Re-balance Cycle Reminder All MyPlanIQ’s newsletters are archived here.

For regular SAA and TAA portfolios, the next re-balance will be on Monday, June 11, 2017. You can also find the re-balance calendar for 2017 on ‘Dashboard‘ page once you log in.

As a reminder to expert users: advanced portfolios are still re-balanced based on their original re-balance schedules and they are not the same as those used in Strategic and Tactical Asset Allocation (SAA and TAA) portfolios of a plan.

Please note that we now list the next re-balance date on every portfolio page.

Money Market Fund Taxonomy

As interest rates continue to rise, cash and cash equivalent are becoming more important. Money market funds, one type of cash equivalent, are becoming main force in one’s investments in the current environment.

Long term readers probably have known that we put quite some emphasis on cash and bonds. To the extent investors finally get used to the concept of low cost investing, we believe cash and bonds, the ‘boring’ investments, will become the next frontier for investors to squeeze out more returns without increasing risk, a true free lunch.

Rates are rising

The following shows the trend of 3 month Treasury Bill (T Bill) yields. T Bill that’s mature in 3 months is widely used as the definition of ‘cash’.

Cash yield is now crawling back to a level in 2008, though it still has a long way to go to a level like 3% to 5%.

In fact, one year T Bill is now yielding 2.28%. These short term yields are now fairly competitive compared with the 1.84% yield of S&P 500 (SPY ETF).

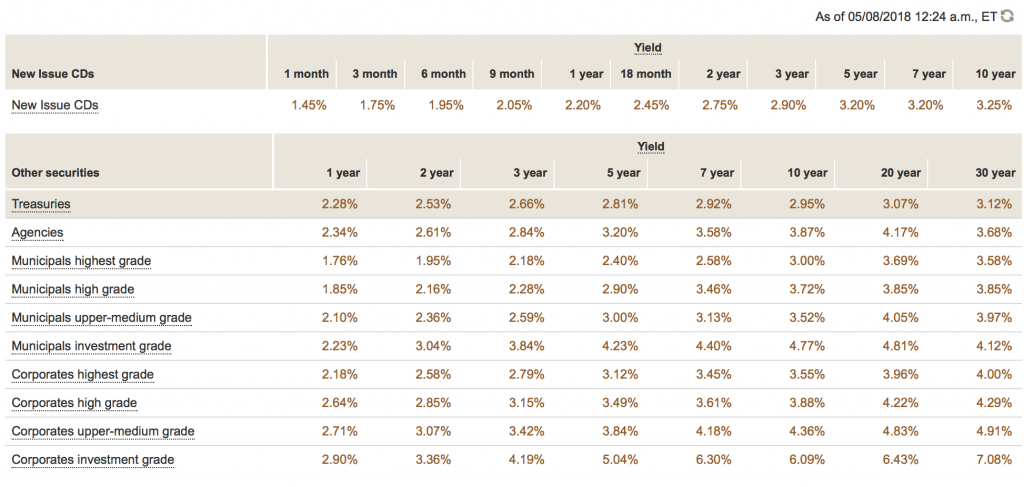

It’s interesting to see that short term T Bills have higher yields than CDs with the same maturity. For example, the highest yielding 3 month CD in Vanguard (in the above table) only yields 1.75%, lower than 1.87% of 3 month T Bill. We discussed this phenomenon in our previous newsletters such as March 19, 2018: Treasury Bills vs. Brokered CDs. We believe the likely explanation is the pace of interest rate rising — faster than the willingness of CD sellers to adjust their rates.

Unfortunately, stocks are now at a very high valuation level by many known long term standards. It’s likely stocks in general will return negative in the coming decade. With cash becoming more appealing, this could only exacerbate their volatility and low returns.

Furthermore, compared with longer term bonds, in such a rising rate environment, bond funds such as VBMFX (Vanguard Total Bond Market Index Inv) and even those with a stellar record such as PONAX (PIMCO Income A) are losing money at the moment. So cash or cash equivalent are becoming the go to shelter, at least at this moment.

Types of Money Market funds

In addition to purchasing T Bills directly from your brokerage accounts (you can purchase those with even shorter maturities such as 2 weeks or one month T Bills), you can invest in money market funds. Money market funds invest in T Bills, CDs, short term loans and bonds. They generally have a rigorous risk control so that

- Their NAV (Net Asset Value) is maintained as 1.00. Unless in a very rare situation, their value is guaranteed to be $1.00.

