 15, 2010)Performance table (as of Oct 15, 2010)

Portfolio Name 1Yr AR 1Yr Sharpe 3Yr AR 3Yr Sharpe 5Yr AR 5Yr Sharpe Vanguard ETFs Tactical Asset Allocation Moderate 10% 67% 6% 39% 13% 84% Vanguard ETFs Strategic Asset Allocation Moderate 13% 92% 3% 9% 8% 39% Five Core Asset Index ETF Funds Tactical Asset Allocation Moderate 10% 65% 7% 48% 15% 103% Five Core Asset Index ETF Funds Strategic Asset Allocation Moderate 14% 99% 3% 10% 9% 41% Currently, asset classes in REITs( IYR , VNQ , ICF ) , Fixed Income( AGG , BND ) and Emerging Market Equity( EEM , VWO ) are doing relatively well. These asset classes are available to Vanguard ETFs participants.

To summarize, Vanguard ETFs plan participants can achieve reasonable investment returns by adopting asset allocation strategies that are tailored to their risk profiles. Currently, the tactical asset allocation strategy indicates overweighing on reits , emerging market equity and fixed income funds.

labels:investment,

Symbols:SUB,SHM,PVI,SMB,EPP,AAXJ,GMF,PAF,DND,SHY,SHV,VGSH,PLK,USY,CSJ,BSV,VCSH,AOR,AOA,IGOV,BWX,WIP,IOO,VT,RWR,PSR,URE,IJS,IWN,JKL,VBR,DSV,PWY,RZV,UVT,IJT,IWO,JKK,VBK,DSG,PWT,RZG,UKK,IJR,IWM,JKJ,VB,DSC,PJM,DES,SAA,UWM,SCHA,ITM,MUB,TFI,PZA,MLN,AGG,GBF,BND,LAG,IJJ,ETFs,Portfolio,Building,Asset,Allocation,Commission,Free,

- Top Tier ETF Provider Playoffs

10/19/2010

ETF’s continue to broaden their appeal both in terms of flexibility and low cost. With commission free ETF’s, more money stays in the investors pocket rather than disappearing in fees. In addition, while many of these ETF’s have a 30 day minimum hold, this is ideal for long term investing when making changes more often than that can be counter productive.

Four companies offer commission free ETF’s and we are going to compare the offerings in detail to determine which is likely to offer the best value to the investor.

In this article we are going to compare Schwab and TD Ameritrade.

Schwab (Ticker SCHW) is a relative late comer to the ETF party. They offer the fewest ETF’s and the ETF’s have the shortest history. They only provide their own ETF's commission free. However, Schwab has a huge network and powerful brand so we expect Schwab to be a significant player in the market.

Schwab ETFNEW Bond ETFsSchwab U.S. TIPS ETF™Schwab Short-Term U.S. Treasury ETF™Schwab Intermediate-Term U.S. Treasury ETF™Domestic Equity ETFsSchwab U.S. Broad Market ETF™Schwab U.S. Large-Cap ETF™Schwab U.S. Large-Cap Growth ETF™Schwab U.S. Large-Cap Value ETF™Schwab U.S. Small-Cap ETF™International Equity ETFsSchwab International Equity ETF™Schwab International Small-Cap Equity ETF™Schwab Emerging Markets Equity ETF™Notable properties about the Schwab offering- The expense ratios are low

- There are four asset classes with a good choice of funds

- We would have liked to have seen more choices with other providers

- We would have liked to have seen funds with a longer history

- We would expect real estate to be added before long

- We would expect more choices in the international and emerging market segments before long

As most of the funds are very new, it’s impossible to do real back testing with the funds. So we have selected a commission efficient portfolio that includes:Asset Class Ticker Name LARGE VALUE SCHV Schwab U.S. Large-Cap Value ETF LARGE BLEND SCHX Schwab U.S. Large-Cap ETF LARGE BLEND SCHB Schwab U.S. Broad Market ETF LARGE GROWTH SCHG Schwab U.S. Large-Cap Growth ETF LARGE GROWTH IWF iShares Russell 1000 Growth Index SMALL VALUE IJS iShares S&P SmallCap 600 Value Index SMALL BLEND SCHA Schwab U.S. Small-Cap ETF Small Growth IJT iShares S&P SmallCap 600 Growth Foreign Large Blend SCHF Schwab International Equity ETF FOREIGN SMALL/MID GROWTH SCHC Schwab International Small-Cap Eq ETF DIVERSIFIED EMERGING MKTS SCHE Schwab Emerging Markets Equity ETF Inflation-Protected Bond TIP iShares Barclays TIPS Bond Intermediate Government IEI iShares Barclays 3-7 Year Treasury Bond SHORT GOVERNMENT SHY iShares Barclays 1-3 Year Treasury Bond Inflation-Protected Bond SCHP Schwab U.S. TIPS ETF SHORT GOVERNMENT SCHO Schwab Short-Term U.S. Treasury ETF Intermediate Government SCHR Schwab Intermediate-Term U.S. Trsy ETF LARGE VALUE VTV Vanguard Value Index LARGE BLEND VTI Vanguard Total Stock Market ETF LARGE VALUE VTV Vanguard Value ETF DIVERSIFIED EMERGING MKTS VWO Vanguard Emerging Markets Stock ETF Foreign Small/Mid Value SCZ iShares MSCI EAFE Small Cap Index Foreign Large Blend EFA iShares MSCI EAFE Index

