|

Vanguard ETF: |     |

7.4%* |

|

Diversified Core: |    |

8.1%* |

|

Six Core Asset ETFs: |    |

7.3%* |

Articles on DBV

- Currencies Snap Back -- Show Their True Colors

03/29/2011

One of the most glaring holes in our education system is retirement investing. Much is said about day trading and the high wire acts of Hedge Funds. Retirement investing is a long term proposition and is similar to looking after your health – do what is sensible and have occasional checkups that become more frequent as you age. We continue to look for areas of investment where we can find long term investment ideas that can give balance to a portfolio to increase risk adjusted returns.

We report on currencies movements by using representative ETF's to uncover whether there are possible longer term investments.

The trend score is defined as the average of 1,4,13,26 and 52 week total returns (including dividend reinvested).

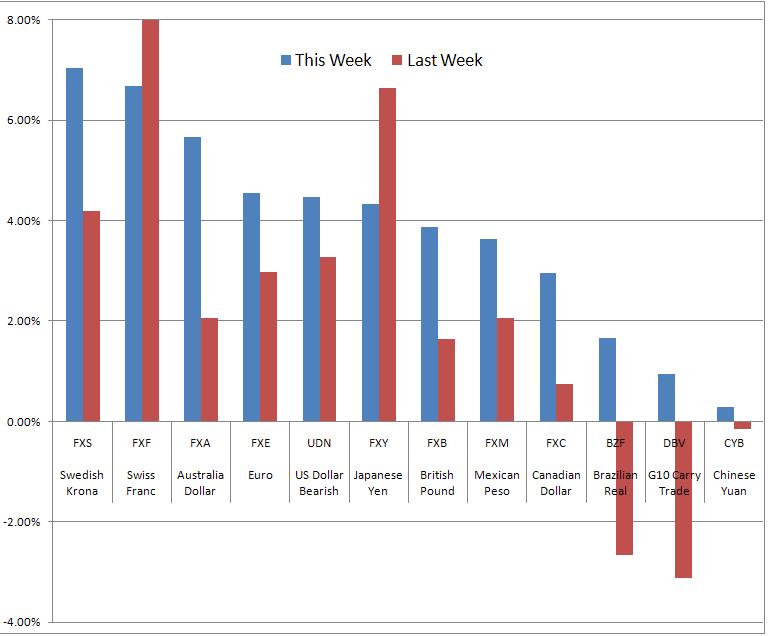

We can see considerable volatility over the past two weeks.All currencies except the Japanese Yen is up this week. This is not a surprise as central banks are doing their best to keep the Yen down to help Japan in their current crisis. Currencies have been under pressure over the last couple of weeks and this is the start of a recovery.

Over the past few months, we have seen the Krona replace the Aussie Dollar at the top of the table -- but things were relatively stable. Over the last couple of weeks there was significant juggling of the order. The Swiss Franc jumped to the top of the list and the Yen, Dollar and Euro popped into the top half of the list, this week, we see the order return to its pre-crisis state.

Top and bottom notes:- The Aussie Dollar and Swedish Krona have been impacted by the impact of the recent crisis -- oil prices and commodity prices are going to weigh on the Australian economy. The Swedish economy, while not closely tied to Europe will be impacted by oil prices and the worry of slower growth.

- The Swiss Franc is the currency that marches to the beat of its own drum in times of increased risk. It has clearly spiked as tension was heightened and is dropping as tension reduces.

- The Real and the Yuan are both good long term bets but continue to have a range of issues related to sovereign governance. Until they are sorted out, they are likely to remain at the bottom of the return table.

There is opportunity trading currencies for those with the intestinal fortitude. For those who have a longer term horizon, it is possible to consider adding the Swiss ETF in a portfolio to hedge against world crises.

Symbols: FXA, FXM, BZF, FXY, FXC, FXF, FXS, DBV, CYB, UDN, FXB, FXE

Symbols: (FXA),(FXM),(BZF),(FXY),(FXC),(FXF),(FXS),(DBV),(CYB),(UDN),(FXB),(FXE),

Disclosure:

MyPlanIQ does not have any business relationship with the company or companies mentioned in this article. It does not set up their retirement plans. The performance data of portfolios mentioned above are obtained through historical simulation and are hypothetical.

- Currencies All Jump Caution Advised

03/04/2011

MyplanIQ tracks currencies using the following currency ETFs (FXS), (FXF), (FXA), (FXC), (FXB), (FXM), (UDN), (FXE), (FXY), (DBV), (CYB), (BZF) to Monitor the trend for bellweather currencies.