- The debts invested should have weighted average maturity maintained within 60 days. Furthermore, no security can have maturity longer than 13 months.

The advantage of investing in a money market fund is that you can withdraw from it any time, more liquid than a T Bill or CD.

Vanguard brokerage offers some of the lowest fee money market funds. The following table shows yields of the 3 types of money market funds in Vanguard:

| Name | SEC Yield |

|---|---|

| Vanguard Treasury Money Market (VUSXX) | 1.63% |

| Vanguard Federal Money Market (VMFXX) (Settlement fund) | 1.59% |

| Vanguard Prime Money Market (VMMXX) | 1.83% |

- Treasury money market fund: it is limited to only investing in Treasury Bills, which are considered the safest securities in the world.

- Federal money market fund: in addition to T Bills, it can also invest in other government agency related bonds including those from the Federal Housing Administration (FHA), Small Business Administration (SBA), Government National Mortgage Association (GNMA), and Government Sponsored Enterprise (GSE) such as Federal National Mortgage Association (Fannie Mae) and Federal Home Loan Mortgage (Freddie Mac),

- Prime money market fund: in addition to T Bills and government agency bonds, it can also invest in CDs and corporate bonds.

One can see as restrictions lessen, prime money market funds should have higher yields than federal money market funds which in turn should have higher yields than Treasury money market funds.

Vanguard Federal money market is also a settlement fund, or so called sweep fund by others. It’s a fund that allows investors to automatically ‘sweep’ to or park cash to once they sell their securities such as stocks or funds.

It’s interesting to see that at the moment, Vanguard Treasury money market fund yields slightly higher than the Federal money market fund.

Vanguard prime money market fund is yielding about the same as the 3 month T bill. In a more normal environment, one can expect a prime money market fund should have comparable yields as 3 to 4 month T Bills.

For comparison, the following are the money market fund yields from Schwab and Fidelity.

| Name | SEC Yield |

|---|---|

| Schwab Value Advantage | 1.7% |

| Schwab Cash Reserve (Sweep) | 1.35% |

| Fidelity Money Market | 1.68% |

| Fidelity Government Cash Reserve (Sweep) | 1.38% |

Vanguard offers the best money market rates.

How to utilize high money market fund yields

Unfortunately, banks and many other brokerages are still slow to offer compelling rates for checking, savings accounts or money market funds. However, for cash investment purpose, one can utilize ACH electronic transfer in between your bank and Vanguard brokerage to obtain higher returns.

For example, you can open a Vanguard (or Schwab or Fidelity if you prefer) account, link your bank account to this brokerage account. You can then use electronic ACH transfer to transfer your money from/to the bank account. It generally takes 2-3 business days to process an ACH request although recently, there has been a push for institutions to offer expedite one day ACH transfer.

To summarize, money market funds are now offering compelling rates. To get a higher rate (in Vanguard case, 0.2% difference), you can invest in prime money market funds that usually yields highest. Furthermore, one can utilize electronic transfer such as ACH to take advantage higher money market yields from other institutions.

Market Overview

Now that 81% of S&P 500 companies have reported earnings for Q1 2018 (by Friday last week), we can almost claim that Q1’s earnings growth is stellar: the blended earnings growth is 24.2% vs. the expected 17.1% on December 31, 2017. In fact, if the trend continues, this would mark the highest earnings growth since Q3 2010 (34.0%). Unfortunately, stocks continued to wobble last week. Markets are more forward looking. Often a market downturn starts right at a very high earnings growth or very low unemployment level. So while we celebrate the good news in the past, we should be cautious to manage our risk exposure to a comfortable level. This is especially true in a rising rate, over extended and over valued market.

As always, stay the course.

For more detailed asset trend scores, please refer to 360° Market Overview.

Now that the Trump administration has been in the office for more than a year, the economy and financial markets are in general still in a good shape. Whether the economy will continue to benefit from the supposedly trickle down of the tax cut, the deregulation, and the promised infrastructure spending remains to be seen. On the other hand, stocks continued to ascend, regardless of the progress. Looking ahead, however, we remain convinced that markets will experience more volatilities at some point when reality finally sets in.

In terms of investments, U.S. stock valuation is at a historically high level. It is thus not a good time to take excessive risk. However, we remain optimistic about U.S. economy in the long term and believe much better investment opportunities will arise in the future.

