Re-balance Cycle Reminder All MyPlanIQ’s newsletters are archived here.

For regular SAA and TAA portfolios, the next re-balance will be on Monday, October 24, 2016. You can also find the re-balance calendar for 2016 on ‘Dashboard‘ page once you log in.

As a reminder to expert users: advanced portfolios are still re-balanced based on their original re-balance schedules and they are not the same as those used in Strategic and Tactical Asset Allocation (SAA and TAA) portfolios of a plan.

Please note that we now list the next re-balance date on every portfolio page.

Momentum Investing Review

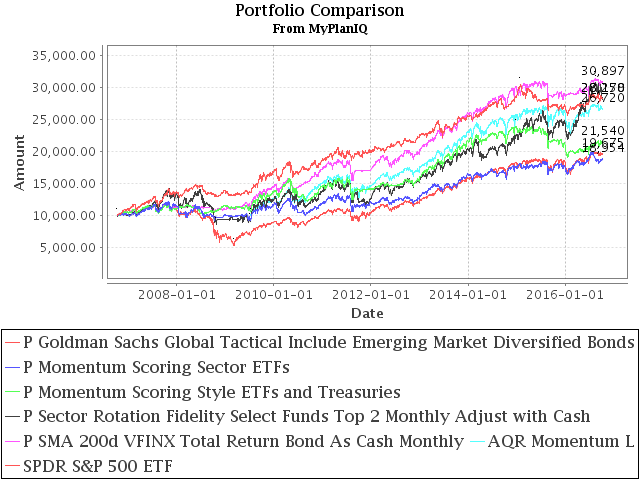

It’s been more than a year since we reviewed various momentum investing portfolios/funds (see July 27, 2015: Performance Dispersion Among Momentum Based Portfolios). As markets have persistently behaved in some strange way, we would like to review these portfolios again.

Just to recall, the taxonomy of these portfolios is as follows:

- m1: A group of individual stocks such as Dow Jones 30 or Nasdaq 100 etc. — Can be Effective, but volatile.

- m2: A group of industrial stock funds such as Fidelity’s famous Fidelity Select funds. – Can be Effective, but volatile.

- m3: A group of stock sector funds such as SPDR’s S&P sector ETFs such as SPDR Select Energy (XLE) etc. – Can be Effective, but volatile.

- m4: A group of stock style funds such as Russell large, mid and small cap stock ETFs. – Effective and comparable risk.

- m5: single stock index (fund) buy/sell decision. – Fickle though might be on par with buy and hold.

- m6: A group of diversified and somewhat uncorrelated asset classes such as stocks, bonds, real estates (REITs) and their minor asset classes such as long term bonds, international bonds, gold etc. – Effective and lower risk.

Furthermore, at MyPlanIQ, we always advocate the momentum driven strategy at asset allocation level, or m6 in the above categories. This is what our Tactical Asset Allocation(TAA) strategy is based on.

Let’s first review the funds at the first level m1.

Individual momentum stock funds are lagging behind US index

For individual stock momentum portfolios, we look at the following representative funds:

| Fund | YTD Return** |

1Yr AR | 3Yr AR | 5Yr AR | 5Yr Sharpe | 10Yr AR |

|---|---|---|---|---|---|---|

| PIE (PowerShares DWA Emerging Markets Mom ETF) | 9.7% | 2.9% | -3.4% | 3.1% | 0.16 | |

| EEM (iShares MSCI Emerging Markets) | 18.0% | 8.9% | -1.3% | 2.8% | 0.13 | 3.4% |

| AMOMX (AQR Momentum L) | 3.3% | 5.1% | 9.3% | 14.9% | 0.92 | |

| PDP (PowerShares DWA Momentum ETF) | 1.1% | 2.4% | 7.7% | 13.8% | 0.92 | |

| SPY (SPDR S&P 500 ETF) | 7.7% | 9.7% | 11.5% | 15.5% | 1.12 | 7.0% |

| AIMOX (AQR International Momentum L) | -0.5% | 0.2% | -1.2% | 6.4% | 0.4 | |

| EFA (iShares MSCI EAFE) | 1.8% | -0.3% | 0.4% | 6.9% | 0.38 | 1.6% |

| ASMOX (AQR Small Cap Momentum L) | 4.6% | 4.7% | 4.4% | 15.5% | 0.75 | |

| IWM (iShares Russell 2000) | 10.3% | 9.0% | 6.6% | 15.2% | 0.85 | 6.8% |

More detailed year by year comparison >>

Highlighted are indices.

