Re-balance Cycle Reminder All MyPlanIQ’s newsletters are archived here.

For regular SAA and TAA portfolios, the next re-balance will be on Monday, July 27, 2015. You can also find the re-balance calendar for 2014 on ‘Dashboard‘ page once you log in.

As a reminder to expert users: advanced portfolios are still re-balanced based on their original re-balance schedules and they are not the same as those used in Strategic and Tactical Asset Allocation (SAA and TAA) portfolios of a plan.

Please note that we now list the next re-balance date on every portfolio page.

Pain in Tactical Portfolios

Many users must have noticed or experienced the lackluster performance of our Tactical Asset Allocation(TAA) based portfolios. Furthermore, several tactical advanced portfolios on Advanced Strategies have done poorly. For example, the advanced portfolio(s) of Goldman Sachs global tactical have incurred some painful loss year to date:

Portfolio Performance Comparison (as of 7/13/2015):

| Ticker/Portfolio Name | YTD Return** |

1Yr AR | 3Yr AR | 5Yr AR | 5Yr Sharpe | 10Yr AR |

|---|---|---|---|---|---|---|

| P Goldman Sachs Global Tactical Include Emerging Market Diversified Bonds ETFs | -4.7% | -2.1% | 8.1% | 7.9% | 0.73 | |

| P Goldman Sachs Global Tactical Include Emerging Market Diversified Bonds | -1.5% | 1.9% | 9.3% | 10.7% | 1.03 | 13.2% |

These portfolios have done well in a longer term but now their performance is anything but stellar.

We touched these portfolios and their performance in the previous newsletter February 23, 2015: Why Is Global Tactical Asset Allocation Not Popular? In the newsletter, we addressed a user’s question. It is worthwhile to look at this user’s question again:

Why isn’t this strategy, the GS GTAA one mentioned above, known and followed all over the place — by investment advisors, retail and institutional investors at large (outside of myplaniq), and so on? …

Basically, the GS GTAA results seem almost too good, compared to everything else–yet the results are easy enough to track, at least through your site, and plain to see. Also, as it uses regular mutual funds (with once-a-day prices) and a monthly rebalance frequency, I have more confidence in backtest results for this strategy, since there is less a chance of losing out due to intraday pricing fluctuation or other friction if you did it for real over the years.

In the newsletter, we gave several reasons on why the portfolio that has seemingly stellar long term record hasn’t been popular. We pointed out one of the key reasons is its out of sync nature with popular market indexes such as S&P 500 stock index. At the time (in February), we said:

This portfolio drew quite some attention earlier this year because of discussions and endorsement from some of our active users. However, we guess these new users are probably suffering from some pain now as the portfolio (especially the ETF one) hadn’t done well.

That is probably one of the best reasons why such a portfolio is not necessarily the most well known and popular as it does not match with most popular market indices such as S&P 500 stock index which has risen relentlessly for several years.

Left unsaid is that what happens if such under performance continues! Here we are five months later: the portfolios have incurred more losses.

If we review the performance of trend following tactical portfolios in a much longer historical period, we can see that the extended under performance is not unprecedented.

Historical under performance in an extended period

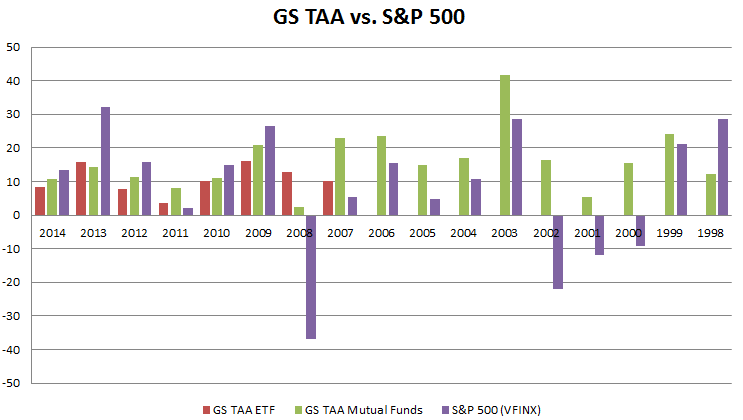

Again, the first evidence is for these portfolios since 1998:

By looking at the above chart, adding this year’s under performance so far, one can see that the portfolios have done poorly since the stock market bottom in 2009. In fact, other than in 2011, the portfolios have done worse every year since 2009. For our basic Tactical Asset Allocation(TAA) based portfolios (i.e. those portfolios a basic subscriber can access to), most portfolios have fared worse than S&P 500 (VFINX) every year since 2009!

We should point out this phenomenon is not only limited to our trend following based tactical portfolios. In fact many tactical or momentum based mutual funds have done worse too. As much as we would like to put a blame on something like that this time is different since markets have been very much artificially intervened by governments and central banks, we believe that a good strategy should withstand any market condition regardless whether it is unprecedented or not. In fact, the reason we need a well defined strategy is precisely to deal with unknowns such as whatever we have experienced since 2009. There is just no excuse for a bad strategy performance.

However, just as Warrent Buffett has pointed out, investing is not a short term popularity contest. For us, a good strategy should perform well in a long term but on the other hand, it should have risk contained in an acceptable range. The latter means that even during a period when the strategy does not perform as well as a popular market index, it should achieve a reasonable return with acceptable risk in that period.

For example, if a strategy returns average 10% annually (assuming 10% is what you would expect) but it does so with large drawdown (or from peak to trough loss) such as 30%, which exceeds your 20% risk tolerance level, you should deem such a portfolio not suitable at best or you should be suspicious on its premise.

On the other hand, if a strategy returns average 10% annually in the last 10 years but only returns annualized 7% in the last 5 years, however, its largest drawdown is only 20% that meets your requirement, you might have to accept this strategy even if it under performs a popular market index.

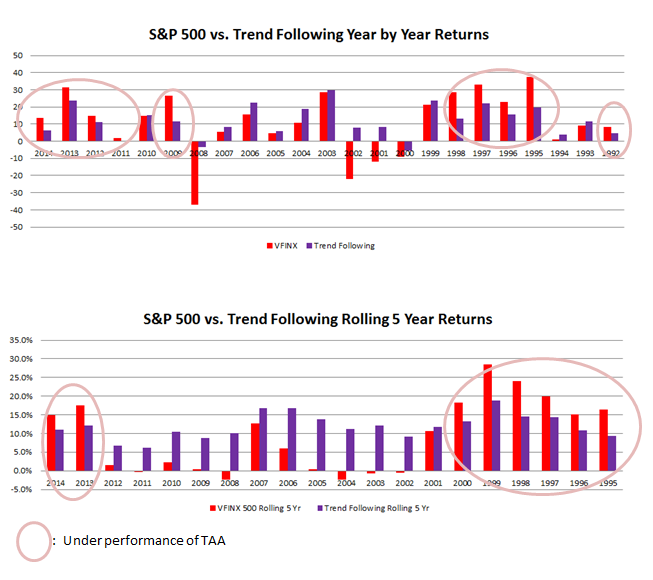

It turns out there are other periods such a trend following strategy lagged behind a stock market main benchmark. For example, in January 12, 2015: How Does Trend Following Tactical Asset Allocation Strategy Deliver Returns, we showed the following two charts for another trend following portfolio P Relative Strength Trend Following Six Assets. Notice that this sole reason we introduced this portfolio is to have a long performance record as we intentionally used geography based diversification (instead of developed country stocks and emerging market stocks, it uses European stocks and Asia Pacific Stocks funds from Vanguard) because both VEURX (Vanguard European Stock Index Inv) and VPACX (Vanguard Pacific Stock Index Inv) have data dated back in 1990. It is a portfolio that has back tested data since 1991:

From the above chart, one can see that in addition to the recent period since 2009, the portfolio under performed every year from 1995 to 1998. In fact the portfolio had been weaker than S&P 500 since 1992, as evident in the rolling 5 year period chart: it did worse all the five rolling years since 1995 to 2000.