We again would like to stress for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.

Latest Articles

- April 30, 2018: Momentum Investing Review

- April 23, 2018: Commodities In Current Environment

- April 16, 2018: Municipal Bonds As A Fixed Income Asset Class

- April 9, 2018: Exponential Or Compounding Nature In Investing

- April 2, 2018: Inside Of The Stock Chaos

- March 26, 2018: Total Return Bond Update

- March 19, 2018: Treasury Bills vs. Brokered CDs

- March 12, 2018: Defensive Conservative Portfolio Review

- March 5, 2018: Warren Buffett’s Advices

- February 26, 2018: Pros And Cons of Strategic And Tactical Portfolios In 2018

- February 12, 2018: Trend Review

- February 5, 2018: Market Selloff And Long Term Investing

- January 29, 2018: The New Addition To Our Total Return Bond Fund Candidates

- January 22, 2018: Where Are Bonds Heading?

- January 15, 2018: Tactical Portfolios Review

- January 8, 2018: Strategic Portfolios Review

- December 18, 2017: Record Highs And Risk

- December 11, 2017: Cash Return And Interest Rate Update

- December 4, 2017: Mutual Fund Star Ratings: Are They Useful?

- November 20, 2017: Thankful And Mindful

- November 13, 2017: Is This A Good Time For Retirees Or Would Be Retirees?

- November 6, 2017: Newsletter Collection Update

- October 30, 2017: Rising Interest Rates

- October 23, 2017: A Primer For Portfolios

- October 16, 2017: REITs As An Asset Class

- October 9, 2017: Conservative Portfolios Revisited

- October 2, 2017: The Role of Short Term Bond Funds

- September 25, 2017: Fees In Cash Investments

- September 18, 2017: Conservative Portfolios Review

- September 11, 2017: International Diversification Effect

- September 4, 2017: Invest And Speculate Revisited

- August 28, 2017: Total Return Bond Fund Portfolios: Where Do They Fit?

- August 21, 2017: Portfolio Performance: A Walk In The Past

- August 14, 2017: Fidelity Commission Free ETFs Update

- August 7, 2017: I Didn’t Learn Anything — Mistake vs. Temporary Underperformance

- July 31, 2017: Asset Classes And Fund Choices: A Primer

- July 24, 2017: Total Return Bond Fund Portfolios And Cash

- July 17, 2017: Long Term Stock Holding Periods For Retirement

- July 10, 2017: Half Year Asset Trend Review

- June 26, 2017: How To Beat The Best Balanced Allocation Fund

- June 19, 2017: Newsletter Collection Update

- June 12, 2017: A Mixed Bag Performance of Momentum Investing

- June 5, 2017: How To Start A New Portfolio

- May 29, 2017: Alternative Assets And Their Role In Portfolios

- May 22, 2017: Summer Seasonality And Portfolio Management

- May 15, 2017: Cash: Banking Or Investing?

- May 8, 2017: Holding Period of Long Term Timing Portfolios

- May 1, 2017: Debate on Risk vs. Volatility

- April 24, 2017: The Long Term Stock Market Timing Return Since 1871

- April 17, 2017: Risk vs. Volatility: Long Term Stock Market Returns

- April 10, 2017: Total Return Bond ETFs And Portfolios

- April 3, 2017: Quarter End Asset Trend Review

- March 27, 2017: Practical Consideration For IRAs And 401k Accounts

- March 20, 2017: Fund Fees: That’s (Still) Outrageous

- March 13, 2017: Long Term Stock Valuation Review

- March 6, 2017: Asset Classes for Retirement Investments

- February 27, 2017: Fidelity Total Bond Fund Review

- February 20, 2017: Long Term Stock Timing Based Portfolios And Their Roles

- February 13, 2017: Alternative Investment Portfolios Review

- February 6, 2017: Tax Free Municipal Bond Investments Review

- January 30, 2017: Brokerage Specific Conservative Portfolios

- January 23, 2017: Fixed Income Portfolio Review

- January 16, 2017: Long Term Trend Following Portfolio Review

- January 9, 2017: Tactical Asset Allocation Review

- January 3, 2017: Strategic Asset Allocation Review

- December 12, 2016: Enhanced Index Funds

- December 5, 2016: Review Of Broad Base Core Mutual Funds For Brokerages

- November 28, 2016: Core Index ETFs Review

- November 21, 2016: International Exposure Of U.S. Large Companies

- November 14, 2016: Asset Trends After The Election

- November 7, 2016: Rising Rate And Current Bond Trend

- October 31, 2016: Economy Power And Long Term Stock Returns

- October 24, 2016: Current Commodity Trend And Managed Futures

- October 17, 2016: Investment Mistakes And Good Or Bad Investment Strategies

- October 10, 2016: Momentum Investing Review

- October 3, 2016: Survey & Feedback

- September 26, 2016: Fixed Income Investing: Actively Managed Funds vs. Index Funds

