|

Vanguard ETF: |     |

7.4%* |

|

Diversified Core: |    |

8.1%* |

|

Six Core Asset ETFs: |    |

7.3%* |

Articles on Tactical

- TD Ameritrade Commission Free ETF’s Empowers Both Strategic and Tactical Asset Allocation

10/19/2010

The recent news that TD Ameritrade are providing over 100 ETF’s commission free is a perfect fit for a retirement portfolio. Investors are able to trade once a month and pick from a wide range of ETF’s without incurring any trading fees. Combine this with an IRA where the tax consequences of trading are removed and you have an almost ideal scenario and back tested returns demonstrate the point.

There is a continuing dilemma between wanting to increase returns while mitigating downside risk against the perceived risk of adopting a tactical asset allocation strategy. It is clear that tactical asset allocation consistently delivers higher returns at a lower risk. At the same time many are uncomfortable moving away from buy and hold which has been the mantra over the past twenty years.

In a previous article we introduced the notion of a core-satellite portfolio where the assets are split between tactical and strategic asset allocation strategies as a way of introducing tactical asset allocation in a step-by-step fashion.

TD Ameritrade making so many ETF’s available commission free allows another alternative to be considered and that is maintaining classic strategic asset allocation – i.e. all asset classes are fully represented at all times but with so many funds in each class, use fund momentum to rotate styles such that the funds in each asset class are regularly optimized.

CategoryJan-08Jan-09Jan-10Apr-10Jul-10Oct-10US EquitiesIWNVUG, MGKIWNVIGIWSVOInternational EquitiesEWJEWGEWJEWAAAXJAAXJEmerging MarketsEWZEWZEWZILFVWOVWOReal EstateVNQVNQVNQVNQVNQVNQCommoditiesDBCDBCDBCDBCDBCDBCBalanced FundAOKAOKAOKAOKAOKFixed IncomeSHY, WIP, JNKSHM, BWXSHY, WIP, JNKVCSH, BWX, JNKCASH, AGG, JNKCASH, AGG, JNKWe used the MyPlanIQ system to build and monitor a moderate risk (40% fixed income) strategic asset allocation portfolio. With five risk based asset classes, each of those classes would have 12% of the assets dedicated to them but the funds would be evaluated every month and the optimal fund selected based on the momentum within the class.

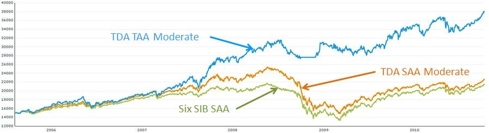

This can be compared with a Six asset SIB for which there is just one fund in each asset class.

From the performance chart, it is clear that there is increased upside potential from being able to switch funds within an asset class. Unfortunately, there is less ability to minimize downside risk when an asset class is under downward pressure.Despite this, for those who want to stay with a buy and hold in terms of asset classes, using this approach can squeeze some extra returns from the strategy.

With the large number of funds in six asset classes, momentum based asset allocation can be seen in its best light.

Portfolio Performance ComparisonPortfolio Name1Yr AR1Yr Sharpe3Yr AR3Yr Sharpe5Yr AR5Yr Sharpe13%87%13%86%20%128%10%83%-1%-6%9%46%11%93%1%5%8%40%Takeaways- ETF’s provide the basis for an outstanding portfolio with either strategic or tactical asset allocation. This is clearly demonstrated with TD’s wide range of commission free funds

- Using a web based application takes a lot of the effort from finding the best funds for either strategy

- Strategic asset allocation with styles rotation can deliver solid results using a well trusted strategy

- Tactical asset allocation greatly benefits from the large number of funds

labels:investment,

Symbols:GSG,DBC,AOK,EEM,GMM,PXH,DEM,SCHE,PCY,VTI,VT,IEV,VGK,PEF,DEB,EFA,VEU,GWL,PFA,EFG,EFV,PID,DWM,IFSM,VSS,SCHC,SCZ,IFGL,RWX,HYG,JNK,PHB,TIP,IEI,VGIT,ITE,AGG,CIU,BIV,BND,EWJ,JPP,PJO,DXJ,IVV,IYY,IWV,VV,SPY,DLN,RSP,SCHX,IVW,IWZ,JKE,VUG,ELG,QQQQ,RPG,SCHG,IVE,IWW,Commission,Free,ETFs,Strategic,Asset,Allocation,Tactical,Asset,Allocation,Asset,Allocation,styles,rotation,