In the light of continued and growing unrest in North Africa, we would have anticipated the continued flight to safe currencies and others would have been under downward pressure. We do not see that trend emerging.

All currencies, with the exception of Japan, are moving upward. It is true that the top three are also considered safe haven currencies but we would have expected to see the Swiss Franc have the biggest jump if it were a move to safety trend and we don't see that.

This may signal that while there is an expectation that oil prices may rise and cause some short term turbulence, there is less concern that this will have any lasting impact on the economy.

Assets Class Symbols 03/02

Trend

Score02/23

Trend

ScoreDirection Swedish Krona FXS 8.52% 7.89% ^ Swiss Franc FXF 7.26% 7.18% ^ Australia Dollar FXA 7.23% 6.42% ^ Canadian Dollar FXC 4.42% 3.29% ^ British Pound FXB 3.87% 3.02% ^ Mexican Peso FXM 3.72% 2.56% ^ US Dollar Bearish UDN 3.67% 3.34% ^ Euro FXE 3.22% 2.96% ^ Japanese Yen FXY 2.65% 2.73% v G10 Carry Trade DBV 2.41% 1.76% ^ Chinese Yuan CYB 0.54% 0.49% ^ Brazilian Real BZF -0.5% -1.35% ^ The trend score is defined as the average of 1,4,13,26 and 52 week total returns (including dividend reinvested).

The Krona continues to lead the table as the economy continues to deliver impressive results. There remains little concern about the currency appreciating and that hurting exports.

The Swiss central bank has issued comments that they will keep a firm grip on inflation and that interest rate rises will be used as they believe the low rates in other Eurozone nations are not sustainable.

The Aussie dollar also climbed sharply despite mixed news between rising commodity prices and less than expected building permits indicating softness in their construction industry.

The Real moved into positive territory as the central bank raised interest rates again. With already high interest rates, the government is trying to avoid overheating the economy even as their currency is making exports more expensive.

The Yuan is little changed as the country's leaders gather for the National People's Congress, which begins Saturday. There are signs that the government may be getting serious about allowing the currency to appreciate but that will have to wait until the session is over.

The G10 Carry Trade Currencies highlight the reduction in concern about the current strife in North Africa in the Middle East but there should be some concern that if this does spread, there may be greater impact on the world economy.

It's hard to throw off the old expectations that currencies will be under pressure during times of world tension and while most of the currencies are moving up, there is reason to be cautious and see if there is a correction next week.

Symbols:FXS,FXF,FXA,FXC,FXB,FXM,UDN,FXE,FXY,DBV,CYB,BZF,

Disclosure:

MyPlanIQ does not have any business relationship with the company or companies mentioned in this article. It does not set up their retirement plans. The performance data of portfolios mentioned above are obtained through historical simulation and are hypothetical.

- Political Unrest Resurfaces, Presses Down on Most Currencies

02/18/2011

After a week when the initial resolution of unrest in Egypt reduced uncertainty and safe currencies dropped back, the new unrest in Bahrain has investors going back to their safe havens.

Most currencies dropped in the light of the increasing tension in the Middle East although there were a couple of exceptions.

We anticipate that this status will remain in place until we see how widespread and effective the current series of demonstrations against hard line governments turns out to be.Assets Class Symbols 02/16

Trend

Score02/09

Trend

ScoreDirection Swedish Krona FXS 7.42% 7.54% v Australia Dollar FXA 5.91% 6.98% v Swiss Franc FXF 4.65% 4.38% ^ Canadian Dollar FXC 3.26% 2.25% ^ Mexican Peso FXM 3.14% 3.64% v G10 Carry Trade DBV 2.5% 2.64% v US Dollar Bearish UDN 1.81% 2.43% v British Pound FXB 1.42% 1.41% ^ Japanese Yen FXY 1.36% 2.35% v Euro FXE 0.99% 2.01% v Chinese Yuan CYB 0.46% 0.32% ^ Brazilian Real BZF -0.55% 0.17% v The trend score is defined as the average of 1,4,13,26 and 52 week total returns (including dividend reinvested).

The Swedish Krona remains at the top of the pile. Sweden have announced interest rate rises and appear comfortable with what that will mean for the currency. Despite that, and the fact that Sweden is something of a safe haven, the currency dropped back a little after the interest rate announcement. It's hard to say whether this was a function of political unrest or the interest rate hike being priced in before hand.

The Australian Dollar is caught between a downdraft due to employment data that didn't meet expectations and the upswing of Asian sentiment which bodes well for the country. Australi are far enough away from the Middle East so as not to be caught up in ti.

