Re-balance Cycle Reminder All MyPlanIQ’s newsletters are archived here.

For regular SAA and TAA portfolios, the next re-balance will be on Monday, January 19, 2016. You can also find the re-balance calendar for 2015 on ‘Dashboard‘ page once you log in.

As a reminder to expert users: advanced portfolios are still re-balanced based on their original re-balance schedules and they are not the same as those used in Strategic and Tactical Asset Allocation (SAA and TAA) portfolios of a plan.

Please note that we now list the next re-balance date on every portfolio page.

High Yield Bonds And Their Correlation With Stocks

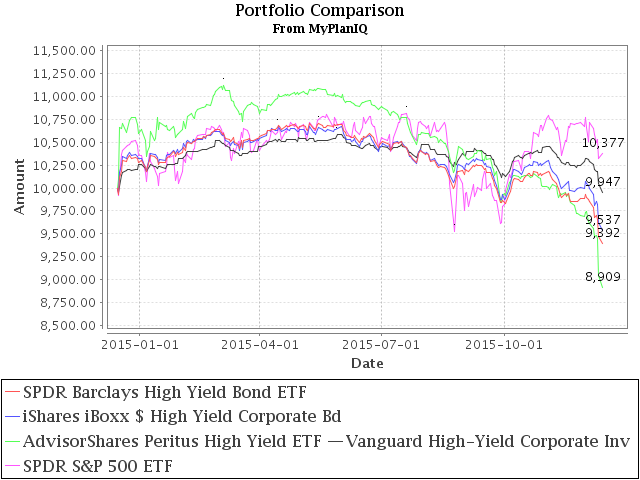

High yield bonds have behaved very weak all year:

High Yield Bond Funds Performance Comparison (as of 12/14/2015):

| Ticker/Portfolio Name | YTD Return** |

1Yr AR | 3Yr AR | 5Yr AR |

|---|---|---|---|---|

| JNK (SPDR Barclays High Yield Bond ETF) | -8.6% | -5.8% | -0.8% | 3.3% |

| HYG (iShares iBoxx $ High Yield Corporate Bd) | -7.6% | -4.7% | -0.1% | 3.7% |

| HYLD (AdvisorShares Peritus High Yield ETF) | -14.6% | -13.8% | -5.9% | -0.4% |

| VWEHX (Vanguard High-Yield Corporate Inv) | -3.0% | -1.0% | 2.1% | 5.6% |

| SPY (SPDR S&P 500 ETF) | -0.3% | 0.9% | 14.4% | 12.4% |

We include HYLD (AdvisorShares Peritus High Yield ETF) as this is one of those high yield bond funds that did exceptionally well in 2012 and 2013 but started to tank in 2014, very similar to TFCIX (Third Avenue Focused Credit Instl) (more about it later). The fund is loaded with many energy related debts and has suffered greatly since oil price dropped.

Recently, as oil price continued to drop and markets are facing an uncertainty on whethe the Federal Reserve posed to raise interest rate, high yield bonds accelerated their downside. The biggest news was that on Thursday last week TFCIX (Third Avenue Focused Credit Instl) announced that it stopped redemption from its investors, due to many illiquid high yield bonds it held. We mentioned the famed Third Avenue value fund TAVFX in our recent newsletter November 23, 2015: Active Stock Fund Performance Consistency.

As of today, the high yield bond carnage continues.

