Currencies Snap Back -- Show Their True Colors

03/29/2011 0 comments

One of the most glaring holes in our education system is retirement investing. Much is said about day trading and the high wire acts of Hedge Funds. Retirement investing is a long term proposition and is similar to looking after your health – do what is sensible and have occasional checkups that become more frequent as you age. We continue to look for areas of investment where we can find long term investment ideas that can give balance to a portfolio to increase risk adjusted returns.

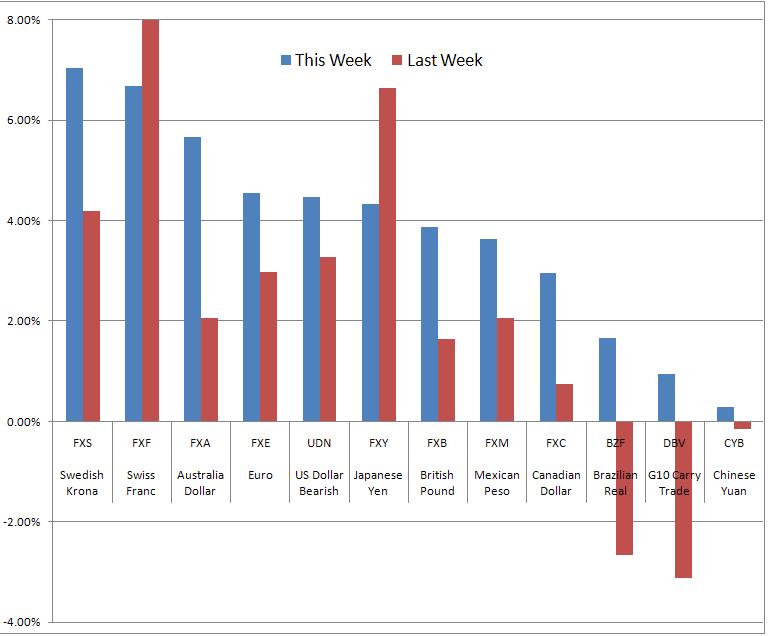

We report on currencies movements by using representative ETF's to uncover whether there are possible longer term investments.

The trend score is defined as the average of 1,4,13,26 and 52 week total returns (including dividend reinvested).

We can see considerable volatility over the past two weeks.All currencies except the Japanese Yen is up this week. This is not a surprise as central banks are doing their best to keep the Yen down to help Japan in their current crisis. Currencies have been under pressure over the last couple of weeks and this is the start of a recovery.

Over the past few months, we have seen the Krona replace the Aussie Dollar at the top of the table -- but things were relatively stable. Over the last couple of weeks there was significant juggling of the order. The Swiss Franc jumped to the top of the list and the Yen, Dollar and Euro popped into the top half of the list, this week, we see the order return to its pre-crisis state.

Top and bottom notes:

- The Aussie Dollar and Swedish Krona have been impacted by the impact of the recent crisis -- oil prices and commodity prices are going to weigh on the Australian economy. The Swedish economy, while not closely tied to Europe will be impacted by oil prices and the worry of slower growth.

- The Swiss Franc is the currency that marches to the beat of its own drum in times of increased risk. It has clearly spiked as tension was heightened and is dropping as tension reduces.

- The Real and the Yuan are both good long term bets but continue to have a range of issues related to sovereign governance. Until they are sorted out, they are likely to remain at the bottom of the return table.

There is opportunity trading currencies for those with the intestinal fortitude. For those who have a longer term horizon, it is possible to consider adding the Swiss ETF in a portfolio to hedge against world crises.

Symbols: FXA, FXM, BZF, FXY, FXC, FXF, FXS, DBV, CYB, UDN, FXB, FXE

Symbols: (FXA),(FXM),(BZF),(FXY),(FXC),(FXF),(FXS),(DBV),(CYB),(UDN),(FXB),(FXE),

Disclosure:

MyPlanIQ does not have any business relationship with the company or companies mentioned in this article. It does not set up their retirement plans. The performance data of portfolios mentioned above are obtained through historical simulation and are hypothetical.

comments 0