As of Oct 15, 2010, the Schwab ETF investment choice is rated asaverage based on MyPlanIQ Plan Rating methodology that was designed to measure how effective a plan's available investment funds are . It has the following detailed ratings:

Diversification -- Rated as below average (19%)

Fund Quality -- Rated as average (59%)

Portfolio Building -- Rated as average (41%)

Overall Rating: average (40%)

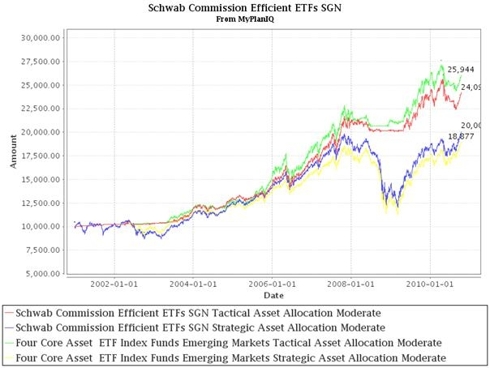

The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies ( SAA and TAA , both provided by MyPlanIQ).

For comparison purpose, we also include the moderate model portfolios of a typical five asset SIB (Simpler Is Better) plan . This SIB plan has the following candidate index funds and their ETFs equivalent:Fixed Income:( AGG or BND )

Foreign Equity:( EFA or VEU )

Emerging Market Equity:( EEM or VWO )

US Equity:( SPY or VTI )

Performance chart (as of Oct 15, 2010)

Performance table (as of Oct 15, 2010)Portfolio Name1Yr AR1Yr Sharpe3Yr AR3Yr Sharpe5Yr AR5Yr Sharpe2%17%6%44%14%88%1%10%5%38%12%88%10%71%1%2%9%40%10%76%1%4%8%37%

The Schwab Funds perform adequately against the SIB’s.TD Ameritrade (Ticker: AMTD) are also newcomers to the ETF space offering 100+ commission free ETFs. The main restriction is that customers have to hold these ETFs for more than 30 days to make such trades ecommission free.

This is an almost ideal platform for retirement investing with a 30 day redemption period. With a web based application to monitor all of the funds in the plan, it should be possible to put together a very solid portfolio and deliver excellent results.

These funds provide exposure to 6 major assets: Emerging Market Equity , Foreign Equity , Fixed Income , US Equity , Commodity , Real estate.