- Armstrong Index Based Lazy Portfolio Returns Study

09/17/2010

Frank Armstrong, author of The Informed Investor, proposed thisportfolio for an MSN Money article. The two key points of the portfolio are that it has four asset classes (US, International, REIT, Bonds) and relies on market indices rather than active management.The portfolio uses index funds because index funds eliminate manager risk. It overweights small-cap stocks as small-cap stocks have historically outperformed large caps stocks. The portfolio has a strong value tilt, based on the theory that, over the long haul, beaten-down stocks will perform better than high-flying growth stocks.

This should be a low cost, well performing portfolio.The fund selection for testing the strategy is listed below with the ETF alternatives:- 9.25% in Vanguard Small Cap Value VISVX (SCZ)

- 9.25% in Vanguard Value VIVAX (SPY, IYY)

- 6.25% in Vanguard Small-Cap Growth VISGX (VBK)

- 6.25% in Vanguard 500 Index VFINX (IVW)

- 31% in Vanguard Total International Stock VGTSX (EFA)

- 8% in Vanguard REIT VGSIX (IYR, VNQ, RWX)

- 30% in Vanguard Short-Term Bond VBISX (BND, AGG)

Things to note about the portfolio:- This is designed as a lazy portfolio with limited rebalancing specified

- With 70% in equities, this would be considered an aggressive portfolio

- REIT is possibly underweighted

We will create historical returns of this portfolio as originally planned and then compare against strategic asset allocation (annual rebalance) and tactical asset allocation. This will measure:- The impact of equal weighting of the equities – bonds will be fixed at 30% -- SAA strategy

- The impact of actively managing the equities – bonds remain fixed at 30% -- TAA strategy

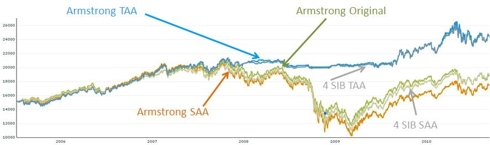

We will then introduce a four asset SIB which will give a measure of the choice of funds. The SAA and TAA strategies will give the same weights to each of the funds but use simpler asset classes funds.4 Asset SIB Breakdown with ETF alternativesLARGE BLEND VTSMX (VTI)Foreign Large Blend VGTSX (VEU)REAL ESTATE VGSIX (VNQ)Intermediate-Term Bond VBMFX (BND)The results are shown below. There are a number of interesting things to note- The closest comparison of similar strategies is the Armstrong Original versus the Armstrong SAA. The Armstrong original outperforms SAA which says that overloading the US stocks towards small value is successful

- All of the buy and hold strategies suffer from the “downturn dip” and the tactical asset allocation strategies perform much better

- The difference between the two TAA strategies is negligible

Annual Returns 1 Year 3 Years 5 Years Original 8.83 -0.88 4.27 Armstrong SAA 13.91 -2.60 2.96 Armstrong TAA 12.71 7.30 10.43 4 SIB SAA 14.12 0.25 4.59 4 SIB TAA 12.32 7.15 10.21

Takeaways:- The Armstrong portfolio is a well constructed set of diversified assets based on market indices

- To reduce volatility in today’s economy, it might make sense to add commodities and emerging market equities

- The biggest impact on returns is moving to a tactical asset allocation strategy

- The SIB portfolios which can easily be executed with ETF’s perform very well and will be low cost

labels:investment,

Symbols:DIA,IYY,VTI,DVY,ONEQ,QCLN,QABA,PWC,VTV,VUG,IWM,IWO,IWW,MDY,IJJ,IJK,VO,AGG,BND,SHY,VBK,IJS,VBR,IWP,IWS,VEA,EFG,EFV,VWO,VEU,SCZ,SPY,IYR,IVW,RWX,EFA,VNQ,Tactical,Asset,Allocation,asset,allocation,armstong,ideal,index,strategic,asset,allocation,

- How Does Your Garden Grow?

