Re-balance Cycle Reminder All MyPlanIQ’s newsletters are archived here.

For regular SAA and TAA portfolios, the next re-balance will be on Monday, May 2, 2016. You can also find the re-balance calendar for 2015 on ‘Dashboard‘ page once you log in.

As a reminder to expert users: advanced portfolios are still re-balanced based on their original re-balance schedules and they are not the same as those used in Strategic and Tactical Asset Allocation (SAA and TAA) portfolios of a plan.

Please note that we now list the next re-balance date on every portfolio page.

Construction of Sound And Conservative Portfolios

In the past, we have pointed out that a portfolio that has conservative allocation usually commands best risk adjusted return or Sharpe ratio. A conservative allocation usually allocates around 20-30% to stocks. For example, VWINX (Vanguard Wellesley Income Inv) had about 30% allocated to US stocks and 7% allocated to Non US stocks on 12/31/2015.

If you are a conservative investor or just a retiree, you might not have much choice but going for a conservative allocation. However, even if you are an investor who can tolerate more risk, you might want to consider a conservative portfolio because of the following reasons:

- You might not want to take more risk since stock markets are at a high valuation level. For example, at this moment, using a long term stock market valuation metric such as Shiller’s CAPE 10 or Buffett’s total market capitalization over gross domestic or national product (see Market Indicators for more details), stocks are at a historical high level and overvalued by over 40%. John Hussman has frequently discussed this subject. Based on his modified Buffet valuation metric, he estimated that S&P 500 will return around 2% annually for the coming 12 years (see his latest weekly commentary). A risk averse investor might want to reduce stock exposure in such market conditions. However, as stock markets can be at a high overvalued level for a long time and it is hard to predict their behavior, one might not want to totally abandon stocks even at such a high level. A conservative allocation is thus a good portfolio to be with in this type of situations.

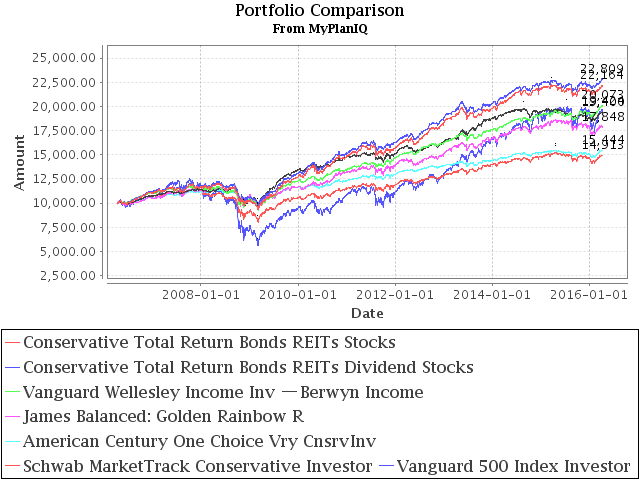

- A conservative portfolio not only provides the best risk adjusted return, it actually can deliver better returns when markets are at a late stage bull market or have been mostly at high valuation levels for a long period of time. For example, in the following table, a conservative portfolio or fund has had a better 10 year return than a stock index such as S&P 500 total return index. Simply put, it doesn’t pay to take excessive risk when markets are frothy. So a conservative portfolio can be a good anchor to wait it out without losing much return opportunity.

Conservative allocation mutual funds

There are several ways to invest in a conservative portfolio. One way is to invest in a mutual fund. There are several excellent conservative allocation funds one can consider. The following table shows some of them:

| Ticker/Portfolio Name | YTD Return** |

1Yr AR | 3Yr AR | 5Yr AR | 10Yr AR | 10Yr Sharpe |

|---|---|---|---|---|---|---|

| Conservative Total Return Bonds REITs Dividend Stocks | 2.8% | 0.6% | 4.9% | 7.6% | 8.6% | 1.14 |

| Conservative Total Return Bonds REITs Stocks | 2.5% | 0.0% | 5.0% | 7.4% | 8.3% | 1.02 |