The Swiss Franc was a main beneficiary of the unrest. After having dropped back with the initial resolution of the Egyptian crisis, it was back in favor once Bahrain unrest surfaced.The Brazilian Real dropped back as it is influenced by its major trading partners. However, with rising commodity prices and the government focused on cutting government spending, there is an expectation that it will start to rise.

The Chinese Yuan continues to appreciate and eventually it should start floating to the top of the pile. It remains an embattled currency as the developed nations complain about its imbalance and the Chinese Government is doing some window dressing before the upcoming G20 meeting.The Euro dropped back into the bottom three as its fragile recovery was dented by the spreading of uprisings in North Africa and the Middle East. There is continuing work to try and deal with the debt in the zone but that is going to be a continuing theme for the foreseeable future.

Symbols:fxs,fxf,fxa,fxm,fxy,fxc,udn,dbv,fxe,cyb,fxb,bzf,

Disclosure:

MyPlanIQ does not have any business relationship with the company or companies mentioned in this article. It does not set up their retirement plans. The performance data of portfolios mentioned above are obtained through historical simulation and are hypothetical.

- Currencies Tumble Across The Board -- Mexico's Peso Bucks the Trend

01/07/2011

MyPlanIQ tracks trends in multiple categories using ETFs. For more information, please visit MyPlanIQ 360 Degree Market View.

After a couple of positive weeks, currencies tumble. Only the Mexican Peso bucks the trend and on that basis pops into the top three.

The bottom of the table remains the same although the Real should break out of there before too long.Assets Class Symbols 01/05

Trend

Score12/29

Trend

ScoreDirection Australia Dollar FXA 6.0% 10.31% v Mexican Peso FXM 3.47% 2.59% ^ Swedish Krona FXS 3.42% 4.25% v Japanese Yen FXY 2.82% 5.73% v Swiss Franc FXF 2.81% 6.42% v Canadian Dollar FXC 2.37% 3.57% v G10 Carry Trade DBV 1.59% 2.34% v Chinese Yuan CYB 0.4% 0.5% v US Dollar Bearish UDN -0.63% 1.34% v British Pound FXB -1.15% -0.45% v Euro FXE -2.37% -0.26% v Brazilian Real BZF -4.52% -3.79% v

The Swedish Krona hit its highest level against the Euro for six years as the Swedish economy warms against concern over the standing of the European single currency.

Despite strong fundamentals, the Australian Dollar has fallen to two week lows as confidence on growth waned in the wake of heavy flooding in Queensland. It still heads the table by some distance as it remains well poised as China drives demand.

The Mexican peso's entrance into the top three could be a New Year phenomenon, as investors look forward to decent economic growth. In addition, the Mexican peso has become aligned with copper and crude oil prices, both of which Mexico produces and both of which are considered hot commodity items.

The Real was hit by concerns of Brazilian banks shorting the US Dollar as the currency has already appreciated 37% against the Greenback.The Euro and the pound trade places at the bottom as they are mired with debt and austerity issues that will continue to drag on the currency even though the Euro has done better against some of the world currencies.

We will see who returns to positive territory next week.

labels:investment,

Symbols:FXA,FXM,BZF,FXY,FXC,FXF,FXS,DBV,CYB,UDN,FXB,FXE,

- End of the Year Review of Luminary Portfolios -- II

01/01/2011

Earlier in the year, we presented a series of reports on lazy portfolios from investing luminaries. We went on to pit them together to come out with an overall winner.

That was then, this is now. It's time to review their progress and look at how they have performed in 2010. This is the second article where we look at the bottom half of the alphabet and see how they have done this year.

We created SIB (Simpler is Better) portfolios one index fund for each asset class (ETF's are ideal for this) as a basic benchmark for each asset class portfolio. A SIB gives you diversification and low cost with no thought to picking a stock or even sub-segment of an asset class.

MyPlanIQ Benchmark

TAA 5 Yr Return Annualized

TAA 1 Year

SAA 1 Year

Asset Classes

15%

8%

10%

6

12%

7%

10%

6

11%

6%

11%

5

9%

8%

11%

4

11%

1%

10%

4

6%

-1%

10%

3

We present four return data points:

- The five year annualized return based on a Tactical Asset Allocation strategy (TAA) -- this gives a viewpoint on the longer term behavior

- The one year TAA return

- The one year Strategic Asset Allocation (SAA) return

We note that for 2010, SAA portfolios have performed better than the SAA but TAA has a better performance metric in the longer run. This will calibrate what we see with the lazy portfolios.

The portfolios are listed by decreasing number of asset classes and decreasing number of funds. We would expect that the portfolio with the greatest number of asset classes to have the highest returns and we will test that to see to what extent it is true.