09/16/2010

Jim Lowell edits MarketWatch's ETF Trader, an investment letter employing a momentum-based exchange-traded-fund strategy for long-term investors. Large/small stocks, proposed his Sower's Growth Portfolio. This is a diversified portfolio of exchange-traded funds. The view is that a growing economy tends to create a growing portfolio.This portfolio is heavily equity and US focused. It is a diversified portfolio of exchange-traded funds including Big-caps ETF (DIAIYYONEQ PWC), Midcaps ETF(MDY), Small-caps ETF (IWM) and foreign ETF(EFA).The fund selection for testing the strategy is listed below with the ETF alternatives:

US Equities- 10% in Diamonds Trust DIA (SPY)

- 15% in iShares DJ U.S. Total Market IYY (VTI, DVY)

- 7.5% in Fidelity NASDAQ Composite ONEQ (QCLN, QABA)

- 7.5% in Power Shares Dynamic Market PWC (VTV, VUG)

- 10% in iShares Russell 2000 IWM (IWO, IWW)

- 15% in Mid Cap SPDR Trust MDY (IJJ, VO)

International Equities

- 25% in iShares MSCI International EAFE EFA (VEA, EFV)

- 10% in iShares MSCI Emerging Markets EEM (VWO)

Things to note about the portfolio:- 100% in equities is an aggressive portfolio

- 65% in US equities is high in today’s market environment

- There is no real estate (IYR, VNQ, ICF) or fixed income which would likely result in improved performance today

- With three asset classes (US, international and emerging markets), this can be mapped against a 3 asset class SIB

We will make a comparison of the performance of this portfolio against strategic asset allocation (equally spread assets), tactical asset allocation and against 3 asset class SIB portfolios we discussed in a previous article,The 3 asset class SIB breakdown- Large Blend VTSMX (ETF VTI)

- Foreign Large Blend VGTSX (ETF VEU)

- Intermediate-Term Bond VBMFX (ETF BND)

There are a number things to note about the comparisons:- The Lowell SAA and TAA were driven with a 100% in equities -- the TAA strategy will move to fixed income (cash) should the momentum drive it that way, the SAA strategy will not

- The 3 asset SIBs are using an aggressive model portfolio that still includes some fixed income

Summary Returns of Lowell's Portfolios Annual Returns 1 year 3 Year 5 Year Lowell Original 9.04 -5.38 2.25 Lowell SAA 13.14 -13.6 1.83 Lowell TAA 6.23 5.26 13.26 3 SIB SAA 7.03 -3.39 3.29 3 SIB TAA -4.23 0.63 5.76

The results are shown above. There are a number of interesting things to note :- The choice of funds, even if diversification enables reasonable returns

- Before the downturn, the original portfolio was outperforming everything except the dynamic allocation of the original strategy

- The strategy falls foul of the 2008/2009 downturn and tracks pretty closely with any buy and hold strategy

- The three asset SIBs have a fixed income fund that enables slightly better performance in choppier market conditions

- The Lowell choice of funds allows the tactical asset allocation strategy to outperform the three asset class SIB with TAA

- The 2008/2009 downturn shows the benefits of a tactical asset allocation – even if it means moving equities to cash

Takeaways:- The Sower’s growth portfolio is a low maintenance portfolio that is heavily weighted towards US equities. In the long term, there is still confidence in the US economy but following this portfolio and strategy will give you some heartache

- This portfolio was created when the sort of downturn we experienced in 2007/2008 was not envisioned -- it's hard to imagine that this portfolio would still be recommended today

- Migrating to a dynamic strategy with the same funds provides much higher returns. Given a dynamic strategy, it would make sense to add some fixed income such as AGG, BND, SHY, CSJ rather than just cash

- Conventional tactical asset allocation with the right number of asset classes (at least five) still provides the best performance

- ETF’s give you a good degree of choice a good vehicle for any portfolio and with increasing track record, it’s possible to demonstrate good historical performance

labels:investment,

Symbols:DIA,IYY,VTI,DVY,ONEQ,QCLN,QABA,PWC,VTV,VUG,IWM,IWO,IWW,MDY,IJJ,IJK,VO,AGG,BND,SHY,SPY,VBK,IJS,IWP,IWS,VEA,EFG,EFV,VWO,VEU,ETF,Asset,Allocation,Tactical,Asset,Allocation,