- September 19, 2016: Stock Investing: Actively Managed Funds vs. Index Funds

- September 12, 2016: Newsletter Update

- September 5, 2016: Overvalued Markets And Long Term Timing Strategies

- August 29, 2016: Your 401K Finally Draws Attention

- August 22, 2016: Inflation Protected Securities TIPS For Current Overvalued Markets

- August 15, 2016: Risk On: Emerging Market Stocks And Small Cap Stocks

- August 8, 2016: Portfolio Construction Using Stock ETFs And Bond Mutual Funds

- August 1, 2016: Adding Value To Your Own Investments

- July 25, 2016: Tactical Asset Allocation Funds Review

- July 18, 2016: Strategic Asset Allocation & Lazy Portfolio Review

- July 11, 2016: Asset Trend Review

- June 27, 2016: Secular Cycles For Tactical And Strategic Investment Strategies

- June 20, 2016: A World of Debt

- June 13, 2016: Managed Futures For Portfolio Building

- June 6, 2016: Newsletter Summary

- May 30, 2016: Swensen Portfolio And Permanent Portfolios

- May 23, 2016: AAII Article And Some Web Changes

- May 16, 2016: The PIMCO (Dis)Advantages

- May 9, 2016: Boost Your Dull Summer Investments

- May 2, 2016: Low Cost Index Fund Investing

- April 25, 2016: Tax Free Municipal Bond Funds & Portfolios

- April 18, 2016: Asset Class Trend Review

- April 11, 2016: Construction of Sound And Conservative Portfolios

- March 28, 2016: Total Return Bond ETFs Review

- March 21, 2016: Small And Large Company Stock Performance In Different Economic Expansion Cycles

- March 14, 2016: Are Tactical And Timing Strategies Losing Steam?

- March 7, 2016: Defined Maturity Bond Fund Analysis

- February 29, 2016: Smart Strategic Asset Allocation Rebalance When Market Trend Changes

- February 22, 2016: Be Cash Smart

- February 15, 2016: Bond ETF Portfolios

- February 8, 2016: Newsletter Collection Update

- February 1, 2016: Total Return Bond Fund Portfolios In A Volatile Period

- January 25, 2016: Alternative Portfolios Review

- January 18, 2016: Strategic Asset Allocation: A Cautious Outlook

- January 11, 2016: Review Of Trend Following Tactical Asset Allocation

- January 4, 2016: What Worked And Didn’t In 2015

- December 21, 2015: Distressed Assets

- December 14, 2015: High Yield Bonds And Their Correlation With Stocks

- December 7, 2015: Diversification And Global Allocation

- November 30, 2015: Investors and Speculators Combined

- November 23, 2015: Active Stock Fund Performance Consistency

- November 16, 2015: Permanent, Risk Parity And Alternative Portfolios Review

- November 9, 2015: Broad Base Core Mutual Fund Review

- November 2, 2015: Broad Base Index Core ETFs Review

- October 26, 2015: Total Return Bond Fund Review

- October 19, 2015: Advanced Portfolio Review

- October 12, 2015: What About Commodities?

- October 5, 2015: Core Satellite Portfolios In A 401k Account

- September 28, 2015: Risk Managed Strategic Asset Allocation Portfolios Revisited

- September 21, 2015: Quest For The Best Investment Strategy

- September 14, 2015: Core Satellite Portfolios In Market Turmoil

- September 7, 2015: Market Rout Creates An Opportunity to Reposition Your Portfolios

- August 31, 2015: Review of Asset Allocation Funds and Portfolios

- August 24, 2015: Market Rout And Your Portfolios

- August 17, 2015: ETF or Mutual Fund Based Portfolios

- August 10, 2015: Updated Newsletter Collection

- August 3, 2015: Slippery Asset Trends

- July 27, 2015: Performance Dispersion Among Momentum Based Portfolios

- July 20, 2015: Global Balanced Portfolio Benchmarks

- July 13, 2015: Pain in Tactical Portfolios

- July 6, 2015: Fixed Income Total Return Bond Funds In Strategic Asset Allocation Portfolios

- June 29, 2015: Core ETF Commission Free Portfolios

- June 22, 2015: Secular Asset Trends

- June 15, 2015: Giving Up Bonds?