The list of minor asset classes covered:COMMODITIES BROAD BASKET: GSG , DBC

Conservative Allocation: AOK

DIVERSIFIED EMERGING MKTS: EEM , GMM , PXH , DEM , SCHE

Emerging Markets Bond: PCY

EQUITY: VTI,VT

EUROPE STOCK: IEV , VGK , PEF , DEB

Foreign Large Blend: EFA , VEU , GWL , PFA

Foreign Large Growth: EFG

Foreign Large Value: EFV , PID , DWM

FOREIGN SMALL/MID GROWTH: IFSM , VSS , SCHC

Foreign Small/Mid Value: SCZ

Global Real Estate: IFGL , RWX

High Yield Bond: HYG , JNK , PHB

Inflation-Protected Bond: TIP

Intermediate Government: IEI , VGIT , ITE

Intermediate-Term Bond: AGG,CIU , BIV,BND

JAPAN STOCK: EWJ , JPP , PJO , DXJ

LARGE BLEND: IVV,IYY,IWV , VTI,VV , SPY , DLN , RSP , SCHX

LARGE GROWTH: IVW,IWZ,JKE , VUG , ELG , QQQQ , RPG , SCHG

LARGE VALUE: IVE,IWW,JKF , VTV , ELV , PWV , RPV , SCHV

Latin America Stock: ILF , GML

LONG GOVERNMENT: TLT,TLH,IEF , EDV,VGLT , TLO , PLW

Long-Term Bond: CLY,LQD , BLV,VCLT

MID-CAP BLEND: IJH,IWR,JKG , VO , MDY,EMM , PJG , DON,EZM , MVV

Mid-Cap Growth: IJK,IWP , VOT , EMG , PWJ , RFG , UKW

MID-CAP VALUE: IJJ,IWS,JKI , VOE , EMV , PWP , RFV , UVU

Moderate Allocation: AOM

Multisector Bond: AGG,GBF , BND , LAG

Muni National Interm: ITM

Muni National Long: MUB , TFI , PZA , MLN

Muni National Short: SUB , SHM , PVI , SMB

PACIFIC/ASIA EX-JAPAN STK: EPP,AAXJ , GMF , PAF , DND

REAL ESTATE: IYR,ICF , VNQ

SHORT GOVERNMENT: SHY,SHV , VGSH , PLK , USY

Short-Term Bond: CSJ , BSV,VCSH

SMALL BLEND: IJR,IWM,JKJ , VB , DSC , PJM , DES , SAA,UWM , SCHA

Small Growth: IJT,IWO,JKK , VBK , DSG , PWT , RZG , UKK

SMALL VALUE: IJS,IWN,JKL , VBR , DSV , PWY , RZV , UVT

SPECIALTY-REAL ESTATE: RWR , PSR , URE

World Allocation: AOR , AOA

WORLD BOND: IGOV , BWX,WIP

WORLD STOCK: IOO , VT

As of Oct 15, 2010, this plan investment choice is rated as above average based on MyPlanIQ Plan Rating methodology that was designed to measure how effective a plan's available investment funds are . It has the following detailed ratings:

Diversification -- Rated as great (97%)

Fund Quality -- Rated as below average (28%)

Portfolio Building -- Rated as great (90%)

Overall Rating: above average (73%)

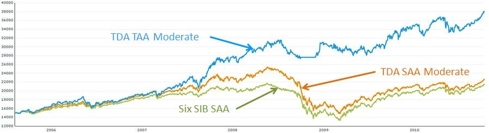

The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies ( SAA and TAA , both provided by MyPlanIQ).

For comparison purpose, we also include the moderate model portfolios of a typical five asset SIB (Simpler Is Better) plan . This SIB plan has the following candidate index funds and their ETFs equivalent:

REITs:( IYR or VNQ or ICF )

Fixed Income:( AGG or BND )

Commodity:(DBC)

Foreign Equity:( EFA or VEU )

Emerging Market Equity:( EEM or VWO )

US Equity:( SPY or VTI )

Performance chart (as of Oct 15, 2010)Portfolio Name1Yr AR1Yr Sharpe3Yr AR3Yr Sharpe5Yr AR5Yr Sharpe13%87%13%86%20%128%10%83%-1%-6%9%46%10%65%9%66%17%114%11%84%2%9%9%42%

Currently, asset classes in REITs( IYR , VNQ , ICF ) , Fixed Income( AGG , BND ) and Emerging Market Equity( EEM , VWO ) are doing relatively well. These asset classes are available to TD Ameritrade Commission Free ETFs participants.

Portfolio Performance ComparisonPortfolio Name1Yr AR1Yr Sharpe3Yr AR3Yr Sharpe5Yr AR5Yr Sharpe13%87%13%86%20%128%1%10%5%38%12%88%10%83%-1%-6%9%46%10%71%1%2%9%40%In this round, TD Ameritrade is the clear winner with tactical asset allocation while the Schwab SAA pretty much matches its counterpart.

Portfolio Performance ComparisonPortfolio Name1Yr AR1Yr Sharpe3Yr AR3Yr Sharpe5Yr AR5Yr Sharpe13%87%13%86%20%128%1%10%5%38%12%88%10%83%-1%-6%9%46%10%71%1%2%9%40%In this round, TD Ameritrade is the clear winner with tactical asset allocation while the Schwab SAA pretty much matches its counterpart.

