12 Blue Chip Stocks by SmartMoney: How Good Are They Compared with A Diversified ETF Portfolio

04/11/2011 0 comments

SmartMoney magazine published its annual best stock ideas in the February issue titled Where to Invest in 2011. We look at a portfolio that consists of the 12 stocks suggested in the article and compare this with an ETF portfolio.

We construct the portfolio "P SmartMoney Magazine Where to Invest 2011 12 Stocks Since 2011" that had equal weights to each of 12 stocks on 12/31/2010. The following is the list of stocks recommended by SmartMoney Magazine and their weightings on 4/8/2011:

| Asset | Fund in this portfolio | Price | Percentage |

|---|---|---|---|

| Asset1 | LOW (Lowe's Companies Inc.) |

26.82 | 6.33% |

| Asset1 | TJX (The TJX Companies, Inc.) |

50.7 | 13.33% |

| Asset1 | YUM (Yum! Brands Inc.) |

49.58 | 10.98% |

| Asset1 | CMCSA (Comcast Corporation) |

24.68 | 6.35% |

| Asset1 | RSG (Republic Services) |

29.91 | 7.08% |

| Asset1 | PEP (PepsiCo Inc) |

65.73 | 7.36% |

| Asset1 | CSCO (Cisco Systems Inc) |

17.65 | 4.57% |

| Asset1 | GOOG (Google Inc) |

578.16 | 7.97% |

| Asset1 | ORCL (Oracle Corp.) |

33.54 | 12.29% |

| Asset1 | UTX (United Technologies) |

84.81 | 8.66% |

| Asset1 | MMM (3M Company) |

93.22 | 7.79% |

| Asset1 | UPS (United Parcel Serv) |

73.25 | 7.29% |

We further construct a portfolio P SmartMoney Magazine Where to Invest 2011 12 Stocks that was started on 1/2/2006.

Buying individual stocks and managing a portfolio with a dozen of stocks is not a small feat: one has to constantly monitor stocks in the portfolio and buy/sell them if it is necessary (such as a fundamental event for a company indicates this company is no longer satisfied with the criteria, or a stock becomes too expensive, or just simply because there is a better more compelling stock available, etc.). In fact, various studies have shown that most professional mutual funds can not even beat a stock index.

On the other hand, an investor can choose a simpler and safer portfolio strategy: asset allocation, especially tactical asset allocation strategy by investing in ETFs or mutual funds. In the case of a tactical asset allocation strategy, it dynamically adjusts the weights of assets represented by ETFs. For example, MyPlanIQ's Tactical Asset Allocation (TAA) strategy adjusts exposure to various assets based on price momentum as well as risk parameters (such as volatility and drawdown).

The following is the list of six assets that represent the major markets:

| Asset Class | Ticker | Name |

|---|---|---|

| LARGE BLEND | VTI | Vanguard Total Stock Market ETF |

| Foreign Large Blend | VEU | Vanguard FTSE All-World ex-US ETF |

| DIVERSIFIED EMERGING MKTS | VWO | Vanguard Emerging Markets Stock ETF |

| REAL ESTATE | VNQ | Vanguard REIT Index ETF |

| COMMODITIES BROAD BASKET | DBC | PowerShares DB Commodity Idx Trking Fund |

| Intermediate-Term Bond | BND | Vanguard Total Bond Market ETF |

Other than the fixed income fund (BND), all other five assets are considered as risk assets.

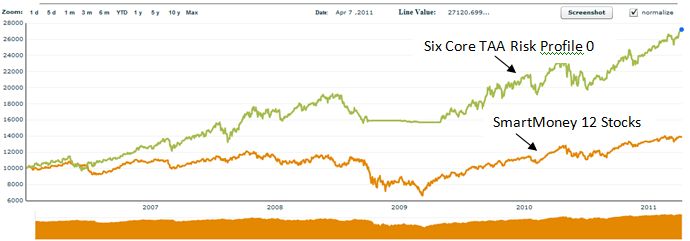

The following compares the performance between P SmartMoney Magazine Where to Invest 2011 12 Stocks and a portfolio with risk profile 0 (i.e. can have 100% invested in the risk assets) Six Core Asset ETF Benchmark TAA Risk Profile 0.

Portfolio Performance Comparison

| Portfolio Name | 1Yr AR | 1Yr Sharpe | 3Yr AR | 3Yr Sharpe | 5Yr AR | 5Yr Sharpe |

|---|---|---|---|---|---|---|

| P SmartMoney Magazine Where to Invest 2011 12 Stocks |

13% | 75% | 8% | 28% | 6% | 20% |

| Six Core Asset ETF Benchmark TAA Risk Profile 0 |

19% | 91% | 16% | 81% | 20% | 95% |

The following chart illustrates the performance comparison:

We make the following observations:

- The SmartMoney 12 stocks were recommended in Februrary 2011. The portfolio P SmartMoney Magazine Where to Invest 2011 12 Stocks was started on 1/2/2006. It is not exactly a fair comparison: most likely, these stocks were recommended based on their past performance and thus, the portfolio's performance could be more over-estimated.

- It is not exactly fair to compare an U.S. stock portfolio with a diversified portfolio that can invest in foreign stocks, emerging market stocks, REITs and even commodities. One reason behind this is that for most individual investors, they tend to focus on only domestic stocks. We will have a follow up article to compare this portfolio with an U.S. stock ETF portfolio.

- The above illustrates that there are simpler and better way to invest other than picking individual stocks. This is applicable to most average investors. Nevertheless, we acknowledge that few investors do have the possibility to achieve high returns with their systematic method and great insights. It is just for many average investors, they do not have time, means and discipline to do so. This is reflected that majority of professional investors under perform against a stock index such as S&P 500 (SPY).

Exchange Tickers: (LOW), (TJX), (YUM), (CMCSA), (RSG), (PEP), (CSCO), (GOOG), (ORCL), (UTX), (MMM), (UPS), (SPY), (EFA), (EEM), (IYR), (AGG), (GSG), (DBC)

comments 0