What does the rolling five year period mean? That would mean that as an investor who was using trend following strategy, your portfolio did worse in the past 5 years when you looked at it in 1995, it then happened again in 1996, again 1997, 1998, 1999 and 2000! It was not until the internet bubble bursted in 2001 when your portfolio started to out perform S&P 500.

No wonder such a portfolio was not popular in 1990s: though occasionally it was better than S&P 500 by a slim margin (such as in 1993 and 1994), it was a laggard all along in those years! A decade long!

To make things worse, if you were a trend following investor in 90s, you had been busy rebalancing every month (or at least once a quarter or once two months) and your portfolio did worse than just simply buying and holding there without doing anything. A very typical “much ado about nothing”!

To make things even worse, the whole financial media, your neighbors and virtually everyone else had been raving about the good market returns and their stock portfolios while yours just meandering (in fact, a close to 10% or even higher average annual return is anything but meandering, but you would feel so when compared with others)!

Putting aside all other reasons we mentioned in February 23, 2015: Why Is Global Tactical Asset Allocation Not Popular?, you now should have a pretty good picture to understand why such a portfolio has not been in favor or popular! In fact, it is also becoming more and more unfavorable recently!

Your investing edge

It is precisely this painful experience an investor has to endure to gain an investing edge, just like what we mentioned in August 18, 2014: Consistency, The Most Important Edge In Investing: Tactical Case. When your portfolio or strategy under performs, the most important question one should ask is

Is this an expected behavior or is this a fundamental flaw that will persist indefinitely?

For us, the current under performance is nothing but an expected behavior based on historical data and our intuition. However, in investing, there is no a sure fire strategy, not a trend following tactical one, not even the buy and hold strategic one. One has to make a trade off whether a strategy’s weakness is worth to tolerate. If the answer is no, you might have to find another one that suits you. Or very often, you might not be able to find one that satisfies all of your requirements. Then you have to make a compromise. You can either trim down your risk exposure in a strategy portfolio, or you can pursue two relatively complementary strategies together, just like the core satellite approach we suggested to have both strategic and tactical portfolios together.

Regardless which way to go, the worst is to bail out at the low of a strategy.

Market Overview

During the weekend, after a long period of negotiation, Euro group finally reached an agreement with the Greek government. However, the drama is still half way played: the Greek government still needs to get an approval from the parliament. Even assuming it is approved, the impact has been felt by many other countries in the Euro zone. Many have pointed out that a single Euro currency imposed on many fiscally independent countries is a flawed design from its beginning. Monetary policies can not be totally independent from fiscal policies. Risk markets again swung back. However, the government driven up and down markets can not be forever. Eventually, markets (and its underlying economies) will be in a more affirmative direction.

For more detailed asset trend scores, please refer to 360° Market Overview.

We would like to remind our readers that markets are more precarious now than other times in the last 5 years. It is a good time and imperative to adjust to a risk level you are comfortable with right now. However, recognizing our deficiency to predict the markets, we will stay on course.

We again copy our position statements (from previous newsletters):

Our position has not changed: We still maintain our cautious attitude to the recent stock market strength. Again, we have not seen any meaningful or substantial structural change in the U.S., European and emerging market economies. However, we will let markets sort this out and will try to take advantage over its irrational behavior if it is possible.

We again would like to stress for any new investor and new money, the best way to step into this kind of markets is through dollar cost average (DCA), i.e. invest and/or follow a model portfolio in several phases (such as 2 or 3 months) instead of the whole sum at one shot.

Latest Articles

- July 6, 2015: Fixed Income Total Return Bond Funds In Strategic Asset Allocation Portfolios

- June 29, 2015: Core ETF Commission Free Portfolios

- June 22, 2015: Secular Asset Trends

- June 15, 2015: Giving Up Bonds?

- June 1, 2015: Summer Blues?