- June 1, 2015: Summer Blues?

- May 26, 2015: Cash, Bonds and Stocks In A Rising Rate Environment

- May 18, 2015: Portfolio Update

- May 11, 2015: Pain in Fixed Income?

- May 4, 2015: The Balanced Stock and Long Term Treasury Bond Portfolios

- April 27, 2015: Long Term Treasury Bond Behavior

- April 20, 2015: 529 College Savings Plan Rebalance Policy Change

- April 13, 2015: Total Return Bond Funds As Smart Cash

- April 6, 2015: The Low Return Environment

- March 30, 2015: Brokerage Specific Core Mutual Fund Portfolios 2

- March 23, 2015: Investment Arithmetic for Long Term Investments

- March 16, 2015: Brokerage Specific Core Mutual Fund Portfolios

- March 9, 2015: Newsletter Collection Update

- March 2, 2015: Total Return Bond ETFs

- February 23, 2015: Why Is Global Tactical Asset Allocation Not Popular?

- February 16, 2015: Where Are Permanent Portfolios Going?

- February 9, 2015: How Have Asset Allocation Funds Done?

- February 2, 2015: Risk Management Everywhere

- January 26, 2015: Composite Portfolios Review

- January 19, 2015: Fixed Income Investing Review

- January 12, 2015: How Does Trend Following Tactical Asset Allocation Strategy Deliver Returns

- January 5, 2015: When Forecast Fails

- December 22, 2014: Long Term Asset Returns: How Long Is Long?

- December 15, 2014: Beaten Down Assets

- December 8, 2014: Implementing Core Asset Portfolios In a Brokerage

- December 1, 2014: Two Key Issues of Investment Strategies

- November 24, 2014: Holiday Readings

- November 17, 2014: Retirement Spending Portfolios Update

- November 10, 2014: Fixed Income Or Cash

- November 3, 2014: Asset Trend Review

- October 27, 2014: Investment Loss, Mistakes And Market Cycles

- October 20, 2014: Strategic Portfolios With Managed Volatility

- October 13, 2014: Embrace Volatility

- October 6, 2014: Tips For 401k Open Enrollment

- September 29, 2014: What Can We Learn From Bill Gross’ Departure From PIMCO?

- September 22, 2014: Why Total Return Bond Funds?

- September 15, 2014: Equity And Total Return Bond Fund Composite Portfolios

- September 8, 2014: Momentum Based Portfolios Review

- September 1, 2014: Risk & Diversification: Mint.com Interview

- August 25, 2014: Remember Risk

- August 18, 2014: Consistency, The Most Important Edge In Investing: Tactical Case

- August 11, 2014: What To Do In Overvalued Stock Markets

- August 4, 2014: Is This The Peak Or Correction?

- July 28, 2014: Stock Musings

- July 21, 2014: Permanent Portfolios & Four Pillar Foundation Based Framework

- July 14, 2014: Composite Portfolios Review

- July 7, 2014: Portfolio Behavior During Market Corrections

- June 30, 2014: Half Year Brokerage ETF and Mutual Fund Portfolios Review

- June 23, 2014: Newsletter Collection Update

- June 16, 2014: There Are Always Lottery Winners

- June 9, 2014: The Arithmetic of Investment Mistakes

- June 2, 2014: Tips On Portfolio Rebalance

- May 26, 2014: In Praise Of Low Cost Core Asset Class Based Portfolios

- May 19, 2014: Consistency, The Most Important Edge In Investing: Strategic Case

- May 12, 2014: How To Handle An Elevated Overvalued Market

- May 5, 2014: Asset Allocation Funds Review

- April 28, 2014: Now The Economy Backs To The ‘Old Normal’, Should Our Investments Too?

- April 21, 2014: Total Return Bond Investing In The Current Market Environment

Diversified Asset Allocation Portfolios For Your Plans

Diversified Asset Allocation Portfolios For Your Plans