| VWINX (Vanguard Wellesley Income Inv) | 4.0% | 3.3% | 5.8% | 7.8% | 7.1% | 0.97 |

| BERIX (Berwyn Income) | 3.0% | -1.3% | 5.1% | 5.4% | 6.8% | 1.04 |

| GLRBX (James Balanced: Golden Rainbow R) | 0.1% | -3.8% | 3.8% | 5.6% | 5.9% | 0.62 |

| AONIX (American Century One Choice Vry CnsrvInv) | 2.7% | 0.3% | 3.0% | 4.2% | 4.4% | 0.72 |

| SWCGX (Schwab MarketTrack Conservative Investor) | 1.8% | -1.6% | 4.0% | 4.9% | 4.1% | 0.4 |

| VFINX (Vanguard 500 Index Investor) | 0.8% | 0.4% | 11.6% | 11.2% | 6.8% | 0.29 |

VWINX (Vanguard Wellesley Income Inv) is one of the most consistent conservative allocation mutual funds. It even outperformed VFINX (a proxy of S&P 500 total return) in the last 10 years. Another good conservative fund BERIX (Berwyn Income) has the same 10 year annual return as VFINX. Other conservative funds have not done as well as these two funds.

There are several reasons that hinder an investor to invest in a good conservative fund. The very first one (and the most practical one) is that many brokerages do not carry all of the good conservative funds as no transaction funds. For example, Schwab, Fidelity and many others charge transaction fees for VWINX.

The other reason is that one can never trust an actively managed mutual fund, no matter how excellent it has been. This has always been one of our investment tenets. There are just too many incidents that a good fund went awry and hurt its investors. The very recent example is SEQUX (Sequoia) fund that had a big loss due to its excessive bet on Valeant stock. Let’s not forget Legg Mason Value fund, Dodge & Cox Stocks and/or, GLRBX (James Balanced: Golden Rainbow R), FPACX etc. It is a long list one can produce.

We are more comfortable with using a fund rotation portfolio to weed out losers such as our conservative upgrade portfolios listed on Brokerage Investors page (or see this link) or a fail safe method in stock component: using stock index funds instead.

Other reasons to construct your own portfolio instead of investing in a mutual fund include tax consideration and flexibility. For example, when stocks are very undervalued, one can simply sell some bond funds in the portfolio and buy stocks if you are willing to take extra risk to boost returns.

Constructing a conservative portfolio using stock index funds and total return bond funds

The conservative portfolios shown in the above table allocate 30% to stocks and REITs. They are strategic or static portfolios. They have the following components:

Conservative Total Return Bonds REITs Dividend Stocks

USStocks VDIGX 20%

REITs VGSIX 10%

TotalReturnBond P_46880 70%

VDIGX (Vanguard Dividend Growth Inv) is Vanguard’s (index) dividend appreciation fund.

P_46880 is Schwab Total Return Bond that is again listed on Brokerage Investors page. It invests in no load and no transaction fee total return bond fund in Schwab. Investors should choose other portfolios if their brokerage is not Schwab.

Conservative Total Return Bonds REITs Stocks

USStocks VFINX 20%

REITs VGSIX 10%

TotalReturnBond P_46880 70%

The difference between the above two portfolios is in the stock portion: either invests in S&P 500 (VFINX) or a dividend growth fund (VDIGX).

From the first table, one can see that not only both portfolios had a better total return than VFINX in the last 10 years, they both have done better than VWINX, a coveted and hard to beat conservative fund by more than 1% annually in the last 10 years. We attribute the outperformance to the excellent total return bond portfolio’s performance and the consistent index type performance in both stock and REIT portions of the portfolios. Investing in an index fund may not get you home runs, but it will not incur man-made errors that sometimes can be hard to repair.

The two portfolios have about 3-5% annual dividends/interests, which are good for income investors too.

Investors can tweak the allocations to suit their own risk tolerance. For example, if 30% of stocks and REITs is too much for your liking, you can reduce the allocation further. The two portfolios lost about 10-12% in 2008 and have about 20% maximum drawdown during that period. See detailed comparison for more portfolio data.

