|

Vanguard ETF: |     |

7.4%* |

|

Diversified Core: |    |

8.1%* |

|

Six Core Asset ETFs: |    |

7.3%* |

Articles on VTV

- Google’s 401K Plan: Another Good Employee Benefit

09/26/2010

In our previous article, we discussed Hewlett Packard 401K plan. This article continues the series of case studies for various 401K plans for IT companies. It discusses Google 401K Plan and how portfolios in this plan are positioned in today’s market environment.

Google (NASDAQ: GOOG) is an internet search and advertising company that pioneered in search technology. It dominates search and its related advertising business. It is headquartered in the old SGI building in Mountain View, California. Google is well known for its talented employees and innovation friendly work environment. Google offers generous 401K match to its employees.

Google 401K plan consists of 15 funds. These funds enable participants to gain exposure to 4 major assets: US Equity, Foreign Equity, REITs and Fixed Income. The list of minor asset classes covered are

Large Blend: SPY, VTI

Mid-Cap Blend: MDY, IWR

Foreign Large Blend: EFA

Foreign Large Growth: EFG

Real Estate: IYR, ICF, VNQ

Intermediate-Term Bond: AGG, BND

Short Bond: BSVAs of 9/15/2010, this plan investment choice is rated as Above Average based on MyPlanIQ Plan Rating methodology that was designed to measure how effective a plan's available investment funds are. It has the following detailed ratings:

Diversification – Rated as average (score: 62%)

Fund Quality – Rated as above average (score: 65%)

Portfolio Building -- Rated as great (score: 92%)

Overall Rating: above average (score: 75%)

The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies (SAA and TAA, both provided by MyPlanIQ). For comparison purpose, we also include the moderate model portfolios of a typical four asset SIB (Simpler Is Better) plan. This SIB plan has the following candidate index funds and their ETFs equivalent:

US Equity (SPY or VTI)

Foreign Equity (EFA or VEU)

REITs (IYR or VNQ or ICF)

Fixed Income (AGG or BND)

Performance chart (as of 9/15/2010)Performance table (as of 9/15/2010)

1 Yr AR (%) 1 Yr Sharpe (%) 3 Yr AR (%) 3 Yr Sharpe(%) 5 Yr AR (%) 5 YR Sharpe (%) Plan SAA 9 83 1 4 4 18 4 SIB SAA 10 72 1 3 5 17 Plan TAA 14 93 11 97 11 101 4 SIB TAA 9 59 7 61 9 80 Currently, asset classes in REITs (Real Estate Investment Trusts) (VNQ, IYR, ICF) and fixed income (AGG, BND) are doing relatively well. These asset classes are available to Google 401k plan participants.

To summarize, Google 401K plan participants can achieve reasonable investment returns by adopting asset allocation strategies that are tailored to their risk profiles. Currently, the tactical asset allocation strategy indicates overweighing on REITs and fixed income funds.

labels:investment,

Symbols:GOOG,HPQ,SPY,VTI,IWD,VTV,IWF,VUG,MDY,IWR,EFA,EFG,EFV,SCZ,IYR,ICF,VNQ,BWX,PCY,EMB,BND,IEF,TLT,BSV,MUB,HYG,JNK,PHB,VEU,ETF,Portfolio,Building,Asset,Allocation,IRA,401K,

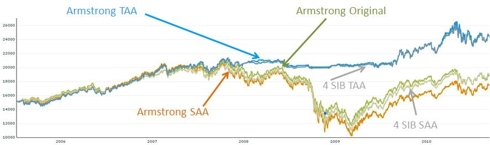

- Armstrong Index Based Lazy Portfolio Returns Study

09/17/2010

Frank Armstrong, author of The Informed Investor, proposed thisportfolio for an MSN Money article. The two key points of the portfolio are that it has four asset classes (US, International, REIT, Bonds) and relies on market indices rather than active management.The portfolio uses index funds because index funds eliminate manager risk. It overweights small-cap stocks as small-cap stocks have historically outperformed large caps stocks. The portfolio has a strong value tilt, based on the theory that, over the long haul, beaten-down stocks will perform better than high-flying growth stocks.