Year to date or in the last one year, all momentum stock funds have performed worse than their respective indices (other than AIMOX vs. EFA for the past 1 year, which both performed closely). In fact, even if one looks at the last 5 year performance, these funds don’t have much edge. However, in a longer term, it’s possible for the momentum stock funds perform better than indices.

Momentum at higher levels

Moving up to industries, sectors, styles and multiple assets, we have the following:

| Portfolio/Fund Name | YTD Return** |

1Yr AR | 3Yr AR | 5Yr AR | 10Yr AR | AR since 1/2/2001 |

|---|---|---|---|---|---|---|

| [m2]P Sector Rotation Fidelity Select Funds Top 2 Monthly Adjust with Cash | 15.8% | 18.4% | 14.0% | 18.2% | 10.9% | 10.8% |

| [m3]P Momentum Scoring Sector ETFs | 8.4% | 8.2% | 8.7% | 10.5% | 6.6% | 7.0% |

| [m4]P Momentum Scoring Style ETFs and Treasuries | 2.7% | -0.6% | 2.7% | 9.3% | 8.0% | 8.4% |

| [m5]P SMA 200d VFINX Total Return Bond As Cash Monthly | 8.1% | 7.4% | 9.1% | 12.7% | 11.9% | 11.7% |

| [m6]P Goldman Sachs Global Tactical Include Emerging Market Diversified Bonds | 4.4% | 4.2% | 4.8% | 7.9% | 10.9% | 13.7% |

| [m1]AMOMX (AQR Momentum L) | 3.3% | 5.1% | 9.3% | 14.9% | ||

| SPY (SPDR S&P 500 ETF) | 7.7% | 9.7% | 11.5% | 15.5% | 7.0% | 5.3% |

More detailed year by year comparison >>

Year to date, other than the industries rotation one (m2), all other portfolios underperformed S&P 500 SPY. In fact, this phenomenon extends to the last 5 years. However, in the last 15+ years (since 1/2/2001), the multi-asset momentum portfolio (m6) still has the highest annualized return (AR) 13.7% while all other momentum portfolios (other than AMOMX which does not have enough data) have done better than SPY, which has only 5.3% annualized return.

The above data indicated that recently, it’s been a difficult period for many momentum based portfolios. Even the finest granularity portfolio (individual stocks) can’t take advantage of the recent market behavior. Even though the industries rotation portfolio has done best for the past one year or year to date, it does come with a price: in the last one week, the portfolio had -6% drop. Overly concentrated only on two industries at a time, this portfolio can deliver high returns in a period (for example, it has 18.2% annualized return in the past 5 years) but it can also lose value quickly.

The single index buy/sell portfolio m5 has done very well recently. It’s also one of the best in the 10 and 15+ year periods. However, we caution that when US stocks lose their strength (as it is very likely going forward because of their elevated overvalued valuation), such a moving average based portfolio might not be able to repeat such a stellar performance.

Market Overview

Rate sensitive assets including REITs and long term bonds had a very bad week. REIT stocks are now in general in a negative trend. Furthermore, gold has retreated noticeably, thanks to the US dollar strength and the upcoming rate hike jitter. Though investors seem to pin their hope/decision on the US presidential election, given the current overvalued markets, we believe markets will undergo certain substantial correction once the election dust settles, regardless who wins the election. Again, we call for a well planned strategy that can manage risk.

For more detailed asset trend scores, please refer to 360° Market Overview.

We would like to remind our readers that since the financial crisis in 2008-2009, we have not seen substantial structural change in the U.S., European and emerging market economies. Economies have heavily relied on low interest debts. Capital might be misallocated to unproductive investments and consumption. U.S. stock valuation is at a historically high level. It is thus not a good time to take excessive risk. However, we remain optimistic on U.S. economy in the long term and believe much better investment opportunities will arise in the future.