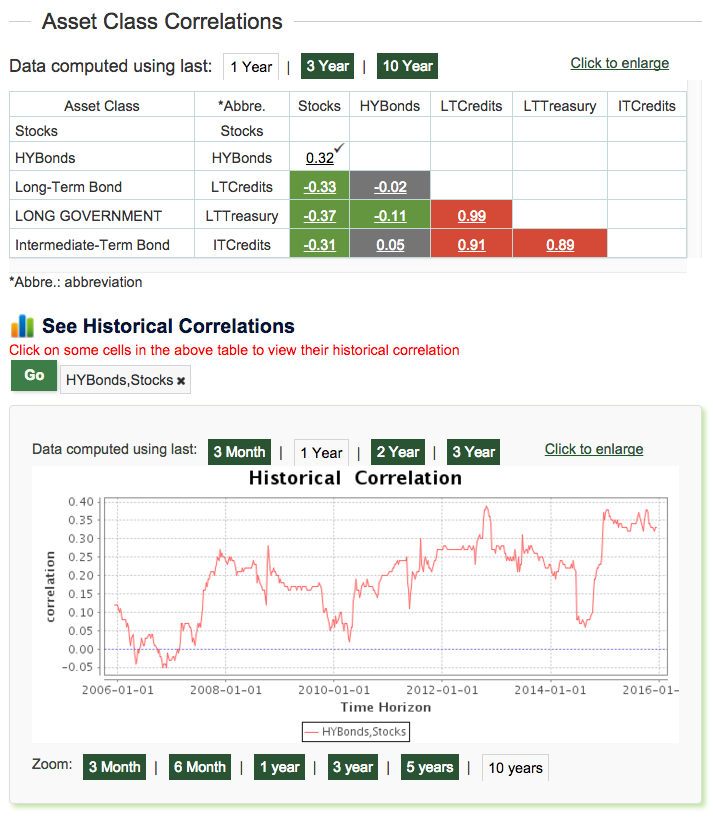

Correlation between High Yield Bonds and Stocks

In the last newsletter June 8, 2015: High Yield Bonds As An Asset Class?, we claimed that high yield bonds should not be treated as a single asset class as it can be a surrogate of a stock and long term Treasury bonds portfolio. If we use our correlation calculation tool listed on Asset Trends & Correlation page, we can see the following correlation between high yield bonds and stocks (using Vanguard High Yield Bond Fund VWEHX and Vanguard 500 Index Fund VFINX):

From the above chart, we can see that for the past 10 years, high yield bonds have been positively correlated to stocks.

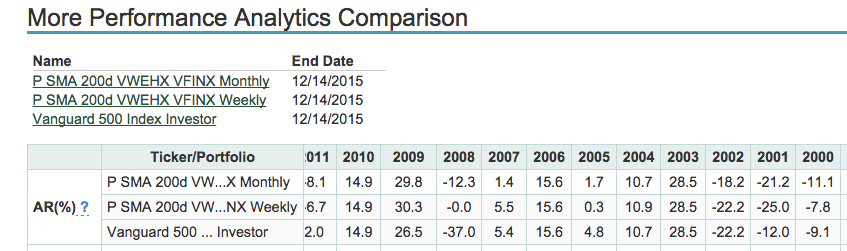

Next, let’s see whether high yield bonds have any predictive power on stocks. In the following table, we look at portfolios using high yield bonds VWEHX total return moving average (200 days simple moving average) to signal a buy and sell S&P 500 (VFINX):

when VWEHX total return is above its moving average, buy VFINX (stocks). Else, buy CASH.

We test this using both month end closing prices and week end closing prices:

Portfolio Performance Comparison (as of 12/14/2015):

| Ticker/Portfolio Name | YTD Return** |

1Yr AR | 3Yr AR | 5Yr AR | 10Yr AR | Max. DD 10 Yr | Since 12/31/91 | Max. DD (since 91) |

|---|---|---|---|---|---|---|---|---|

| P SMA 200d VWEHX VFINX Monthly | -2.7% | 0.1% | 10.8% | 7.8% | 8.0% | 22.5% | 8.2% | 49.8% |

| P SMA 200d VWEHX VFINX Weekly | 6.0% | 6.0% | 12.6% | 9.1% | 10.6% | 18% | 9.1% | 52.8% |

| VFINX (Vanguard 500 Index Investor) | 0.1% | 3.0% | 14.5% | 12.5% | 7.0% | 55.3% | 8.9% | 55.3% |

Max. DD: Maximum Drawdown.

A few of observations:

- The weekly portfolio has done better than the monthly one. Year to date, the weekly one has safely avoided the recent weakness in S&P 500 (VFINX) and has returned 6%.

- For the past 10 years, high yield bond moving average based stock portfolios have definitely out performed S&P 500, in terms of both total returns and risk (maximum drawdown).

- However, when one extends to the whole testing period since 12/31/1991, the two portfolios have behaved in par with the buy and hold S&P 500, even though their Sharpe ratios are still meaningfully higher than VFINX’s and their standard deviations are much lower than VFINX’s (see the detailed comparison table).