This should be a low cost, well performing portfolio.The fund selection for testing the strategy is listed below with the ETF alternatives:- 9.25% in Vanguard Small Cap Value VISVX (SCZ)

- 9.25% in Vanguard Value VIVAX (SPY, IYY)

- 6.25% in Vanguard Small-Cap Growth VISGX (VBK)

- 6.25% in Vanguard 500 Index VFINX (IVW)

- 31% in Vanguard Total International Stock VGTSX (EFA)

- 8% in Vanguard REIT VGSIX (IYR, VNQ, RWX)

- 30% in Vanguard Short-Term Bond VBISX (BND, AGG)

Things to note about the portfolio:- This is designed as a lazy portfolio with limited rebalancing specified

- With 70% in equities, this would be considered an aggressive portfolio

- REIT is possibly underweighted

We will create historical returns of this portfolio as originally planned and then compare against strategic asset allocation (annual rebalance) and tactical asset allocation. This will measure:- The impact of equal weighting of the equities – bonds will be fixed at 30% -- SAA strategy

- The impact of actively managing the equities – bonds remain fixed at 30% -- TAA strategy

We will then introduce a four asset SIB which will give a measure of the choice of funds. The SAA and TAA strategies will give the same weights to each of the funds but use simpler asset classes funds.4 Asset SIB Breakdown with ETF alternativesLARGE BLEND VTSMX (VTI)Foreign Large Blend VGTSX (VEU)REAL ESTATE VGSIX (VNQ)Intermediate-Term Bond VBMFX (BND)The results are shown below. There are a number of interesting things to note- The closest comparison of similar strategies is the Armstrong Original versus the Armstrong SAA. The Armstrong original outperforms SAA which says that overloading the US stocks towards small value is successful

- All of the buy and hold strategies suffer from the “downturn dip” and the tactical asset allocation strategies perform much better

- The difference between the two TAA strategies is negligible

Annual Returns 1 Year 3 Years 5 Years Original 8.83 -0.88 4.27 Armstrong SAA 13.91 -2.60 2.96 Armstrong TAA 12.71 7.30 10.43 4 SIB SAA 14.12 0.25 4.59 4 SIB TAA 12.32 7.15 10.21

Takeaways:- The Armstrong portfolio is a well constructed set of diversified assets based on market indices

- To reduce volatility in today’s economy, it might make sense to add commodities and emerging market equities

- The biggest impact on returns is moving to a tactical asset allocation strategy

- The SIB portfolios which can easily be executed with ETF’s perform very well and will be low cost

labels:investment,

Symbols:DIA,IYY,VTI,DVY,ONEQ,QCLN,QABA,PWC,VTV,VUG,IWM,IWO,IWW,MDY,IJJ,IJK,VO,AGG,BND,SHY,VBK,IJS,VBR,IWP,IWS,VEA,EFG,EFV,VWO,VEU,SCZ,SPY,IYR,IVW,RWX,EFA,VNQ,Tactical,Asset,Allocation,asset,allocation,armstong,ideal,index,strategic,asset,allocation,

- Getting Most out of Your Retirement Plan: A Case Study on Hewlett Packard 401K Plan

09/16/2010

Retirement investing is an integral part of American personal finance. With $8.9 trillion parked in over 800 thousand retirement plans (401K), millions of Americans will increasingly rely on their 401K accounts to fund their future retirement needs. This article is part of a series of case studies we are conducting for various 401K plans. In this article, we will discuss how participants in Hewlett Packard 401K plan can achieve reasonable investment results using asset allocation strategies. We will also discuss how those portfolios are positioned in today’s market environment.

Hewlett Packard (HP) (NYSE: HPQ) is one of the largest IT companies. Founded by Bill Hewlett and Dave Packard in Palo Alto, California, HP was the earliest technology company that eventually led the formation of Silicon Valley. Today Hewlett-Packard has over 300 thousands employees world wide.

HP is known to be employee friendly. It has been named several times as one of the best companies to work for. Its 401k plan provides a well diversified array of high quality funds.