Table of Lazy Portfolios and their classes and funds

Plan Name

TAA 5 Yr Return Annualized

TAA 1 Year

SAA 1 Year

Original

Asset Classes

11%

6%

11%

7%

5

10%

9%

11%

13%

6

13%

7%

13%

15%

3

6%

10%

14%

9%

3

13%

11%

14%

12%

7

11%

10%

10%

13%

5

9%

9%

13%

11%

4

- Gibson's 5 Equal Asset Allocation Strategy comes from his Asset Allocation: Balancing Financial Risks book. In it, he outlined a simple yet diversified asset allocation model: putting equal amount of investment into 5 asset classes: US Equity, International Equity, REIT, Commodity, Fixed Income.

- Alexander Green proposed this The Gone Fishin' Portfolio. Based on the book the allocation is achieved using Vanguard low cost index funds (in Bogleheads forum, there is a discussion thread devoted to this portfolio)

- Jim Lowell edits MarketWatch's ETF Trader, an investment letter employing a momentum-based exchange-traded-fund strategy for long-term investors. Large and small stocks, proposed his Sower's Growth Portfolio. This is a diversified portfolio of exchange-traded funds

- Bill Schulthe is is a former Smith Barney broker and author of "The Coffeehouse Investor"

- Craig L. Israelsen is an Associate Professor at Brigham Young University where he teaches Personal and Family Finance to over 1,200 students each year. The Israelsen Seven Equally Weighted is aimed to protect the portfolio against losses

- David Swensen, the Yale Endowment Manager, proposed a one size fit in all model portfolio for individual investors. The major difference of this portfolio is the emphasis on international equities (including emerging market equities) and real estate

- John Wasik is a professional journalist and author specializing in personal finance, the environment, investing and social issues. John has proposed a Nano plan investment portfolio which employs a handful of index or ETFs to cover virtually the entire world of bond and stock markets

The one year returns of the original portfolio are presented in order of highest to lowest.

How do the returns compare to what we would have expected?

Plan Name

TAA 5 Yr Return Annualized

TAA

1 Year ReturnSAA

1 Year ReturnOriginal 1Year

Asset Classes

13%

7%

13%

15%

3

10%

9%

11%

13%

6

11%

10%

10%

13%

5

13%

11%

14%

12%

7

9%

9%

13%

11%

4

6%

10%

14%

9%

3

11%

6%

11%

7%

5

- The second half of the group performed slightly better as a group than the first half. Lowell's return is the highest of the bunch -- as a three asset class portfolio, that will be an interesting study as to whether this will continue in 2011

- All of the portfolios exhibited the same behavior of the buy and hold approaches beating TAA -- this is an important lesson that TAA, while having significant benefits in a choppy market, may not perform as well as SAA in a good market

- As we end the year on a relatively strong note, there is still a note of caution and concern about the future and we will have to see how well these portfolios perform next year

Takeaways- 2010 has been a good year for lazy portfolios as stocks have continued their recovery albeit with concern for the future

- TAA has real benefits but so does SAA or buy and hold -- this year demonstrates this point

- Index funds continue to show good results against managed funds

- Larger asset class plans have the benefit of stability and good returns

- ETF’s can be used to implement any of these strategies

- We pick the top three -- Lowell, Green and Swensen Brown to move on to the finals

- The Seven-12 portfolio can feel hard done by because if it were in the top half of the draw, it would have made it through to the finals

labels:investment,

Symbols:ACWI,ACWX,ADRE,AGG,BIV,BLV,BND,BSV,BWX,CFT,CIU,CSJ,DBC,DBV,DIA,DVY,EDV,EEM,EFA,EFG,EFV,EMB,ETF,GLD,GOOG,GSG,GXC,HPQ,HYG,ICF,IEF,IEI,IFGL,IGOV,IGR,IJH,IJJ,IJK,IJR,IJS,IJT,IVE,IVV,IVW,IWB,IWC,IWD,IWF,IWM,IWN,

- Year End Currencies -- WIP

12/30/2010

- Top Currencies Up Again; Weaker Currencies Falter

12/25/2010

- Currencies Up Again, With the Exception of the Yuan

12/16/2010

- World Currencies All Bounce Back

12/10/2010

- Currencies Nov 29

11/30/2010

- Currencies react to rate raises and bailouts

11/23/2010

- Currency ETF's show movement in who is top and who is bottom of the table

11/19/2010

- Currency ETFs Give Insight to National Fiscal Issues and Policy

11/12/2010

- Lazy Portfolios -- The Playoffs II

10/19/2010

- Lazy Portfolios -- The Playoffs

10/19/2010