If one looks more carefully at the return table data (from detailed comparison table), we see the following:

In fact, from 2000 to 2002, the high yield bond predictive power over stocks faltered badly. The reason: VWEHX did pretty well in those three years. In the three years, instead of positive correlation, high yield bonds were positive while stocks did badly, a very negative correlation. In fact, during those three years of the burst of technology bubble, high yield bonds, small cap stocks and REITs all did well, thanks to the Federal Reserve’s aggressive monetary loosening policy.

So it is really not a sure thing to proclaim high yield bonds are positively correlated with stocks.

As always, we remind our readers that we are not officially supporting or advocating the two portfolios mentioned in our newsletters. These are merely used for study purpose.

What about Now?

First, the situation in 2000-2002 is different from today: at that time, high yield bonds were strong and stocks were weak. This time, high yield bonds have been weak. Or put simply, that situation is not in conflict with today’s high yield bond weakness. When high yield bonds are weak, it might indeed cause trouble for stocks. Here are some plausible reasons:

- Oil price is now at 11 year low. The massive oversupply of oil has forced many debt heavy energy companies to shut down their operations. They have a hard time to service their debts. Recent MLP rout (representative one is that Kinder Morgan reduced its dividend by 75%, see wsj report) exemplifies this.

- High yield bonds have been issued to many companies that have shaky financial balance sheets. These companies are mostly small and medium size businesses. They are the engine of economy. When they have a debt problem, the damage can be wide spread.

- The upcoming possible Federal Reserve’s interest rate raise will only exacerbate the problem.

- All of the above can cause even investment grade companies’ debt interest rate go up. The stocks of S&P 500 companies have been largely supported by the biggest buyer — corporations themselves for several years now. Stock buy backs from Apple to Cisco to IBM have propped up their stocks. If this source of stock purchase funding dries up, it is hard to see how stocks can be supported at this hefty valuation level.

To summarize, whether high yield bond weakness is a presage of the stock weakness or not, there is a reasonable doubt on the current stocks’ strength.

Market Overview

There are still two relatively bright spots in the US stock market: REITs and large technology stocks (represented by Nasdaq 100 QQQ, for example) have positive trend scores at this moment. However, as the broad base risk assets all have retreated, it is easy to see that investors are very risk averse at the moment.

For more detailed asset trend scores, please refer to 360° Market Overview.

We would like to remind our readers that markets are more precarious now than other times in the last 5 years. It is a good time and imperative to adjust to a risk level you are comfortable with right now. However, recognizing our deficiency to predict the markets, we will stay on course.

We again copy our position statements (from previous newsletters):

Our position has not changed: We still maintain our cautious attitude to the recent stock market strength. Again, we have not seen any meaningful or substantial structural change in the U.S., European and emerging market economies. However, we will let markets sort this out and will try to take advantage over its irrational behavior if it is possible.

We again would like to stress for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Latest Articles

- December 7, 2015: Diversification And Global Allocation

- November 30, 2015: Investors and Speculators Combined

- November 23, 2015: Active Stock Fund Performance Consistency

- November 16, 2015: Permanent, Risk Parity And Alternative Portfolios Review

- November 9, 2015: Broad Base Core Mutual Fund Review

- November 2, 2015: Broad Base Index Core ETFs Review

- October 26, 2015: Total Return Bond Fund Review

- October 19, 2015: Advanced Portfolio Review

- October 12, 2015: What About Commodities?

- October 5, 2015: Core Satellite Portfolios In A 401k Account

- September 28, 2015: Risk Managed Strategic Asset Allocation Portfolios Revisited

- September 21, 2015: Quest For The Best Investment Strategy

- September 14, 2015: Core Satellite Portfolios In Market Turmoil

- September 7, 2015: Market Rout Creates An Opportunity to Reposition Your Portfolios

- August 31, 2015: Review of Asset Allocation Funds and Portfolios

- August 24, 2015: Market Rout And Your Portfolios

- August 17, 2015: ETF or Mutual Fund Based Portfolios

- August 10, 2015: Updated Newsletter Collection

- August 3, 2015: Slippery Asset Trends

- July 27, 2015: Performance Dispersion Among Momentum Based Portfolios

- July 20, 2015: Global Balanced Portfolio Benchmarks

- July 13, 2015: Pain in Tactical Portfolios

- July 6, 2015: Fixed Income Total Return Bond Funds In Strategic Asset Allocation Portfolios

- June 29, 2015: Core ETF Commission Free Portfolios

- June 22, 2015: Secular Asset Trends

- June 15, 2015: Giving Up Bonds?