TD Ameritrade's two key advantages are:- A large number of ETF’s in six asset classes to allow the construction of high performance portfolios

- Providing ETF’s with history from industry leading suppliers

TD Ameritrade is the clear winner and moves on to the final round.labels:investment,

Symbols:SUB,SHM,PVI,SMB,EPP,AAXJ,GMF,PAF,DND,SHY,SHV,VGSH,PLK,USY,CSJ,BSV,VCSH,AOR,AOA,IGOV,BWX,WIP,IOO,VT,RWR,PSR,URE,IJS,IWN,JKL,VBR,DSV,PWY,RZV,UVT,IJT,IWO,JKK,VBK,DSG,PWT,RZG,UKK,IJR,IWM,JKJ,VB,DSC,PJM,DES,SAA,UWM,SCHA,ITM,MUB,TFI,PZA,MLN,AGG,GBF,BND,LAG,IJJ,ETFs,Portfolio,Building,Asset,Allocation,Commission,Free,

- TD Ameritrade Commission Free ETF’s Empowers Both Strategic and Tactical Asset Allocation

10/19/2010

The recent news that TD Ameritrade are providing over 100 ETF’s commission free is a perfect fit for a retirement portfolio. Investors are able to trade once a month and pick from a wide range of ETF’s without incurring any trading fees. Combine this with an IRA where the tax consequences of trading are removed and you have an almost ideal scenario and back tested returns demonstrate the point.

There is a continuing dilemma between wanting to increase returns while mitigating downside risk against the perceived risk of adopting a tactical asset allocation strategy. It is clear that tactical asset allocation consistently delivers higher returns at a lower risk. At the same time many are uncomfortable moving away from buy and hold which has been the mantra over the past twenty years.

In a previous article we introduced the notion of a core-satellite portfolio where the assets are split between tactical and strategic asset allocation strategies as a way of introducing tactical asset allocation in a step-by-step fashion.

TD Ameritrade making so many ETF’s available commission free allows another alternative to be considered and that is maintaining classic strategic asset allocation – i.e. all asset classes are fully represented at all times but with so many funds in each class, use fund momentum to rotate styles such that the funds in each asset class are regularly optimized.

CategoryJan-08Jan-09Jan-10Apr-10Jul-10Oct-10US EquitiesIWNVUG, MGKIWNVIGIWSVOInternational EquitiesEWJEWGEWJEWAAAXJAAXJEmerging MarketsEWZEWZEWZILFVWOVWOReal EstateVNQVNQVNQVNQVNQVNQCommoditiesDBCDBCDBCDBCDBCDBCBalanced FundAOKAOKAOKAOKAOKFixed IncomeSHY, WIP, JNKSHM, BWXSHY, WIP, JNKVCSH, BWX, JNKCASH, AGG, JNKCASH, AGG, JNKWe used the MyPlanIQ system to build and monitor a moderate risk (40% fixed income) strategic asset allocation portfolio. With five risk based asset classes, each of those classes would have 12% of the assets dedicated to them but the funds would be evaluated every month and the optimal fund selected based on the momentum within the class.

This can be compared with a Six asset SIB for which there is just one fund in each asset class.

From the performance chart, it is clear that there is increased upside potential from being able to switch funds within an asset class. Unfortunately, there is less ability to minimize downside risk when an asset class is under downward pressure.Despite this, for those who want to stay with a buy and hold in terms of asset classes, using this approach can squeeze some extra returns from the strategy.

With the large number of funds in six asset classes, momentum based asset allocation can be seen in its best light.

Portfolio Performance ComparisonPortfolio Name1Yr AR1Yr Sharpe3Yr AR3Yr Sharpe5Yr AR5Yr Sharpe13%87%13%86%20%128%10%83%-1%-6%9%46%11%93%1%5%8%40%Takeaways- ETF’s provide the basis for an outstanding portfolio with either strategic or tactical asset allocation. This is clearly demonstrated with TD’s wide range of commission free funds

- Using a web based application takes a lot of the effort from finding the best funds for either strategy

- Strategic asset allocation with styles rotation can deliver solid results using a well trusted strategy

- Tactical asset allocation greatly benefits from the large number of funds

labels:investment,

Symbols:GSG,DBC,AOK,EEM,GMM,PXH,DEM,SCHE,PCY,VTI,VT,IEV,VGK,PEF,DEB,EFA,VEU,GWL,PFA,EFG,EFV,PID,DWM,IFSM,VSS,SCHC,SCZ,IFGL,RWX,HYG,JNK,PHB,TIP,IEI,VGIT,ITE,AGG,CIU,BIV,BND,EWJ,JPP,PJO,DXJ,IVV,IYY,IWV,VV,SPY,DLN,RSP,SCHX,IVW,IWZ,JKE,VUG,ELG,QQQQ,RPG,SCHG,IVE,IWW,Commission,Free,ETFs,Strategic,Asset,Allocation,Tactical,Asset,Allocation,Asset,Allocation,styles,rotation,

- TD Ameritrade Commission Free ETF’s Empowers Both Strategic and Tactical Asset Allocation

10/19/2010

The recent news that TD Ameritrade are providing over 100 ETF’s commission free is a perfect fit for a retirement portfolio. Investors are able to trade once a month and pick from a wide range of ETF’s without incurring any trading fees. Combine this with an IRA where the tax consequences of trading are removed and you have an almost ideal scenario and back tested returns demonstrate the point.