We again would like to stress for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Latest Articles

- October 3, 2016: Survey & Feedback

- September 26, 2016: Fixed Income Investing: Actively Managed Funds vs. Index Funds

- September 19, 2016: Stock Investing: Actively Managed Funds vs. Index Funds

- September 12, 2016: Newsletter Update

- September 5, 2016: Overvalued Markets And Long Term Timing Strategies

- August 29, 2016: Your 401K Finally Draws Attention

- August 22, 2016: Inflation Protected Securities TIPS For Current Overvalued Markets

- August 15, 2016: Risk On: Emerging Market Stocks And Small Cap Stocks

- August 8, 2016: Portfolio Construction Using Stock ETFs And Bond Mutual Funds

- August 1, 2016: Adding Value To Your Own Investments

- July 25, 2016: Tactical Asset Allocation Funds Review

- July 18, 2016: Strategic Asset Allocation & Lazy Portfolio Review

- July 11, 2016: Asset Trend Review

- June 27, 2016: Secular Cycles For Tactical And Strategic Investment Strategies

- June 20, 2016: A World of Debt

- June 13, 2016: Managed Futures For Portfolio Building

- June 6, 2016: Newsletter Summary

- May 30, 2016: Swensen Portfolio And Permanent Portfolios

- May 23, 2016: AAII Article And Some Web Changes

- May 16, 2016: The PIMCO (Dis)Advantages

- May 9, 2016: Boost Your Dull Summer Investments

- May 2, 2016: Low Cost Index Fund Investing

- April 25, 2016: Tax Free Municipal Bond Funds & Portfolios

- April 18, 2016: Asset Class Trend Review

- April 11, 2016: Construction of Sound And Conservative Portfolios

- March 28, 2016: Total Return Bond ETFs Review

- March 21, 2016: Small And Large Company Stock Performance In Different Economic Expansion Cycles

- March 14, 2016: Are Tactical And Timing Strategies Losing Steam?

- March 7, 2016: Defined Maturity Bond Fund Analysis

- February 29, 2016: Smart Strategic Asset Allocation Rebalance When Market Trend Changes

- February 22, 2016: Be Cash Smart

- February 15, 2016: Bond ETF Portfolios

- February 8, 2016: Newsletter Collection Update

- February 1, 2016: Total Return Bond Fund Portfolios In A Volatile Period

- January 25, 2016: Alternative Portfolios Review

- January 18, 2016: Strategic Asset Allocation: A Cautious Outlook

- January 11, 2016: Review Of Trend Following Tactical Asset Allocation

- January 4, 2016: What Worked And Didn’t In 2015

- December 21, 2015: Distressed Assets

- December 14, 2015: High Yield Bonds And Their Correlation With Stocks

- December 7, 2015: Diversification And Global Allocation

- November 30, 2015: Investors and Speculators Combined

- November 23, 2015: Active Stock Fund Performance Consistency

- November 16, 2015: Permanent, Risk Parity And Alternative Portfolios Review

- November 9, 2015: Broad Base Core Mutual Fund Review

- November 2, 2015: Broad Base Index Core ETFs Review

- October 26, 2015: Total Return Bond Fund Review

- October 19, 2015: Advanced Portfolio Review

- October 12, 2015: What About Commodities?

- October 5, 2015: Core Satellite Portfolios In A 401k Account

- September 28, 2015: Risk Managed Strategic Asset Allocation Portfolios Revisited

- September 21, 2015: Quest For The Best Investment Strategy

- September 14, 2015: Core Satellite Portfolios In Market Turmoil

- September 7, 2015: Market Rout Creates An Opportunity to Reposition Your Portfolios

- August 31, 2015: Review of Asset Allocation Funds and Portfolios

- August 24, 2015: Market Rout And Your Portfolios

- August 17, 2015: ETF or Mutual Fund Based Portfolios

- August 10, 2015: Updated Newsletter Collection

- August 3, 2015: Slippery Asset Trends

- July 27, 2015: Performance Dispersion Among Momentum Based Portfolios

- July 20, 2015: Global Balanced Portfolio Benchmarks

- July 13, 2015: Pain in Tactical Portfolios

- July 6, 2015: Fixed Income Total Return Bond Funds In Strategic Asset Allocation Portfolios

- June 29, 2015: Core ETF Commission Free Portfolios

- June 22, 2015: Secular Asset Trends

- June 15, 2015: Giving Up Bonds?