Since the portfolios always buy and hold the stocks and REITs, it is possible to pay up one time transaction fee to initiate holding of VDIGX in those brokerages that charge transaction fees for this fund. For other funds such as VFINX and VGSIX, one can find plenty of substitutes in major brokerages. You can even use ETF VNQ, for example, to substitute VGSIX in almost all brokerages.

If stocks are at a very under valued level (such as it can deliver more than 10% annual return for the next 10 years), one can take extra risk to sell some portion of bond funds and overweight the stock funds. You can then liquidate the extra stock portion or rebalance back to conservative level when stocks are fairly valued or over valued.

The investing approach in the proposed conservative portfolios enables investors to be less psychologically impacted by volatile markets while in the meantime, it is still possible to deliver reasonable or even market beating returns with far less risk.

Market Overview

Stocks are now stuck at a level that is just above its 200 day moving average. In the meantime, long term bonds and gold are all exhibiting positive strength. It’s possible we are yet into another goldilocks or at least that is what investors are perceiving. However, we are more concerned about the general economy and the upcoming earnings season. Again, as stated in the above, it does not pay to take excessive risk at this moment.

For more detailed asset trend scores, please refer to 360° Market Overview.

We would like to remind our readers that markets are more precarious now than other times in the last 6 years. Since the financial crisis in 2008-2009, we have not seen substantial structural change in the U.S., European and emerging market economies. Even though U.S. stocks have had a recent correction, their valuation is still at a historical high level. It is thus not a good time to take excessive risk.

We again would like to stress for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Latest Articles

- March 28, 2016: Total Return Bond ETFs Review

- March 21, 2016: Small And Large Company Stock Performance In Different Economic Expansion Cycles

- March 14, 2016: Are Tactical And Timing Strategies Losing Steam?

- March 7, 2016: Defined Maturity Bond Fund Analysis

- February 29, 2016: Smart Strategic Asset Allocation Rebalance When Market Trend Changes

- February 22, 2016: Be Cash Smart

- February 15, 2016: Bond ETF Portfolios

- February 8, 2016: Newsletter Collection Update

- February 1, 2016: Total Return Bond Fund Portfolios In A Volatile Period

- January 25, 2016: Alternative Portfolios Review

- January 18, 2016: Strategic Asset Allocation: A Cautious Outlook

- January 11, 2016: Review Of Trend Following Tactical Asset Allocation

- January 4, 2016: What Worked And Didn’t In 2015

- December 21, 2015: Distressed Assets

- December 14, 2015: High Yield Bonds And Their Correlation With Stocks

- December 7, 2015: Diversification And Global Allocation

- November 30, 2015: Investors and Speculators Combined

- November 23, 2015: Active Stock Fund Performance Consistency

- November 16, 2015: Permanent, Risk Parity And Alternative Portfolios Review

- November 9, 2015: Broad Base Core Mutual Fund Review

- November 2, 2015: Broad Base Index Core ETFs Review

- October 26, 2015: Total Return Bond Fund Review

- October 19, 2015: Advanced Portfolio Review

- October 12, 2015: What About Commodities?

- October 5, 2015: Core Satellite Portfolios In A 401k Account

- September 28, 2015: Risk Managed Strategic Asset Allocation Portfolios Revisited

- September 21, 2015: Quest For The Best Investment Strategy

- September 14, 2015: Core Satellite Portfolios In Market Turmoil

- September 7, 2015: Market Rout Creates An Opportunity to Reposition Your Portfolios

- August 31, 2015: Review of Asset Allocation Funds and Portfolios

- August 24, 2015: Market Rout And Your Portfolios

- August 17, 2015: ETF or Mutual Fund Based Portfolios

- August 10, 2015: Updated Newsletter Collection

- August 3, 2015: Slippery Asset Trends

- July 27, 2015: Performance Dispersion Among Momentum Based Portfolios

- July 20, 2015: Global Balanced Portfolio Benchmarks

- July 13, 2015: Pain in Tactical Portfolios

- July 6, 2015: Fixed Income Total Return Bond Funds In Strategic Asset Allocation Portfolios

- June 29, 2015: Core ETF Commission Free Portfolios

- June 22, 2015: Secular Asset Trends

- June 15, 2015: Giving Up Bonds?