Hewlett Packard 401K plan consists of 29 funds. These funds enable participants to gain exposure to 5 major assets: US Equity, Foreign Equity, Emerging Market Equity, REITs and Fixed Income. The the list of minor asset classes covered:

Large Blend: SPY, VTI

Large Value: IWD, VTV

Large Growth: IWF, VUG

Mid-Cap Blend: MDY, IWR

Foreign Large Blend: EFA

Foreign Large Growth: EFG

Foreign Large Value: EFV

Foreign Small/Mid Growth: SCZ

Diversified Emerging Mkts: EEM, VWO

Real Estate: IYR, ICF, VNQ

World Bond: BWX

Emerging Markets Bond: PCY, EMB

Inflation-Protected Bond: TIP

Intermediate-Term Bond: AGG, BND

Long Government: IEF, TLT

UltraShort Bond: BSV

Muni National Long: MUB

High Yield Bond: HYG, JNKAs of 9/13/2010, this plan investment choice is rated as Above Average based on MyPlanIQ Plan Rating methodology that was designed to measure how effective a plan's available investment funds are. It has the following detailed ratings:

Diversification – Rated as great (score: 89%)

Fund Quality – Rated as above average (score: 76%)

Portfolio Building -- Rated as above average (score: 72%)

Overall Rating: above average (score: 78%)

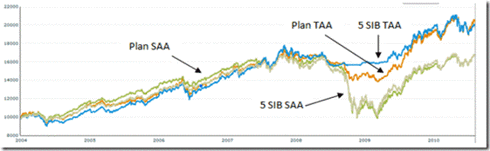

The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies (SAA and TAA, both provided by MyPlanIQ). For comparison purpose, we also include the moderate model portfolios of a typical five asset SIB (Simpler Is Better) plan. This SIB plan has the following candidate index funds and their ETFs equivalent:

US Equity (SPY or VTI)

Foreign Equity (EFA or VEU)

Emerging Market Equity (EEM or VWO)

REITs (IYR or VNQ or ICF)

Fixed Income (AGG or BND)

Performance chart (as of 9/13/2010)Performance table (as of 9/13/2010)

1 Yr AR (%) 1 Yr Sharpe (%) 3 Yr AR (%) 3 Yr Sharpe(%) 5 Yr AR (%) 5 YR Sharpe (%) Plan SAA 15.95 145.83 2.34 10.27 5.76 29.43 5 SIB SAA 13.09 96.52 2.49 8.77 6.74 29.02 Plan TAA 15.53 103.28 9.35 73.75 11.43 88.56 5 SIB TAA 9.99 68.82 8.11 66.77 11.62 92.08 Currently, asset classes in emerging market stocks (EEM, VWO), REITs (Real Estate Investment Trusts) (VNQ, IYR, ICF) and fixed income (AGG, BND) are doing relatively well. These asset classes are available to HP 401k participants.

To summarize, Hewlett Packard 401K plan participants can achieve reasonable investment returns by adopting asset allocation strategies that are tailored to their risk profiles. Currently, the tactical asset allocation strategy indicates overweighing on emerging market stocks, REITs and fixed income funds.

labels:investment,

Symbols:HPQ,SPY,VTI,IWD,VTV,IWF,VUG,MDY,IWR,EFA,EFG,EFV,SCZ,IYR,ICF,VNQ,BWX,PCY,EMB,BND,IEF,TLT,BSV,MUB,HYG,JNK,PHB,VEU,ETF,Portfolio,Building,Asset,Allocation,IRA,401K,

- How Does Your Garden Grow?

09/16/2010

Jim Lowell edits MarketWatch's ETF Trader, an investment letter employing a momentum-based exchange-traded-fund strategy for long-term investors. Large/small stocks, proposed his Sower's Growth Portfolio. This is a diversified portfolio of exchange-traded funds. The view is that a growing economy tends to create a growing portfolio.This portfolio is heavily equity and US focused. It is a diversified portfolio of exchange-traded funds including Big-caps ETF (DIAIYYONEQ PWC), Midcaps ETF(MDY), Small-caps ETF (IWM) and foreign ETF(EFA).The fund selection for testing the strategy is listed below with the ETF alternatives:

US Equities- 10% in Diamonds Trust DIA (SPY)

- 15% in iShares DJ U.S. Total Market IYY (VTI, DVY)

- 7.5% in Fidelity NASDAQ Composite ONEQ (QCLN, QABA)

- 7.5% in Power Shares Dynamic Market PWC (VTV, VUG)

- 10% in iShares Russell 2000 IWM (IWO, IWW)

- 15% in Mid Cap SPDR Trust MDY (IJJ, VO)

International Equities

- 25% in iShares MSCI International EAFE EFA (VEA, EFV)

- 10% in iShares MSCI Emerging Markets EEM (VWO)

Things to note about the portfolio:- 100% in equities is an aggressive portfolio

- 65% in US equities is high in today’s market environment

- There is no real estate (IYR, VNQ, ICF) or fixed income which would likely result in improved performance today

- With three asset classes (US, international and emerging markets), this can be mapped against a 3 asset class SIB

We will make a comparison of the performance of this portfolio against strategic asset allocation (equally spread assets), tactical asset allocation and against 3 asset class SIB portfolios we discussed in a previous article,The 3 asset class SIB breakdown- Large Blend VTSMX (ETF VTI)

- Foreign Large Blend VGTSX (ETF VEU)

- Intermediate-Term Bond VBMFX (ETF BND)

There are a number things to note about the comparisons:- The Lowell SAA and TAA were driven with a 100% in equities -- the TAA strategy will move to fixed income (cash) should the momentum drive it that way, the SAA strategy will not

- The 3 asset SIBs are using an aggressive model portfolio that still includes some fixed income

Summary Returns of Lowell's Portfolios Annual Returns 1 year 3 Year 5 Year Lowell Original 9.04 -5.38 2.25 Lowell SAA 13.14 -13.6 1.83 Lowell TAA 6.23 5.26 13.26 3 SIB SAA 7.03 -3.39 3.29 3 SIB TAA -4.23 0.63 5.76

The results are shown above. There are a number of interesting things to note :- The choice of funds, even if diversification enables reasonable returns

- Before the downturn, the original portfolio was outperforming everything except the dynamic allocation of the original strategy

- The strategy falls foul of the 2008/2009 downturn and tracks pretty closely with any buy and hold strategy

- The three asset SIBs have a fixed income fund that enables slightly better performance in choppier market conditions

- The Lowell choice of funds allows the tactical asset allocation strategy to outperform the three asset class SIB with TAA

- The 2008/2009 downturn shows the benefits of a tactical asset allocation – even if it means moving equities to cash

Takeaways:- The Sower’s growth portfolio is a low maintenance portfolio that is heavily weighted towards US equities. In the long term, there is still confidence in the US economy but following this portfolio and strategy will give you some heartache

- This portfolio was created when the sort of downturn we experienced in 2007/2008 was not envisioned -- it's hard to imagine that this portfolio would still be recommended today

- Migrating to a dynamic strategy with the same funds provides much higher returns. Given a dynamic strategy, it would make sense to add some fixed income such as AGG, BND, SHY, CSJ rather than just cash

- Conventional tactical asset allocation with the right number of asset classes (at least five) still provides the best performance

- ETF’s give you a good degree of choice a good vehicle for any portfolio and with increasing track record, it’s possible to demonstrate good historical performance

labels:investment,

Symbols:DIA,IYY,VTI,DVY,ONEQ,QCLN,QABA,PWC,VTV,VUG,IWM,IWO,IWW,MDY,IJJ,IJK,VO,AGG,BND,SHY,SPY,VBK,IJS,IWP,IWS,VEA,EFG,EFV,VWO,VEU,ETF,Asset,Allocation,Tactical,Asset,Allocation,

- Schwab ETFs Review

07/27/2010

In June, Schwab announced reducing expenses for their proprietary ETFs. This, along with recently announced commission free ETF trading from Schwab, Vanguard and Fidelity, represents an important and promising trend for ETFs in portfolio building. The following is the comparison among similar ETFs from Schwab, Vanguard and iShares.