- June 1, 2015: Summer Blues?

- May 26, 2015: Cash, Bonds and Stocks In A Rising Rate Environment

- May 18, 2015: Portfolio Update

- May 11, 2015: Pain in Fixed Income?

- May 4, 2015: The Balanced Stock and Long Term Treasury Bond Portfolios

- April 27, 2015: Long Term Treasury Bond Behavior

- April 20, 2015: 529 College Savings Plan Rebalance Policy Change

- April 13, 2015: Total Return Bond Funds As Smart Cash

- April 6, 2015: The Low Return Environment

- March 30, 2015: Brokerage Specific Core Mutual Fund Portfolios 2

- March 23, 2015: Investment Arithmetic for Long Term Investments

- March 16, 2015: Brokerage Specific Core Mutual Fund Portfolios

- March 9, 2015: Newsletter Collection Update

- March 2, 2015: Total Return Bond ETFs

- February 23, 2015: Why Is Global Tactical Asset Allocation Not Popular?

- February 16, 2015: Where Are Permanent Portfolios Going?

- February 9, 2015: How Have Asset Allocation Funds Done?

- February 2, 2015: Risk Management Everywhere

- January 26, 2015: Composite Portfolios Review

- January 19, 2015: Fixed Income Investing Review

- January 12, 2015: How Does Trend Following Tactical Asset Allocation Strategy Deliver Returns

- January 5, 2015: When Forecast Fails

- December 22, 2014: Long Term Asset Returns: How Long Is Long?

- December 15, 2014: Beaten Down Assets

- December 8, 2014: Implementing Core Asset Portfolios In a Brokerage

- December 1, 2014: Two Key Issues of Investment Strategies

- November 24, 2014: Holiday Readings

- November 17, 2014: Retirement Spending Portfolios Update

- November 10, 2014: Fixed Income Or Cash

- November 3, 2014: Asset Trend Review

- October 27, 2014: Investment Loss, Mistakes And Market Cycles

- October 20, 2014: Strategic Portfolios With Managed Volatility

- October 13, 2014: Embrace Volatility

- October 6, 2014: Tips For 401k Open Enrollment

- September 29, 2014: What Can We Learn From Bill Gross’ Departure From PIMCO?

- September 22, 2014: Why Total Return Bond Funds?

- September 15, 2014: Equity And Total Return Bond Fund Composite Portfolios

- September 8, 2014: Momentum Based Portfolios Review

- September 1, 2014: Risk & Diversification: Mint.com Interview

- August 25, 2014: Remember Risk

- August 18, 2014: Consistency, The Most Important Edge In Investing: Tactical Case

- August 11, 2014: What To Do In Overvalued Stock Markets

- August 4, 2014: Is This The Peak Or Correction?

- July 28, 2014: Stock Musings

- July 21, 2014: Permanent Portfolios & Four Pillar Foundation Based Framework

- July 14, 2014: Composite Portfolios Review

- July 7, 2014: Portfolio Behavior During Market Corrections

- June 30, 2014: Half Year Brokerage ETF and Mutual Fund Portfolios Review

- June 23, 2014: Newsletter Collection Update

- June 16, 2014: There Are Always Lottery Winners

- June 9, 2014: The Arithmetic of Investment Mistakes

- June 2, 2014: Tips On Portfolio Rebalance

- May 26, 2014: In Praise Of Low Cost Core Asset Class Based Portfolios

- May 19, 2014: Consistency, The Most Important Edge In Investing: Strategic Case

- May 12, 2014: How To Handle An Elevated Overvalued Market

- May 5, 2014: Asset Allocation Funds Review

- April 28, 2014: Now The Economy Backs To The ‘Old Normal’, Should Our Investments Too?

- April 21, 2014: Total Return Bond Investing In The Current Market Environment

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.

Diversified Asset Allocation Portfolios For Your Plans

Diversified Asset Allocation Portfolios For Your Plans