There is a continuing dilemma between wanting to increase returns while mitigating downside risk against the perceived risk of adopting a tactical asset allocation strategy. It is clear that tactical asset allocation consistently delivers higher returns at a lower risk. At the same time many are uncomfortable moving away from buy and hold which has been the mantra over the past twenty years.

In a previous article we introduced the notion of a core-satellite portfolio where the assets are split between tactical and strategic asset allocation strategies as a way of introducing tactical asset allocation in a step-by-step fashion.

TD Ameritrade making so many ETF’s available commission free allows another alternative to be considered and that is maintaining classic strategic asset allocation – i.e. all asset classes are fully represented at all times but with so many funds in each class, use fund momentum to rotate styles such that the funds in each asset class are regularly optimized.

CategoryJan-08Jan-09Jan-10Apr-10Jul-10Oct-10US EquitiesIWNVUG, MGKIWNVIGIWSVOInternational EquitiesEWJEWGEWJEWAAAXJAAXJEmerging MarketsEWZEWZEWZILFVWOVWOReal EstateVNQVNQVNQVNQVNQVNQCommoditiesDBCDBCDBCDBCDBCDBCBalanced FundAOKAOKAOKAOKAOKFixed IncomeSHY, WIP, JNKSHM, BWXSHY, WIP, JNKVCSH, BWX, JNKCASH, AGG, JNKCASH, AGG, JNKWe used the MyPlanIQ system to build and monitor a moderate risk (40% fixed income) strategic asset allocation portfolio. With five risk based asset classes, each of those classes would have 12% of the assets dedicated to them but the funds would be evaluated every month and the optimal fund selected based on the momentum within the class.

This can be compared with a Six asset SIB for which there is just one fund in each asset class.

From the performance chart, it is clear that there is increased upside potential from being able to switch funds within an asset class. Unfortunately, there is less ability to minimize downside risk when an asset class is under downward pressure.Despite this, for those who want to stay with a buy and hold in terms of asset classes, using this approach can squeeze some extra returns from the strategy.

With the large number of funds in six asset classes, momentum based asset allocation can be seen in its best light.

Portfolio Performance ComparisonPortfolio Name1Yr AR1Yr Sharpe3Yr AR3Yr Sharpe5Yr AR5Yr Sharpe13%87%13%86%20%128%10%83%-1%-6%9%46%11%93%1%5%8%40%Takeaways- ETF’s provide the basis for an outstanding portfolio with either strategic or tactical asset allocation. This is clearly demonstrated with TD’s wide range of commission free funds

- Using a web based application takes a lot of the effort from finding the best funds for either strategy

- Strategic asset allocation with styles rotation can deliver solid results using a well trusted strategy

- Tactical asset allocation greatly benefits from the large number of funds

labels:investment,

Symbols:GSG,DBC,AOK,EEM,GMM,PXH,DEM,SCHE,PCY,VTI,VT,IEV,VGK,PEF,DEB,EFA,VEU,GWL,PFA,EFG,EFV,PID,DWM,IFSM,VSS,SCHC,SCZ,IFGL,RWX,HYG,JNK,PHB,TIP,IEI,VGIT,ITE,AGG,CIU,BIV,BND,EWJ,JPP,PJO,DXJ,IVV,IYY,IWV,VV,SPY,DLN,RSP,SCHX,IVW,IWZ,JKE,VUG,ELG,QQQQ,RPG,SCHG,IVE,IWW,Commission,Free,ETFs,Strategic,Asset,Allocation,Tactical,Asset,Allocation,Asset,Allocation,styles,rotation,

- TD Ameritrade Commission Free ETF’s Empowers Both Strategic and Tactical Asset Allocation

10/19/2010

- Case Study: Hewlett Packard's 401K Plan

10/09/2010

- Three Asset Class Lazy Portfolios Reviewed

09/29/2010

- Google’s 401K Plan: Another Good Employee Benefit

09/26/2010

- Armstrong Index Based Lazy Portfolio Returns Study

09/17/2010

- Armstrong Index Based Lazy Portfolio Returns Study

09/17/2010

- Armstrong Index Based Lazy Portfolio Returns Study

09/17/2010

- Getting Most out of Your Retirement Plan: A Case Study on Hewlett Packard 401K Plan

09/16/2010

- How Does Your Garden Grow?

09/16/2010

- How Does Your Garden Grow?

09/16/2010