Schwab Vanguard iShares Schwab U.S. Broad Market ETF SCHB (0.06%) VTI (0.07%) IWV(0.21%) Schwab U.S. Large-Cap ETF SCHX (0.08%) VV (0.12%) IVV (0.09%) Schwab U.S. Large-Cap Growth ETF SCHG (0.13%) VUG (0.14%) IVW (0.18%) Schwab U.S. Large-Cap Value ETF SCHV (0.13%) VTV (0.14%) IVE (0.18%) Schwab U.S. Small-Cap ETF SCHA (0.13%) VB (0.14%) IJR (0.20%) Schwab International Equity ETF SCHF (0.13%) VEA (0.14%) EFA (0.35%) Schwab International Small-Cap Equity ETF SCHC (0.35%) VSS (0.40%) SCZ (0.40%) Schwab Emerging Markets Equity ETF SCHE (0.25%) VWO (0.27%) EEM (0.72%) So far, Schwab ETFs are all equity (stock) index based funds that include U.S. stocks, international stocks and emerging market equity. Compared with iShares or even Vanguard, Schwab has been late in the game and their ETFs have short history. However, Schwab has a relatively good record in their mutual funds that are managed using quantitative models. That experience using quantitative models in their portfolio management certainly can help their ETF management. Ultimately, what it really matters for investors are the total returns of ETFs that reflect both expenses (taken out from asset under management, usually monthly) and fund performance before fee. The following is the total annualized return table for ETFs from Schwab, Vanguard and iShares up to 7/23/2010. All performance data are calculated from Schwab ETFs’ inception date.

Schwab Vanguard iShares Schwab U.S. Broad Market ETF (inception 11/03/2009) SCHB (11.78%) VTI (11.09%) IWV(11.9%) Schwab U.S. Large-Cap ETF (inception 11/03/2009) SCHX (10.57%) VV (9.54%) IVV (9.37%) Schwab U.S. Large-Cap Growth ETF (inception 1/4/2010) SCHG (-4.23%) VUG (-4.72%) IVW (-5.81%) Schwab U.S. Large-Cap Value ETF (inception 12/15/2009) SCHV (1.48%) VTV (1.06%) IVE (0.5%) Schwab U.S. Small-Cap ETF (inception 11/03/2009) SCHA (23.92%) VB (23.25%) IJR (22.08%) Schwab International Equity ETF (inception 11/03/2009) SCHF (-0.01%) VEA (-2.25%) EFA (-4.03%) Schwab International Small-Cap Equity ETF (inception 1/14/2010) SCHC (-9.51%) VSS (-8.43%) SCZ (-11.14%) Schwab Emerging Markets Equity ETF (inception 1/14/2010) SCHE (-3.09%) VWO (-2.49%) EEM (-5.77%) From their short history, it is very impressive that almost all of Schwab ETFs deliver better or no worse total returns: all Schwab ETFs outperform their iShares counterparts while, compared with Vanguard, only SCHE (emerging mkt equity) and SCHC (international small cap) slightly underperform Vanguard VWO and VSS respectively. Coupled with commission free trades for these ETFs, Schwab ETFs are very enticing for investors. The main drawback, however, is that Schwab does not offer ETFs in other major asset classes, especially in fixed income (it was reported that Schwab will soon provide fixed income ETFs). To build an effective portfolio, investors are forced to use other ETFs to cover missing major asset classes such as fixed income. Schwab charges $8.95 per trade for ETFs provided by other parties.

MyPlanIQ maintains Schwab Commission Efficient ETFs Plan. Since Schwab's ETFs only cover Domestic and International Equities, the additional ETFs are used to include other major asset classes including US REIT (IYR), Global REIT (IGR), Commodities (DBC, GLD), International Bonds (BWX), Fixed Incomes and Long/Intermediate/Short US Treasury Bonds (TLT, IEI, SHY) and High Yield Junk Bond (JNK). These additional ETFs are not commission free in a Schwab brokerage account. The strategic and tactical asset allocation moderate portfolios have the following performance:

1 Yr Annual Return 3 Year Annual Return 5 Year Annual Return Strategic Asset Allocation Moderate 20% 0% 3% Tactical Asset Allocation Moderate 4% 5% 6% In conclusion, like Vanguard ETFs, Schwab proprietary ETFs offer compelling values for portfolio building: low cost and commission free. To make their ETFs widely usable and competitive to iShares, however, Schwab (as well as Vanguard) needs to help to increase trading volume for these ETFs so that the tracking errors/friction could be reduced. This is perhaps the major important remaining obstacle for these ETFs to become staples for portfolios.