- May 26, 2015: Cash, Bonds and Stocks In A Rising Rate Environment

- May 18, 2015: Portfolio Update

- May 11, 2015: Pain in Fixed Income?

- May 4, 2015: The Balanced Stock and Long Term Treasury Bond Portfolios

- April 27, 2015: Long Term Treasury Bond Behavior

- April 20, 2015: 529 College Savings Plan Rebalance Policy Change

- April 13, 2015: Total Return Bond Funds As Smart Cash

- April 6, 2015: The Low Return Environment

- March 30, 2015: Brokerage Specific Core Mutual Fund Portfolios 2

- March 23, 2015: Investment Arithmetic for Long Term Investments

- March 16, 2015: Brokerage Specific Core Mutual Fund Portfolios

- March 9, 2015: Newsletter Collection Update

- March 2, 2015: Total Return Bond ETFs

- February 23, 2015: Why Is Global Tactical Asset Allocation Not Popular?

- February 16, 2015: Where Are Permanent Portfolios Going?

- February 9, 2015: How Have Asset Allocation Funds Done?

- February 2, 2015: Risk Management Everywhere

- January 26, 2015: Composite Portfolios Review

- January 19, 2015: Fixed Income Investing Review

- January 12, 2015: How Does Trend Following Tactical Asset Allocation Strategy Deliver Returns

- January 5, 2015: When Forecast Fails

- December 22, 2014: Long Term Asset Returns: How Long Is Long?

- December 15, 2014: Beaten Down Assets

- December 8, 2014: Implementing Core Asset Portfolios In a Brokerage

- December 1, 2014: Two Key Issues of Investment Strategies

- November 24, 2014: Holiday Readings

- November 17, 2014: Retirement Spending Portfolios Update

- November 10, 2014: Fixed Income Or Cash

- November 3, 2014: Asset Trend Review

- October 27, 2014: Investment Loss, Mistakes And Market Cycles

- October 20, 2014: Strategic Portfolios With Managed Volatility

- October 13, 2014: Embrace Volatility

- October 6, 2014: Tips For 401k Open Enrollment

- September 29, 2014: What Can We Learn From Bill Gross’ Departure From PIMCO?

- September 22, 2014: Why Total Return Bond Funds?

- September 15, 2014: Equity And Total Return Bond Fund Composite Portfolios

- September 8, 2014: Momentum Based Portfolios Review

- September 1, 2014: Risk & Diversification: Mint.com Interview

- August 25, 2014: Remember Risk

- August 18, 2014: Consistency, The Most Important Edge In Investing: Tactical Case

- August 11, 2014: What To Do In Overvalued Stock Markets

- August 4, 2014: Is This The Peak Or Correction?

- July 28, 2014: Stock Musings

- July 21, 2014: Permanent Portfolios & Four Pillar Foundation Based Framework

- July 14, 2014: Composite Portfolios Review

- July 7, 2014: Portfolio Behavior During Market Corrections

- June 30, 2014: Half Year Brokerage ETF and Mutual Fund Portfolios Review

- June 23, 2014: Newsletter Collection Update

- June 16, 2014: There Are Always Lottery Winners

- June 9, 2014: The Arithmetic of Investment Mistakes

- June 2, 2014: Tips On Portfolio Rebalance

- May 26, 2014: In Praise Of Low Cost Core Asset Class Based Portfolios

- May 19, 2014: Consistency, The Most Important Edge In Investing: Strategic Case

- May 12, 2014: How To Handle An Elevated Overvalued Market

- May 5, 2014: Asset Allocation Funds Review

- April 28, 2014: Now The Economy Backs To The ‘Old Normal’, Should Our Investments Too?

- April 21, 2014: Total Return Bond Investing In The Current Market Environment

Enjoy Newsletter

How can we improve this newsletter? Please take our survey

–Thanks to those who have already contributed — we appreciate it.

Diversified Asset Allocation Portfolios For Your Plans

Diversified Asset Allocation Portfolios For Your Plans