- June 1, 2015: Summer Blues?

- May 26, 2015: Cash, Bonds and Stocks In A Rising Rate Environment

- May 18, 2015: Portfolio Update

- May 11, 2015: Pain in Fixed Income?

- May 4, 2015: The Balanced Stock and Long Term Treasury Bond Portfolios

- April 27, 2015: Long Term Treasury Bond Behavior

- April 20, 2015: 529 College Savings Plan Rebalance Policy Change

- April 13, 2015: Total Return Bond Funds As Smart Cash

- April 6, 2015: The Low Return Environment

- March 30, 2015: Brokerage Specific Core Mutual Fund Portfolios 2

- March 23, 2015: Investment Arithmetic for Long Term Investments

- March 16, 2015: Brokerage Specific Core Mutual Fund Portfolios

- March 9, 2015: Newsletter Collection Update

- March 2, 2015: Total Return Bond ETFs

- February 23, 2015: Why Is Global Tactical Asset Allocation Not Popular?

- February 16, 2015: Where Are Permanent Portfolios Going?

- February 9, 2015: How Have Asset Allocation Funds Done?

- February 2, 2015: Risk Management Everywhere

- January 26, 2015: Composite Portfolios Review

- January 19, 2015: Fixed Income Investing Review

- January 12, 2015: How Does Trend Following Tactical Asset Allocation Strategy Deliver Returns

- January 5, 2015: When Forecast Fails

- December 22, 2014: Long Term Asset Returns: How Long Is Long?

- December 15, 2014: Beaten Down Assets

- December 8, 2014: Implementing Core Asset Portfolios In a Brokerage

- December 1, 2014: Two Key Issues of Investment Strategies

- November 24, 2014: Holiday Readings

- November 17, 2014: Retirement Spending Portfolios Update

- November 10, 2014: Fixed Income Or Cash

- November 3, 2014: Asset Trend Review

- October 27, 2014: Investment Loss, Mistakes And Market Cycles

- October 20, 2014: Strategic Portfolios With Managed Volatility

- October 13, 2014: Embrace Volatility

- October 6, 2014: Tips For 401k Open Enrollment

- September 29, 2014: What Can We Learn From Bill Gross’ Departure From PIMCO?

- September 22, 2014: Why Total Return Bond Funds?

- September 15, 2014: Equity And Total Return Bond Fund Composite Portfolios

- September 8, 2014: Momentum Based Portfolios Review

- September 1, 2014: Risk & Diversification: Mint.com Interview

- August 25, 2014: Remember Risk

- August 18, 2014: Consistency, The Most Important Edge In Investing: Tactical Case

- August 11, 2014: What To Do In Overvalued Stock Markets

- August 4, 2014: Is This The Peak Or Correction?

- July 28, 2014: Stock Musings

- July 21, 2014: Permanent Portfolios & Four Pillar Foundation Based Framework

- July 14, 2014: Composite Portfolios Review

- July 7, 2014: Portfolio Behavior During Market Corrections

- June 30, 2014: Half Year Brokerage ETF and Mutual Fund Portfolios Review

- June 23, 2014: Newsletter Collection Update

- June 16, 2014: There Are Always Lottery Winners

- June 9, 2014: The Arithmetic of Investment Mistakes

- June 2, 2014: Tips On Portfolio Rebalance

- May 26, 2014: In Praise Of Low Cost Core Asset Class Based Portfolios

- May 19, 2014: Consistency, The Most Important Edge In Investing: Strategic Case

- May 12, 2014: How To Handle An Elevated Overvalued Market

- May 5, 2014: Asset Allocation Funds Review

- April 28, 2014: Now The Economy Backs To The ‘Old Normal’, Should Our Investments Too?

- April 21, 2014: Total Return Bond Investing In The Current Market Environment

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.

Diversified Asset Allocation Portfolios For Your Plans

Diversified Asset Allocation Portfolios For Your Plans