Symbols:schb,vti,iwv,schx,vv,ivv,schg,vug,ivw,schv,vtv,ive,scha,vb,ijr,schf,vea,efa,schc,vss,scz,sche,vwo,eem,iyr,icf,igr,dbc,gld,bwx,tlt,iei,shy,jnk,iyg,agg,bnd,

- Aflac Incorporated 401(k) Savings and Profit Sharing Plan Report On 12/03/2010

12/03/2010

This report reviews Aflac Incorporated 401(k) Savings and Profit Sharing Plan plan. We will discuss the investment choices and present the plan rating by MyPlanIQ. Current economic and market conditions are discussed in the context of the investment portfolios in the plan. We will then show how participants in Aflac Incorporated 401(k) Savings and Profit Sharing Plan can achieve reasonable investment results using asset allocation strategies.

Plan Review and Rating

AFLAC Inc (Ticker:AFL) has the "Aflac Incorporated 401(k) Savings and Profit Sharing Plan".

Aflac Incorporated 401(k) Savings and Profit Sharing Plan's 401K plan consists of 11 funds. These funds enable participants to gain exposure to 3 major assets: US Equity, Foreign Equity, Fixed Income. The list of minor asset classes covered:

Foreign Large Blend: EFA, VEU, GWL, PFA

Intermediate-term Bond: AGG, CIU, BIV, BND

Large Blend: IVV, IYY, IWV, VTI, VV, SPY, DLN, RSP, SCHX

Large Growth: IVW, IWZ, JKE, VUG, ELG, QQQQ, RPG, SCHG

Large Value: IVE, IWW, JKF, VTV, ELV, PWV, RPV, SCHV

Mid-cap Growth: IJK, IWP, VOT, EMG, PWJ, RFG, UKW

Moderate Allocation: AOM

Small Growth: IJT, IWO, JKK, VBK, DSG, PWT, RZG, UKK

As of Dec 2, 2010, this plan investment choice is rated as based on MyPlanIQ Plan Rating methodology that measures the effectiveness of a plan's available investment funds. It has the following detailed ratings:

Diversification -- Rated as (35%)

Fund Quality -- Rated as (33%)

Portfolio Building -- Rated as (36%)

Overall Rating: (35%)Current Economic and Market Conditions

We have experienced an uncertain 2010: plenty of worries on whether the US economy will climb out of the great recession and recover.

- The Federal Reserve embarked on Quantitative Easing II (QE2) to stimulate the economy.

- The housing market is still at its low but largely stabilized.

- The unemployment rate is stuck at 9%.

Americans continue to face an uncertain future, given (among others) the high unemployment rate, large federal and local government debts and global trade imbalance. With such an economic backdrop, the stock and debt markets are going to be volatile. Despite this, markets have been resilient and appear positioned to rebound.

In this market it is even more critical to properly diversify and respond market changes. MyPlanIQ offers two asset allocation strategies: strategic and tactical asset allocation strategies ( SAA and TAA for participants in Aflac Incorporated 401(k) Savings and Profit Sharing Plan).

Strategic Asset Allocation is based on well known modern portfolio theory and its key features include: diversification, proper fund selection and periodically re-balancing.

Tactical Asset Allocation works on a diversified array of assets provided by funds in a plan and adjusts asset mixes based on market conditions such as asset price momentum utilized by TAA.