- June 1, 2015: Summer Blues?

- May 26, 2015: Cash, Bonds and Stocks In A Rising Rate Environment

- May 18, 2015: Portfolio Update

- May 11, 2015: Pain in Fixed Income?

- May 4, 2015: The Balanced Stock and Long Term Treasury Bond Portfolios

- April 27, 2015: Long Term Treasury Bond Behavior

- April 20, 2015: 529 College Savings Plan Rebalance Policy Change

- April 13, 2015: Total Return Bond Funds As Smart Cash

- April 6, 2015: The Low Return Environment

- March 30, 2015: Brokerage Specific Core Mutual Fund Portfolios 2

- March 23, 2015: Investment Arithmetic for Long Term Investments

- March 16, 2015: Brokerage Specific Core Mutual Fund Portfolios

- March 9, 2015: Newsletter Collection Update

- March 2, 2015: Total Return Bond ETFs

- February 23, 2015: Why Is Global Tactical Asset Allocation Not Popular?

- February 16, 2015: Where Are Permanent Portfolios Going?

- February 9, 2015: How Have Asset Allocation Funds Done?

- February 2, 2015: Risk Management Everywhere

- January 26, 2015: Composite Portfolios Review

- January 19, 2015: Fixed Income Investing Review

- January 12, 2015: How Does Trend Following Tactical Asset Allocation Strategy Deliver Returns

- January 5, 2015: When Forecast Fails

- December 22, 2014: Long Term Asset Returns: How Long Is Long?

- December 15, 2014: Beaten Down Assets

- December 8, 2014: Implementing Core Asset Portfolios In a Brokerage

- December 1, 2014: Two Key Issues of Investment Strategies

- November 24, 2014: Holiday Readings

- November 17, 2014: Retirement Spending Portfolios Update

- November 10, 2014: Fixed Income Or Cash

- November 3, 2014: Asset Trend Review

- October 27, 2014: Investment Loss, Mistakes And Market Cycles

- October 20, 2014: Strategic Portfolios With Managed Volatility

- October 13, 2014: Embrace Volatility

- October 6, 2014: Tips For 401k Open Enrollment

- September 29, 2014: What Can We Learn From Bill Gross’ Departure From PIMCO?

- September 22, 2014: Why Total Return Bond Funds?

- September 15, 2014: Equity And Total Return Bond Fund Composite Portfolios

- September 8, 2014: Momentum Based Portfolios Review

- September 1, 2014: Risk & Diversification: Mint.com Interview

- August 25, 2014: Remember Risk

- August 18, 2014: Consistency, The Most Important Edge In Investing: Tactical Case

- August 11, 2014: What To Do In Overvalued Stock Markets

- August 4, 2014: Is This The Peak Or Correction?

- July 28, 2014: Stock Musings

- July 21, 2014: Permanent Portfolios & Four Pillar Foundation Based Framework

- July 14, 2014: Composite Portfolios Review

- July 7, 2014: Portfolio Behavior During Market Corrections

- June 30, 2014: Half Year Brokerage ETF and Mutual Fund Portfolios Review

- June 23, 2014: Newsletter Collection Update

- June 16, 2014: There Are Always Lottery Winners

- June 9, 2014: The Arithmetic of Investment Mistakes

- June 2, 2014: Tips On Portfolio Rebalance

- May 26, 2014: In Praise Of Low Cost Core Asset Class Based Portfolios

- May 19, 2014: Consistency, The Most Important Edge In Investing: Strategic Case

- May 12, 2014: How To Handle An Elevated Overvalued Market

- May 5, 2014: Asset Allocation Funds Review

- April 28, 2014: Now The Economy Backs To The ‘Old Normal’, Should Our Investments Too?

- April 21, 2014: Total Return Bond Investing In The Current Market Environment

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.

Diversified Asset Allocation Portfolios For Your Plans

Diversified Asset Allocation Portfolios For Your Plans