Portfolio Discussions

The chart and table below show the historical performance of moderate model portfolios employing strategic and tactical asset allocation strategies. For comparison purpose, we also include the moderate model portfolios of a typical 3 asset SIB (Simpler Is Better) plan . This SIB plan has the following candidate index funds and their ETFs equivalent:

US Equity: (SPY or VTI)

Foreign Equity: (EFA or VEU)

Fixed Income: (AGG or BND)

Performance chart (as of Dec 2, 2010)Performance table (as of Dec 2, 2010)

Portfolio Name 1Yr AR 1Yr Sharpe 3Yr AR 3Yr Sharpe 5Yr AR 5Yr Sharpe Aflac Incorporated 401(k) Savings and Profit Sharing Plan Tactical Asset Allocation Moderate 4% 34% 5% 64% 8% 81% Aflac Incorporated 401(k) Savings and Profit Sharing Plan Strategic Asset Allocation Moderate 10% 100% 2% 8% 6% 31% Three Core Asset ETF Index Funds Tactical Asset Allocation Moderate -4% -35% 1% 9% 4% 27% Three Core Asset ETF Index Funds Strategic Asset Allocation Moderate 9% 60% -0% -3% 4% 13% Currently, asset classes in US Equity (SPY,VTI), Foreign Equity (EFA,VEU) and Fixed Income (AGG,BND) are doing relatively well. These asset classes are available to Aflac Incorporated 401(k) Savings and Profit Sharing Plan participants.

To summarize, Aflac Incorporated 401(k) Savings and Profit Sharing Plan plan participants can achieve reasonable investment returns by adopting asset allocation strategies that are tailored to their risk profiles.

Symbols: AFL , SPY , VTI , EFA , VEU , AGG , BND , AOM , CIU , BIV , GWL , PFA , IVE , IWW , JKF , VTV , ELV , PWV , RPV , SCHV , IVV , IYY , IWV , VV , DLN , RSP , SCHX , IVW , IWZ , JKE , VUG , ELG , QQQQ , RPG , SCHG , IJK , IWP , VOT , EMG , PWJ , RFG , UKW , IJT , IWO , JKK , VBK , DSG , PWT , RZG , UKK

- ALLERGAN, INC. SAVINGS AND INVESTMENT PLAN Report On 12/03/2010

12/03/2010

- Apartment Investment and Management Company 401(k) Retirement Plan Report On 12/03/2010

12/03/2010

- ASSURANT 401(k) PLAN A&PLAN B Report On 12/03/2010

12/03/2010

- Abercrombie Fitch Co. Savings and Retirement Plan Report On 12/03/2010

12/03/2010

- Apache Design Solutions 401K Report On 12/03/2010

12/03/2010

- Allegheny Ludlum Corporation Personal Retirement and 401(k) Savings Account Plan Report On 12/03/2010

12/03/2010

- ALLEGHENY ENERGY EMPLOYEE STOCK OWNERSHIP AND SAVINGS PLAN Report On 12/03/2010

12/03/2010

- BAKER 401(k) PLAN Report On 12/03/2010

12/03/2010

- BRISTOL-MYERS SQUIBB COMPANY SAVINGS AND INVESTMENT PROGRAM Report On 12/03/2010

12/03/2010

- PEABODY WESTERN-UMWA 401(K) PLAN Report On 12/03/2010

12/03/2010

- Peabody Investments Corp.Employee Retirement Account Report On 12/03/2010

12/03/2010

- Capital Accumulation Plan of The Chubb Corporation Report On 12/03/2010

12/03/2010

- CEPHALON, INC. 401(k) PROFIT SHARING PLAN Report On 12/03/2010

12/03/2010

- Danaher Corporation Subsidiaries Retirement and Savings Plan Report On 12/03/2010

12/03/2010

- Danaher Corporation Subsidiaries Savings Plan Report On 12/03/2010

12/03/2010

- EQT CORPORATION SAVINGS AND PROTECTION PLAN Report On 12/03/2010

12/03/2010

- Vanguard Variable Annuity Report On 12/06/2010

12/06/2010

- TD Ameritrade Commission Free ETFs Report On 12/07/2010

12/07/2010

- Qualcomm 401(k) Plan Report On 12/07/2010

12/07/2010

- Vanguard-VA-Clone Report On 12/07/2010

12/07/2010

- Tiffany Co. Employee Profit Sharing and Retirement Savings Plan Report On 03/21/2011

03/21/2011

- Sprint Nextel 401K Plan Report On 03/21/2011

03/21/2011